Maine Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate

Description

How to fill out Personal Guaranty - Guarantee Of Contract For The Lease And Purchase Of Real Estate?

If you require to download, print, or access authentic document templates, utilize US Legal Forms, the foremost collection of legal forms available online.

Take advantage of the website's user-friendly and efficient search to find the documents you need.

Many templates for commercial and personal purposes are organized by categories and states, or keywords.

Once you have found the form you need, click the Buy Now button. Choose the pricing plan you prefer and submit your information to register for the account.

Complete the transaction. You can use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to find the Maine Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Obtain button to download the Maine Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, refer to the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

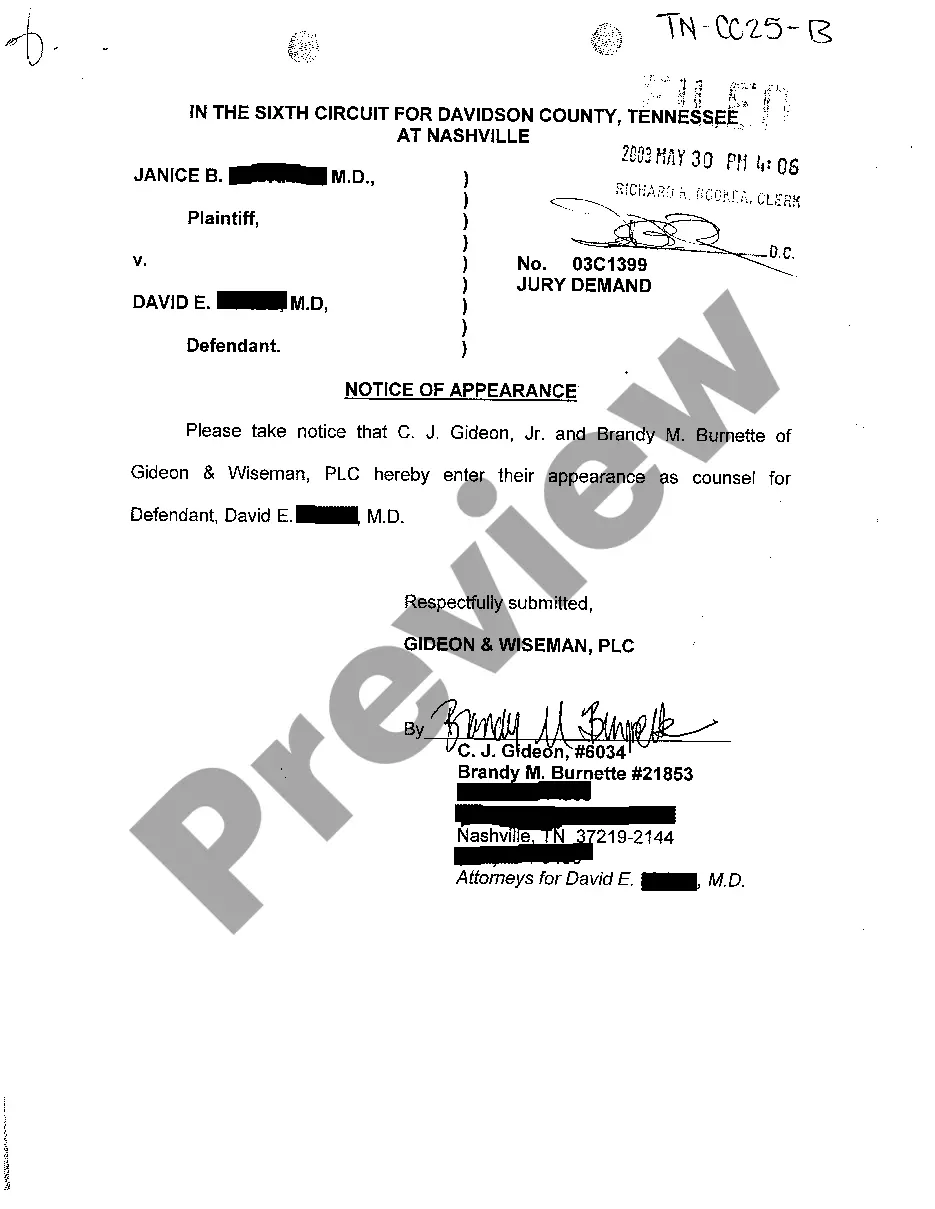

- Step 2. Use the Preview option to view the form's content. Don’t forget to read the details.

- Step 3. If you are not satisfied with the form, use the Search section at the top of the page to find other variants of the legal form format.

Form popularity

FAQ

While 'guarantee' and 'guaranty' are often used interchangeably, 'guarantee' typically serves as a verb, indicating the act of providing assurance, while 'guaranty' functions as a noun describing a formal promise. In the realm of Maine Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate, it is essential to grasp the nuances, particularly when entering legal agreements.

A bank guarantee involves a bank promising to cover a debt if the borrower defaults, often used in commercial transactions. A personal guarantee, on the other hand, is an individual's promise to cover a debt that they personally owe. When dealing with Maine Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate, knowing this difference is crucial, as personal guarantees often signify greater personal risk.

A guarantor is an individual or entity that agrees to be responsible for another party's obligations if they default. A personal guarantee, however, is a commitment made by an individual personally, indicating they are liable for the debt. In terms of Maine Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate, understanding this distinction helps you recognize who is legally accountable in various real estate agreements.

A guarantee generally refers to a promise made by one party to fulfill the obligations of another if they fail to do so. In contrast, a personal guaranty is a specific type of guarantee where an individual takes personal responsibility for a debt or obligation. In the context of Maine Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate, this means that an individual’s assets could be at risk if the lease or purchase agreement is not honored.

An example of a personal guarantee clause might state: 'The undersigned hereby guarantees payment of all rent due under this lease agreement, along with any costs incurred in enforcement or collection.' This clause clearly outlines the responsibilities assumed by the guarantor. Such explicit clauses enhance the strength of the Maine Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate and provide assurance to landlords and lenders.

When filling out a personal guarantee, you should start by entering your complete legal name and the address of the property involved. Next, clearly outline your obligations under the guarantee, including specific terms from the lease or purchase agreement. Be mindful to include signatures and dates, as these confirm your acceptance of the agreement. Platforms like USLegalForms can assist you in drafting and reviewing this important document.

In many cases, notarization is not strictly required for a personal guarantee. However, having it notarized adds an extra layer of validity and is recommended for both parties' peace of mind. It ensures that all parties involved are aware of their commitments as outlined in the Maine Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate. Always check local regulations for any specific notarization requirements.

To fill out a personal guaranty, you need to provide your full legal name and contact information, along with the details of the lease or purchase agreement involved. Include the specific obligations you are guaranteeing, making it clear what your responsibilities are. You should also specify the agreement's date for legal clarity. This careful approach ensures the personal guaranty aligns with Maine laws regarding property agreements.

Filling in the lease agreement requires careful attention to detail. Start by entering the names of all parties involved and the property address. Next, define the lease term, monthly rent, and any other essential conditions, such as maintenance responsibilities. By following these steps, you can create a comprehensive document that aligns with the Maine Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate.

The Maine Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate serves as a legal safety net. Essentially, it protects landlords or lenders by ensuring that a third party, the guarantor, will fulfill the obligations if the primary party defaults. This document enhances the confidence of property owners when entering a lease or purchase agreement. It ultimately helps facilitate smoother transactions.