Maine Document Organizer and Retention

Description

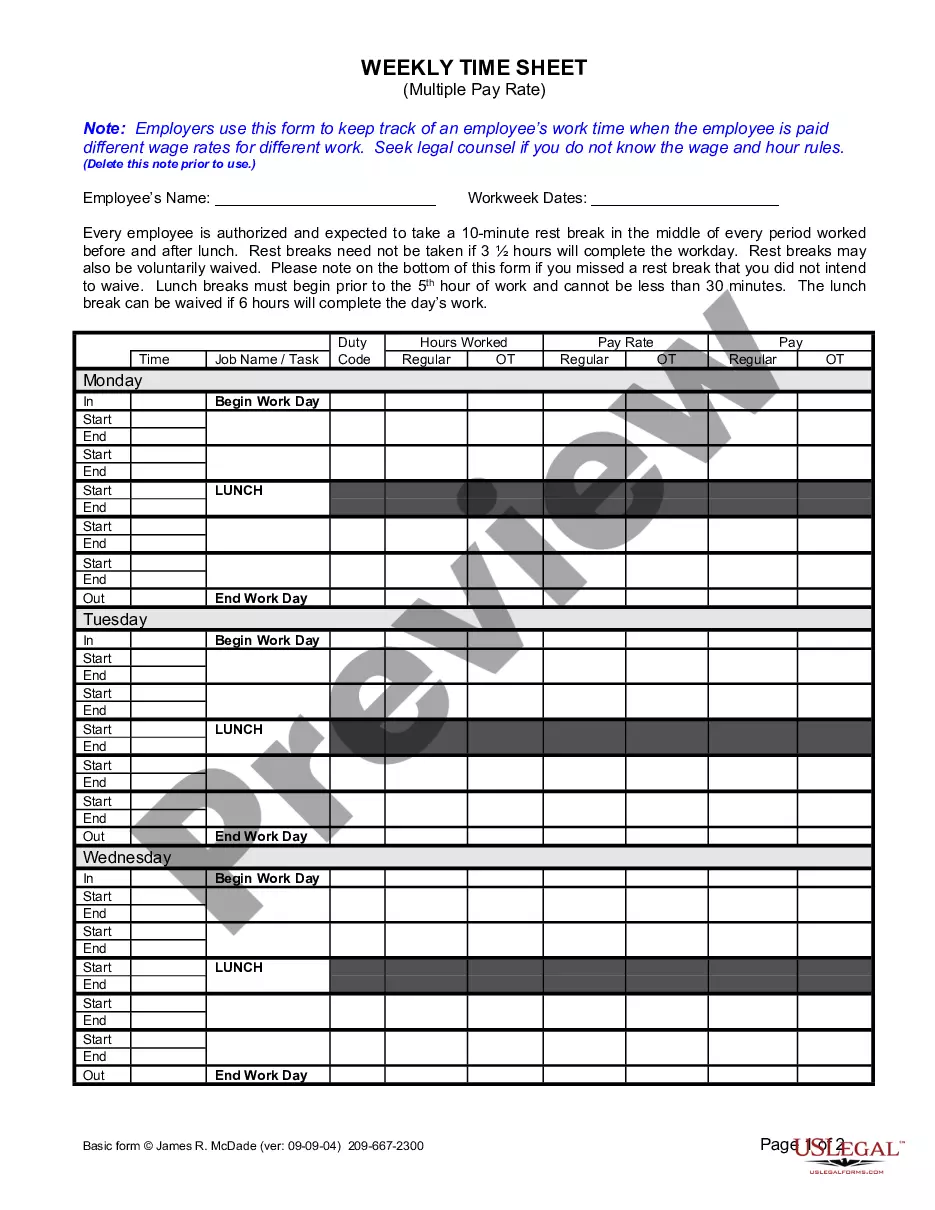

How to fill out Document Organizer And Retention?

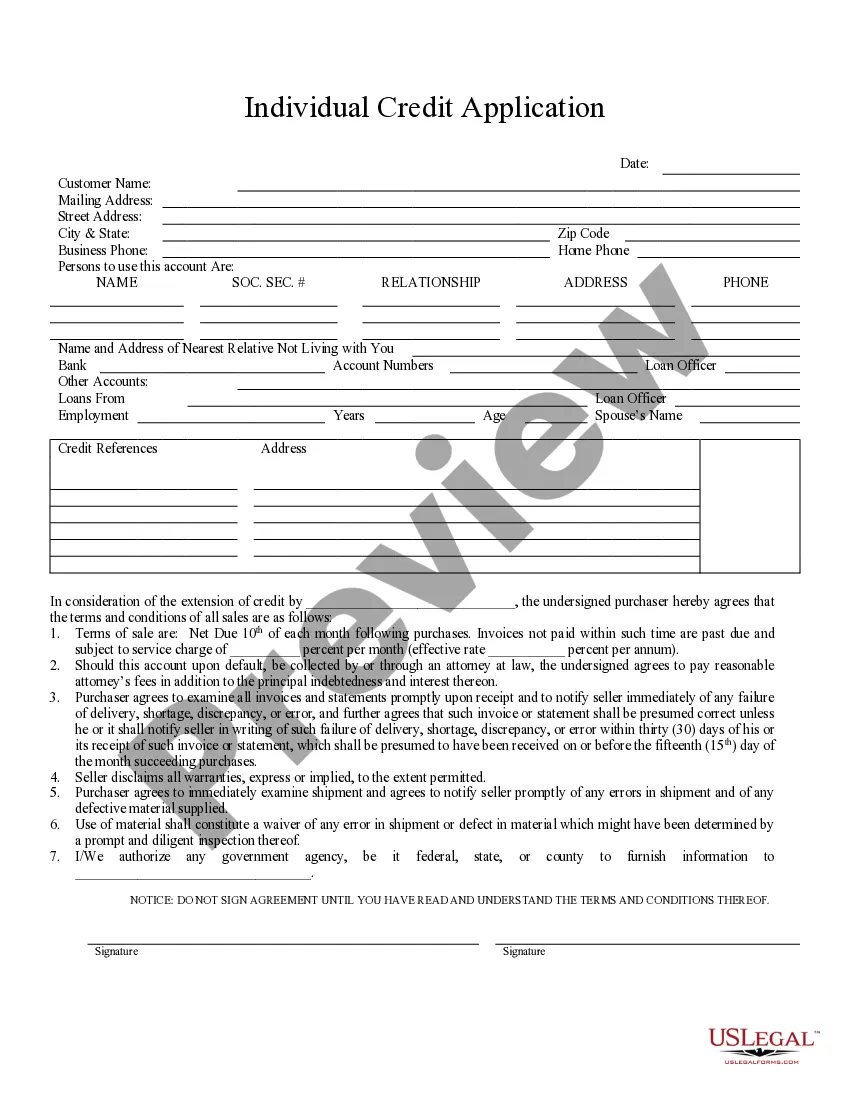

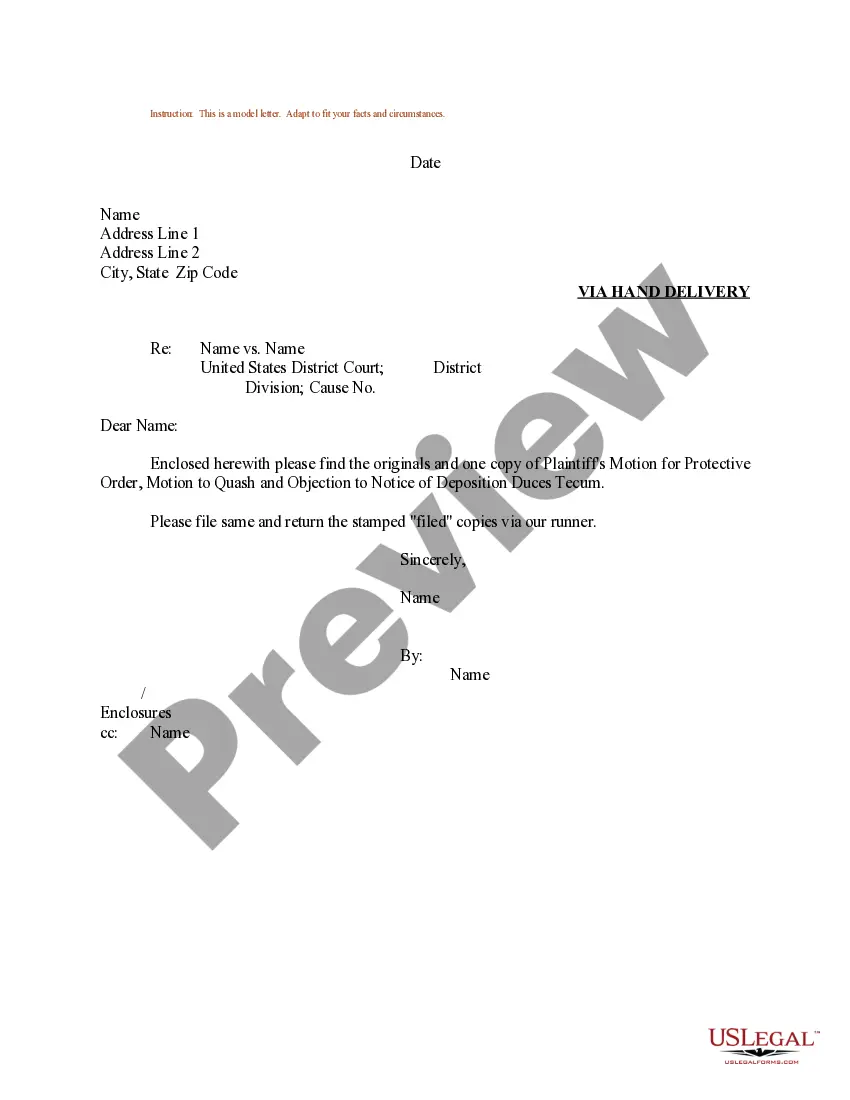

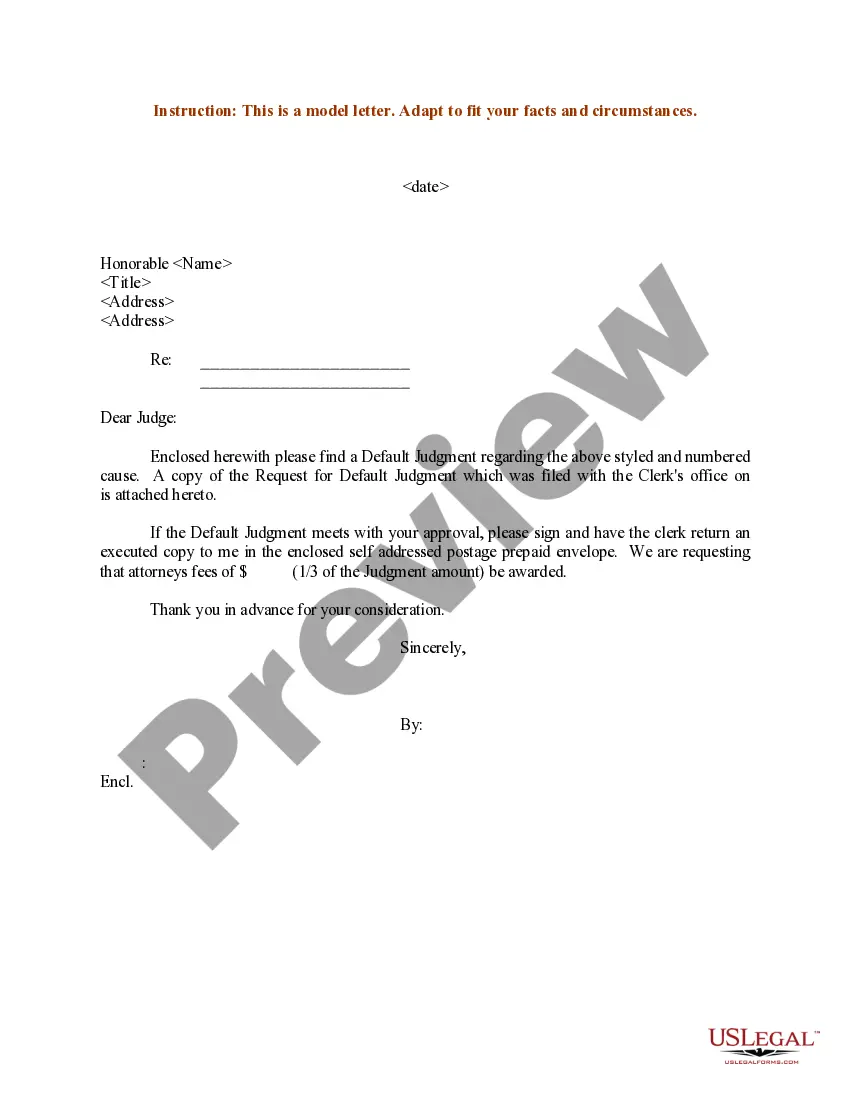

You can dedicate hours online trying to locate the legal document template that meets the state and federal requirements you need.

US Legal Forms offers thousands of legal forms that can be evaluated by professionals.

It’s easy to obtain or create the Maine Document Organizer and Retention from our service.

If available, use the Review button to look through the document template as well. If you wish to find another version of the form, utilize the Search field to locate the template that meets your needs and requirements.

- If you have a US Legal Forms account, you can Log In and click the Download button.

- After that, you can complete, modify, print, or sign the Maine Document Organizer and Retention.

- Every legal document template you acquire is yours to keep indefinitely.

- To get an additional copy of a purchased form, visit the My documents tab and click the corresponding button.

- If you’re using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the county/town of your choice.

- Review the form details to confirm that you have chosen the right form.

Form popularity

FAQ

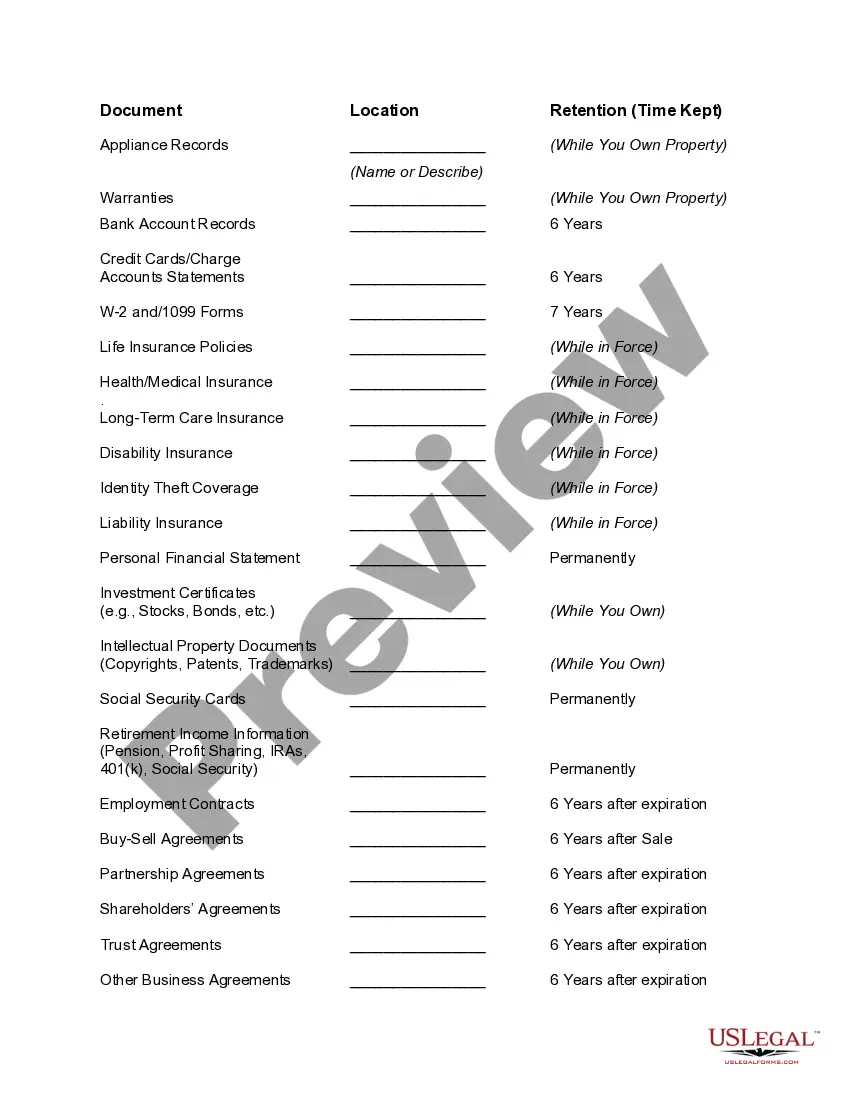

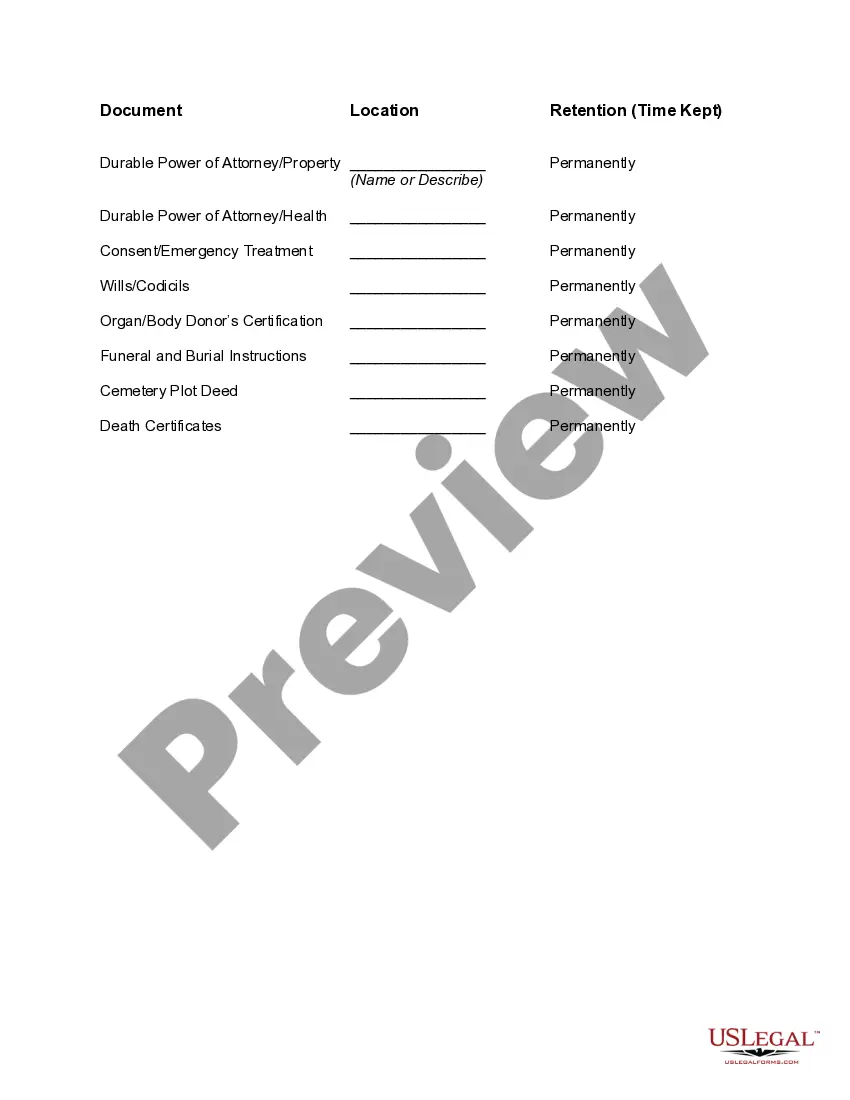

A retention period (associated with a retention schedule or retention program) is an aspect of records and information management (RIM) and the records life cycle that identifies the duration of time for which the information should be maintained or "retained," irrespective of format (paper, electronic, or other).

A DRP will identify documents that need to be maintained, contain guidelines for how long certain documents should be kept, and save your company valuable computer and physical storage space.

Document retention guidelines typically require businesses to store records for one, three or seven years. In some cases, you will need to keep the records forever.

Knowing that, a good rule of thumb is to save any document that verifies information on your tax returnincluding Forms W-2 and 1099, bank and brokerage statements, tuition payments and charitable donation receiptsfor three to seven years.

A records retention schedule is a policy that defines how long data items must be kept and provides disposal guidelines for how data items should be discarded.

Records Retention Guideline #4: Keep everyday paperwork for 3 yearsMonthly financial statements.Credit card statements.Utility records.Employment applications (for businesses)Medical bills (in case of insurance disputes)

Records retention refers to methods and practices organizations use to maintain important information for a required period of time for administrative, financial, legal, and historical purposes. It applies to paper documents as well as the retention of electronic records such as word documents and spreadsheets.

A document retention schedule is a policy that clearly defines what documents need to be maintained and for how long. A retention policy will include all types of documents and records that are created on behalf of the company as part of its business.

(also disposition standard), n. The length of time records should be kept in a certain location or form for administrative, legal, fiscal, historical, or other purposes.

A maximum retention period tells you when to destroy a certain record. When this period has lapsed you are really not supposed to have the record anymore. It is time to say goodbye to it. In some countries, though, there are exceptions when you issue a legal hold notice or a tax hold notice.