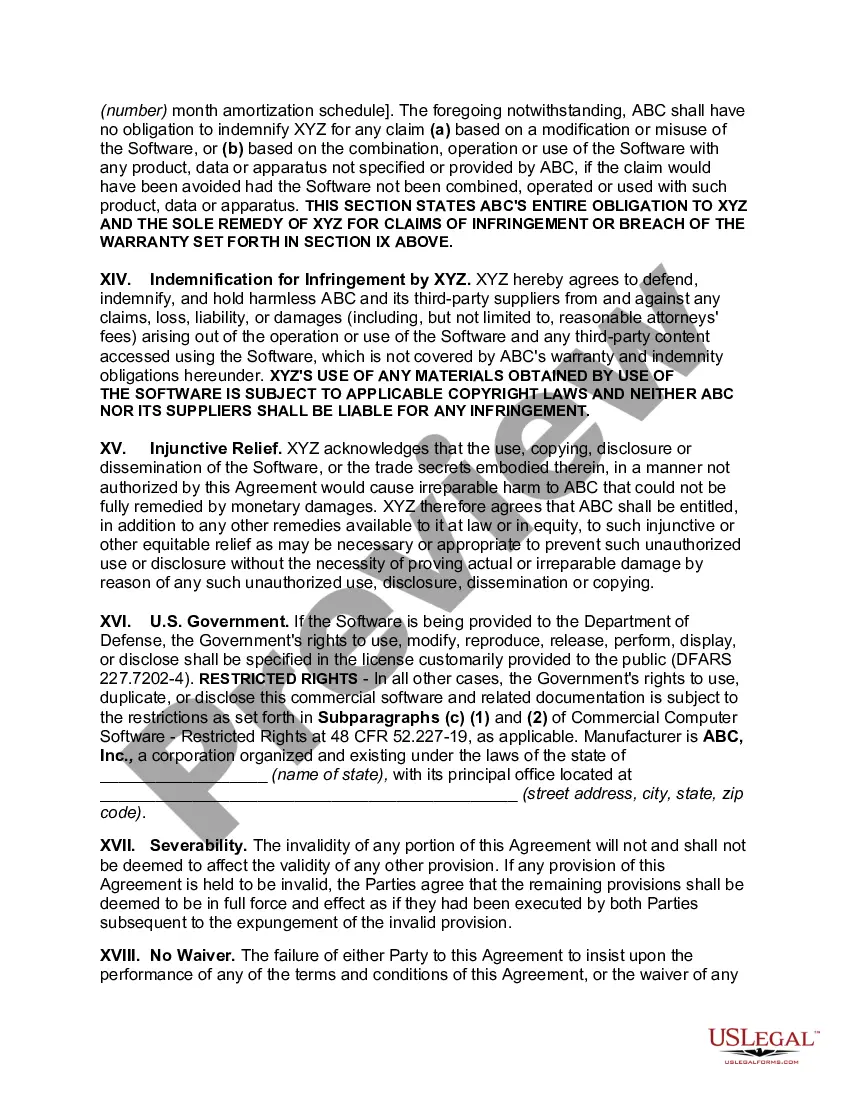

Maine Application Service Provider Software License Agreement

Description

How to fill out Application Service Provider Software License Agreement?

You might spend time online trying to discover the appropriate legal document template that satisfies the federal and state requirements you need.

US Legal Forms offers an extensive collection of legal forms that are reviewed by experts.

It is easy to download or print the Maine Application Service Provider Software License Agreement from our service.

First, ensure that you have selected the correct document template for the state/region of your choice. Review the form details to confirm you have chosen the right document. If available, utilize the Review option to browse through the document template as well. If you want to find another version of the form, use the Search field to discover the template that suits your requirements and needs.

- If you already possess a US Legal Forms account, you can Log In and select the Download option.

- After that, you can complete, modify, print, or sign the Maine Application Service Provider Software License Agreement.

- Every legal document template you purchase belongs to you permanently.

- To obtain another copy of a purchased form, access the My documents tab and select the relevant option.

- If you are using the US Legal Forms site for the first time, follow the straightforward instructions below.

Form popularity

FAQ

Maine's sales and use taxes, currently imposed at a 5.5% rate, do not generally apply to the sale of services. However, specified services have historically been subject to a separate Maine tax called the service provider tax, currently imposed at a 6% rate.

The following services are subject to the Service Provider Tax in MaineAncillary Services.Rental of Video Media and Video Equipment.Rental of Furniture, Audio Media and Equipment pursuant to a Rental-Purchase Agreement.Telecommunications Services.Installation, Maintenance or Repair of Telecommunications Equipment.More items...

Maine likely does not require sales tax on Software-as-a-Service. Why does Maine not require sales tax on Software-as-a-Service (SaaS)?

Goods that are subject to sales tax in Maine include physical property, like furniture, home appliances, and motor vehicles. Groceries, Prescription medicine, and gasoline are all tax-exempt.

In most states, where services aren't taxable, SaaS also isn't taxable. Other states, like Washington, consider SaaS to be an example of tangible software and thus taxable. Just like with anything tax related, each state has made their own rules and laws.

Sales of custom software - delivered on tangible media are exempt from the sales tax in Maine. Sales of custom software - downloaded are exempt from the sales tax in Maine.

Only two states Tennessee and Vermont have specific statutes in place to address SaaS transactions and sales tax. Several states have ping-ponged on their decisions, the most recent being Michigan, who ultimately decided to exempt it.

File is a convenient and accurate way to file your Maine individual income tax return. File using a participating preparer, purchase commercial software or a commercial website.

Maine likely does not require sales tax on Software-as-a-Service. Why does Maine not require sales tax on Software-as-a-Service (SaaS)?