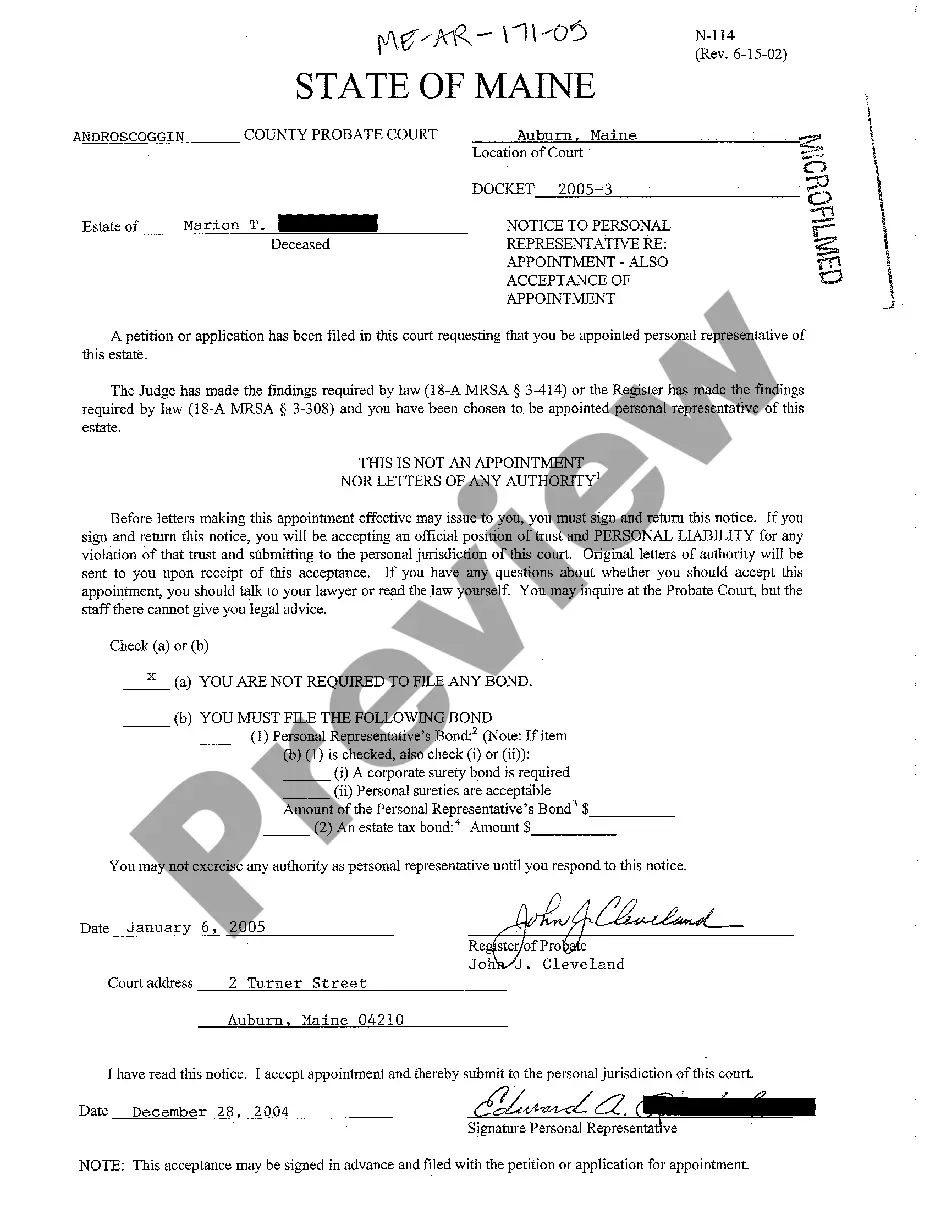

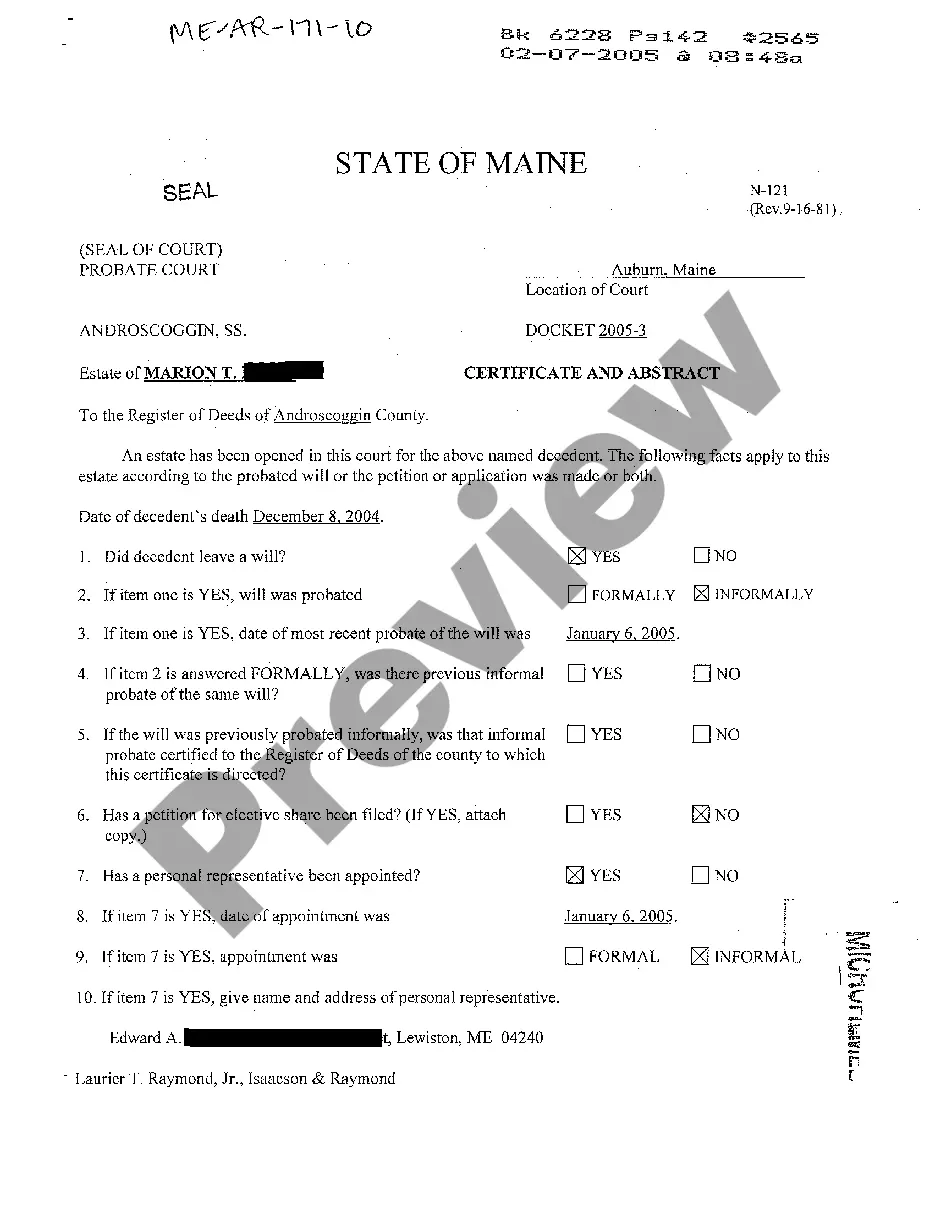

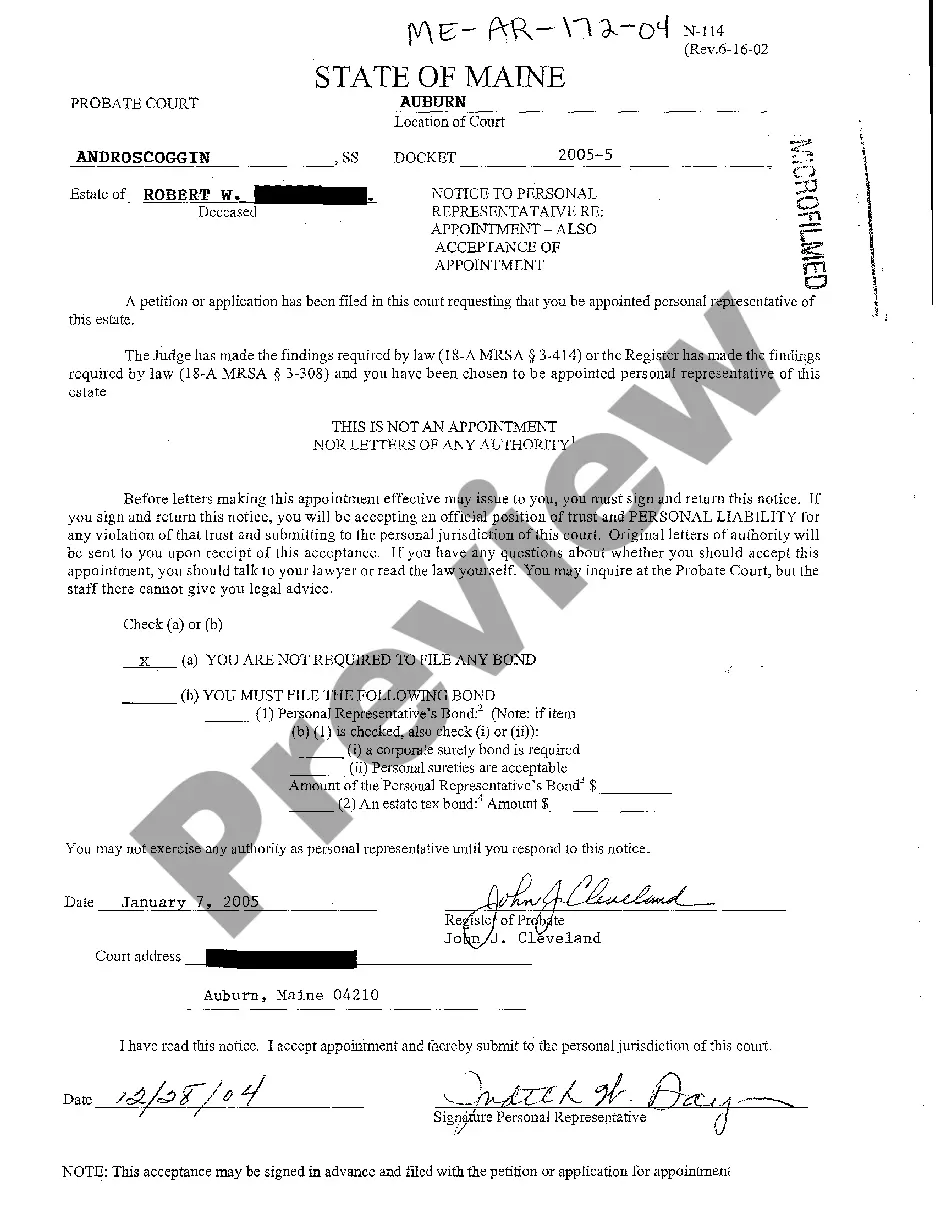

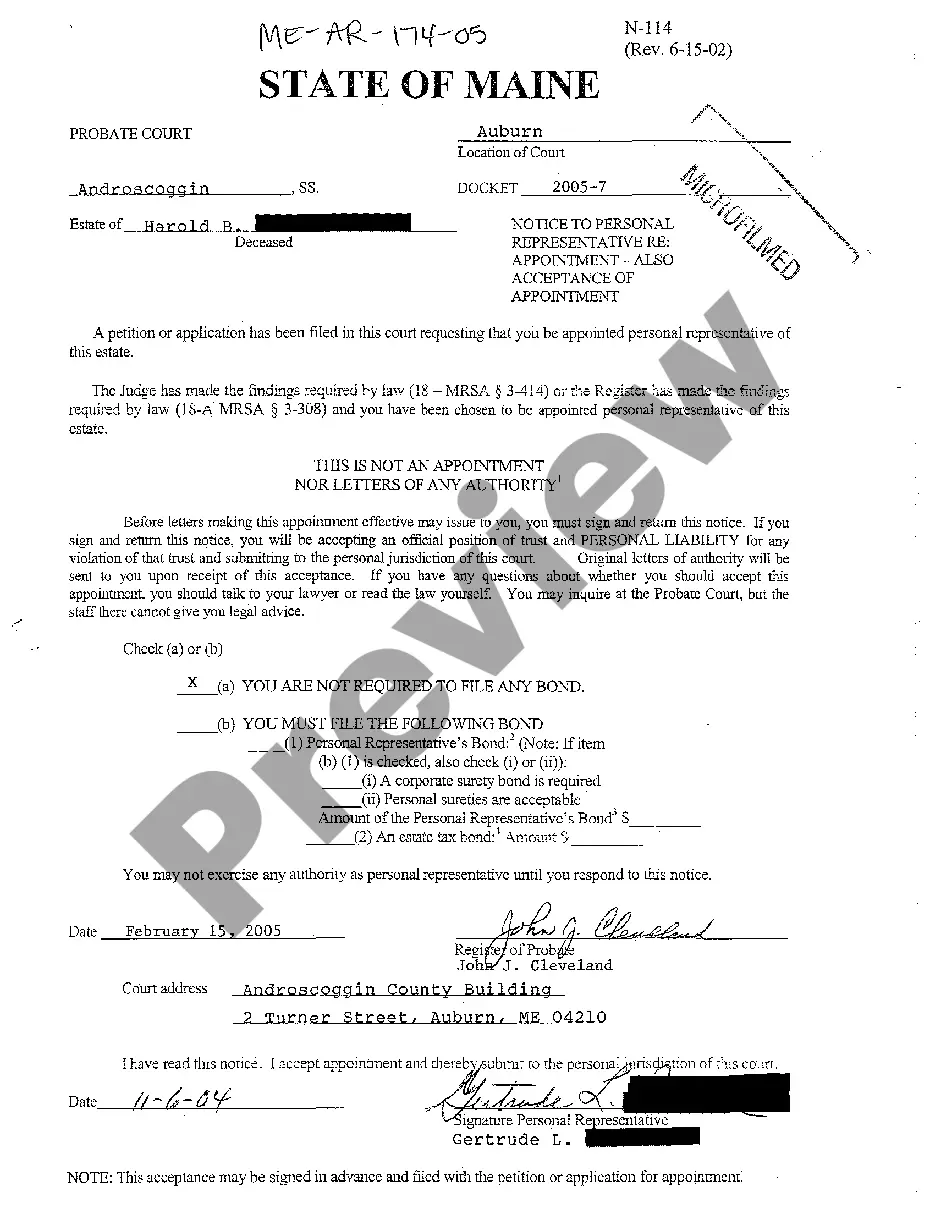

Maine Notice to Personal Representative - Also Acceptance of Appointment

Description

How to fill out Maine Notice To Personal Representative - Also Acceptance Of Appointment?

Welcome to the most extensive legal document repository, US Legal Forms.

Here you can obtain any template such as the Maine Notice to Personal Representative - Also Acceptance of Appointment forms and save them (as numerous as you need). Draft official documents in just a few hours, instead of days or weeks, without spending a fortune on a legal expert.

Receive your state-specific template in a few clicks, knowing it has been prepared by our state-certified attorneys.

To create an account, choose a pricing plan, use a credit card or PayPal to subscribe, download the template in your desired format (Word or PDF), print the document and fill it out with your or your business’s details. Once you’ve completed the Maine Notice to Personal Representative - Also Acceptance of Appointment, send it to your attorney for verification. It’s an additional step but a crucial one to ensure you’re fully protected. Join US Legal Forms now and gain access to thousands of reusable templates.

- If you’re already a registered user, just Log In to your account and then click Download next to the Maine Notice to Personal Representative - Also Acceptance of Appointment that you require.

- Since US Legal Forms is online, you’ll always have access to your downloaded documents, no matter the device you’re using.

- You can find them in the My documents section.

- If you don't have an account yet, what are you waiting for? Follow our instructions below to get started.

- If it’s a state-specific template, verify its validity in your state.

- Review the description (if available) to confirm it’s the correct template.

- Explore more details with the Preview feature.

- If the template meets all your requirements, simply click Buy Now.

Form popularity

FAQ

However, being an executor can be a time-consuming job that can take weeks or even months. That's why most executors are entitled to receive some sort of payment for their services, either through the terms of the will or by state law.

A personal representative is appointed by a judge to oversee the administration of a probate estate.When a personal representative is nominated to the position in a will, he's commonly called the executor of the estate.

As the Personal Representative, you are responsible for doing the following: 2022 Collecting and inventorying the assets of the estate; 2022 Managing the assets of the estate during the probate process; 2022 Paying the bills of the estate. Making distribution to the heirs or beneficiaries of the estate.

The executor is entitled to 5% of the first $200,000 of corpus; 3.5% of the excess over $200,000 up to $1,000,000; and 2% of the excess of the corpus over $1,000,000. From a practical standpoint, using my example of a $400,000 estate, my hypothetical executor would be entitled to a commission of $17,000.

A personal representative in California is entitled to compensation for ordinary services provided to the estate. California Probate Code § 10800. These fees are also called statutory fees, because they are provided by statute.

If a personal representative fails to act in the best interests of the beneficiaries to such an extent that the welfare of the beneficiaries is at risk, they can be removed by the Court.

No. The person must be appointed by the probate court as the personal representative and letters issued for the appointment as personal representative to be effective. California Probate Code §8400(a).To learn about the duties of a personal representative in California probate, click here.

The fee varies depending on the size of the estate from $20.00 for an estate of $10,000 or less to $950.00 for an estate of $2,000,000 plus $100.00 for each additional $500,000.