Maine Letter to Creditors notifying them of Identity Theft

Description

How to fill out Letter To Creditors Notifying Them Of Identity Theft?

Are you in the situation the place you need to have documents for possibly business or individual purposes just about every working day? There are a lot of authorized papers templates accessible on the Internet, but locating kinds you can depend on isn`t simple. US Legal Forms gives 1000s of form templates, much like the Maine Letter to Creditors notifying them of Identity Theft, that happen to be published to fulfill state and federal needs.

In case you are currently acquainted with US Legal Forms website and also have a free account, basically log in. Afterward, you are able to obtain the Maine Letter to Creditors notifying them of Identity Theft format.

If you do not provide an bank account and want to begin using US Legal Forms, adopt these measures:

- Discover the form you need and ensure it is to the proper metropolis/county.

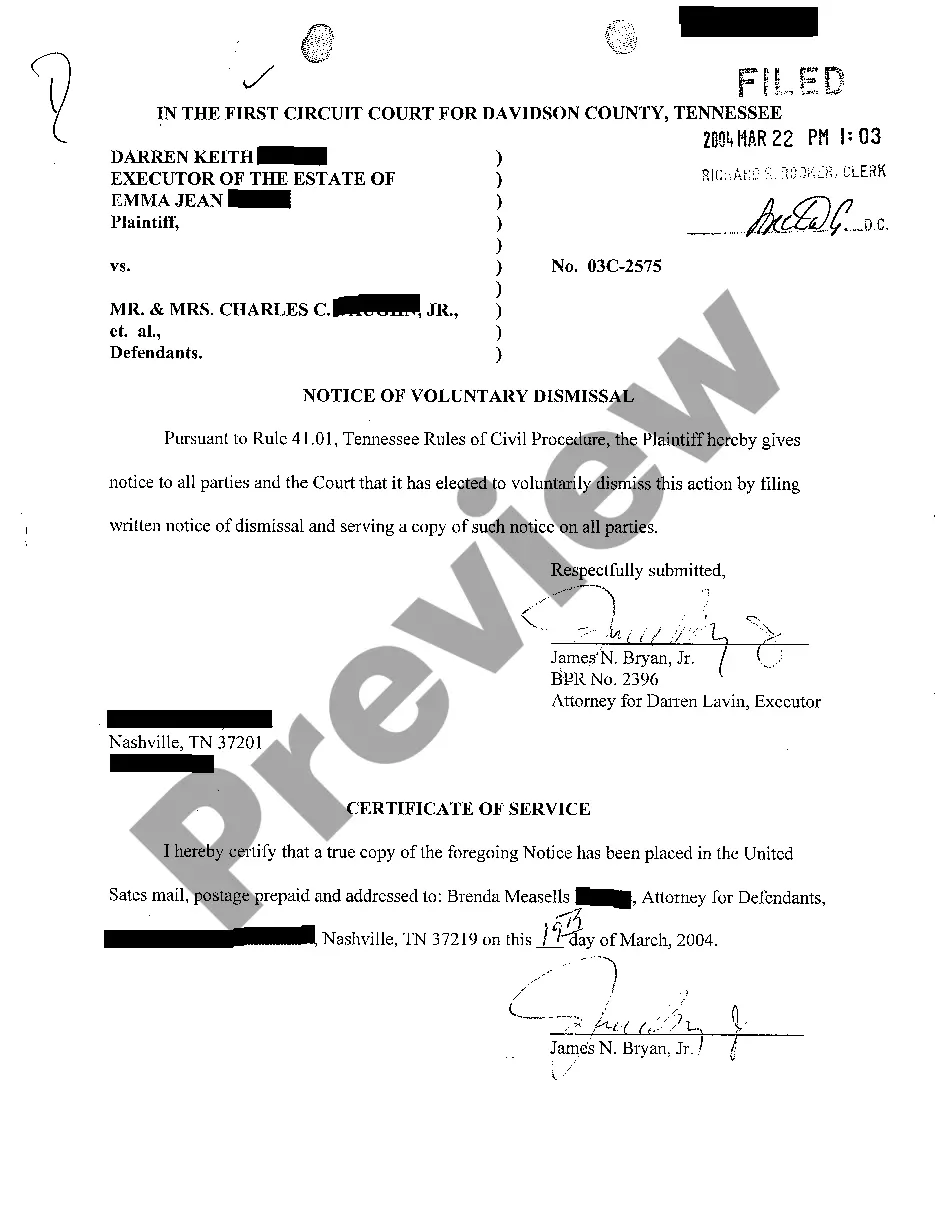

- Use the Review option to examine the form.

- Read the explanation to ensure that you have selected the appropriate form.

- In the event the form isn`t what you`re seeking, use the Research industry to get the form that fits your needs and needs.

- If you find the proper form, click Acquire now.

- Opt for the pricing strategy you would like, submit the desired information to generate your account, and pay for the transaction utilizing your PayPal or credit card.

- Choose a handy data file formatting and obtain your version.

Discover every one of the papers templates you possess purchased in the My Forms food selection. You can aquire a additional version of Maine Letter to Creditors notifying them of Identity Theft at any time, if needed. Just click on the essential form to obtain or print the papers format.

Use US Legal Forms, one of the most comprehensive assortment of authorized forms, in order to save time as well as stay away from errors. The services gives professionally produced authorized papers templates that can be used for a variety of purposes. Generate a free account on US Legal Forms and start making your lifestyle easier.

Form popularity

FAQ

Your letter should clearly identify each item in your report you dispute, state the facts, explain why you dispute the information, and request that it be removed or corrected. You may want to enclose a copy of your credit report with the items in question circled.

Dear Sir or Madam: I am a victim of identity theft. I recently learned that my personal information was used to open an account at your company. I did not open or authorize this account, and I therefore request that it be closed immediately.

I am a victim of identity theft, and did not make the charge(s). I am requesting that the item(s) be blocked to correct my credit report. Enclosed are copies of (describe any enclosed documents) supporting my position. Please investigate this (these) matter(s) and block the disputed item(s) as soon as possible.

To make certain that you do not become responsible for any debts incurred in your name by an identity thief, you must prove that you didn't create the debt. Taking action quickly is important, so don't delay. Create a personalized recovery plan at IdentityTheft.gov that walks you through each step of the process.

To report identity theft, contact: The Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338. The three major credit reporting agencies. Ask them to place fraud alerts and a credit freeze on your accounts.

I am a victim of identity theft, and I did not make [this/these] charge(s). I request that you remove the fraudulent charge(s) and any related finance charge and other charges from my account, send me an updated and accurate statement, and close the account (if applicable).

The Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338. The three major credit reporting agencies. Ask them to place fraud alerts and a credit freeze on your accounts.