Maine Agreement to Compromise Debt by Returning Secured Property

Description

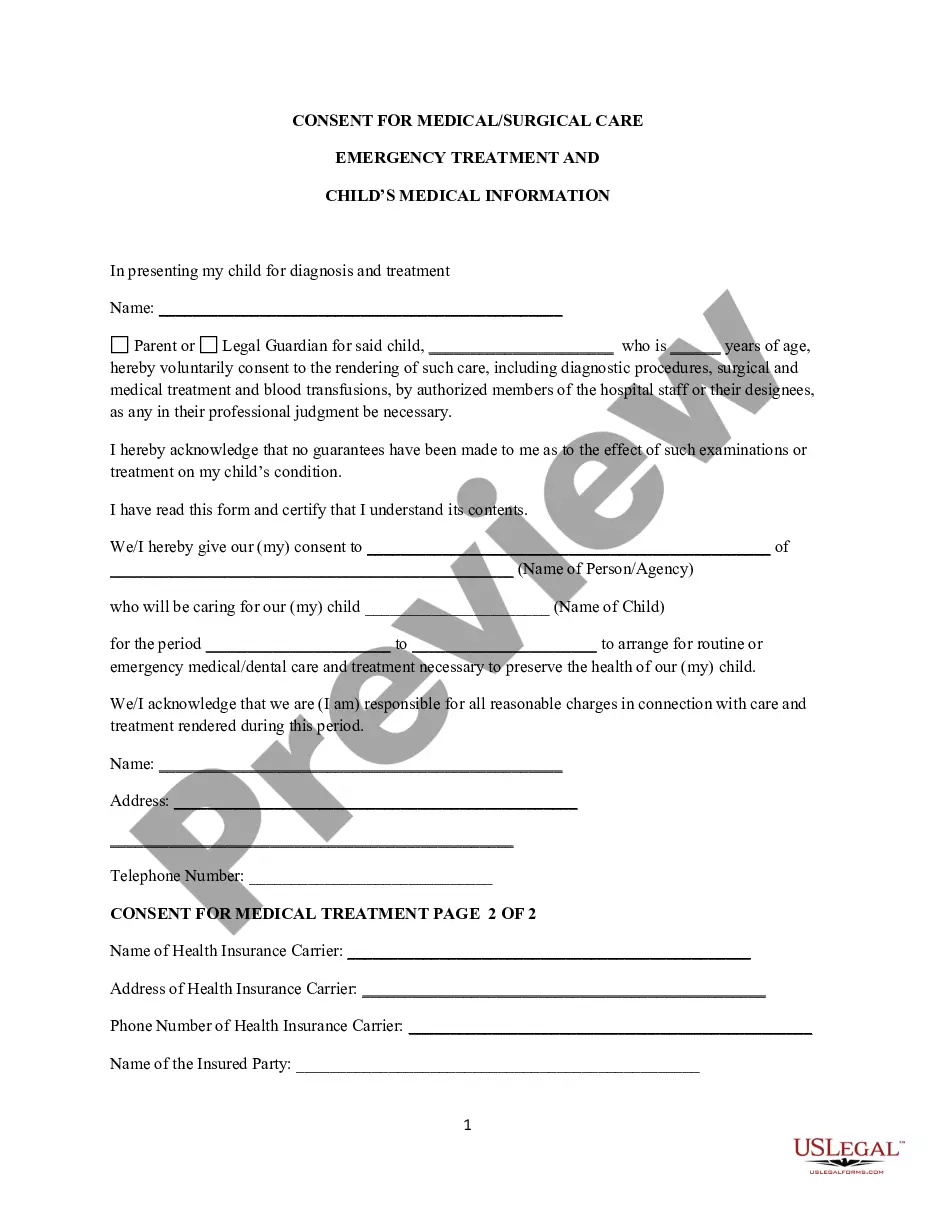

How to fill out Agreement To Compromise Debt By Returning Secured Property?

If you need to finalize, acquire, or print legal document templates, utilize US Legal Forms, the most significant assortment of legal templates available online.

Leverage the site’s user-friendly and efficient search to get the documents you require.

Various templates for business and personal use are categorized by groups and states, or keywords.

Step 4. Once you have found the document you need, click the Get now button. Choose your preferred pricing plan and provide your information to create an account.

Step 6. Complete the payment process. You may use your credit card or PayPal account to finish the transaction.

- Employ US Legal Forms to obtain the Maine Agreement to Settle Debt by Returning Secured Property in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click on the Download button to retrieve the Maine Agreement to Settle Debt by Returning Secured Property.

- You can also find forms you previously downloaded under the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the guidelines below.

- Step 1. Confirm you have selected the document for your specific city/state.

- Step 2. Utilize the Preview option to review the document’s content. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal document template.

Form popularity

FAQ

The statute of limitations for debt collection in Maine typically stands at six years for most consumer debts, including credit card debt and personal loans. Once this period elapses, creditors lose the ability to sue you for collection. It’s important to note that this doesn’t erase the debt itself, but it does limit how creditors can pursue you. Utilizing a Maine Agreement to Compromise Debt by Returning Secured Property can offer a structured way to address your obligations.

Debts can become uncollectible after a specified period defined by the statute of limitations. In Maine, this period generally spans six years for most consumer debts. After this period, collectors cannot legally enforce collection, although the debt remains owed. Understanding the implications of a Maine Agreement to Compromise Debt by Returning Secured Property can provide further options for managing such debts.

In most cases, a debt collector can sue you within the statute of limitations for your specific debt type. In Maine, the limit is generally six years for most debts. However, the timeframe may differ depending on the nature of the debt. If you are dealing with debts that you intended to resolve using a Maine Agreement to Compromise Debt by Returning Secured Property, it's wise to act promptly.

In Maine, the statute of limitations for debt collection is typically six years for most debts. After this period, your debt becomes uncollectible, and creditors may no longer pursue you for repayment. Understanding the implications of the Maine Agreement to Compromise Debt by Returning Secured Property can help clarify your options before debts reach that point.

One downside for the IRS when accepting an offer in compromise is the potential loss of revenue, as the agency may receive less than the total owed. This method may also encourage some individuals to not fulfill their payment responsibilities, which could lead to future compliance issues. However, the Maine Agreement to Compromise Debt by Returning Secured Property aims to provide a fair resolution for both parties.

An offer in compromise through the Maine Revenue Services is a legal agreement that allows you to settle your debt for less than the total amount owed. This option gives you a chance to regain control of your finances while addressing your secured property. Utilizing the Maine Agreement to Compromise Debt by Returning Secured Property can greatly benefit those struggling to meet their debt obligations.

The timeline for accepting an offer in compromise can vary, but typically, the Maine Revenue Services takes several months to review the submission. After a thorough assessment, you may receive a decision within six months. This wait may feel long, but it ensures that all factors related to the Maine Agreement to Compromise Debt by Returning Secured Property are carefully considered.