Maine Revocable Living Trust for Single Person

Description

How to fill out Revocable Living Trust For Single Person?

You can spend multiple hours online looking for the valid document template that meets the federal and state regulations you require.

US Legal Forms offers thousands of legal documents that are reviewed by experts.

It is easy to obtain or create the Maine Revocable Living Trust for Single Person from my service.

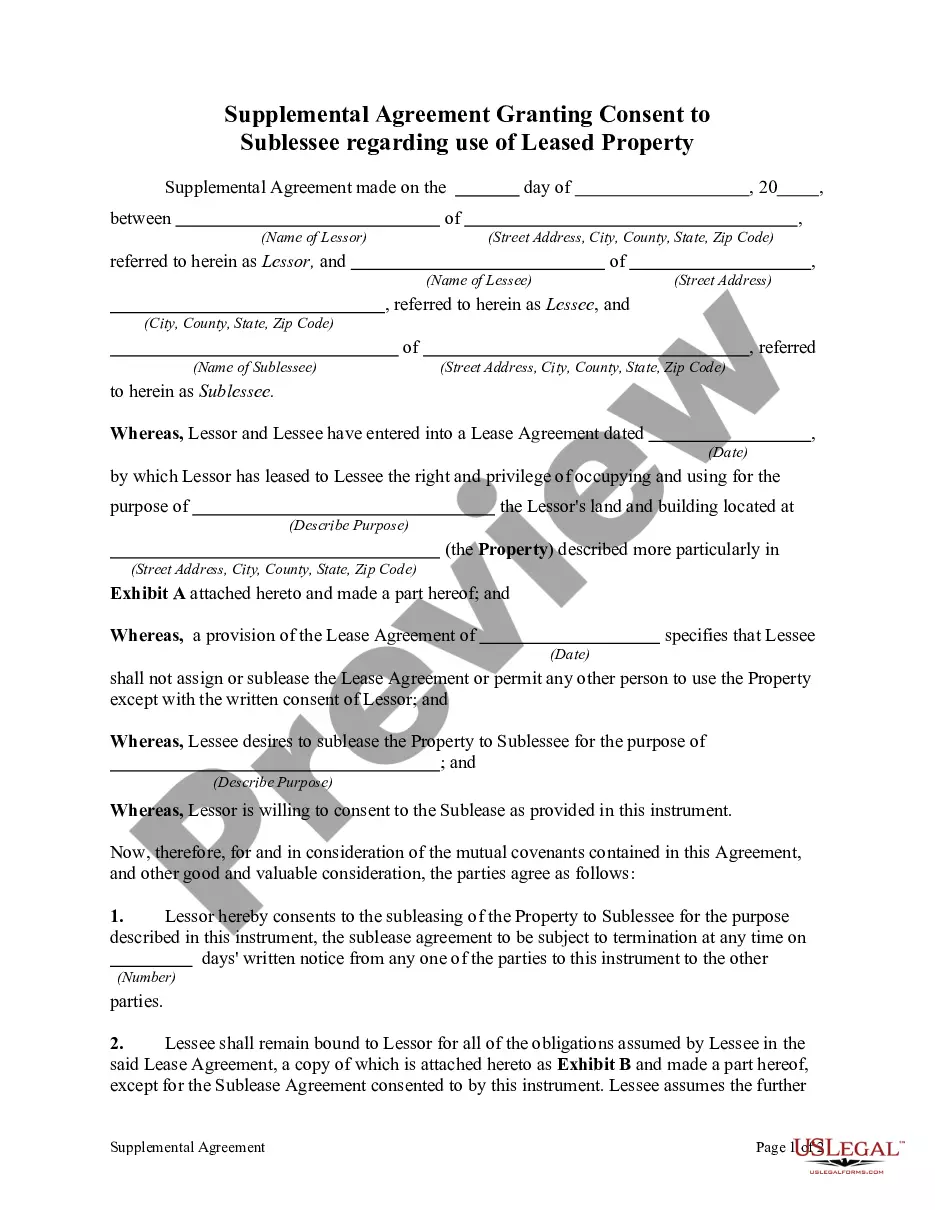

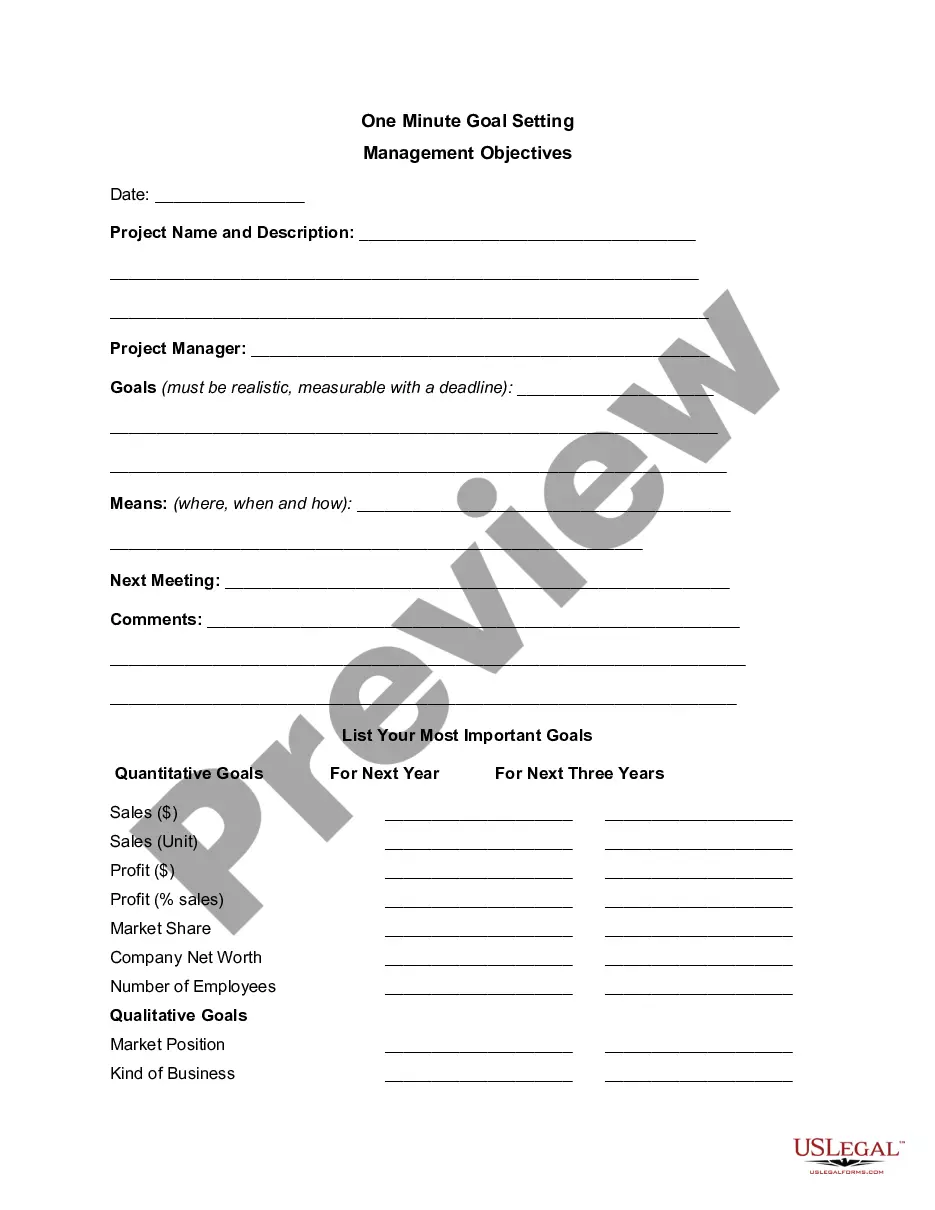

If available, utilize the Review option to examine the document template as well.

- If you already have a US Legal Forms account, you can Log In and select the Download option.

- Then, you can complete, modify, create, or sign the Maine Revocable Living Trust for Single Person.

- Every legal document template you acquire is yours permanently.

- To retrieve an additional copy of the purchased document, visit the My documents tab and click on the relevant option.

- If this is your first time using the US Legal Forms website, follow the simple steps outlined below.

- First, ensure that you have selected the correct document template for your state or city of preference.

- Read the document description to verify that you have chosen the right form.

Form popularity

FAQ

A simple will is typically best for a single person who has assets to distribute. This type of will clearly outlines your wishes regarding asset distribution and guardianship for any dependents. While a will addresses asset transfer, pairing it with a Maine Revocable Living Trust for Single Person enhances your estate plan. This combination ensures that your overall estate is managed according to your specifications and minimizes potential conflicts among heirs.

The ideal option for a single person is a Maine Revocable Living Trust for Single Person. This trust offers flexibility, allowing you to amend or revoke it as your circumstances change. It also protects your assets from probate, ensuring a smooth transfer to your beneficiaries. Additionally, establishing a trust gives you peace of mind knowing that you have a plan in place for your future.

For a single person, a Maine Revocable Living Trust for Single Person is typically the best choice. A joint trust is often suited for couples who share assets and want to manage them together. By choosing a single trust, you retain complete control over your assets and can make individual decisions that align with your personal goals. This approach simplifies estate management and provides clarity for your heirs.

Yes, a single person can greatly benefit from establishing a Maine Revocable Living Trust for Single Person. This type of trust allows you to manage your assets during your lifetime and specify how they will be distributed after your death. It helps avoid the probate process, which can be lengthy and costly. By creating a trust, you ensure that your wishes are followed and your loved ones are taken care of.

When considering a Maine Revocable Living Trust for a Single Person, it’s important to choose someone knowledgeable and trustworthy. Typically, individuals might consult an estate planning attorney who specializes in trusts, as they can provide tailored advice according to specific needs. Alternatively, you might consider using a reputable online service, like US Legal Forms, to simplify the process and help you set up your trust effectively. This way, you ensure the trust is constructed correctly and aligns with your wishes.

Filling out a Maine Revocable Living Trust for Single Person requires careful attention to detail. You'll begin by entering your personal information, including your name and address. Next, specify the assets you wish to include in the trust, along with the names of your beneficiaries. To ensure you complete the process correctly, consider using resources from uslegalforms, which can provide templates and instructions tailored to your needs.

Setting up a Maine Revocable Living Trust for Single Person involves several steps. First, you need to create a trust document that outlines its terms and details, specifying how your assets will be managed and distributed. Next, you must transfer your assets into the trust, a process known as funding. You can utilize platforms like uslegalforms to guide you through the necessary paperwork and processes.

The primary downside of a Maine Revocable Living Trust for Single Person is that it does not provide asset protection from creditors. Additionally, while you have flexibility to make changes, your assets are still considered part of your estate for tax purposes. This could lead to potential estate tax issues down the road. It's important to weigh these factors when considering a revocable trust.