Maine Contractor's Final Affidavit of Payment to Subcontractors

Description

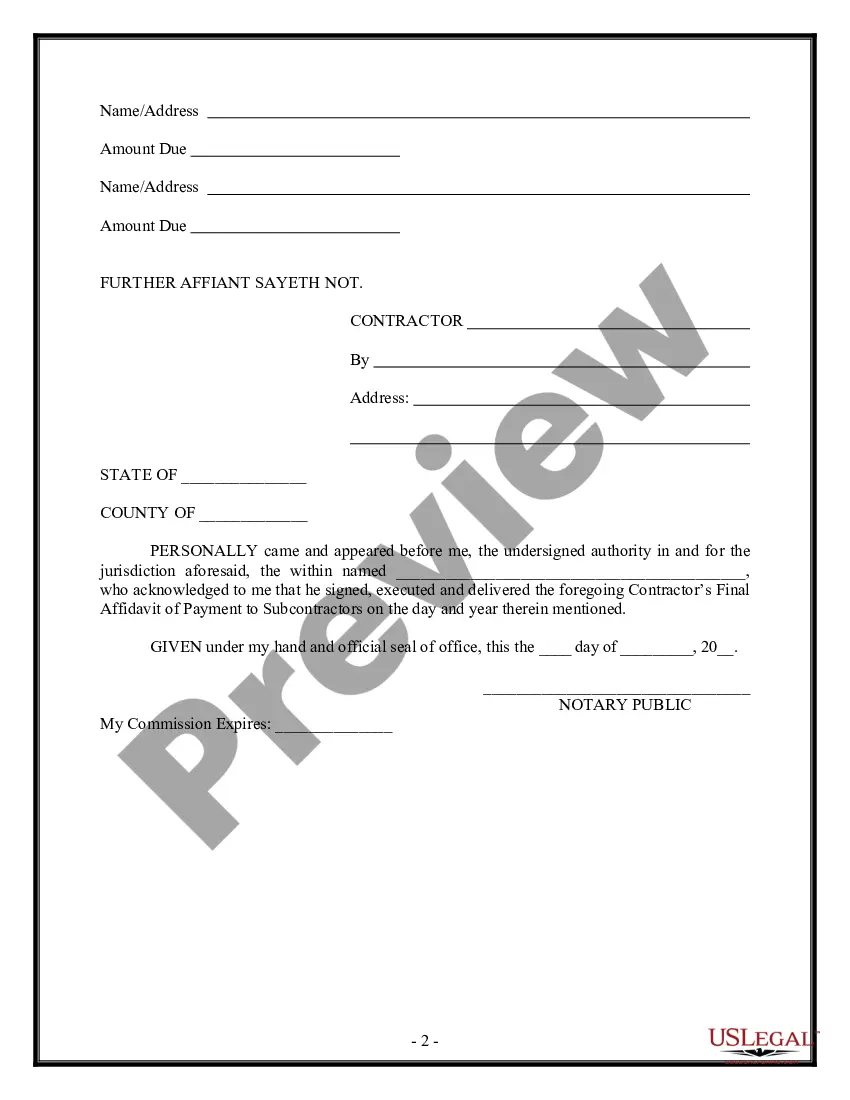

How to fill out Contractor's Final Affidavit Of Payment To Subcontractors?

If you need to thoroughly obtain, download, or print legal document templates, utilize US Legal Forms, the largest assortment of legal documents available online.

Employ the site’s straightforward and user-friendly search feature to find the forms you require. Different templates for business and personal purposes are categorized by types and states, or keywords.

Utilize US Legal Forms to acquire the Maine Contractor's Final Affidavit of Payment to Subcontractors in just a few clicks.

Every legal document template you purchase is yours indefinitely. You can access every form you acquired through your account. Go to the My documents section and select a form to print or download again.

Compete and download, and print the Maine Contractor's Final Affidavit of Payment to Subcontractors using US Legal Forms. There are millions of professional and state-specific forms you can utilize for your personal or business needs.

- If you are already a US Legal Forms user, sign in to your account and click on the Download button to obtain the Maine Contractor's Final Affidavit of Payment to Subcontractors.

- You can also access forms you previously acquired in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Preview option to review the form’s content. Make sure to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other versions of the legal document template.

- Step 4. Once you have found the form you want, click the Get Now button. Choose the pricing plan you prefer and provide your details to register for an account.

- Step 5. Complete the payment process. You can use your Visa, Mastercard, or PayPal account to finalize the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Maine Contractor's Final Affidavit of Payment to Subcontractors.

Form popularity

FAQ

200dA 'Payment Notice' is the document the contractor (the employer) serves the subcontractor (the employee) providing details of what's payable and why. This is known as the 'Notified Sum' and this is what will be paid on the 'Final Date for Payment' (see below).

What does Payment Notice mean? A notice given under HGCRA 1996, s 110A by a payer (or specified person) or the payee setting out the amount to be paid and how it is calculated. Most standard form contracts provide that the notice is to be given by the payer (or specified person).

Thus, if a general contractor's subcontract currently requires its subcontractors to indemnify it from any and all claims or disputes arising from general contractor's sole negligence, it will not be enforceable.

PURPOSE: To provide for methodical and orderly effort in which a subcontractor or vendor is legally notified to address contractual deficiencies and/or to be terminated.

The most common causes of back charges are defective work, damages to the property caused by performance of your work, costs for use of contractor's equipment, and site clean-up costs.

You usually pay your subcontractors directly. But you can pay them through a third party (such as a relative or debt company) if they ask you to. If you make deductions, you must give the subcontractor a payment and deduction statement within 14 days of the end of each tax month.

When the subcontractor does not get paid then they have grounds to pursue the contractor for monies owed. This could be in the form of wages or unpaid invoices for services rendered. In the USA, the owner of the property can be held liable for payment under a Mechanics Lien.

Paying subcontractorsYou usually pay your subcontractors directly. But you can pay them through a third party (such as a relative or debt company) if they ask you to. If you make deductions, you must give the subcontractor a payment and deduction statement within 14 days of the end of each tax month.

Building and Construction Prime contractors looking for subcontractors hire electricians, plumbers, carpenters, carpet layers, painters, landscapers, roofers and flooring specialists to do most of the work.

When you pay subcontractors, you'll usually need to make deductions from their payments and pay the money to HMRC. Deductions count as advance payments towards the subcontractor's tax and National Insurance bill. You'll need to file monthly returns and keep full CIS records - you may get a penalty if you do not.