Maine Approval of Incentive Stock Option Plan

Description

How to fill out Approval Of Incentive Stock Option Plan?

Are you in a placement where you need to have documents for sometimes business or specific uses almost every working day? There are a variety of lawful document layouts available on the net, but discovering kinds you can rely is not effortless. US Legal Forms delivers a huge number of develop layouts, much like the Maine Approval of Incentive Stock Option Plan, that happen to be written to meet federal and state requirements.

Should you be previously familiar with US Legal Forms site and get a free account, merely log in. Following that, you can obtain the Maine Approval of Incentive Stock Option Plan web template.

Unless you provide an bank account and need to begin to use US Legal Forms, adopt these measures:

- Get the develop you require and ensure it is for your proper town/state.

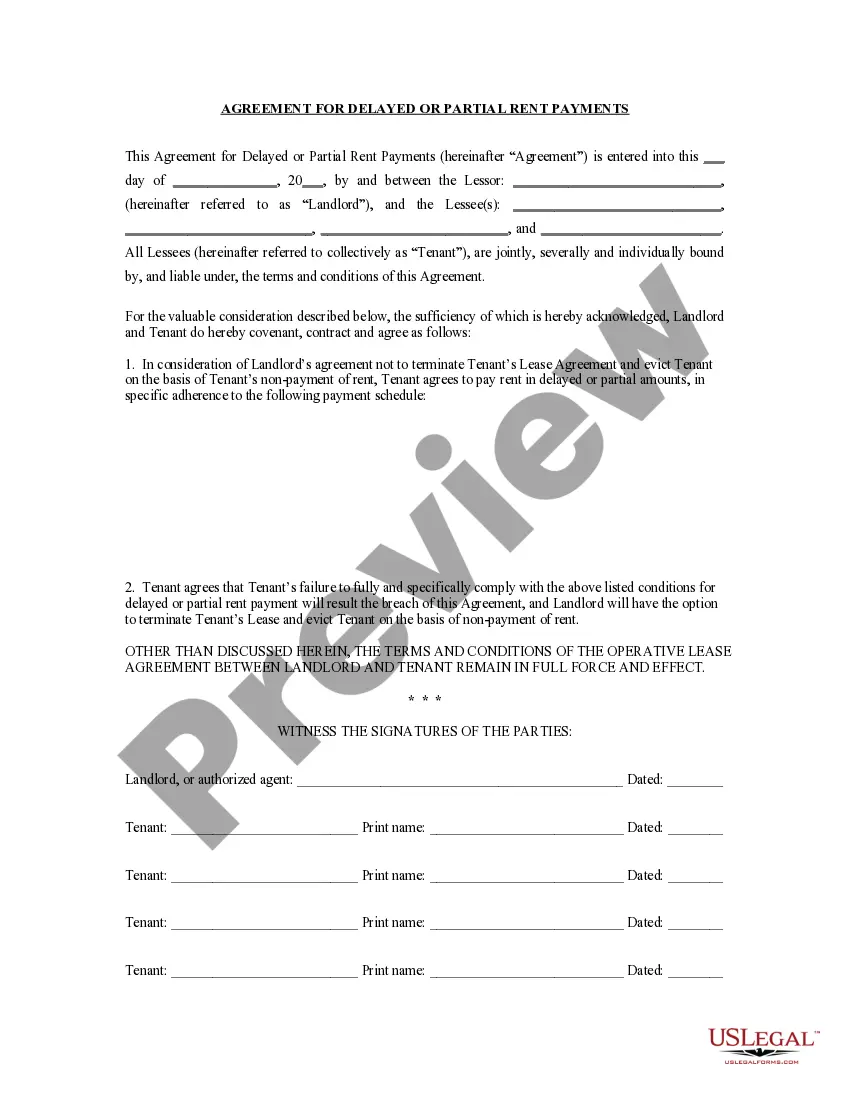

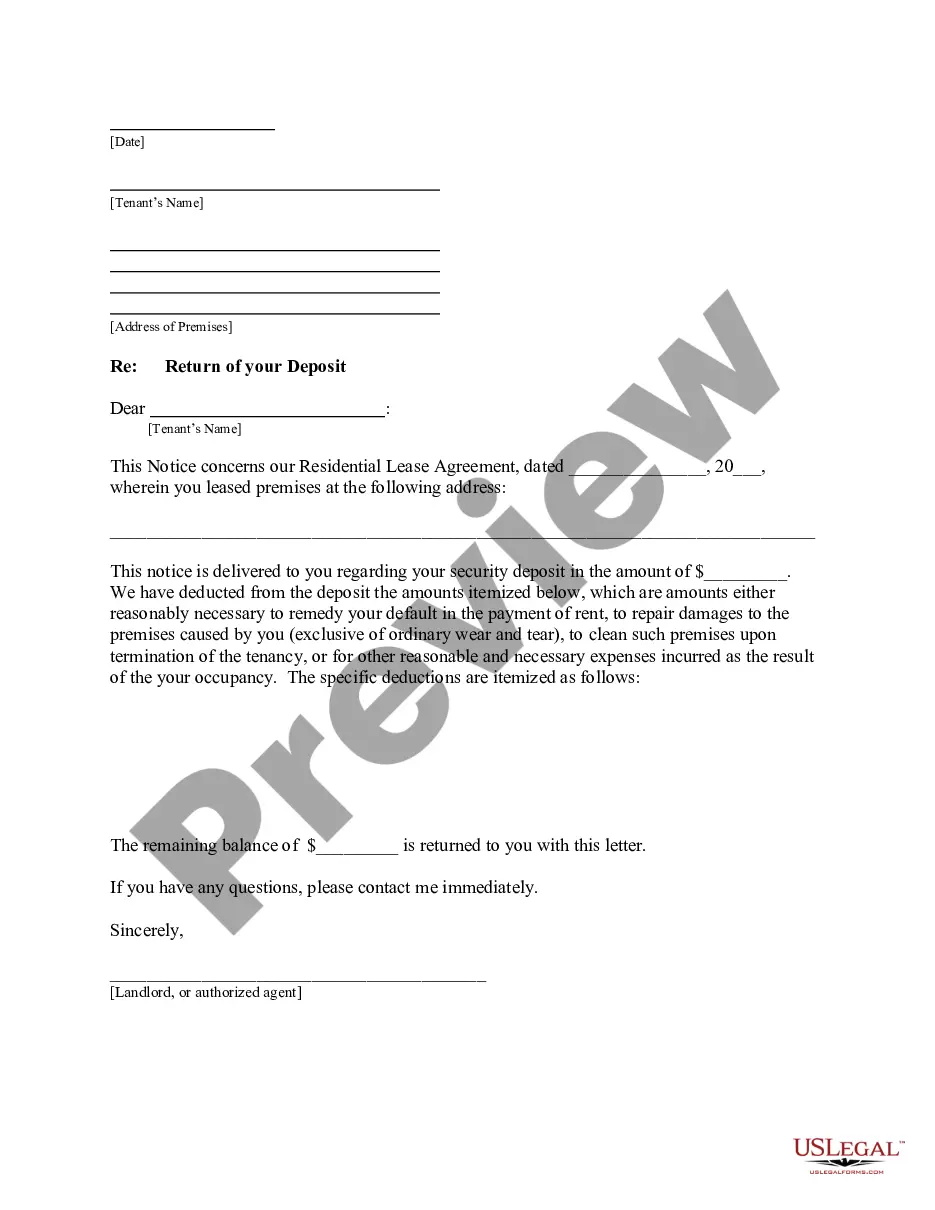

- Utilize the Preview switch to examine the form.

- Look at the outline to ensure that you have chosen the proper develop.

- In the event the develop is not what you`re seeking, utilize the Research area to discover the develop that meets your needs and requirements.

- Once you obtain the proper develop, simply click Purchase now.

- Opt for the pricing plan you need, complete the desired details to make your account, and purchase the transaction making use of your PayPal or bank card.

- Select a hassle-free paper format and obtain your backup.

Find each of the document layouts you have bought in the My Forms menus. You can obtain a extra backup of Maine Approval of Incentive Stock Option Plan any time, if necessary. Just select the essential develop to obtain or produce the document web template.

Use US Legal Forms, one of the most substantial collection of lawful types, to save lots of time and prevent blunders. The support delivers appropriately made lawful document layouts which you can use for an array of uses. Create a free account on US Legal Forms and commence generating your way of life a little easier.

Form popularity

FAQ

If this amount is not included in Box 1 of Form W-2, add it as "Other Income" on your Form 1040. Report the sale on your 2023 Schedule D, Part I as a short-term sale. The sale is short-term because not more than one year passed between the date you acquired the actual stock and the date you sold it.

The option plan must be approved by the stockholders within 12 months before or after the plan is adopted (see also Explanation: §423, Shareholder Approval Requirement) (IRC § 422(b)(1); Reg. §1.422-3).

The option plan must be approved by the stockholders within 12 months before or after the plan is adopted (see also Explanation: §423, Shareholder Approval Requirement) (IRC § 422(b)(1); Reg. §1.422-3).

Employee stock options are offered by companies to their employees as equity compensation plans. These grants come in the form of regular call options and give an employee the right to buy the company's stock at a specified price for a finite period of time.

There are many requirements on using ISOs. First, the employee must not sell the stock until after two years from the date of receiving the options, and they must hold the stock for at least a year after exercising the option like other capital gains. Secondly, the stock option must last ten years.