Maine Letter to Creditors Notifying Them of Identity Theft for New Accounts

Description

How to fill out Letter To Creditors Notifying Them Of Identity Theft For New Accounts?

Are you in a position where you need documents for either business or personal reasons nearly every day? There are numerous legitimate document templates accessible online, but finding forms you can rely on is not simple. US Legal Forms offers thousands of form templates, including the Maine Letter to Creditors Informing Them of Identity Theft for New Accounts, which are designed to satisfy state and federal regulations.

If you are already acquainted with the US Legal Forms website and have an account, simply Log In. After that, you can download the Maine Letter to Creditors Informing Them of Identity Theft for New Accounts template.

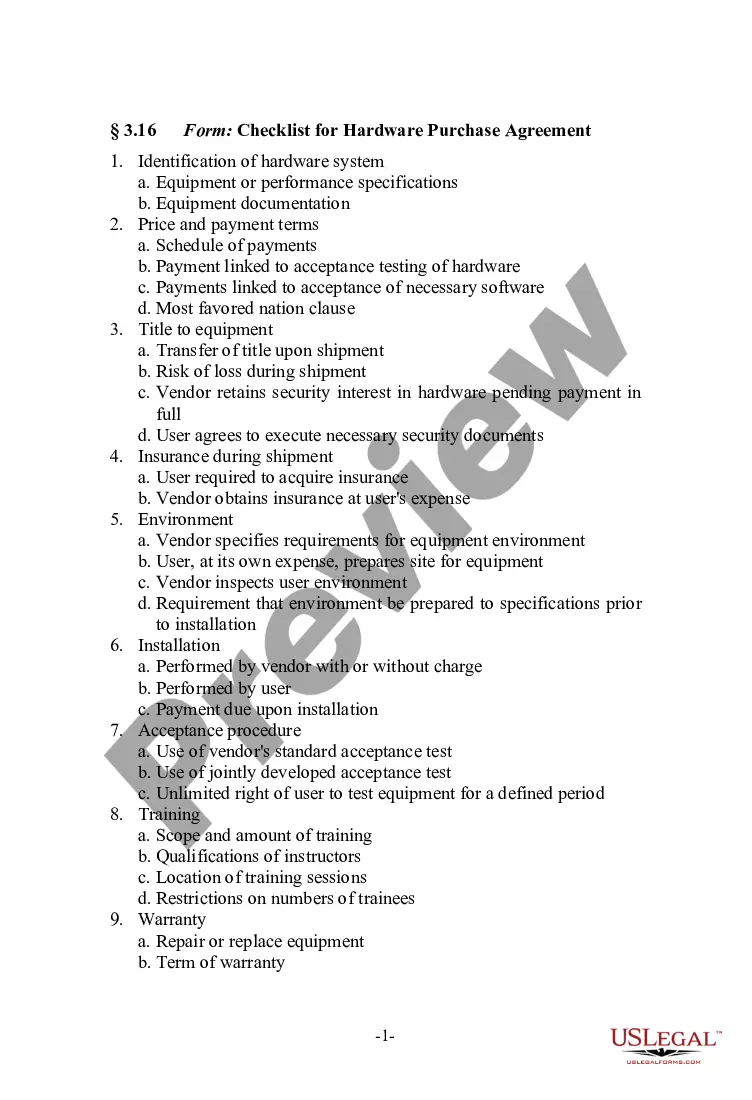

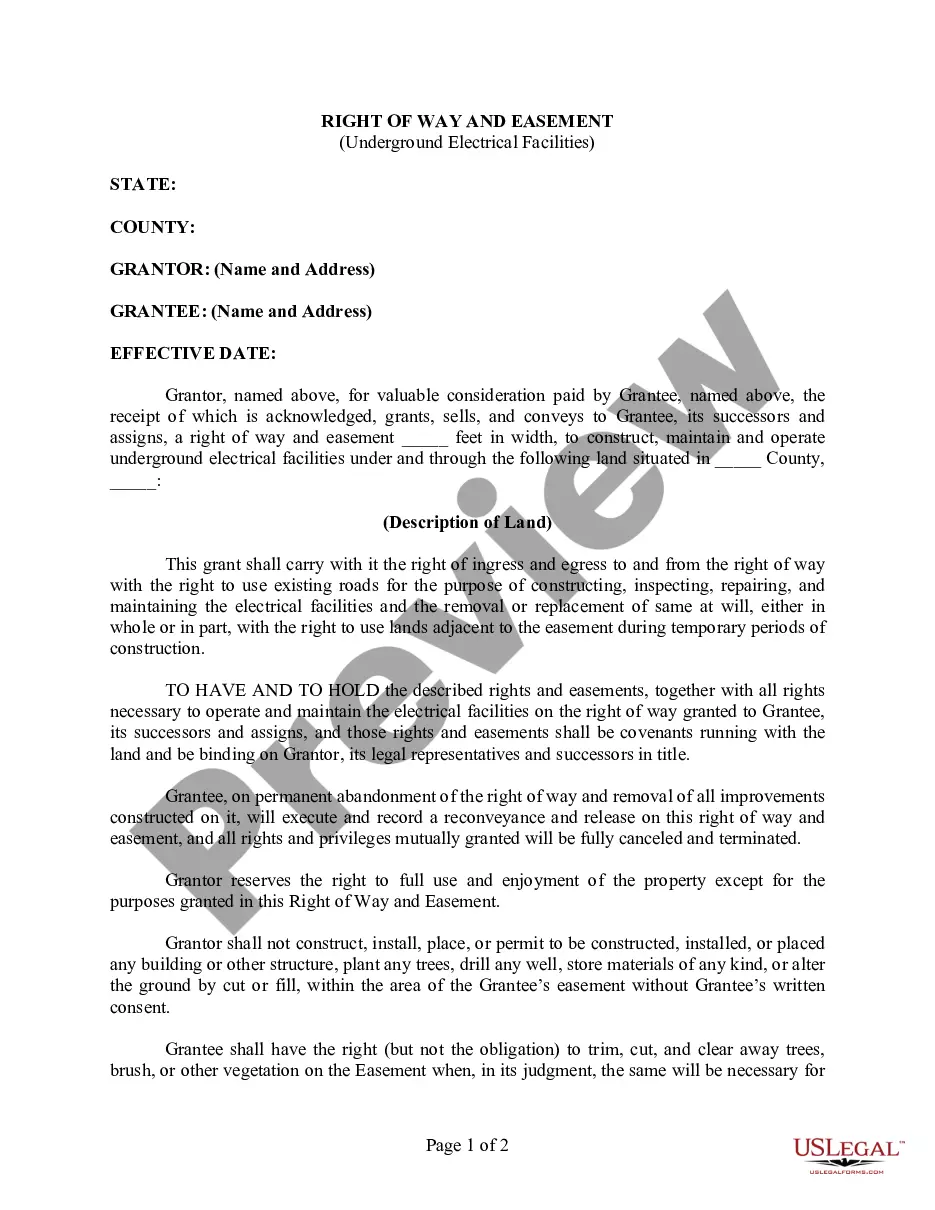

If you do not have an account and wish to start using US Legal Forms, follow these steps: Obtain the form you need and ensure it is for your correct area/county. Use the Review button to inspect the form. Check the description to confirm that you have selected the right document. If the form is not what you seek, use the Search field to locate the form that aligns with your needs and specifications. When you find the suitable form, click on Get now. Choose the pricing plan you prefer, complete the required information to create your account, and pay for the order using your PayPal or credit card. Select a convenient file format and download your copy.

- View all the document templates you have purchased in the My documents section. You can download an additional copy of the Maine Letter to Creditors Informing Them of Identity Theft for New Accounts whenever needed. Click on the desired form to download or print the document template.

- Utilize US Legal Forms, one of the most extensive collections of legal forms, to save time and avoid mistakes. The service provides expertly crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

Form popularity

FAQ

I am a victim of identity theft, and did not make the charge(s). I am requesting that the item(s) be blocked to correct my credit report. Enclosed are copies of (describe any enclosed documents) supporting my position. Please investigate this (these) matter(s) and block the disputed item(s) as soon as possible.

I am a victim of identity theft, and I did not make [this/these] charge(s). I request that you remove the fraudulent charge(s) and any related finance charge and other charges from my account, send me an updated and accurate statement, and close the account (if applicable).

Your letter should clearly identify each item in your report you dispute, state the facts, explain why you dispute the information, and request that it be removed or corrected. You may want to enclose a copy of your credit report with the items in question circled.

New account fraud occurs when a fraudster or money mule has been successfully onboarded by a financial institution after applying using their own identity (first-party fraud), a stolen identity (third-party fraud) or a synthetic identity.

Dispute Credit Fraud With Your Lenders Call any affected companies where fraud has occurred. Contact your credit card company and cancel all affected cards. Place a fraud alert with all three credit bureaus. Dispute incorrect information on your credit report. Close any other new accounts opened in your name.

Asked by: Mr. Jillian Rau | Last update: February 9, 2022 Score: 4.1/5 (71 votes) Section 623 of the FRCA allows you to dispute any inaccurate information on your credit report directly with the original creditor, as long as you've already completed the process with the credit bureau.

Sample dispute letter to credit reporting agencies: [RE: Your Account Number (if known)] Dear Sir or Madam: I am a victim of identity theft and I write to dispute certain information in my file resulting from the crime. I have circled the items I dispute on the attached copy of the report I received.

Dear Sir or Madam: I am a victim of identity theft. I recently learned that my personal information was used to open an account at your company. I did not open or authorize this account, and I therefore request that it be closed immediately.