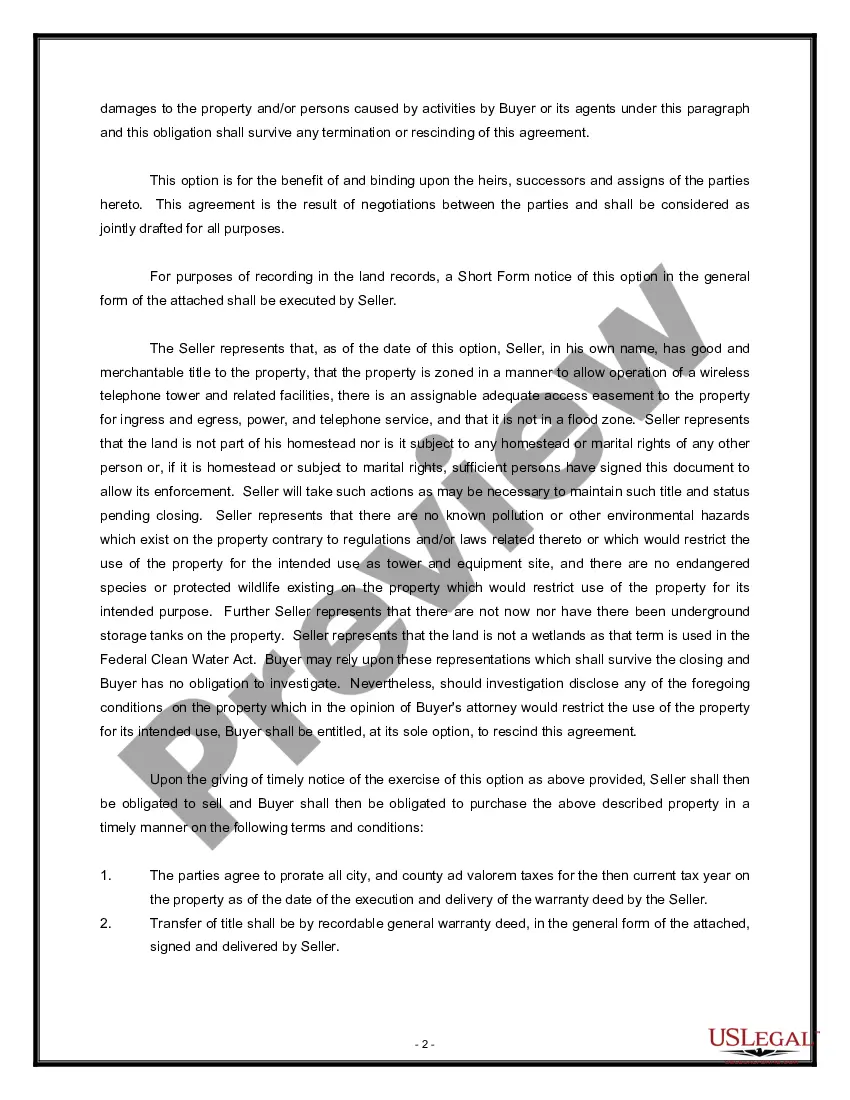

Maine Option to Purchase Real Estate - Long Form

Description

How to fill out Option To Purchase Real Estate - Long Form?

You might spend hours online searching for the legal document format that meets the federal and state requirements you need.

US Legal Forms provides thousands of legal templates that can be reviewed by professionals.

You can easily download or print the Maine Option to Purchase Real Estate - Long Form from our service.

If available, use the Preview button to view the document format as well.

- If you already possess a US Legal Forms account, you can Log In and click the Obtain button.

- Then, you can complete, modify, print, or sign the Maine Option to Purchase Real Estate - Long Form.

- Every legal document template you purchase is yours indefinitely.

- To obtain another copy of a purchased form, go to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document format for your area/city of interest.

- Check the form description to confirm you have chosen the right template.

Form popularity

FAQ

One key difference between North Carolina's standard form 580 T and the 580L T lies in their intended use. The 580 T is typically a residential transaction form, while the 580L T is for land transactions. Understanding these differences is crucial when navigating real estate agreements. If you want more insights into similar agreements, exploring the Maine Option to Purchase Real Estate - Long Form could be beneficial.

While it's not mandatory to have a realtor when buying a house in Maine, their expertise can be invaluable. Realtors can guide you through complex processes, from negotiations to closing. If you are considering the Maine Option to Purchase Real Estate - Long Form, a realtor can help ensure you maximize this purchase method’s benefits.

The NC sales tax exempt form is known as Form E-595E. This form allows exempt organizations or individuals to make purchases without paying sales tax on qualifying items. Keeping proper documentation is essential to avoid issues during audits. If you're exploring options in Maine, the Maine Option to Purchase Real Estate - Long Form may assist with understanding financial obligations.

The non-resident tax form for North Carolina is typically Form D-400. This form is necessary for non-residents who need to report income earned in North Carolina. It's crucial to file correctly to avoid penalties. For additional guidance on real estate investments, consider using the Maine Option to Purchase Real Estate - Long Form as a resource.

Yes, you can back out of a real estate contract in North Carolina under specific circumstances. Most contracts have contingency clauses that may allow you to terminate the agreement without any penalties. However, if no contingencies exist, you might be liable for damages. When dealing with contracts, consider how the Maine Option to Purchase Real Estate - Long Form can provide you more flexibility and clarity.

To avoid Maine capital gains tax on real estate property, consider strategies such as reinvesting the proceeds in another property, or leveraging tax exemptions applicable to primary residences. Consulting a tax professional can provide tailored advice based on your unique situation. The Maine Option to Purchase Real Estate - Long Form may also offer insights into how to navigate these tax implications effectively, ensuring you maximize your investment.

Yes, Maine has e-file forms to simplify the process of submitting various documents electronically. This feature can streamline transactions for buyers and sellers alike. Utilizing e-file forms can save you time and ensure accuracy in your submissions. For those exploring options, the Maine Option to Purchase Real Estate - Long Form can help you understand how to utilize these forms for real estate transactions.