Maine Lease to Own for Commercial Property is a financial arrangement that combines elements of leasing and buying, providing an opportunity for tenants to eventually own the commercial property they are leasing. This option allows businesses to secure a space for their operations while building equity towards future ownership. In a typical lease to own agreement, the tenant agrees to lease the commercial property for a specified period. During this time, a portion of the monthly lease payments is typically allocated towards the eventual purchase of the property. This portion is commonly referred to as a "rent credit" and serves as a form of down payment that accumulates over the lease term. Maine Lease to Own for Commercial Property offers several benefits for both the tenant and the property owner. For tenants, it provides a pathway to ownership, allowing them to invest their monthly payments towards ownership rather than paying rent with no return on investment. Additionally, it provides an opportunity for businesses to establish a foothold in their desired location without having to commit to an immediate purchase. For property owners, offering a lease to own arrangement can attract prospective tenants who may not have the financial means to purchase the property outright. It also offers a potential exit strategy for property owners who are looking to sell but are having difficulty finding a buyer. There are a few different types of lease to own arrangements for commercial properties in Maine. One type is the lease option, where the tenant has the right to purchase the property at a predetermined price within a specified timeframe. Another type is the lease purchase, where the tenant is obligated to purchase the property at a predetermined price at the end of the lease term. It is important for both tenants and property owners to carefully review and negotiate the terms of the lease to own agreement, including factors such as purchase price, lease term, rent credits, and maintenance responsibilities. Consulting with real estate professionals and legal advisors is strongly recommended ensuring a fair and mutually beneficial arrangement.

Maine Lease to Own for Commercial Property

Description

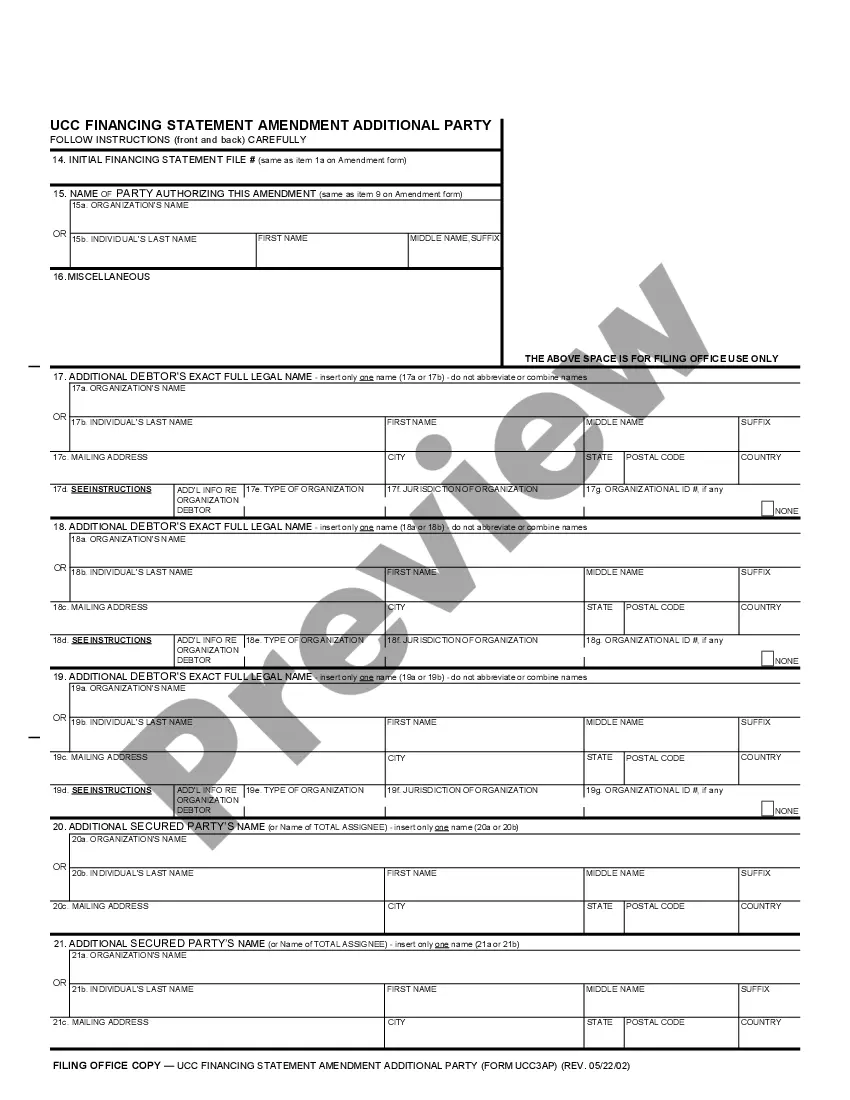

How to fill out Maine Lease To Own For Commercial Property?

Are you presently in a circumstance that you need documents for either organizational or personal purposes almost every time.

There are numerous legitimate document templates available online, yet find ones you can trust isn't straightforward.

US Legal Forms offers a vast assortment of template forms, such as the Maine Lease to Own for Commercial Property, which can be tailored to meet state and federal standards.

When you find the appropriate form, simply click Purchase now.

Select the pricing plan you require, provide the necessary information to create your account, and complete the order using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and have your account, simply Log In.

- Once logged in, you can download the Maine Lease to Own for Commercial Property template.

- If you do not possess an account and wish to start using US Legal Forms, follow these steps.

- Locate the template you need and check that it corresponds to the right region/state.

- Utilize the Review button to verify the form.

- Examine the summary to ensure that you've selected the correct document.

- If the form isn't what you are seeking, use the Search box to find the template that fulfills your needs.

Form popularity

FAQ

Typically, investors and real estate specialists would say that a GRM between 4 to 7 are considered to be 'healthy. ' Anything above would mean having a more difficult time paying off the property price gross with the annual gross annual income of the rent.

Capital AppreciationIt is not uncommon for commercial properties to increase significantly in value of time. In fact, commercial real estate has proven to be one of the greatest hedges to inflation of all investment types.

Depending on the location and quality of the property, rental yields can be anywhere between six to 10 percent for commercial property investment in India. But capital appreciation is limited.

From taxes to operating costs, there are many additional costs associated with buying commercial property that you'll need to factor into your budget....Ongoing costsInsurance payments.Repairs and maintenance.Energy costs.Service charges, such as waste collection.

Commercial property valuations are based more on the tenant than on the property itself. If you've previously invested in residential buy-to-let then you'll have probably covered rental yields to a degree (usually when taking out a mortgage) but it's much more in-depth with how the values of commercial are calculated.

First, take the property's net annual rental income and divide it by your estimate of the building value, based on sales of similar ones in the local area. This will give you your 'capitalisation rate' or the rate of return. Then, take your net operating income and divide it by that figure.

Commercial properties typically have an annual return off the purchase price between 6% and 12%, depending on the area, current economy, and external factors (such as a pandemic). That's a much higher range than ordinarily exists for single family home properties (1% to 4% at best).

What value is most commonly used for commercial property? The income approach is the most frequently used method for valuing commercial real estate, as it can be used for any property that produces consistent, predictable income.

Interesting Questions

More info

Estate Vault A. Legal Basis Of The Agreement 1. The entire text of the Commercial Lease Agreement is as follows: “This is an original agreement that includes and is a true copy of the full text of the previous Commercial Lease Agreement dated December 26, 1999, that was entered into between the parties and which is still in effect. It is the express written consent of the parties that it be treated as though you had originally signed a copy of this Agreement. The foregoing is personal service of this document on all the party hereto together with any and all exhibits and related paper work and all amendments thereto.” 2. A true copy of the previous Commercial Lease Agreement was filed in Sacramento County court on July 8, 2001. All exhibits were submitted through the following mail order service company, the same named entities listed at Paragraph A of this document and on the above-mentioned document filed in Sacramento County court.