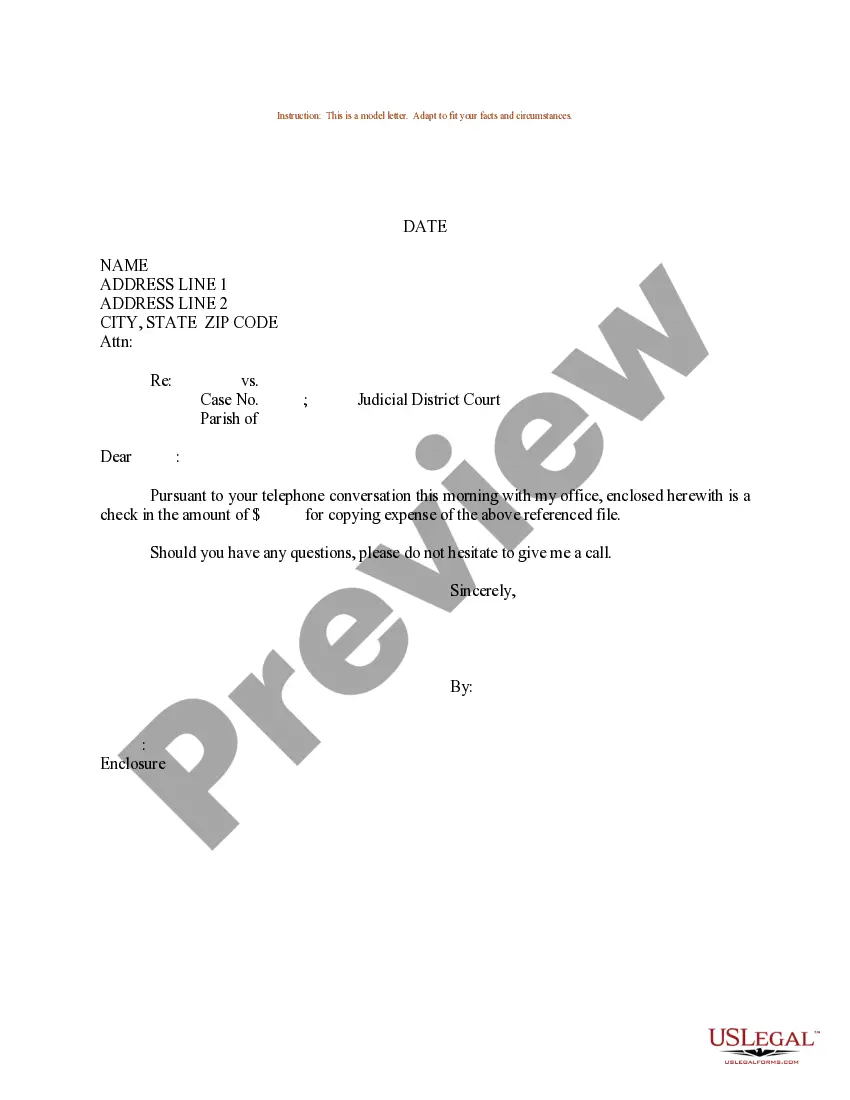

Maine Sample Letter sending Check for Copying Expense

Description

How to fill out Sample Letter Sending Check For Copying Expense?

Have you been within a situation the place you need to have files for either business or individual reasons almost every day? There are plenty of authorized file themes available on the net, but discovering ones you can depend on is not effortless. US Legal Forms delivers thousands of type themes, just like the Maine Sample Letter sending Check for Copying Expense, which are created in order to meet state and federal requirements.

In case you are already familiar with US Legal Forms site and get a free account, basically log in. Afterward, you can obtain the Maine Sample Letter sending Check for Copying Expense format.

If you do not have an account and wish to begin to use US Legal Forms, abide by these steps:

- Get the type you need and make sure it is for your proper town/county.

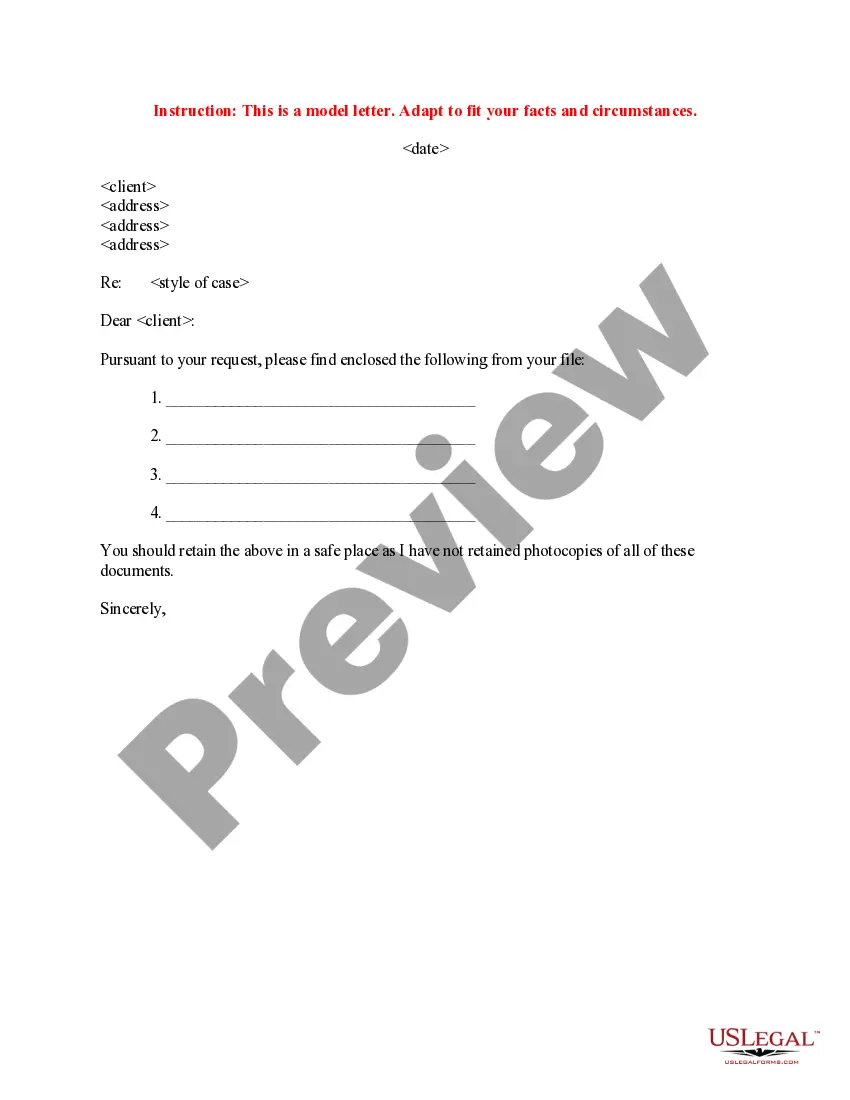

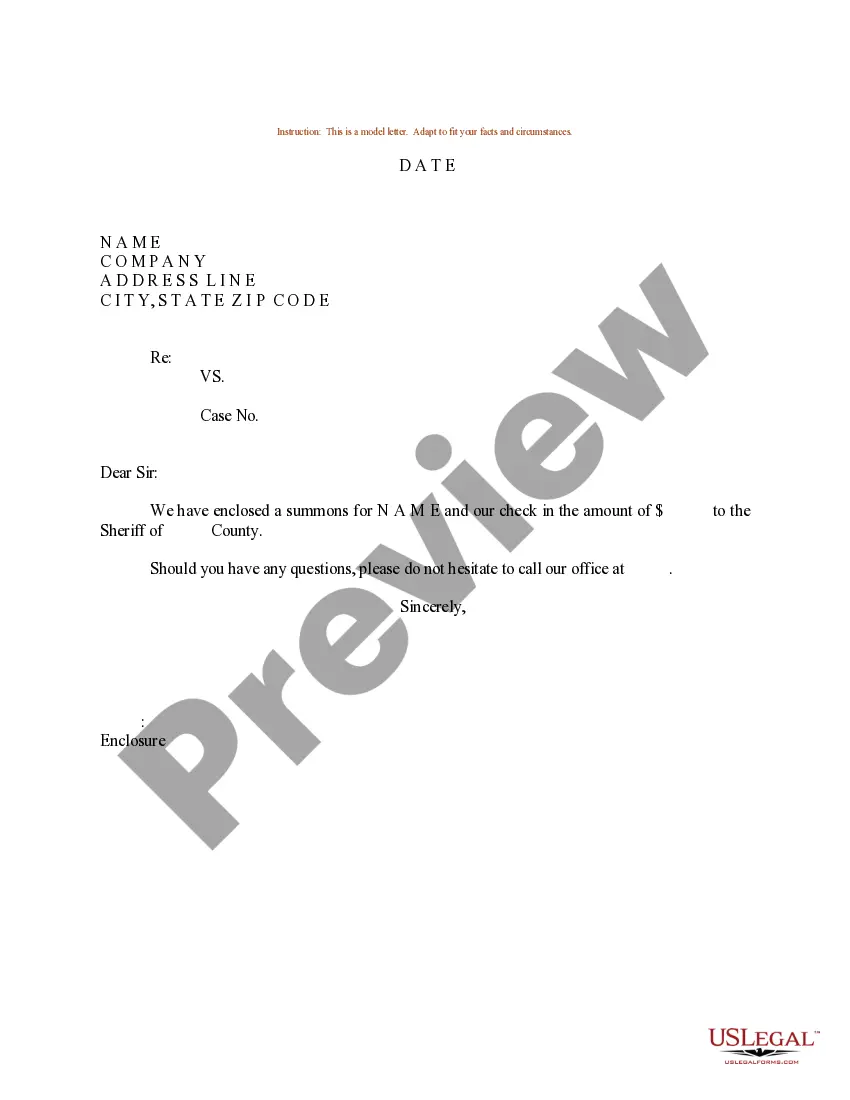

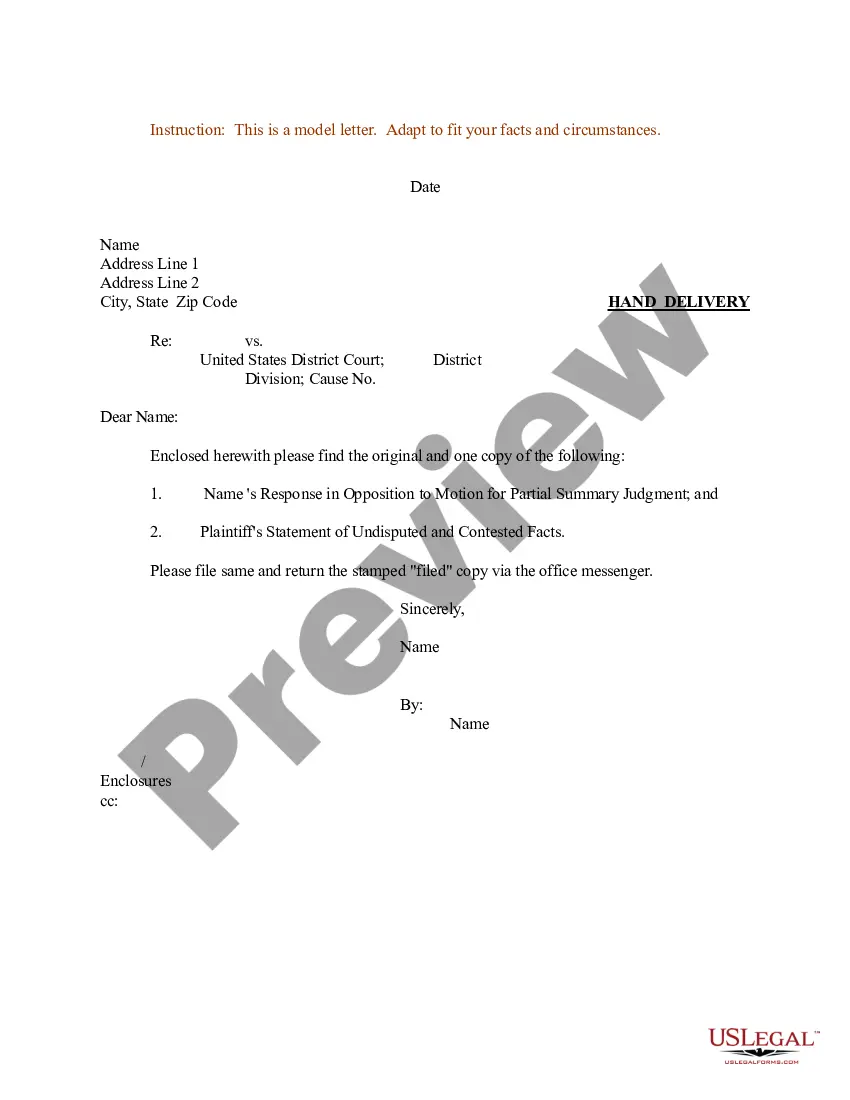

- Make use of the Preview switch to analyze the form.

- See the description to ensure that you have selected the correct type.

- In case the type is not what you`re searching for, make use of the Lookup area to find the type that meets your requirements and requirements.

- When you find the proper type, click on Purchase now.

- Pick the costs prepare you would like, fill in the specified information to generate your bank account, and pay for your order using your PayPal or bank card.

- Pick a handy document file format and obtain your backup.

Discover all of the file themes you possess purchased in the My Forms menu. You may get a extra backup of Maine Sample Letter sending Check for Copying Expense whenever, if possible. Just click the essential type to obtain or print the file format.

Use US Legal Forms, the most extensive variety of authorized forms, in order to save time and avoid mistakes. The assistance delivers professionally produced authorized file themes which you can use for a variety of reasons. Create a free account on US Legal Forms and initiate creating your way of life easier.

Form popularity

FAQ

If you file a Federal Income Tax Return, even if it is filed jointly and the only income is attributable to your spouse, you must enclose a copy of the first two pages of your U.S. Individual Income Tax Return (Federal Form 1040, or 1040A, or 1040EZ).

Income/Estate Tax Division What is being mailed:Mailing Address:Individual Income Tax (Form 1040ME) Mail to this address if you are enclosing a check for paymentP.O. Box 1067, Augusta, ME 04332-1067Individual Income Tax (Form 1040ME) Mail to this address if you are expecting a refundP.O. Box 1066, Augusta, ME 04332-106611 more rows

Wages, business income, and capital gains from sources within Maine are Maine income even if you received the income as a nonresident. All part-year residents, nonresidents and safe harbor residents must send a copy of their federal return with their Maine return.

2 form from each employer. Other earning and interest statements (1099 and 1099INT forms) Receipts for charitable donations; mortgage interest; state and local taxes; medical and business expenses; and other taxdeductible expenses if you are itemizing your return.

Non-resident return This is for taxpayers that are Non-residents of Maine. The taxpayer lives in a state other than Maine, they have earned some of their income in Maine. Consequently, they owe Maine Non-resident income tax.

If you earn income in one state while living in another, you should expect to file a tax return for the state where you are living (your ?resident? state). You may also be required to file a state tax return where your employer is located or any state where you have a source of income.

While anyone with an existing tax debt may submit an offer in compromise of that debt, the Assessor's authority is wholly discretionary; no taxpayer has a right to settle a state tax debt. A settlement must be grounded upon doubt as to liability, doubt as to collectibility or both.

Instead, many states require you to submit a copy of your entire federal tax return, including any schedules you attach such as a Schedule C for self-employment earnings or Schedule A for your itemized deductions. In certain circumstances, you may have to attach an additional state schedule to your state tax return.