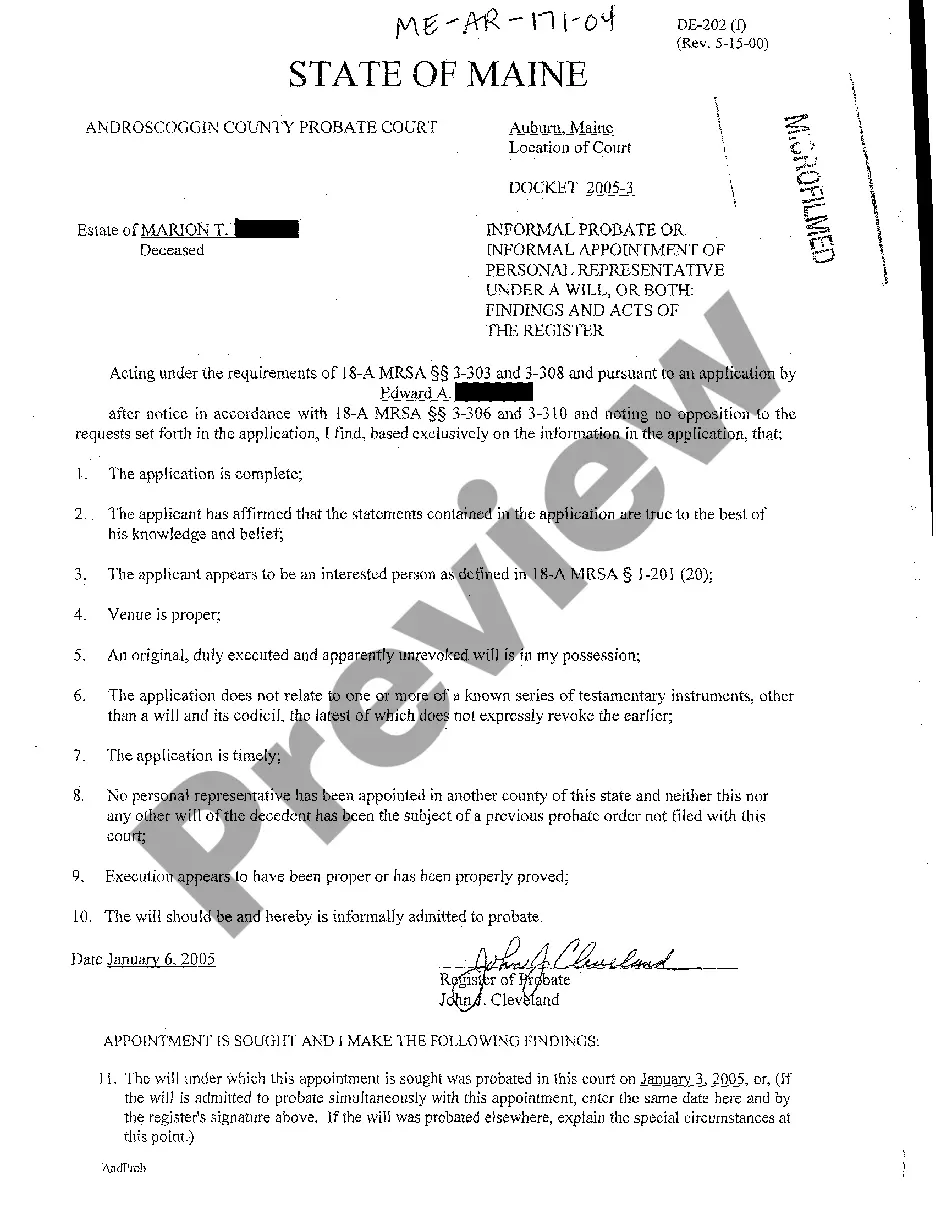

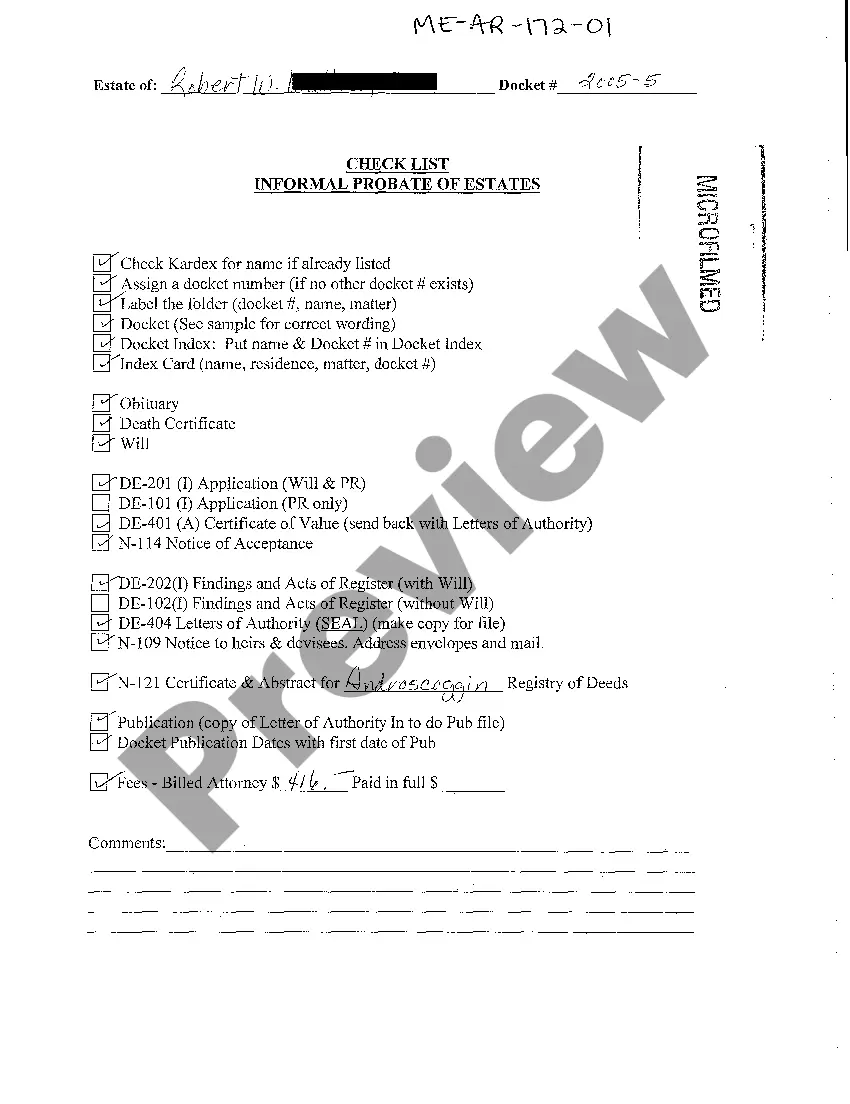

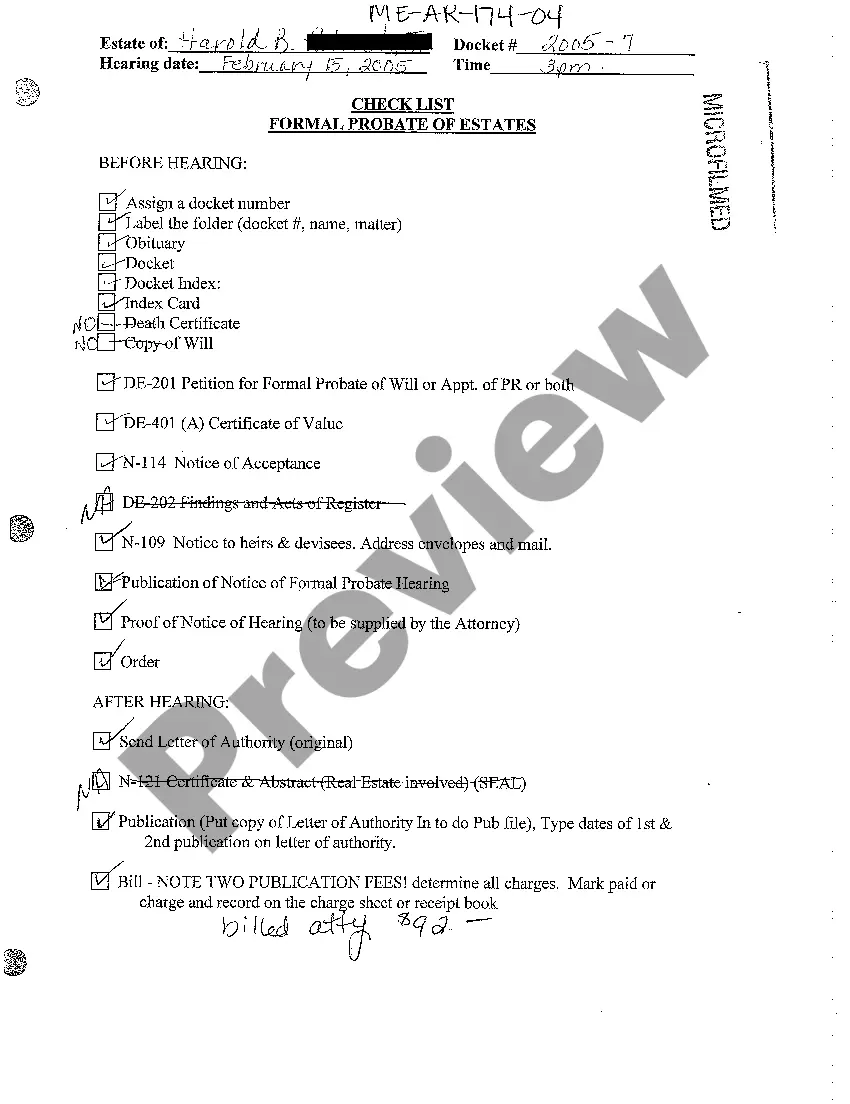

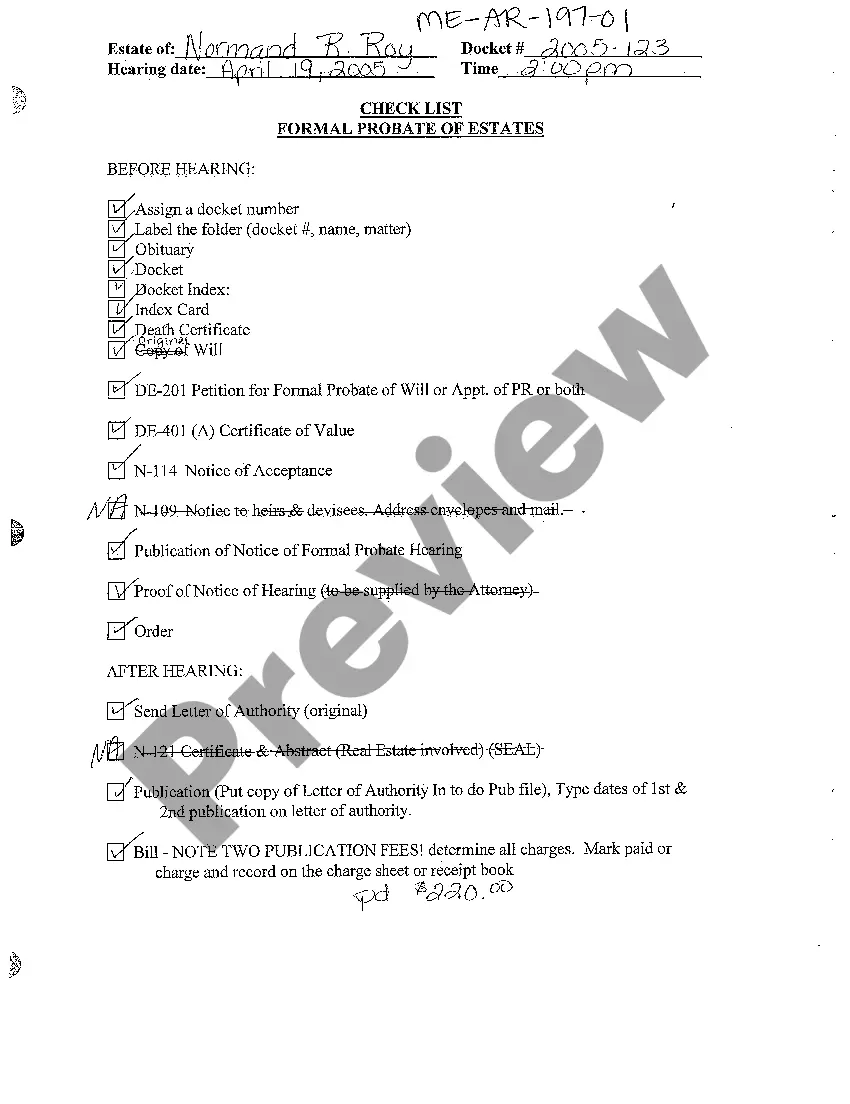

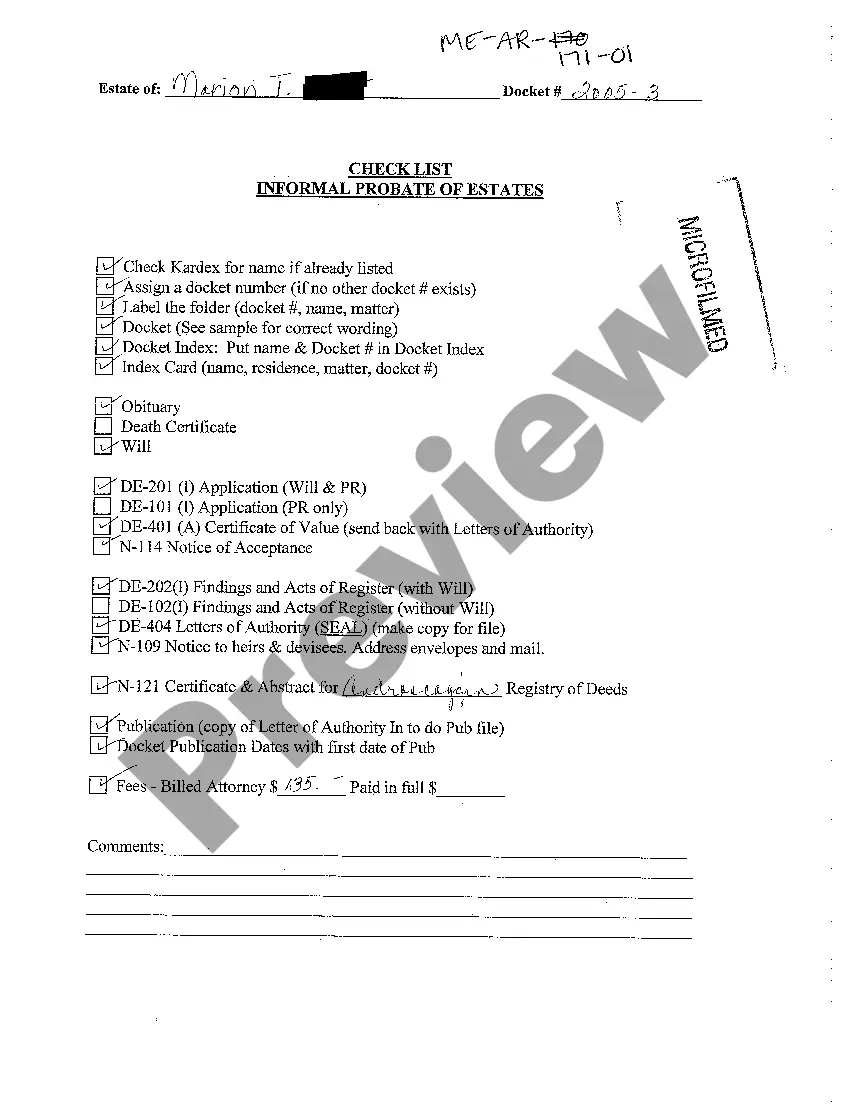

Maine Informal Probate of Estates Check List

Description

How to fill out Maine Informal Probate Of Estates Check List?

You are invited to the most extensive legal documents repository, US Legal Forms.

Here you can discover any template including Maine Informal Probate of Estates Check List forms and store them (as many as you desire).

Create formal documents within a few hours, rather than days or weeks, without spending a fortune on an attorney.

To create an account, choose a pricing plan. Utilize a credit card or PayPal account to sign up. Save the template in your preferred format (Word or PDF). Print the document and complete it with your or your business’s information. Once you’ve finished the Maine Informal Probate of Estates Check List, submit it to your lawyer for validation. It’s an additional step but an essential one for ensuring you’re completely protected. Register for US Legal Forms today and gain access to a vast number of reusable samples.

- Obtain your state-specific form in a matter of clicks and feel confident knowing it was crafted by our state-qualified lawyers.

- If you’re already a subscribed member, simply Log In to your account and click Download beside the Maine Informal Probate of Estates Check List you require.

- Since US Legal Forms is internet-based, you will always have access to your stored templates, regardless of the device you are using.

- Locate them in the My documents section.

- If you do not have an account yet, what are you waiting for.

- Review our instructions below to get initiated.

- If this is a state-specific template, verify its validity in your residing state.

- Check the description (if present) to ensure it’s the correct template.

Form popularity

FAQ

Pass real estate and other assets owned in joint tenancy to the surviving joint tenant. transfer bank accounts and securities registered in "payable on death" form to beneficiaries. transfer funds in IRAs and retirement plans to named beneficiaries.

Probate records are court records dealing with the distribution of a person's estate after death. Information recorded may include the death date, names of heirs, family members, and guardians, relationships, residences, inventories of the estate (including trade and household goods), and names of witnesses.

It issues legal documents which give people the authority to deal with the estate of someone who has died. The probate registry issue a grant of probate to an executor named in a Will. The probate registry also issue a grant of letters of administration when there isn't a valid Will.

Before distributing assets to beneficiaries, the executor must pay valid debts and expenses, subject to any exclusions provided under state probate laws.The executor must maintain receipts and related documents and provide a detailed accounting to estate beneficiaries.

Probated wills are public record, which means anyone can show up at the courthouse and view them in their entirety. A person who has reason to believe they might be included in a will may thus examine the will.