Maine Bill of Sale of Personal Property - Reservation of Life Estate in Seller

Description

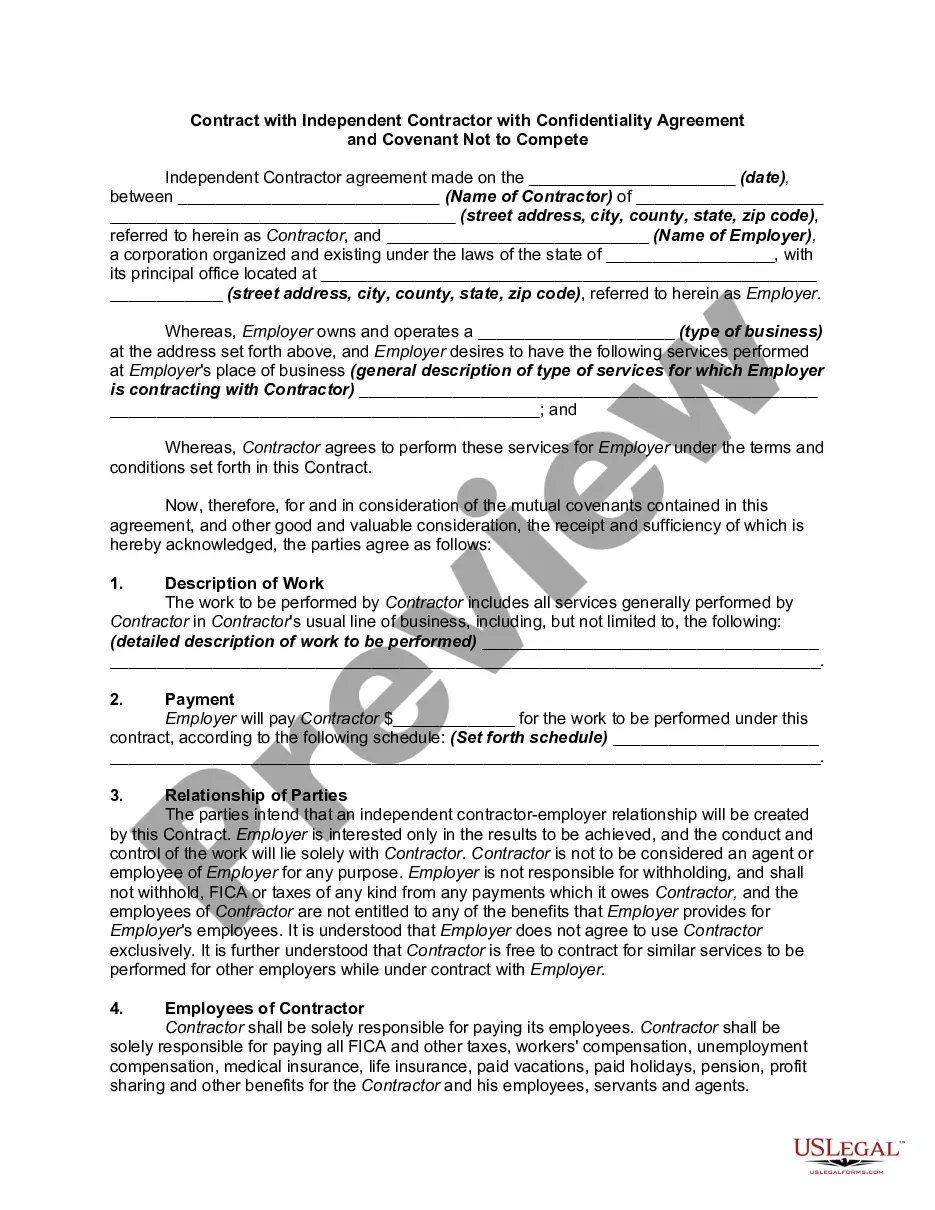

How to fill out Bill Of Sale Of Personal Property - Reservation Of Life Estate In Seller?

US Legal Forms - among the most important collections of legal documents in the United States - offers a broad selection of legal form templates you can download or print.

Through the website, you can find thousands of forms for business and personal use, organized by categories, states, or keywords. You can quickly access the latest forms such as the Maine Bill of Sale of Personal Property - Reservation of Life Estate in Seller.

If you already have a membership, Log In and download the Maine Bill of Sale of Personal Property - Reservation of Life Estate in Seller from the US Legal Forms library. The Download option will appear on every form you view. You have access to all previously acquired forms in the My documents tab of your account.

Process the transaction. Use your credit card or PayPal account to complete the payment.

Choose the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded Maine Bill of Sale of Personal Property - Reservation of Life Estate in Seller. Every template you save in your account does not have an expiration date and is yours to keep permanently. So, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the Maine Bill of Sale of Personal Property - Reservation of Life Estate in Seller with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

- To use US Legal Forms for the first time, here are straightforward instructions to help you get started.

- Ensure you have selected the correct form for your city/region.

- Click the Preview option to review the content of the form.

- Read the form description to confirm that you have chosen the right document.

- If the form does not meet your needs, use the Search field at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, select your preferred pricing plan and provide your details to register for an account.

Form popularity

FAQ

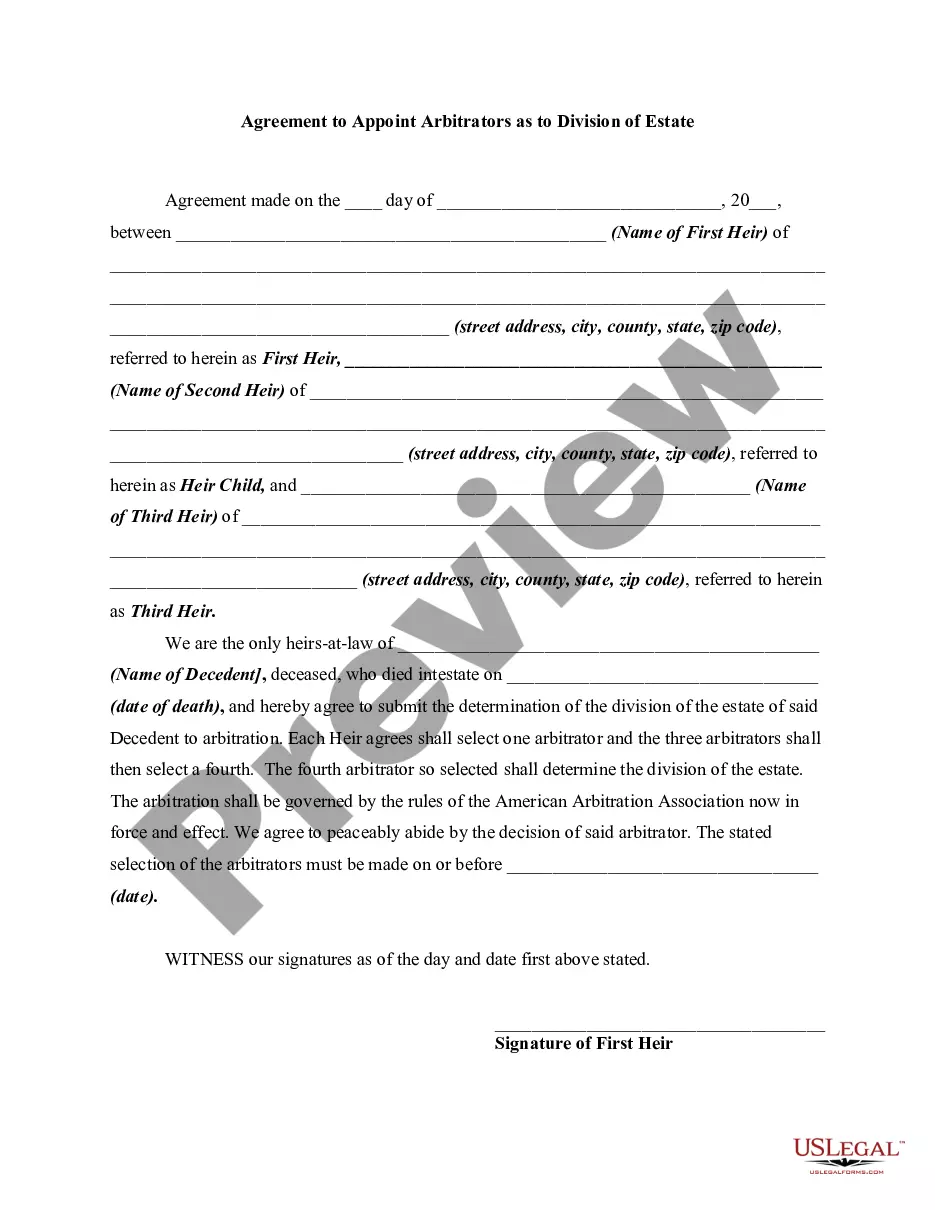

Key Takeaways. A life estate is a type of joint property ownership. Under a life estate, the owners have the right to use the property for life. Typically, the life estate process is adopted to streamline inheritance while avoiding probate.

Advantages of a Life Estate No probate proceeding will be required to transfer title. The transfer/gift of the property to the persons who are deeded the property is a completed gift/transfer.

The transfer by deed of the residence with a retained life estate will therefore be taxed for gift tax purposes at the fair market value of the entire residence, without reduction for the value of the retained life estate and without the annual $10,000 exclusion.

Personal property may not be included as additional security for any mortgage on a one-unit property unless otherwise specified by Fannie Mae. For example, certain personal property is pledged when the Multistate Rider and Addenda (Form 3170) is used.

Life estate consThe life tenant cannot change the remainder beneficiary without their consent.If the life tenant applies for any loans, they cannot use the life estate property as collateral.There's no creditor protection for the remainderman.You can't minimize estate tax.More items...

Under a life estate deed, however, the remainder owner's tax basis is the value of the home at the time of the life tenant's death (a stepped-up basis), greatly reducing or even eliminating any capital gains tax consequences of future sale of the property. Medicaid Exemption After Five Years.

Legally, the items you listed are personal property because they are not permanently attached to the house. Unless specifically itemized, such personal property is not included in the home sale.

In a nutshell, real property is anything that's immovable and attached to the house - walls, windows, blinds, light fixtures, doors, and (most) appliances. Personal property is anything that can be moved or taken from the house - furniture, artwork, above-ground hot tubs, and more.