Maine Resolution of Meeting of LLC Members to Sell or Transfer Stock

Description

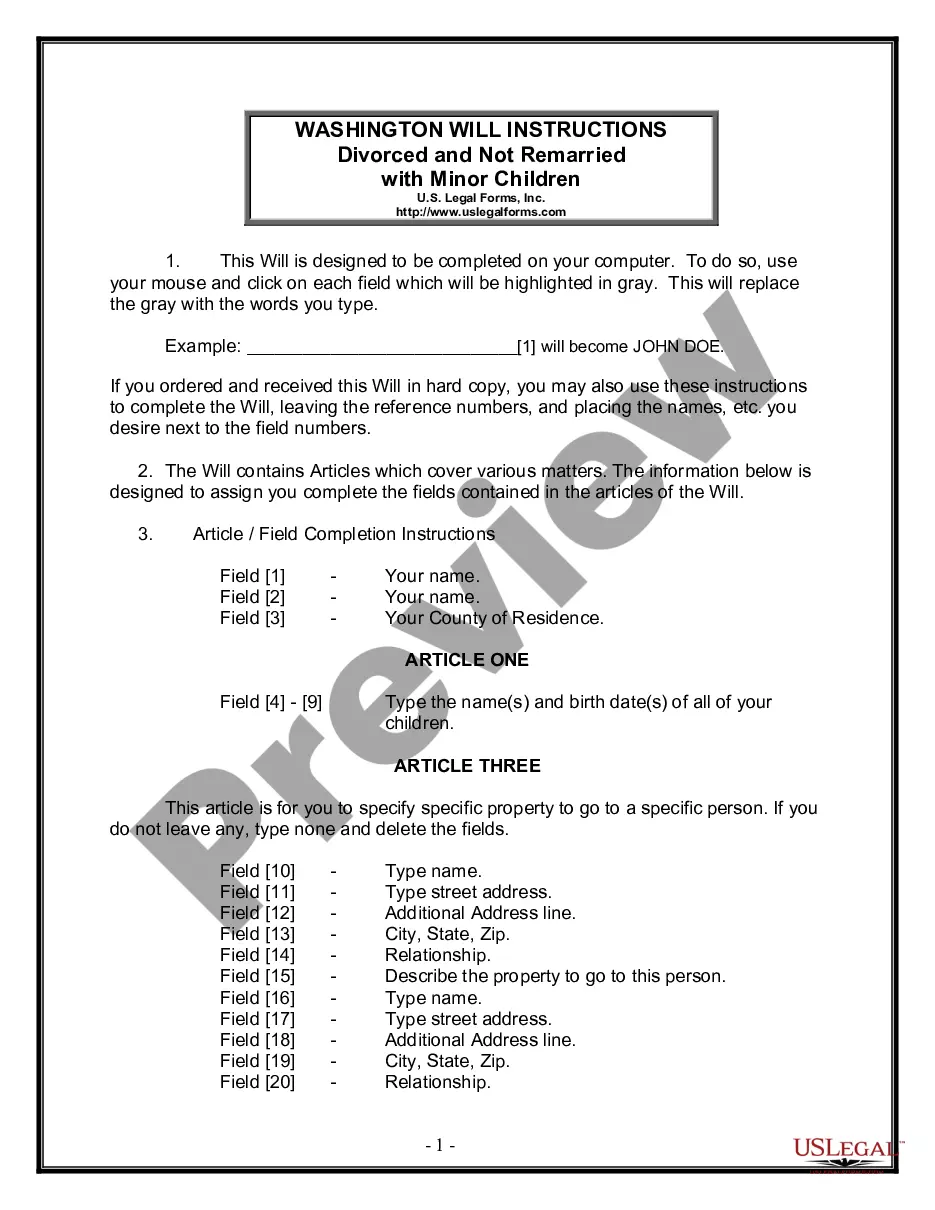

How to fill out Resolution Of Meeting Of LLC Members To Sell Or Transfer Stock?

It is feasible to spend hours online searching for the legal document format that meets the federal and state requirements you will require.

US Legal Forms offers a vast collection of legal templates that have been reviewed by experts.

You can download or print the Maine Resolution of Meeting of LLC Members to Sell or Transfer Stock from our platform.

If available, utilize the Review option to explore the document format as well.

- If you already possess a US Legal Forms account, you can Log In and then select the Download option.

- After that, you can complete, edit, print, or sign the Maine Resolution of Meeting of LLC Members to Sell or Transfer Stock.

- Every legal document format you purchase is yours indefinitely.

- To obtain another copy of the purchased form, navigate to the My documents section and select the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions outlined below.

- First, ensure that you have chosen the correct document format for the location/city of your preference.

- Review the form details to confirm you have selected the right template.

Form popularity

FAQ

A limited liability company (LLC) cannot issue shares of stock. An LLC is a business entity structured to have either a single or multiple owners, who are referred to as the LLC's members.

A limited liability company (LLC) cannot issue shares of stock. An LLC is a business entity structured to have either a single or multiple owners, who are referred to as the LLC's members.

Your best option for an LLC transfer of ownership is to write an OA with detailed buy/sell provisions in it. If your LLC's OA has buy/sell provisions, just follow those provisions in a partial transfer. Otherwise, you have to follow the provisions in the Maine statutes.

How to Change your Maine Registered AgentObtain a New Maine Registered Agent. Hire your new Maine registered agent before filing the change with the state.Complete the Maine Change of Agent form.Pay the Filing Fee.

Differences in ownership and formalities LLCs can have an unlimited number of members; S corps can have no more than 100 shareholders (owners).

If you want to change the name of your Maine LLC, you have to go through a legal process known as an amendment. Submit the proper form to the Secretary of State to let them know about your plan to change the company name.

LLC ownership percentage is usually determined by how much equity each owner has contributed. The ownership interest given to each owner can depend on the need of the limited liability company and the rules of the state where the LLC has been formed.

LLCs can have an unlimited number of members; S corps can have no more than 100 shareholders (owners).

Yes, any owner or employee of a business can be its registered agent in Maine as long as they are over the age of 18, and have a street address in Maine. You could also choose to elect a member of your LLC, or even a friend you trust, as long as the person meets these requirements too.

Many experts suggest starting with 10,000, but companies can authorize as little as one share. While 10,000 may seem conservative, owners can file for more authorized stocks at a later time. Typically, business owners should choose a number that includes the stocks being issued and some for reservation.