Maine Sample Letter for Collection - Referral of Account to Collection Agency

Description

How to fill out Sample Letter For Collection - Referral Of Account To Collection Agency?

If you require to complete, acquire, or create legal document templates, utilize US Legal Forms, the largest selection of legal forms, which are accessible online.

Use the website's straightforward and user-friendly search to locate the documents you seek.

Various templates for commercial and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have identified the form you need, click the Get now button. Choose the pricing plan you prefer and enter your information to register for an account.

Step 5. Process the payment. You may use your Visa or Mastercard or PayPal account to complete the transaction. Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, edit, and print or sign the Maine Sample Letter for Collection - Referral of Account to Collection Agency.

Every legal document template you purchase is yours permanently. You will have access to every form you downloaded in your account. Go to the My documents section and select a form to print or download again.

Be proactive and download and print the Maine Sample Letter for Collection - Referral of Account to Collection Agency with US Legal Forms. There are numerous professional and state-specific forms you can use for your business or personal needs.

- Use US Legal Forms to find the Maine Sample Letter for Collection - Referral of Account to Collection Agency with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to access the Maine Sample Letter for Collection - Referral of Account to Collection Agency.

- You can also view forms you previously downloaded from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the appropriate area/state.

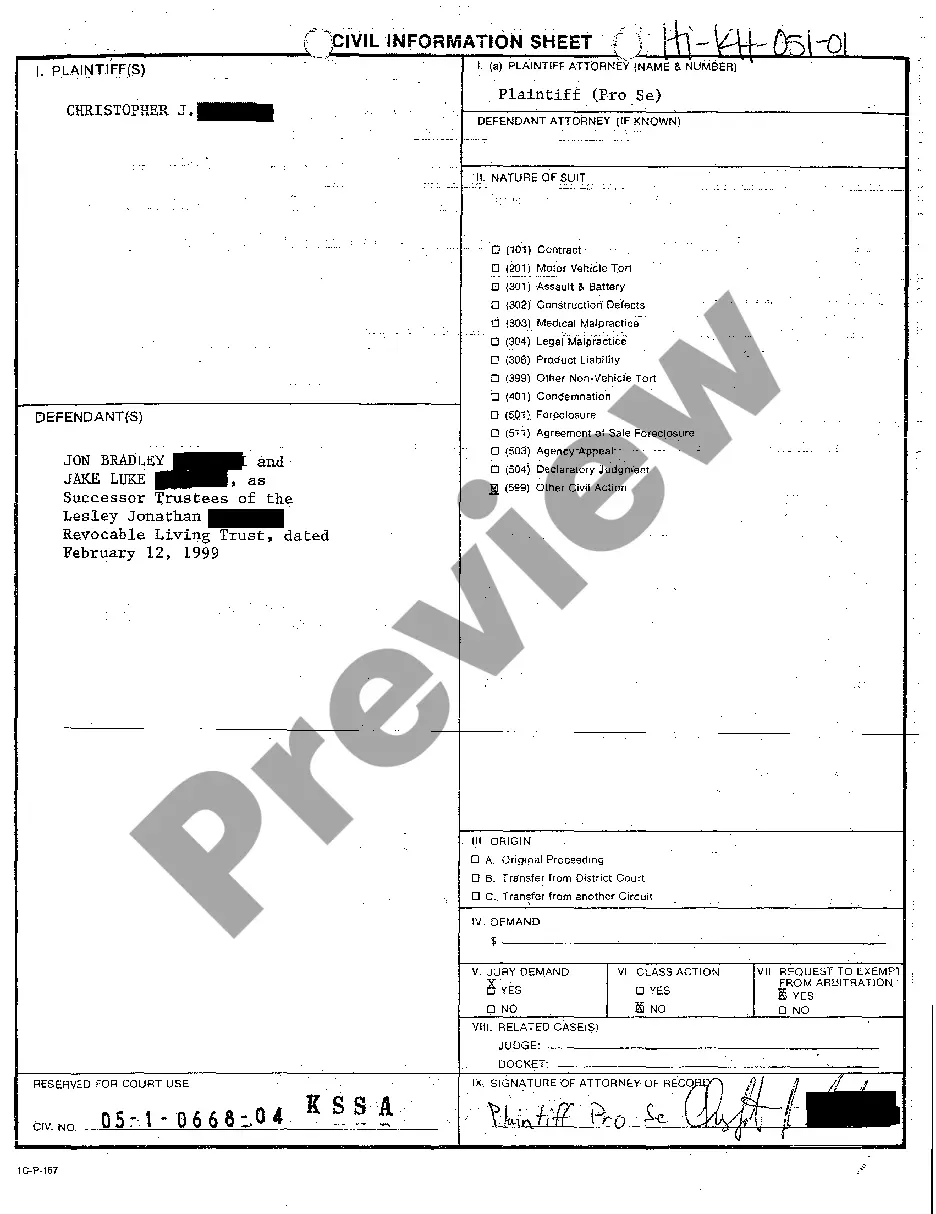

- Step 2. Utilize the Review option to browse the form's content. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other variations of the legal form template.

Form popularity

FAQ

Debt collection agencies cannot harass you, threaten violence, or use deceptive practices to collect debts. They are also prohibited from contacting you before 8 AM or after 9 PM, and they must respect your right to dispute the debt. To ensure compliance and protect your rights, consider using a Maine Sample Letter for Collection - Referral of Account to Collection Agency, designed to facilitate clear communication and proper documentation of your position.

Typically, a debt can become uncollectible after a certain period, often around six to seven years, depending on state laws. Once this statute of limitations expires, debt collectors can no longer sue you to recover the debt. By utilizing a Maine Sample Letter for Collection - Referral of Account to Collection Agency, you can clarify your stance on older debts and minimize the risk of continued collection efforts.

The 777 rule for debt collectors is aimed at protecting consumers from aggressive or deceptive collection practices. It outlines the proper conduct expected from debt collectors, ensuring they do not engage in harassment or misleading tactics. When facing collection challenges, using a Maine Sample Letter for Collection - Referral of Account to Collection Agency can help you assert your rights and hold collectors accountable.

The 777 rule refers to a guideline for debt collectors that sets certain ethical boundaries on their collection practices. It emphasizes transparency and fairness during the debt collection process, ensuring that collectors adhere to legal standards. By utilizing a Maine Sample Letter for Collection - Referral of Account to Collection Agency, you can effectively communicate your expectations and rights in these situations.

To write a letter for debt collection, start by identifying yourself and the debt clearly. Use concise language and include relevant account details, amount owed, and payment options. Utilizing a Maine Sample Letter for Collection - Referral of Account to Collection Agency will ensure your letter is comprehensive and effective. Remember to maintain a polite tone while stressing the urgency of the payment.

When interacting with a debt collector, avoid admitting to the debt or giving personal information like your Social Security number. It is also wise not to engage in arguments or make commitments you cannot fulfill. The Maine Sample Letter for Collection - Referral of Account to Collection Agency can guide you in establishing clear boundaries. Stay calm and collected, focusing on resolving the issue professionally.

To write a dispute letter to a collection agency, begin by clearly stating your intention to dispute the debt. Include details such as your name, address, account number, and the specific amount you dispute. Reference the Maine Sample Letter for Collection - Referral of Account to Collection Agency for a structured approach. Ensure you send the letter via certified mail and keep a copy for your records.

A referral to a collections agency is the formal act of sending an account to a professional agency that specializes in recovering debts. This decision typically follows the creditor's unsuccessful attempts to collect payment directly. By familiarizing yourself with this process, you can better prepare yourself and potentially utilize the Maine Sample Letter for Collection - Referral of Account to Collection Agency found on USLegalForms to handle your case with confidence.

Referred to collections means a creditor has handed your account over to a collection agency due to non-payment. This situation can escalate quickly and may involve legal actions if the debt remains unpaid. Understanding this term can help you navigate the process effectively, using resources like the Maine Sample Letter for Collection - Referral of Account to Collection Agency on USLegalForms to manage your debt.

When you are referred to debt collection, the agency will take steps to recover the owed amount, which may include phone calls and letters. This can eventually lead to negative impacts on your credit score if the debt remains unpaid. To better understand the process and protect your interests, consider using the Maine Sample Letter for Collection - Referral of Account to Collection Agency as a tool.