Maine Sample Letter for Request of Information Pertaining to Property Sale

Description

How to fill out Sample Letter For Request Of Information Pertaining To Property Sale?

Are you currently within a situation the place you need files for possibly company or personal reasons almost every day time? There are a lot of authorized record web templates available on the Internet, but discovering kinds you can rely is not easy. US Legal Forms gives a huge number of type web templates, just like the Maine Sample Letter for Request of Information Pertaining to Property Sale, which are published in order to meet federal and state requirements.

When you are previously acquainted with US Legal Forms internet site and have an account, simply log in. After that, it is possible to down load the Maine Sample Letter for Request of Information Pertaining to Property Sale format.

Should you not come with an accounts and want to start using US Legal Forms, abide by these steps:

- Get the type you want and ensure it is for the correct area/area.

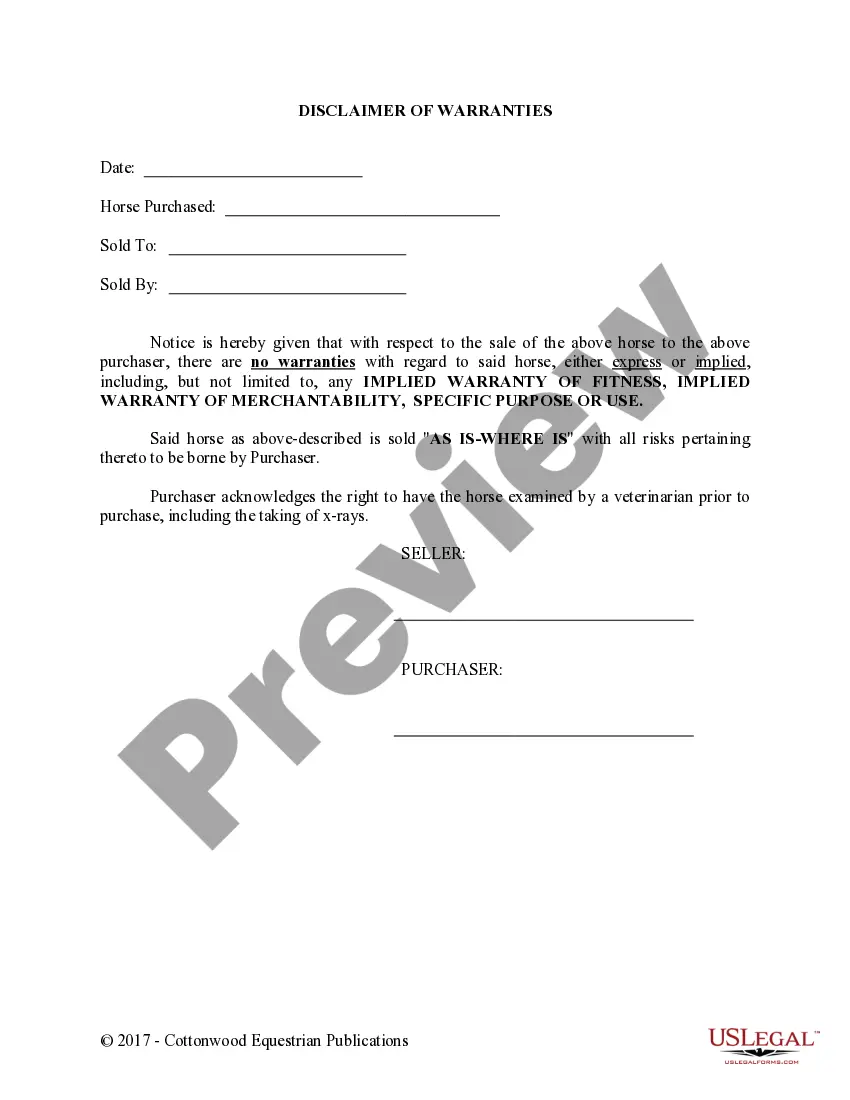

- Make use of the Review key to analyze the form.

- Read the explanation to actually have chosen the correct type.

- In case the type is not what you`re looking for, use the Lookup discipline to find the type that fits your needs and requirements.

- Whenever you obtain the correct type, simply click Buy now.

- Choose the costs plan you want, complete the specified info to produce your bank account, and pay for an order using your PayPal or bank card.

- Decide on a convenient paper formatting and down load your copy.

Discover all the record web templates you might have bought in the My Forms menus. You can aquire a more copy of Maine Sample Letter for Request of Information Pertaining to Property Sale at any time, if required. Just click the required type to down load or printing the record format.

Use US Legal Forms, the most extensive collection of authorized kinds, to save some time and prevent faults. The assistance gives professionally made authorized record web templates that can be used for a variety of reasons. Generate an account on US Legal Forms and begin generating your lifestyle a little easier.

Form popularity

FAQ

The most commonly used method determines how much it would take at the current price of materials and labor to replace a building, then subtracts out how much the building has depreciated. A second method compares the selling price of similar types of property.

?You must let the assessor inside your home.? If you do not want us inside your home, that is your right.

What to Include in Your Demand Letter Make sure to include background facts describing the property and how it was taken. ... Only make claims that are legally correct. ... Explain your ownership rights to the property. ... State how the property can be returned. ... Include a deadline and intent to sue language.

1. Minimum assessment ratios: ?a 70% minimum assessment ratio by 1979 and thereafter. Ratio of sale price to assessed value = assessed value divided by sale price.

The buyer of the property will withhold and remit the Real Estate Withholding money to Maine Revenue Services using form REW-1. The amount to be withheld is equal to 2.5% of the sale price.

The Current Mil Rate for 2023/2024 is $15.14 The mill rate is based on "mills." It is a figure that represents the amount per $1,000 of the assessed value of the property, which is used to calculate the amount of property tax. If playback doesn't begin shortly, try restarting your device.

Just value is equal to market value. Municipalities must assess property taxes ing to the just value of property. The phrase ?ing to? does not mean that all property must be valued at market value, but all property must be valued at the same relation to market value.