Maine Letter to Creditor Requesting a Temporary Payment Reduction

Description

How to fill out Letter To Creditor Requesting A Temporary Payment Reduction?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a diverse selection of legal document templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can obtain the latest forms, such as the Maine Letter to Creditor Requesting a Temporary Payment Reduction, within moments.

If you already hold a membership, Log In to retrieve the Maine Letter to Creditor Requesting a Temporary Payment Reduction from the US Legal Forms library. The Download button will be visible on every form you view. All previously downloaded forms can be found in the My documents section of your account.

Complete the purchase. Use your credit card or PayPal account to finalize the transaction.

Select the format and download the form onto your device. Edit, fill out, modify, and print the acquired Maine Letter to Creditor Requesting a Temporary Payment Reduction. Each template added to your account does not have an expiration date and belongs to you forever. Therefore, to download or print another copy, simply visit the My documents section and click on the form you need. Access the Maine Letter to Creditor Requesting a Temporary Payment Reduction with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements and specifications.

- If you are using US Legal Forms for the first time, here are simple steps to help you get started.

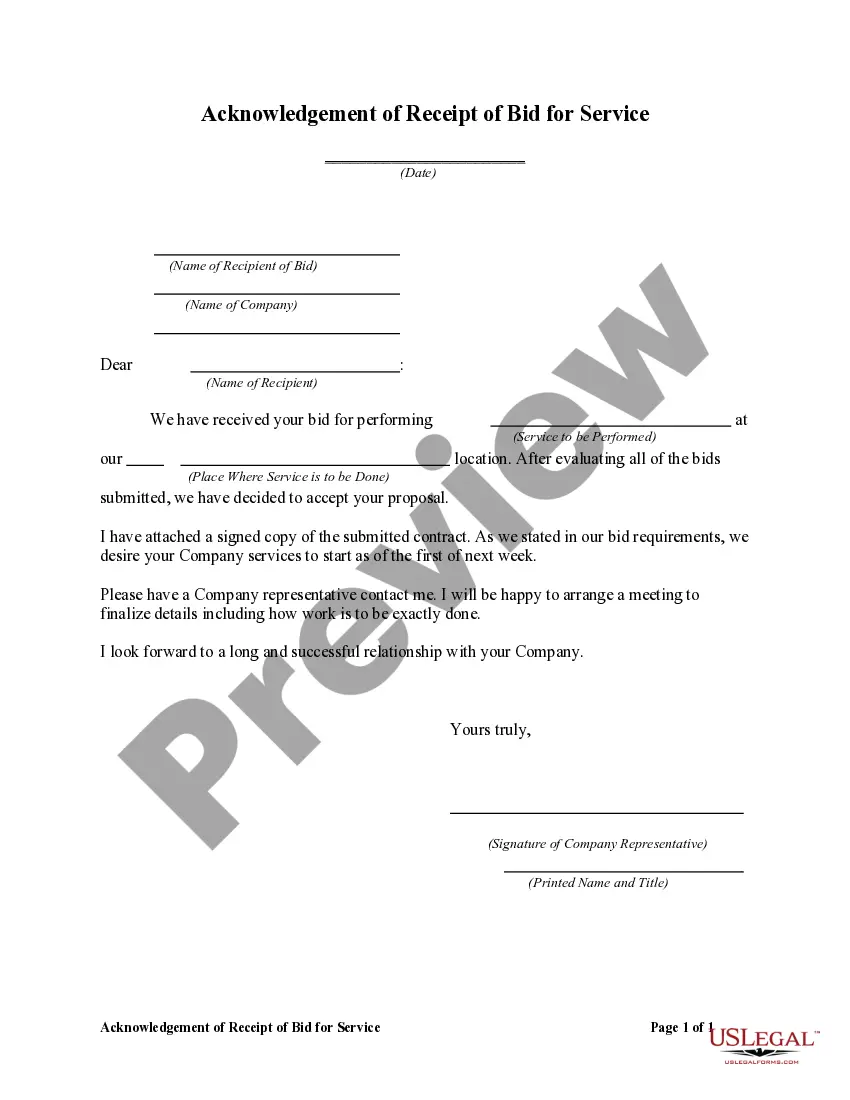

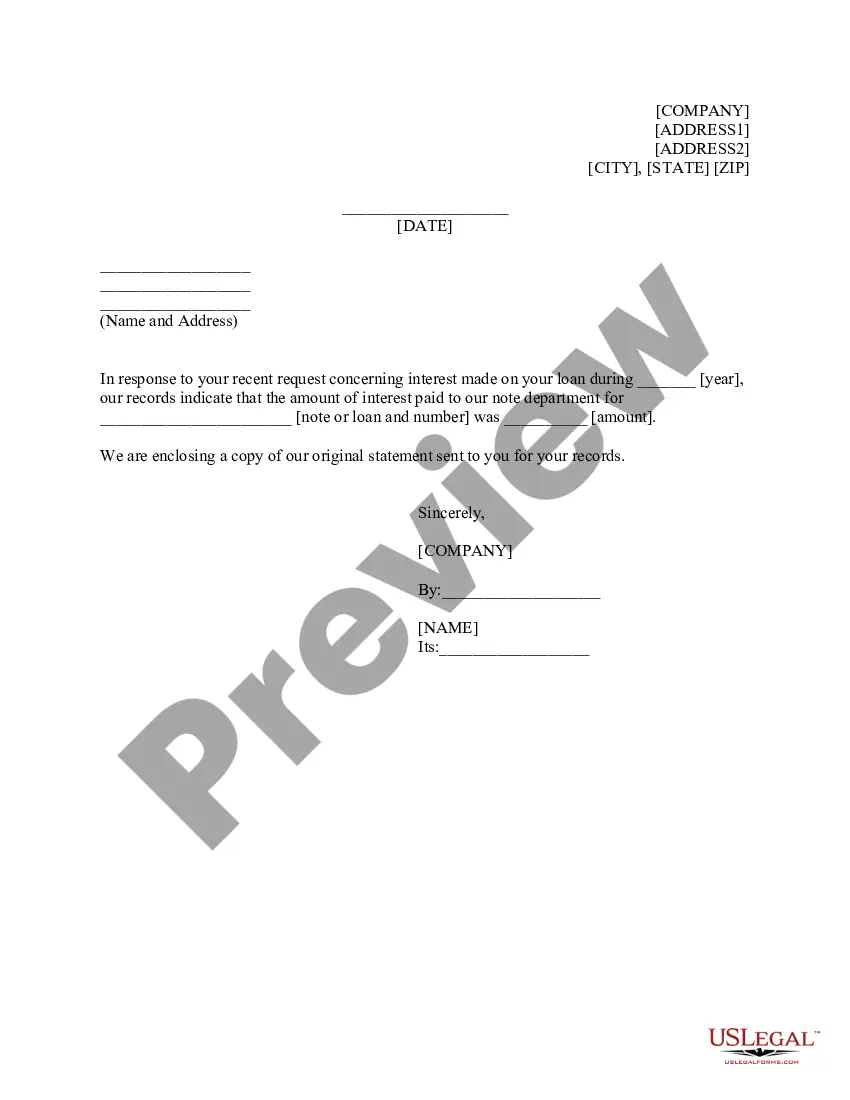

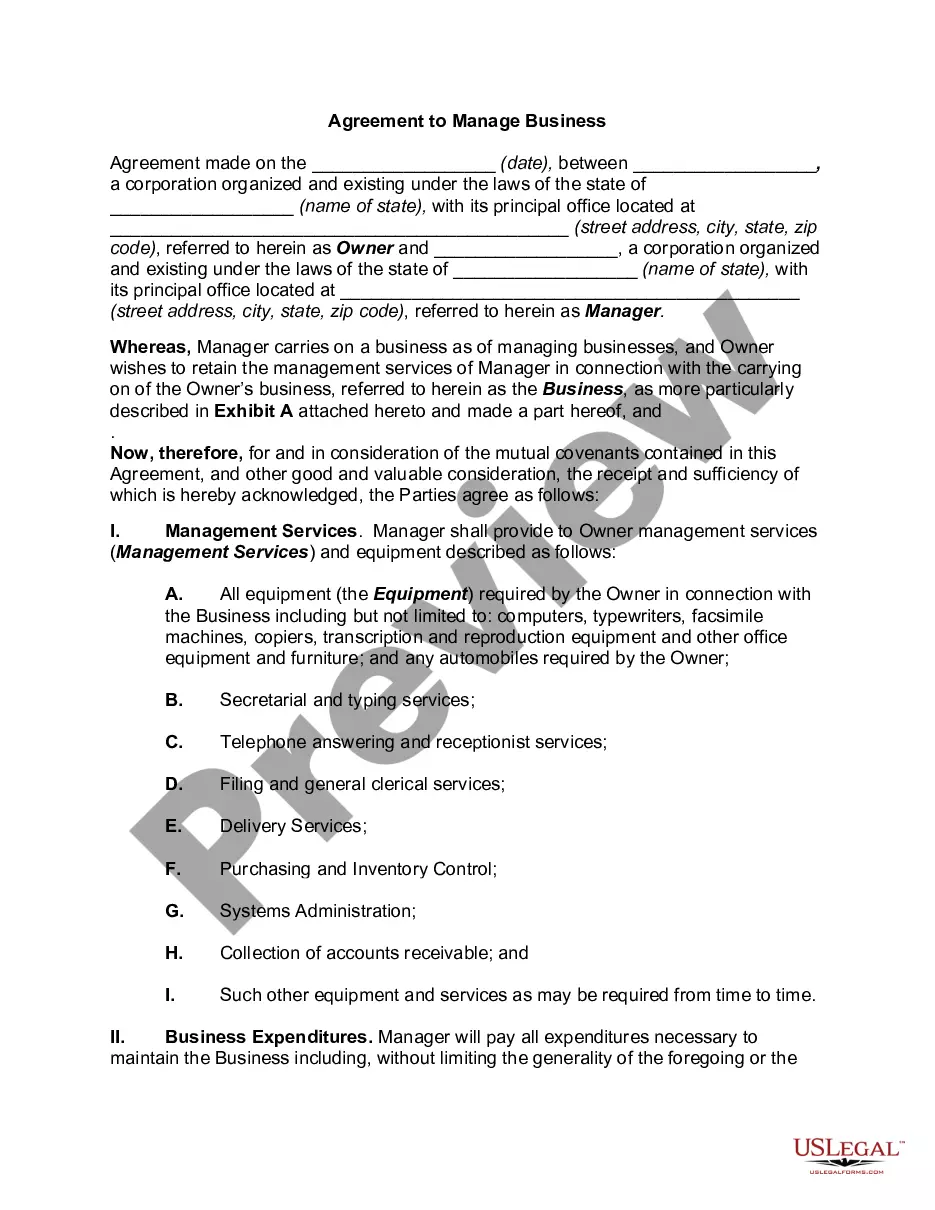

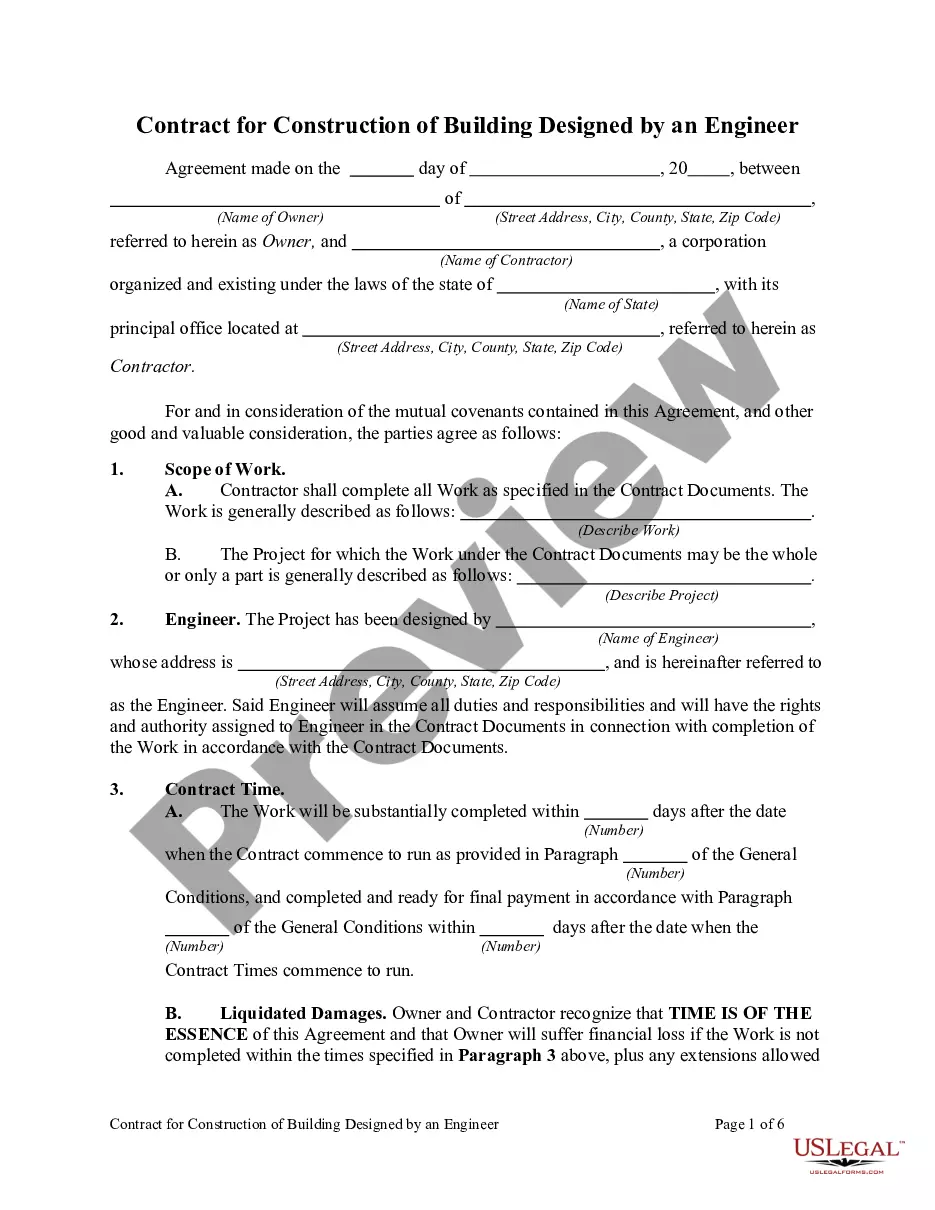

- Make sure you have selected the correct form for your city/state. Click the Preview button to review the form's content.

- Check the form description to confirm you have picked the appropriate form.

- If the form does not meet your needs, use the Search area at the top of the screen to find the one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Next, select the payment plan you prefer and provide your details to register for an account.

Form popularity

FAQ

Both state and federal law allow for business owners to deny credit cards as payment. Many merchants choose to set a minimum amount for credit cards and if a customer chooses to buy less than this amount, they will have to use cash.

Typically, a creditor will agree to accept 40% to 50% of the debt you owe, although it could be as much as 80%, depending on whether you're dealing with a debt collector or the original creditor. In either case, your first lump-sum offer should be well below the 40% to 50% range to provide some room for negotiation.

Speak to the Original Creditor Inform the original creditor that you want to find a way to settle the debt, and ask if they're willing to negotiate. The creditor may choose to accept your initial offer, negotiate a new amount, or refuse outright and refer you back to the collection agency.

If the collection agency refuses your settlement offer, consider contacting the original creditor of the debt. This is possible only if the original creditor still owns the debt and hired the collection agency to collect on its behalf.

Dear debt collector, I am responding to your contact about collecting a debt. You contacted me by phone/mail, on date and identified the debt as any information they gave you about the debt. I do not have any responsibility for the debt you're trying to collect.

You can stop calls from collection agencies by sending a certified letter asking them to stop calling. Debt collectors must send you a written validation notice that states how much money you owe, the name of the creditor and how to proceed if you want to dispute the debt.

Tips for Writing a Hardship LetterKeep it original.Be honest.Keep it concise.Don't cast blame or shirk responsibility.Don't use jargon or fancy words.Keep your objectives in mind.Provide the creditor an action plan.Talk to a Financial Couch.

How to prepare to talk with your creditorsThe specifics of your account. If you're calling to discuss a current account or loan, be sure to have a current statement on hand.An explanation of your situation.A repayment option/plan.Proof of your situation.A cool head.

Can a debt collector refuse your payment plan? Yes, they can. There are no laws that say debt collectors have to accept a plan that fits your budget. Debt collectors want to collect the debt as quickly as possible which can mean expensive monthly payments.

Your dispute letter should include the following information:Your full name.Your date of birth.Your Social Security number.Your current address and any other addresses at which you have lived during the past two years.A copy of a government-issued identification card such as a driver's license or state ID.More items...?