Maine Personal Planning Information and Document Inventory Worksheets - A Legal Life Document

Description

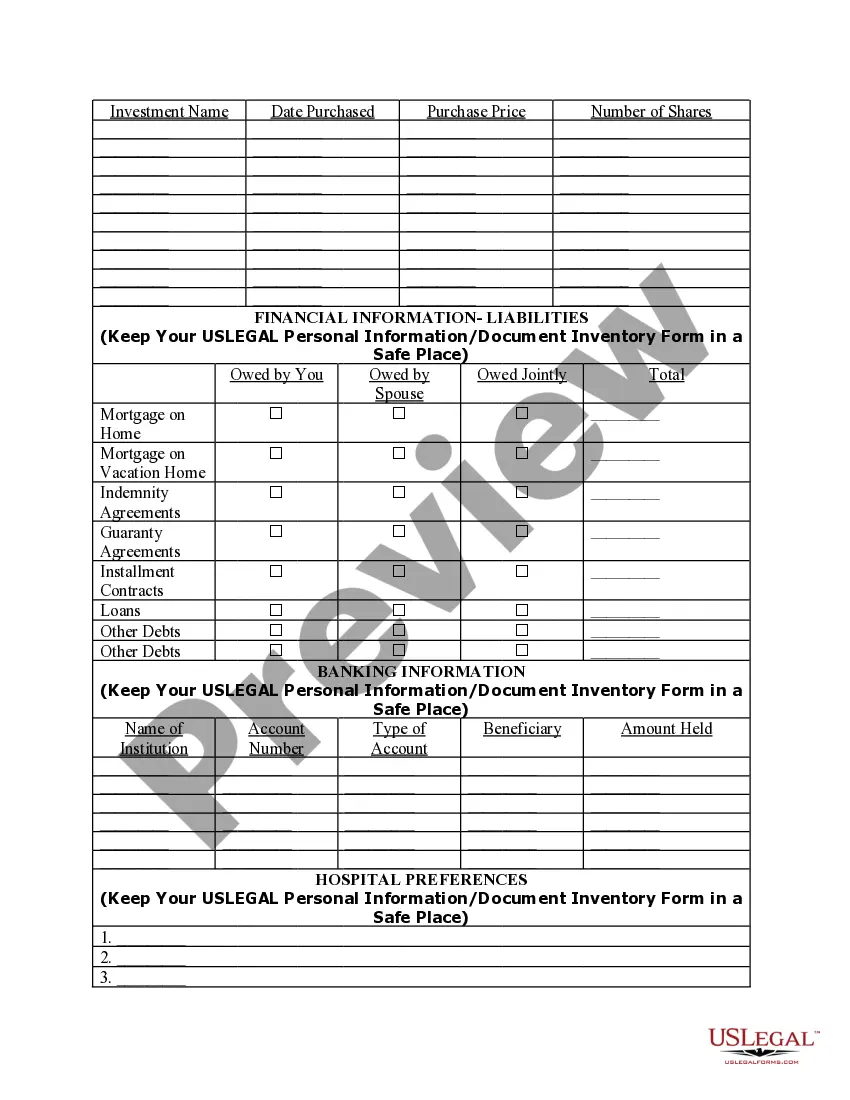

How to fill out Personal Planning Information And Document Inventory Worksheets - A Legal Life Document?

You might spend time online trying to locate the legal document template that meets both federal and state requirements that you will require.

US Legal Forms provides a large number of legal forms that have been reviewed by professionals.

It is easy to download or print the Maine Personal Planning Information and Document Inventory Worksheets - A Legal Life Document from the services.

If available, use the Review button to take a look through the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Obtain button.

- After that, you can complete, modify, print, or sign the Maine Personal Planning Information and Document Inventory Worksheets - A Legal Life Document.

- Every legal document template you acquire is yours permanently.

- To get an extra copy of a purchased form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for your state/city of choice.

- Check the form description to confirm you have selected the right form.

Form popularity

FAQ

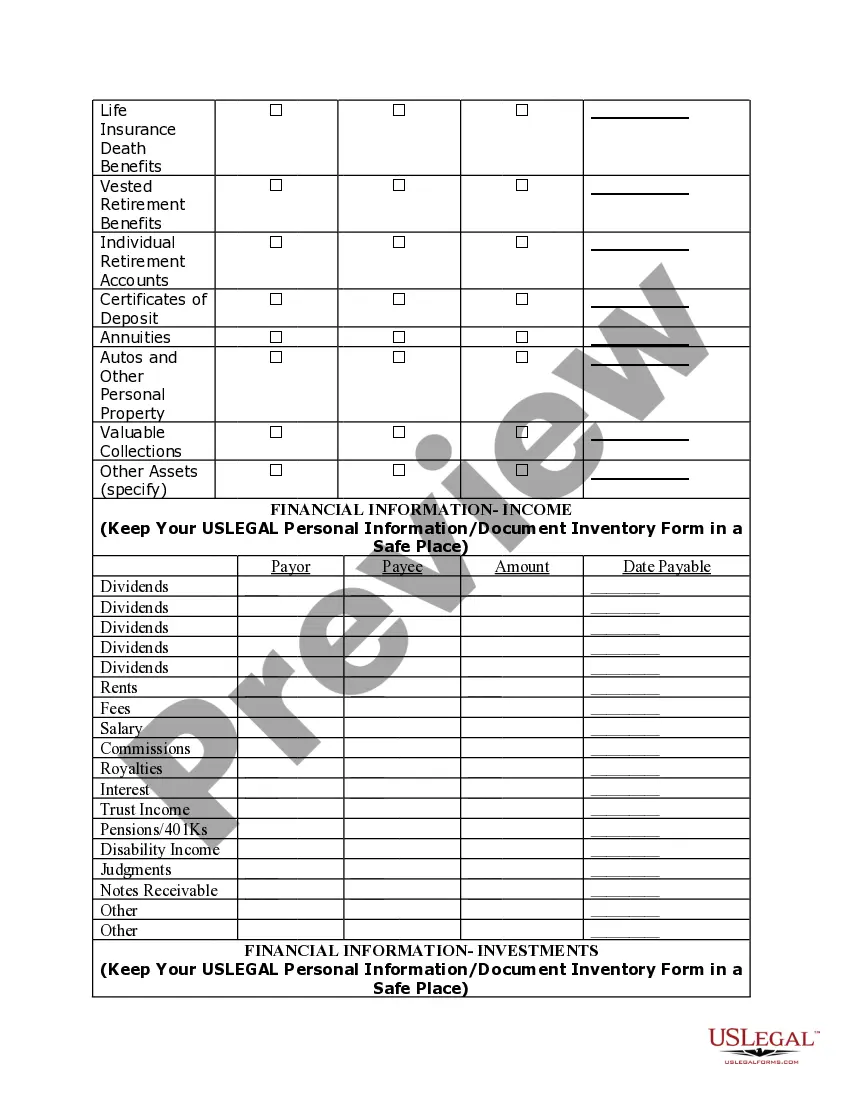

To submit a 1099 form to Maine, you need to file it with the Maine Revenue Services as part of your tax requirements. This process ensures all income reported to you also gets reported to the state. Using the Maine Personal Planning Information and Document Inventory Worksheets - A Legal Life Document can help you track income and necessary forms, making the submission process seamless.

The actual place of abode is defined as the physical location where you live and consider your home. It often represents your primary residence, where you return after travels or work. For those navigating legal documents, the Maine Personal Planning Information and Document Inventory Worksheets - A Legal Life Document can aid in organizing your housing information and supporting documentation.

If you are a resident of Maine or generate income from Maine sources, you typically need to file a state tax return. This requirement ensures you comply with state tax laws and obligations. Utilizing Maine Personal Planning Information and Document Inventory Worksheets - A Legal Life Document can simplify your preparation and ensure you gather all necessary documents for a comprehensive tax filing.

To be considered a resident of Maine, you generally need to establish a continuous physical presence in the state. This usually means living in Maine for a minimum of six months. You can document this residency using resources like the Maine Personal Planning Information and Document Inventory Worksheets - A Legal Life Document, which assist with maintaining your legal documentation as you transition to full residency.

The 183 day rule in Maine is a guideline that determines your residency based on the number of days you spend in the state. If you reside in Maine for 183 days or more within a calendar year, you may be considered a resident for tax purposes. Understanding this rule helps you utilize the Maine Personal Planning Information and Document Inventory Worksheets - A Legal Life Document for better tax management and planning.

A permanent place of abode in Maine refers to a dwelling that you maintain as a fixed residence. This can include a home, apartment, or any structure you use as a base for living. It’s essential for various legal and tax considerations, especially with the Maine Personal Planning Information and Document Inventory Worksheets - A Legal Life Document. Having a permanent place of abode helps clarify your residency status.

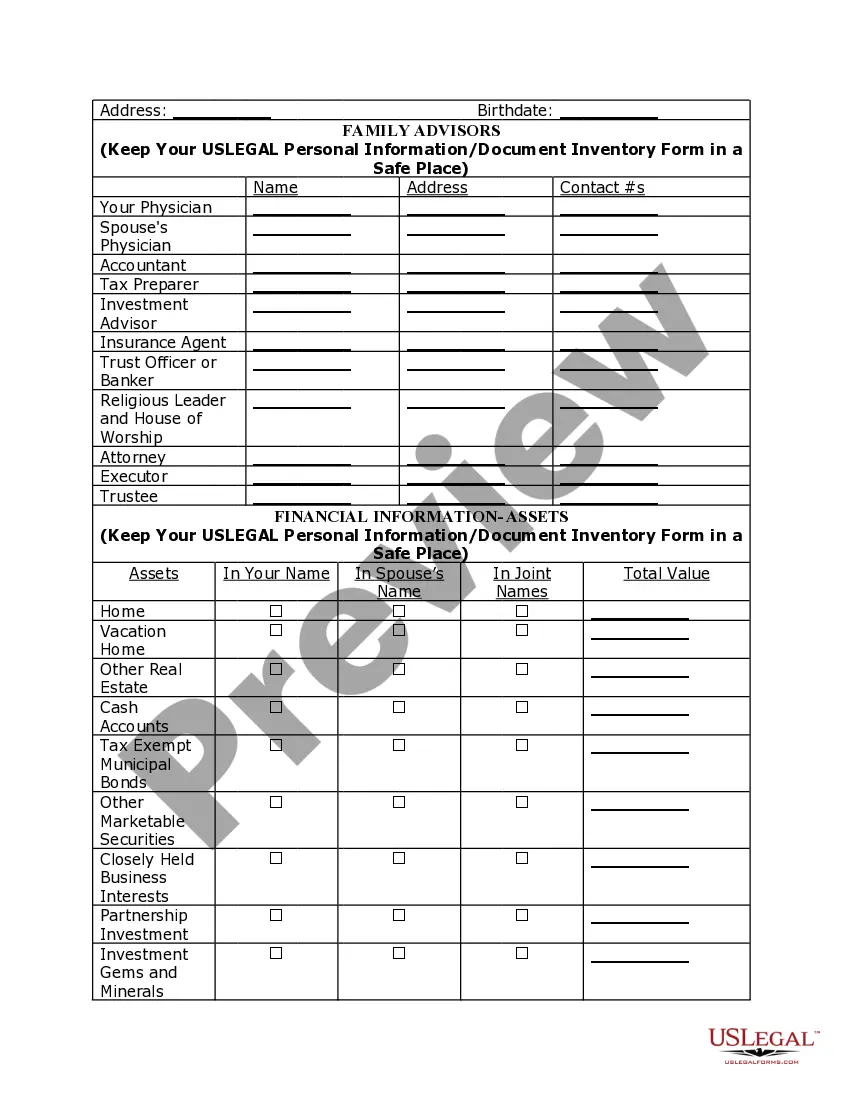

This online program includes the tools to build your four "must-have" documents:Will.Revocable Trust.Financial Power of Attorney.Durable Power of Attorney for Healthcare.

Five Must-Have Legal DocumentsGuardianship Documents.Health Care Power of Attorney.Financial Power of Attorney.Living Will.Last Will and Testament.U.S. Legal Services Can Help!

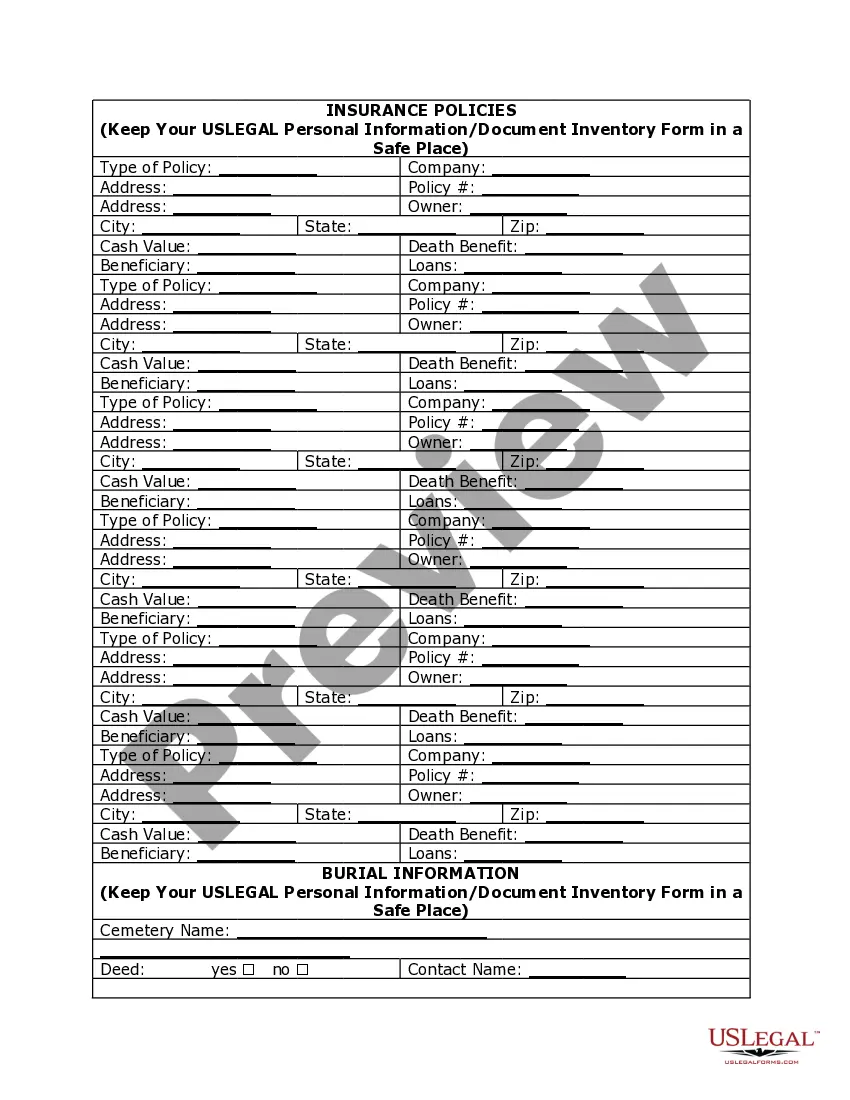

Estate planning checklistLast will and testament.Revocable living trust.Beneficiary designations.Advance healthcare directive (AHCD) / living will.Financial power of attorney (POA)Insurance policies and financial information.Proof of identity documents.Titles and property deeds.More items...?

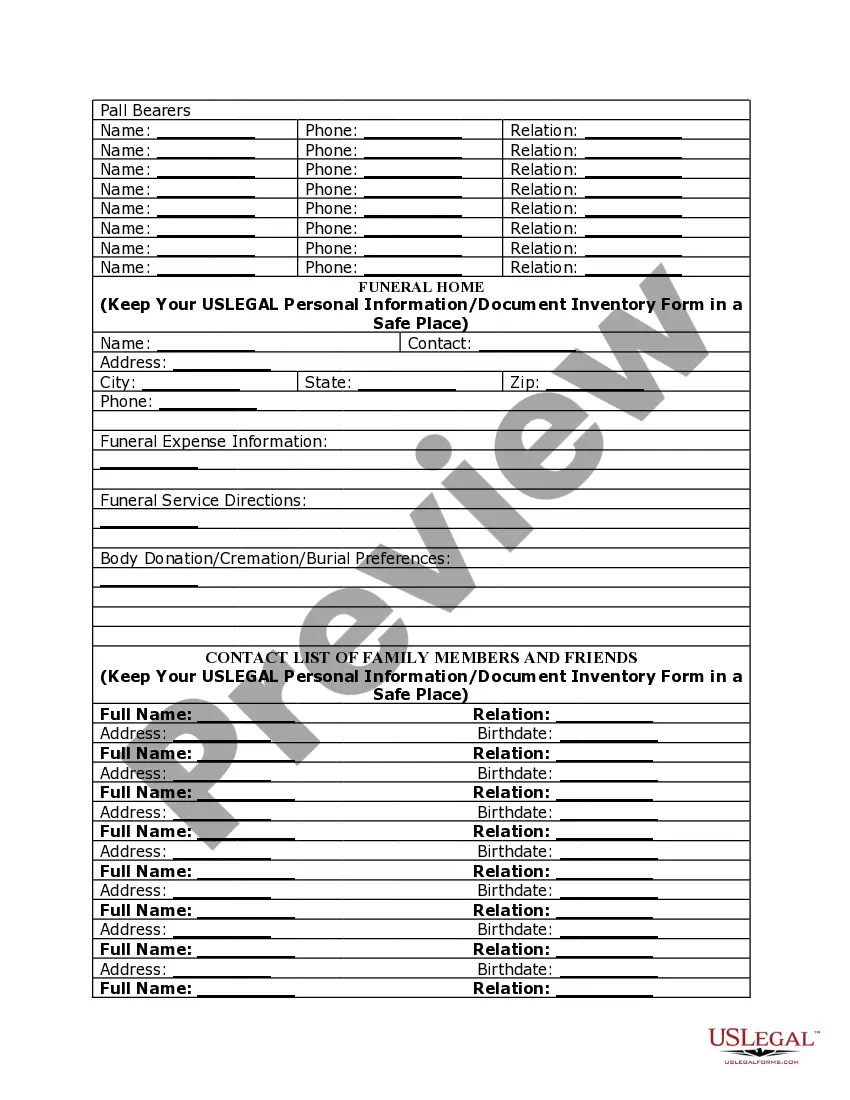

Living Will. A will is one of the most common documents you hear about when it comes to end-of-life planning.Last Will and Testament.Living Trust.Letter of Intent.Financial Power of Attorney.Health Care Power of Attorney.Letter of Competency.Organ Donor Card.More items...?06-May-2021