Maine Deed Conveying Property to Charity with Reservation of Life Estate

Description

How to fill out Deed Conveying Property To Charity With Reservation Of Life Estate?

Discovering the right legitimate file design could be a have difficulties. Of course, there are a variety of templates accessible on the Internet, but how do you get the legitimate type you need? Make use of the US Legal Forms site. The support gives a large number of templates, for example the Maine Deed Conveying Property to Charity with Reservation of Life Estate, that you can use for company and private requires. All the types are examined by professionals and satisfy federal and state specifications.

In case you are currently listed, log in for your profile and then click the Obtain key to find the Maine Deed Conveying Property to Charity with Reservation of Life Estate. Utilize your profile to appear from the legitimate types you possess acquired in the past. Go to the My Forms tab of your respective profile and obtain one more backup of your file you need.

In case you are a new customer of US Legal Forms, allow me to share basic instructions that you should follow:

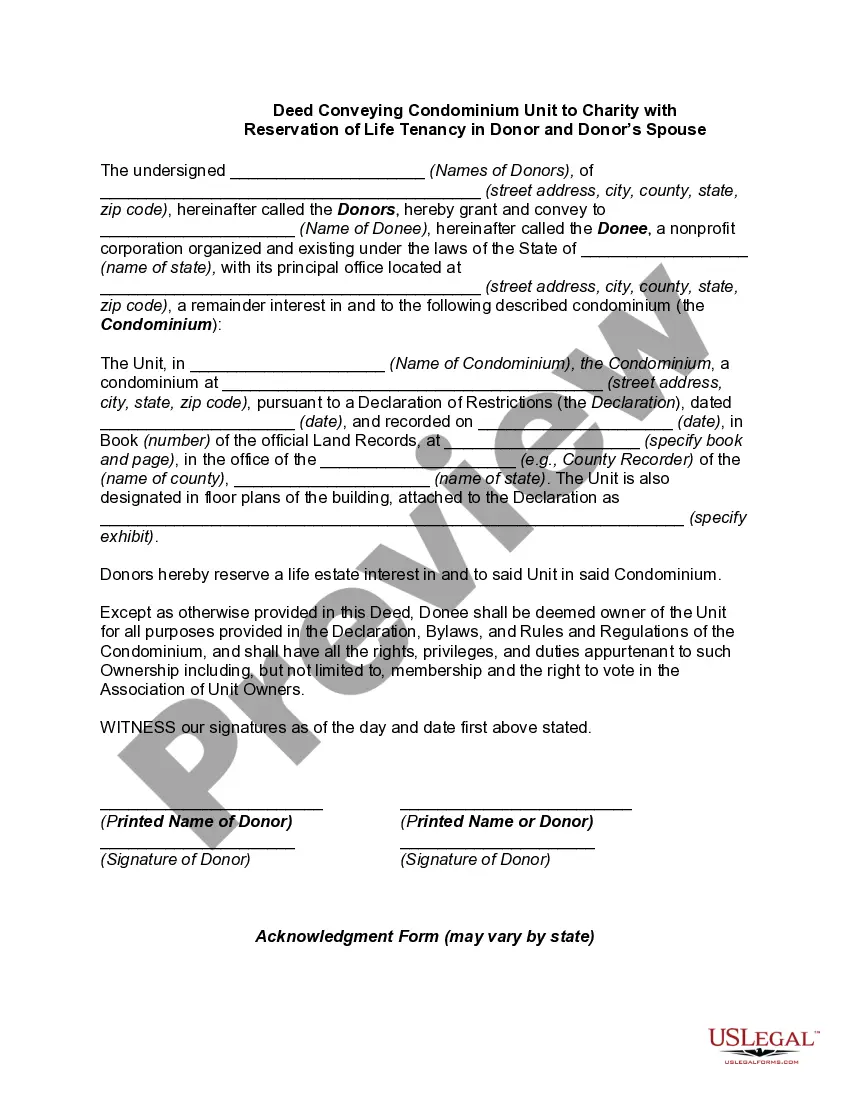

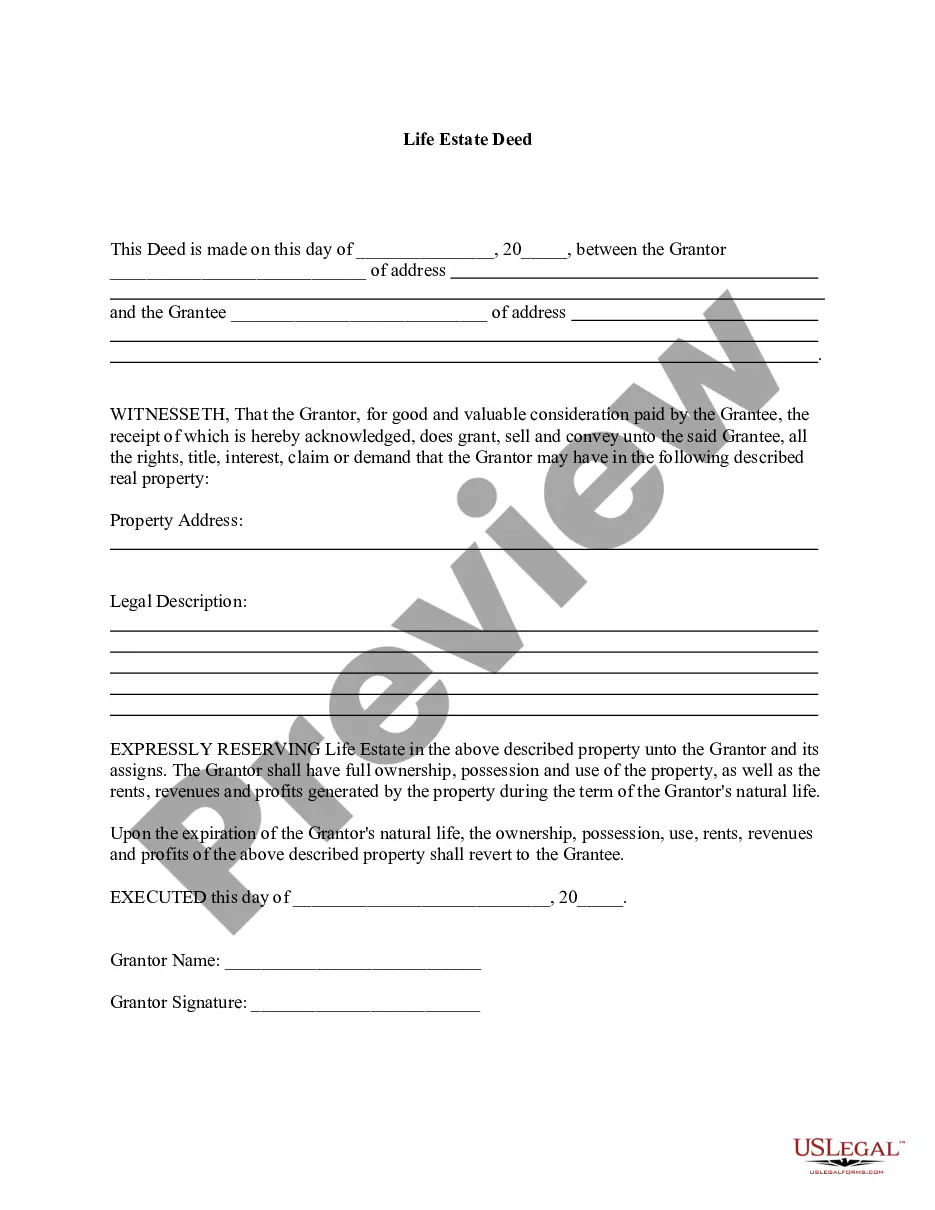

- Initially, make certain you have chosen the appropriate type for your personal area/state. You can check out the form utilizing the Review key and read the form explanation to ensure this is basically the best for you.

- In the event the type does not satisfy your needs, take advantage of the Seach discipline to get the proper type.

- Once you are certain that the form would work, click on the Purchase now key to find the type.

- Pick the pricing strategy you need and enter the essential details. Create your profile and purchase your order making use of your PayPal profile or bank card.

- Opt for the document formatting and acquire the legitimate file design for your gadget.

- Complete, change and produce and indication the attained Maine Deed Conveying Property to Charity with Reservation of Life Estate.

US Legal Forms is definitely the greatest local library of legitimate types that you can discover different file templates. Make use of the service to acquire appropriately-made files that follow condition specifications.

Form popularity

FAQ

A life tenant does not have complete control over the property because they do not own the whole bundle of rights. The life tenant cannot sell, mortgage or in any way transfer or encumber the property. If either party wants to sell the property, both the life tenant and remainderman must agree.

Executor's Deed: This may be used when a person dies testate (with a will). The estate's executor will dispose of the decedent's assets and an executor's deed may be used to convey the title or real property to the grantee.

Life Estates establish two different categories of property owners: the Life Tenant Owner and the Remainder Owner. The Life Tenant Owner maintains the absolute and exclusive right to use the property during his or her lifetime. This can be a sole owner or joint Life Tenants.

Dower & Curtesy Defined At common law, the estate of dower is held by a widow upon her husband's death and consists of a life estate of one-third to one-half of the land owned by her husband if he held a freehold interest in the land (e.g., a fee simple) and the land is inheritable by the issue of the marriage.

Cons of a Life Estate Deed Lack of control for the owner. ... Property taxes, which remain for the life tenant until their death. ... It's tough to reverse. ... The owner is still vulnerable to any debt actions that may be brought against the future beneficiary or remainderman.

A life estate deed is a legal document that changes the ownership of a piece of real property. The person who owns the real property (in this example, Mom) signs a deed that will pass the ownership of the property automatically upon her death to someone else, known as the "remainderman" (in this example, Son).

The owner of a life estate cannot leave the property to anyone in their will as their interest in the property will terminate at their death. The holder has full rights to possess and use the property, and may also transfer their interest during their lifetime.

Cons of a Life Estate Deed Lack of control for the owner. ... Property taxes, which remain for the life tenant until their death. ... It's tough to reverse. ... The owner is still vulnerable to any debt actions that may be brought against the future beneficiary or remainderman.