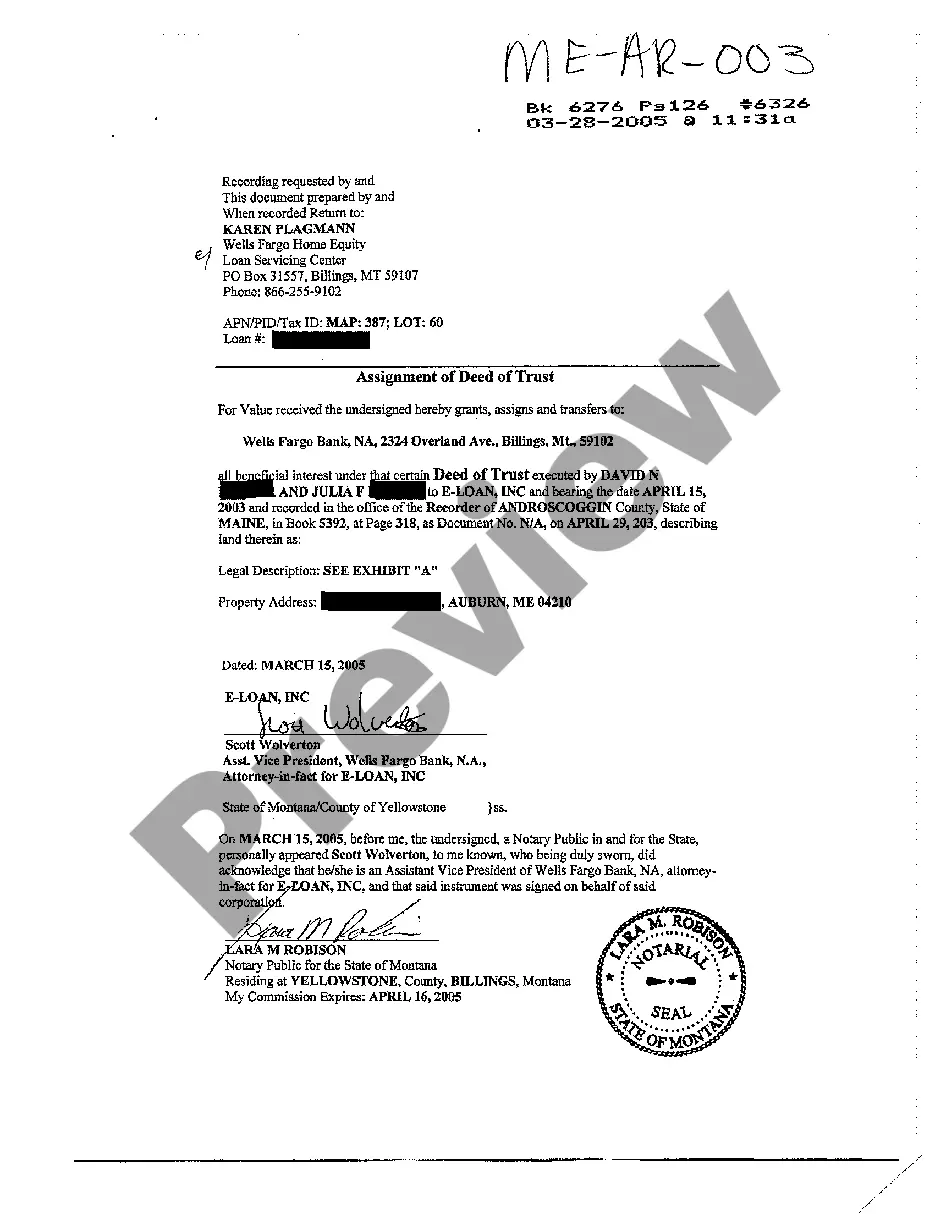

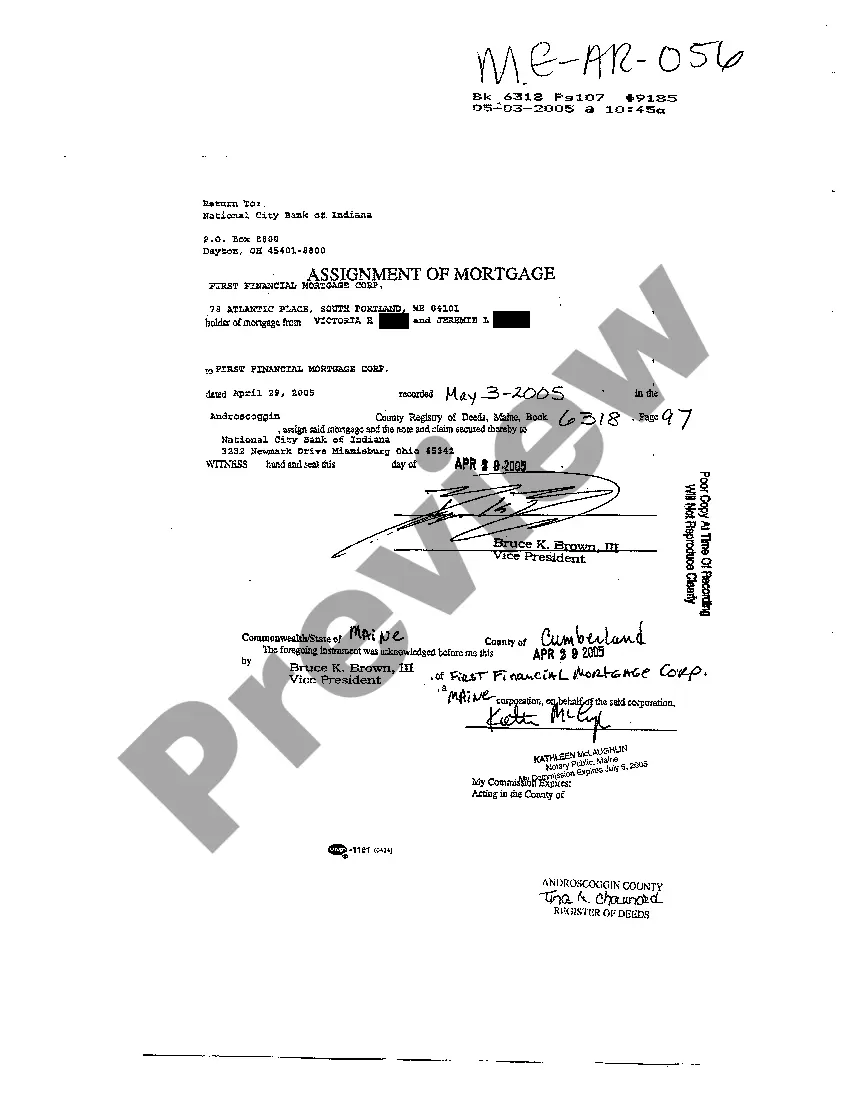

Maine Assignment of Mortgage

Description

How to fill out Maine Assignment Of Mortgage?

Greetings to the most essential legal documents repository, US Legal Forms. Here you will discover any sample including Maine Assignment of Mortgage templates and retain them (as many as you wish/require). Prepare formal papers in a matter of hours, rather than days or even weeks, without spending a fortune on a lawyer. Obtain the state-specific sample in just a few clicks and feel assured with the knowledge that it was created by our experienced attorneys.

If you’re already a registered user, just Log Into your account and then click Download beside the Maine Assignment of Mortgage you desire. Because US Legal Forms is online, you’ll always have access to your downloaded documents, no matter what device you’re using. View them within the My documents section.

If you do not have an account yet, what are you waiting for? Check our guidelines below to start.

Once you’ve completed the Maine Assignment of Mortgage, present it to your attorney for validation. It’s an extra step but a crucial one to ensure you’re fully protected. Sign up for US Legal Forms now and gain access to a vast array of reusable samples.

- If this is a state-specific document, verify its relevance in your state.

- Review the description (if available) to determine if it’s the correct template.

- Explore more content using the Preview option.

- If the sample fulfills your requirements, click Buy Now.

- To create an account, choose a subscription plan.

- Utilize a credit card or PayPal account to register.

- Download the template in your preferred format (Word or PDF).

- Print the document and fill it with your/your company’s information.

Form popularity

FAQ

Corporate mortgage assignment defined. An assignment of a mortgage occurs when a loan for a piece of property (home or otherwise) is assigned to another party.A corporate assignment of a mortgage occurs when the third party that assumes the obligation for the loan is a corporation.

An assignment of mortgage gives the loan seller's rights under the mortgage, including the right to foreclose if the borrower doesn't make payments, to the new owner of the loan.

What does Assignment of Mortgage mean: The most common example of an Assignment of Mortgage is when a mortgage lender transfers/sells the mortgage to another lender. This can be done more than once until the balance is paid.If a borrower transfers the mortgage to another borrower, this is called an assumed mortgage.

A transfer or sale of your mortgage loan should not affect you. A lender cannot change the terms, balance or interest rate of the loan from those set forth in the documents you originally signed. The payment amount should not just change, either. And it should have no impact on your credit score, says Whitman.

Gap Financing is a term mostly associated with mortgage loans or property loans such as a bridge loan. It is an interim loan given to finance the difference between the floor loan and the maximum permanent loan as committed.

Purpose A gap mortgages allows funding for a property to continue while it is going through the process of selling.Documents required for a mortgage assignment are: Instead of having you pay off your old loan with money from your new lender, your original lender assigns your loan balance to the new one.

Corporate mortgage assignment defined. An assignment of a mortgage occurs when a loan for a piece of property (home or otherwise) is assigned to another party.A corporate assignment of a mortgage occurs when the third party that assumes the obligation for the loan is a corporation.

An assignment transfers all of the original mortgagee's interest under the mortgage or deed of trust to the new bank. Generally, the mortgage or deed of trust is recorded shortly after the mortgagors sign it and, if the mortgage is subsequently transferred, each assignment is to be recorded in the county land records.

A mortgage lender can transfer a mortgage to another company using an assignment agreement.Many banks and mortgage lenders sell outstanding loans in order to free up money to lend to new borrowers, and use an assignment of mortgage to legally grant the loan obligation to the new mortgage holder.