Maine Revocable Living Trust for Unmarried Couples

Description

How to fill out Revocable Living Trust For Unmarried Couples?

US Legal Forms - one of the largest repositories of legal documents in the USA - offers a variety of legal document formats that you can download or print.

Using the website, you can find thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can discover the latest forms like the Maine Revocable Living Trust for Unmarried Couples in seconds.

If you're a member, Log In and download the Maine Revocable Living Trust for Unmarried Couples from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms from the My documents section of your account.

Complete the transaction. Use your Visa, Mastercard, or PayPal account to finish the purchase.

Select the format and download the form to your device. Make changes. Fill out, edit, print, and sign the downloaded Maine Revocable Living Trust for Unmarried Couples. Each template added to your account has no expiration and belongs to you permanently. So, if you want to download or print another copy, just go to the My documents section and click on the form you need. Access the Maine Revocable Living Trust for Unmarried Couples with US Legal Forms, one of the most comprehensive libraries of legal document formats. Utilize thousands of professional and state-specific forms that meet your business or personal requirements.

- Ensure you have selected the correct form for your city/county.

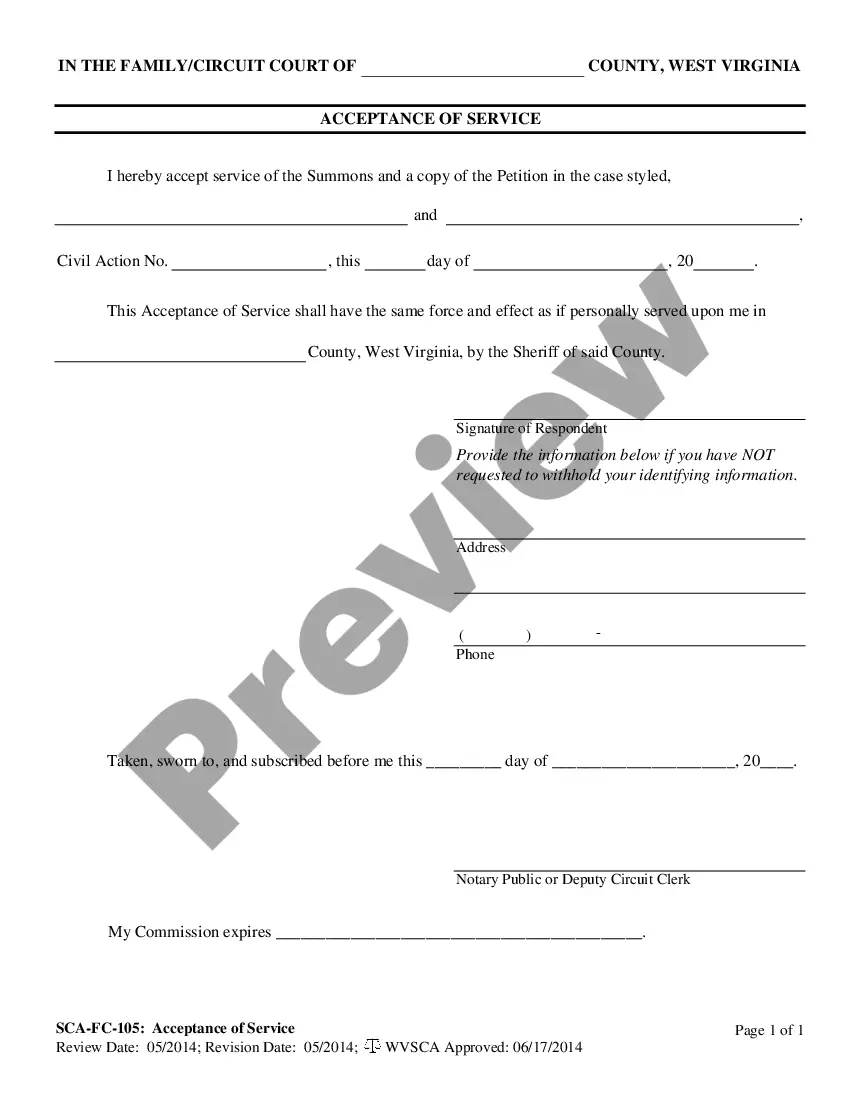

- Click the Preview button to review the content of the form.

- Check the form description to make sure you've chosen the correct form.

- If the form doesn't meet your needs, use the Search box at the top of the screen to find one that does.

- Once you are satisfied with the form, confirm your selection by clicking the Buy now button.

- Then, choose the payment plan you prefer and provide your information to register for an account.

Form popularity

FAQ

While Maine Revocable Living Trust for Unmarried Couples offers numerous benefits, there are some potential dangers to consider. One significant risk is the possibility of mismanagement, especially if the trust lacks clear guidelines. Furthermore, if trust documents are not correctly drafted or updated, they can lead to family disputes or unintended asset distribution. To mitigate these risks, working with qualified professionals, like those at USLegalForms, can ensure proper setup and management.

To establish a Maine Revocable Living Trust for Unmarried Couples, you should follow several essential steps. First, gather necessary information about your assets and decide how you want to distribute them. Next, consult with an attorney or utilize online resources like USLegalForms to draft the trust document in compliance with Maine laws. Finally, transfer your assets into the trust, ensuring they are properly titled to avoid issues later.

Creating a Maine Revocable Living Trust for Unmarried Couples can provide significant advantages for your parents. This trust helps manage their assets during their lifetime and ensures a smooth transition of their estate after they pass away. Additionally, it helps avoid probate, offers privacy, and provides flexibility in asset management. Encouraging them to consider this option can lead to better financial security and peace of mind.

While this FAQ targets unmarried couples, it's important to note that a Maine Revocable Living Trust is also beneficial for married couples seeking flexibility and control over their assets. Each couple's situation is different, so the 'best' trust often depends on specific needs and goals. Many couples benefit from consulting a professional service like uslegalforms to create a tailored trust that meets their unique requirements. Each trust can provide peace of mind as you navigate the complexities of asset management.

When creating a Maine Revocable Living Trust for Unmarried Couples, it's advisable not to include certain assets like retirement accounts or life insurance policies, as they may have designated beneficiaries. Additionally, avoid placing personal items that lack significant value or require careful handling outside the trust. Including property that might have fluctuating values can also complicate management. Consulting a legal expert can help you make informed decisions about what to include.

In a Maine Revocable Living Trust for Unmarried Couples, when one partner passes away, the trust typically continues to exist. The surviving partner retains control over the trust assets, which can help avoid probate and streamline the transition process. This structure provides a clear pathway for asset distribution as outlined in the trust documents. It's important to review these documents regularly to ensure they reflect your current wishes.

When setting up a Maine Revocable Living Trust for Unmarried Couples, having one joint trust can simplify management and distribution of assets. It allows both partners to easily access and control the trust's contents, fostering transparency in financial matters. However, individual trusts might offer personal flexibility regarding personal assets and decisions. Ultimately, the choice depends on your unique circumstances and goals.

For unmarried couples, a tenancy in common is often the better choice as it permits each partner to own a specific share of the property. This arrangement ensures that each person can pass their share to their chosen heirs outside of the other's control. Additionally, utilizing a Maine Revocable Living Trust for Unmarried Couples can further clarify the distribution of assets and provide peace of mind. It’s wise to explore all options to find what best fits your situation.

The most popular form of marital trust is the QTIP trust, which allows for the deferral of estate tax until the death of the surviving spouse. While this type of trust can be advantageous in certain scenarios, a Maine Revocable Living Trust for Unmarried Couples may better suit those who are not legally married. This option grants flexibility and clear directives on asset management in a manner that aligns with your wishes.

Deciding between a single or joint trust hinges on your relationship status and goals for asset management. A Maine Revocable Living Trust for Unmarried Couples is ideal for those who want a clear structure without the complexities of joint ownership. This choice allows for individual control and personalization of your asset distribution. Evaluating your unique situation will guide you in making the right decision.