Maine Revocable Trust for Lottery Winnings

Description

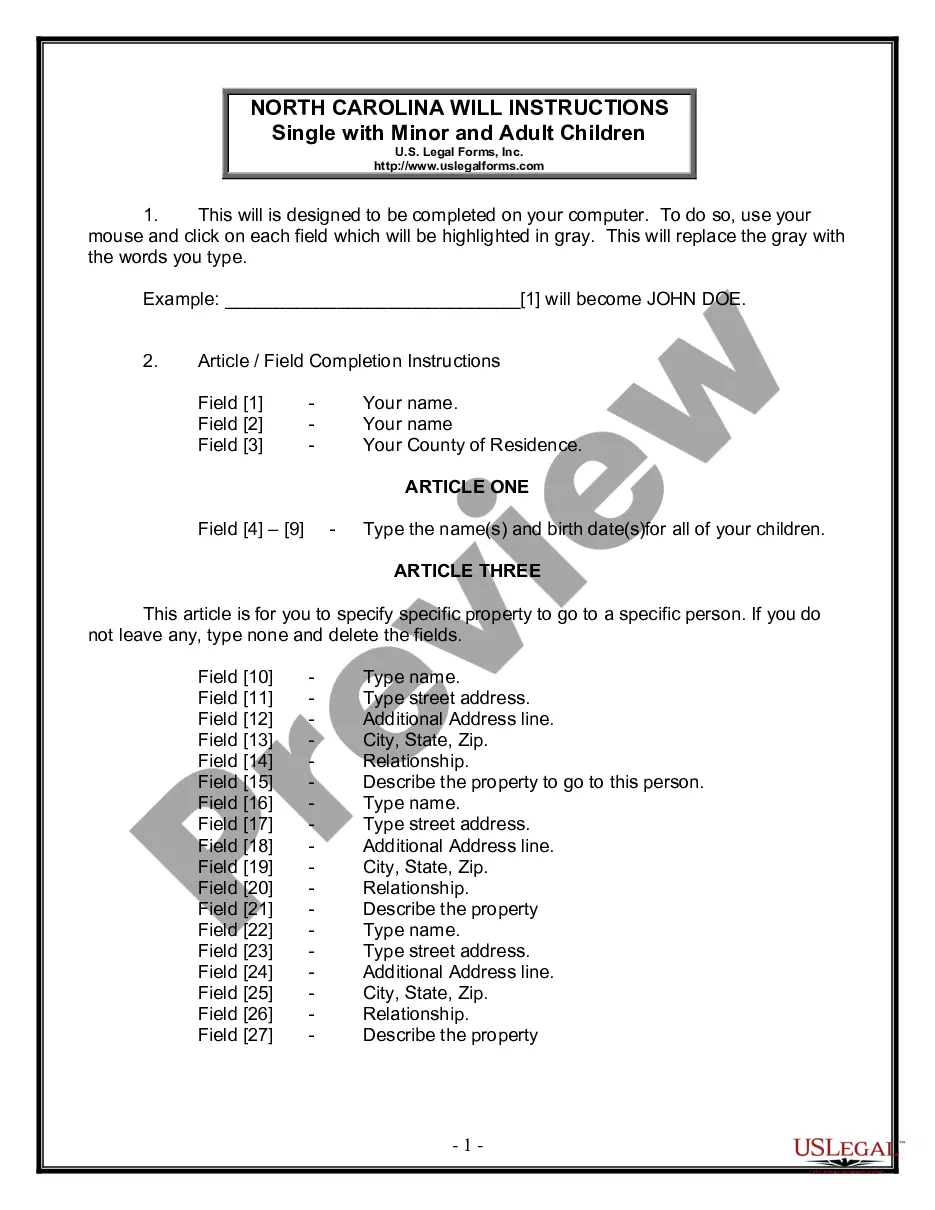

How to fill out Revocable Trust For Lottery Winnings?

Selecting the optimal authentic document template can be challenging.

Clearly, there are numerous templates available online, but how do you find the genuine form you require.

Utilize the US Legal Forms website.

If you are a new user of US Legal Forms, here are some simple steps to follow: First, ensure you have selected the correct form for your city/region. You can preview the form using the Review option and read the form description to confirm it is suitable for you. If the form does not meet your needs, use the Search field to find the appropriate document. Once you are confident that the form is correct, click on the Buy now button to acquire the template. Select the pricing plan you prefer and enter the required details. Create your account and complete the purchase using your PayPal account or credit card. Choose the document format and download the legal document template to your device. Complete, modify, print, and sign the obtained Maine Revocable Trust for Lottery Winnings. US Legal Forms is the premier collection of legal templates where you can access a variety of document formats. Use this service to download professionally crafted papers that adhere to state requirements.

- The service offers a vast array of templates, including the Maine Revocable Trust for Lottery Winnings, which you can use for both business and personal purposes.

- All documents are verified by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click on the Acquire button to locate the Maine Revocable Trust for Lottery Winnings.

- Use your account to search through the legal forms you have previously obtained.

- Visit the My documents tab in your account to download another copy of the document you need.

Form popularity

FAQ

Avoiding gift tax on lottery winnings hinges on proper planning and legal strategies. One effective method is to use a Maine Revocable Trust for Lottery Winnings, ensuring that distributions adhere to IRS guidelines. Consulting with a tax advisor can help you navigate the complexities of tax laws and optimize your winnings.

The best investment after winning the lottery largely depends on your financial goals. Many lottery winners benefit from diversifying their investments, which could include real estate or stocks. Working with a financial planner can help you explore these options while funding your Maine Revocable Trust for Lottery Winnings.

In Maine, the ability to claim lottery winnings anonymously is limited. However, using a Maine Revocable Trust for Lottery Winnings can offer a layer of privacy. By claiming your winnings through the trust, you can shield your identity while still ensuring your financial security.

The best type of trust for lottery winnings is a Maine Revocable Trust for Lottery Winnings. This trust allows you to retain control over your assets while providing protection and privacy. It also enables you to manage distributions according to your specific plans.

Claiming lottery winnings through a trust typically involves naming the trust as the recipient on your claim form. You should ensure your Maine Revocable Trust for Lottery Winnings is properly established beforehand. Consulting with legal experts can facilitate a smoother process and help you maintain your anonymity if desired.

A Maine Revocable Trust for Lottery Winnings is often recommended for lottery winners. This trust offers flexibility, allowing you to manage and distribute your assets while avoiding the probate process. Establishing such a trust can protect your privacy and provide peace of mind.

Winning the lottery can be overwhelming; therefore, the first step is to stay calm and seek professional advice. Consulting with financial advisors and attorneys experienced in lottery winnings can provide valuable insights. They can help you establish a Maine Revocable Trust for Lottery Winnings, ensuring your prize is managed effectively.

The ideal account for managing lottery winnings often includes a Maine Revocable Trust for Lottery Winnings. This type of trust allows you to control the assets while providing potential tax benefits. Additionally, it can help streamline the distribution of your wealth according to your wishes.

Sharing lottery winnings can be done effectively through a Maine Revocable Trust for Lottery Winnings. By allocating funds through the trust, you can provide financial gifts to your loved ones without incurring gift taxes. This method helps preserve the value of your gifts while ensuring compliance with tax regulations. Engaging with professionals can enhance your gift-sharing strategy while safeguarding your assets.

While it’s challenging to avoid taxes entirely on lottery winnings, using a Maine Revocable Trust for Lottery Winnings can help mitigate your tax obligations. This approach can provide financial flexibility and may offer opportunities to manage tax liabilities over time. By strategically planning your assets within the trust, you can optimize your tax efficiency. It’s wise to seek guidance from a tax advisor to explore all available options.