Maine Reorganization of Partnership by Modification of Partnership Agreement

Description

How to fill out Reorganization Of Partnership By Modification Of Partnership Agreement?

You can spend time online trying to locate the sanctioned document template that meets the federal and state requirements you need.

US Legal Forms offers thousands of legal forms that are vetted by professionals.

You can easily download or print the Maine Reorganization of Partnership by Modification of Partnership Agreement from the site.

If you want to find another version of the form, use the Search field to locate the template that fits your needs and specifications.

- If you already own a US Legal Forms account, you can sign in and click on the Download button.

- Next, you can complete, modify, print, or sign the Maine Reorganization of Partnership by Modification of Partnership Agreement.

- Each legal document template you purchase is yours forever.

- To get another copy of any purchased form, visit the My documents tab and click on the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your state/city of choice.

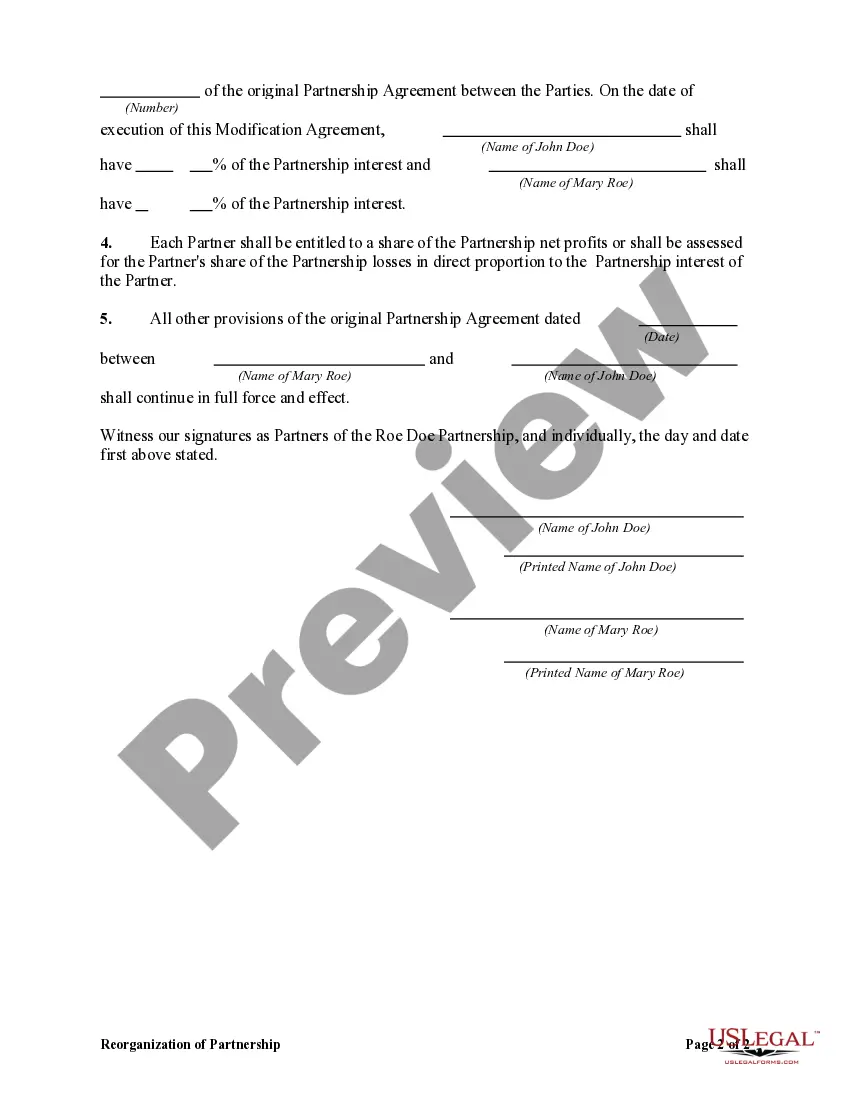

- Check the form details to confirm you have selected the appropriate forma. If available, use the Preview option to view the document template as well.

Form popularity

FAQ

Yes, you can file a Maine extension electronically. The state of Maine provides online options that streamline the process, making it easier for you to handle extensions related to your partnership. By utilizing these electronic services, you simplify your filing, especially in circumstances that involve the Maine Reorganization of Partnership by Modification of Partnership Agreement. Always ensure that you follow the instructions to ensure a smooth filing experience.

Yes, Maine does accept federal extensions for partnerships. When you file for a federal extension, it allows you additional time to file your Maine tax return, including those pertinent forms related to the Maine Reorganization of Partnership by Modification of Partnership Agreement. This ensures that you remain compliant with state requirements while taking advantage of the extra time granted federally. Make sure to check specific guidelines to understand any additional filings or requirements for Maine.

Yes, a partnership agreement can be modified or changed, provided all partners consent to the new terms. Changes may address various aspects, such as partner roles, profit-sharing, or operational procedures. It’s vital to document these modifications to establish a clear record and avoid future disputes. The Maine Reorganization of Partnership by Modification of Partnership Agreement facilitates this process, guiding you through legal requirements.

Removing a partner from a partnership agreement typically involves a formal process that includes reviewing the partnership agreement's terms. All partners must agree on the removal, and it is often advisable to document the decision in writing. Further, legal advice may be beneficial to ensure compliance with local laws regarding the Maine Reorganization of Partnership by Modification of Partnership Agreement. This process helps prevent misunderstandings and potential legal issues in the future.

A partnership agreement is indeed legally binding once it is signed by all parties involved. This legally binding nature means that all partners must adhere to the terms outlined in the agreement. If disputes arise, the partnership agreement serves as the foundational document in legal matters. Understanding this legal commitment is essential when considering the Maine Reorganization of Partnership by Modification of Partnership Agreement.

Yes, amending a partnership agreement is possible and often necessary to reflect changes in the business. An amendment can involve altering terms, adding new partners, or removing existing ones. The process requires mutual consent from all partners, and documentation of the amendment should be carefully maintained. This step is crucial during the Maine Reorganization of Partnership by Modification of Partnership Agreement for legal clarity.

Yes, you can modify a partnership agreement as long as all partners agree to the changes. This modification process is vital for adapting to new business circumstances or partner contributions. It’s essential to formalize any modifications in writing to maintain clarity and protect all parties involved. The Maine Reorganization of Partnership by Modification of Partnership Agreement allows you to make these necessary adjustments effectively.

A partnership agreement may be voided if it involves illegal activities or unethical practices. Additionally, if one partner is unable to meet their obligations due to financial constraints or incapacity, the agreement can be rendered invalid. Furthermore, a lack of mutual consent among partners can contribute to the voiding of the partnership agreement. Understanding the implications of voiding a partnership is essential for the Maine Reorganization of Partnership by Modification of Partnership Agreement.

To file a partnership return, complete Form 1065, which reports income, deductions, and credits. All partners must receive a Schedule K-1, reflecting their share of the partnership's income. Make sure to adhere to the filing deadlines to avoid penalties. If you need assistance, the Maine Reorganization of Partnership by Modification of Partnership Agreement can guide you through the complexities of partnership filings.

Filing an amended tax return typically does not incur a penalty, provided you accurately report the changes. However, if the amendment results in additional taxes owed, you may face interest on that amount. It’s wise to address any issues promptly. When dealing with partnerships, consider how the Maine Reorganization of Partnership by Modification of Partnership Agreement might alleviate potential tax concerns.