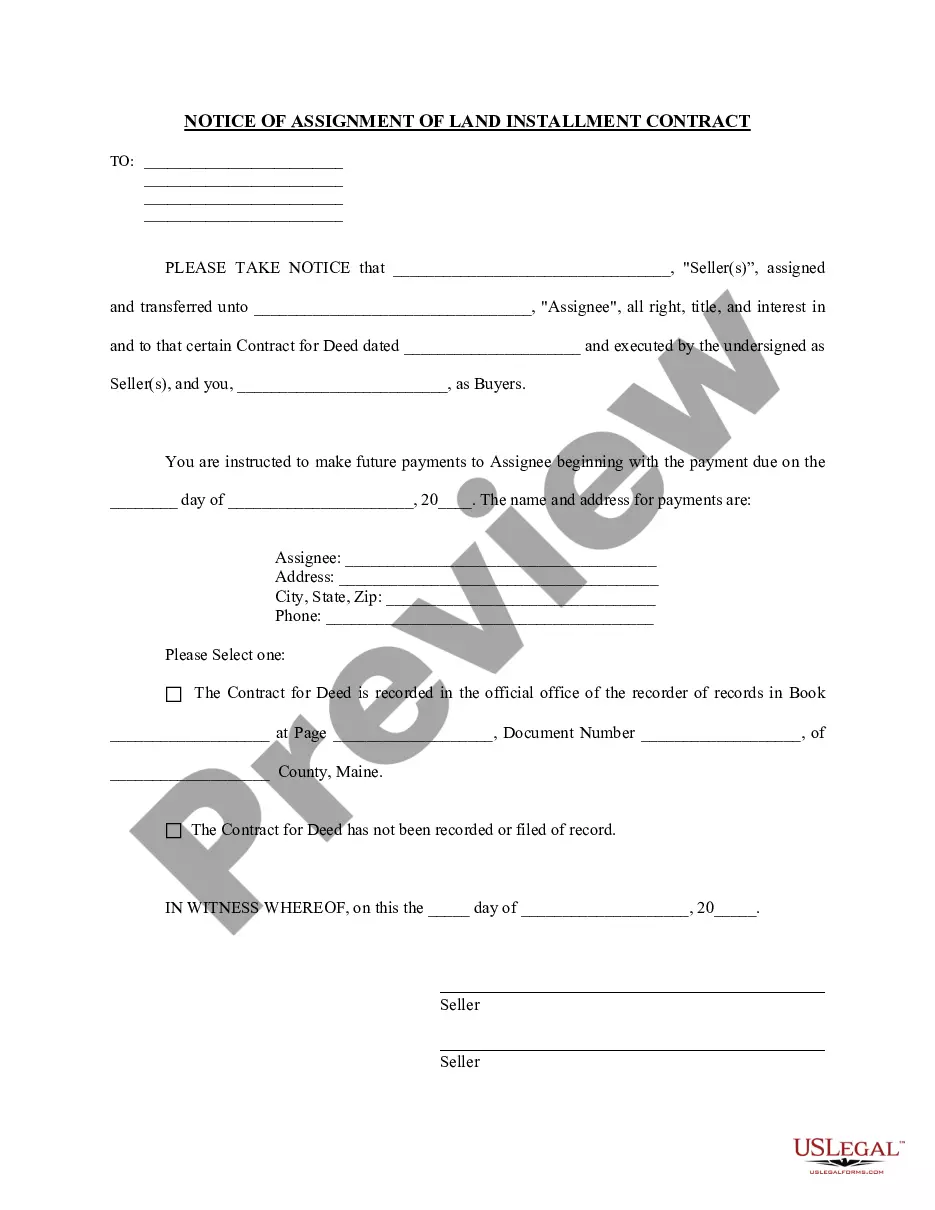

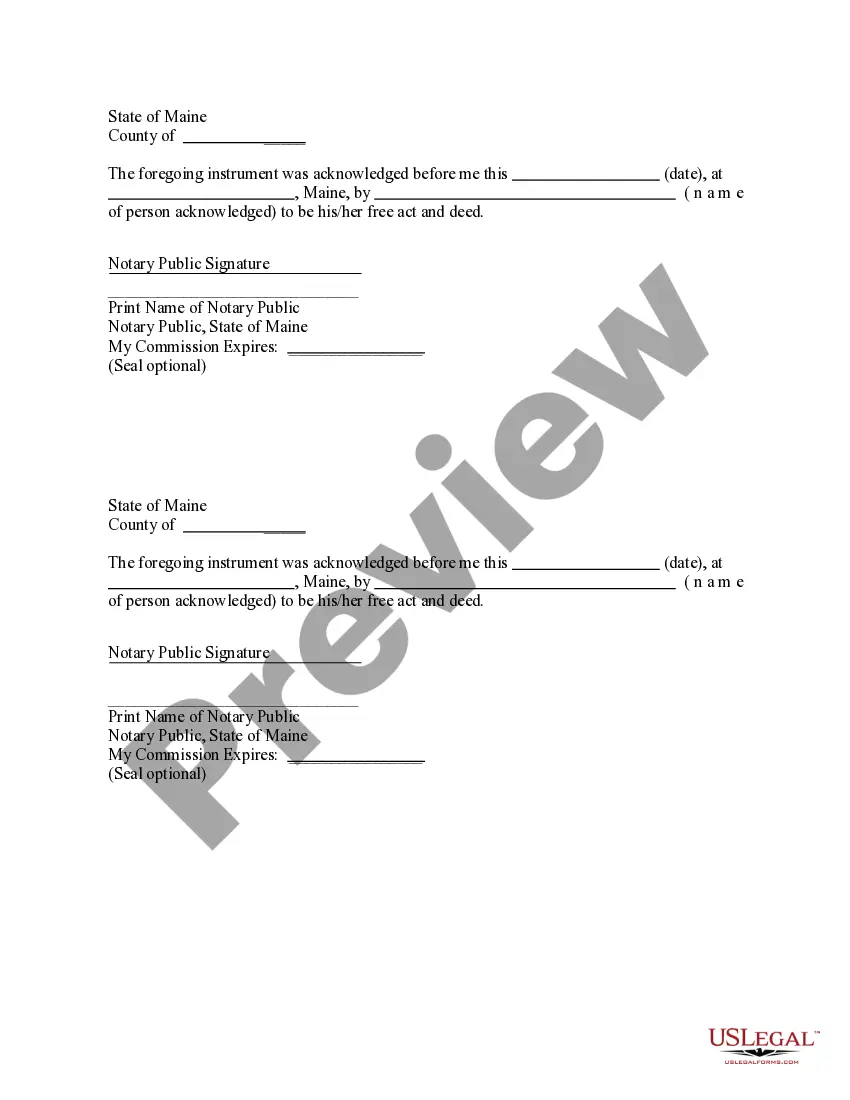

This Notice of Assignment of Contract for Deed is used by a Seller to provide notice to the Buyer(s) that the Seller has assigned a contract for deed to a third party and to make future payments to the third party. This form must be signed by the Seller and notarized.

Maine Notice of Assignment of Contract for Deed

Description

How to fill out Maine Notice Of Assignment Of Contract For Deed?

You are invited to the largest repository of legal documents, US Legal Forms.

Here you can obtain any template including Maine Notice of Assignment of Contract for Deed forms and retain them (as many as you need). Prepare official documents in just a few hours, instead of days or weeks, without having to spend a fortune on a lawyer.

Acquire the state-specific form with just a couple of clicks and rest assured knowing that it was created by our experienced legal experts.

If the document fulfills all your requirements, simply click Buy Now. To create an account, select a pricing plan. Use a credit card or PayPal account to register. Download the template in your preferred format (Word or PDF). Print the document and complete it with your or your business’s details. Once you’ve filled out the Maine Notice of Assignment of Contract for Deed, submit it to your lawyer for validation. It's an extra step but a crucial one to ensure you're fully protected. Join US Legal Forms today and gain access to a multitude of reusable templates.

- If you’re already a registered customer, just Log In to your account and click Download next to the Maine Notice of Assignment of Contract for Deed you require.

- As US Legal Forms is an online service, you'll typically have access to your saved documents, regardless of the device you're using.

- Find them under the My documents section.

- If you don’t have an account yet, what are you waiting for.

- Review our guidelines below to get started.

- If this is a state-specific example, verify its validity in your residing state.

- Examine the description (if available) to determine if it’s the correct template.

- View additional content with the Preview feature.

Form popularity

FAQ

Purchase price. Down payment. Interest rate. Number of monthly installments. Responsibilities of the buyer and seller. Legal remedies for the seller if the buyer does not make payments.

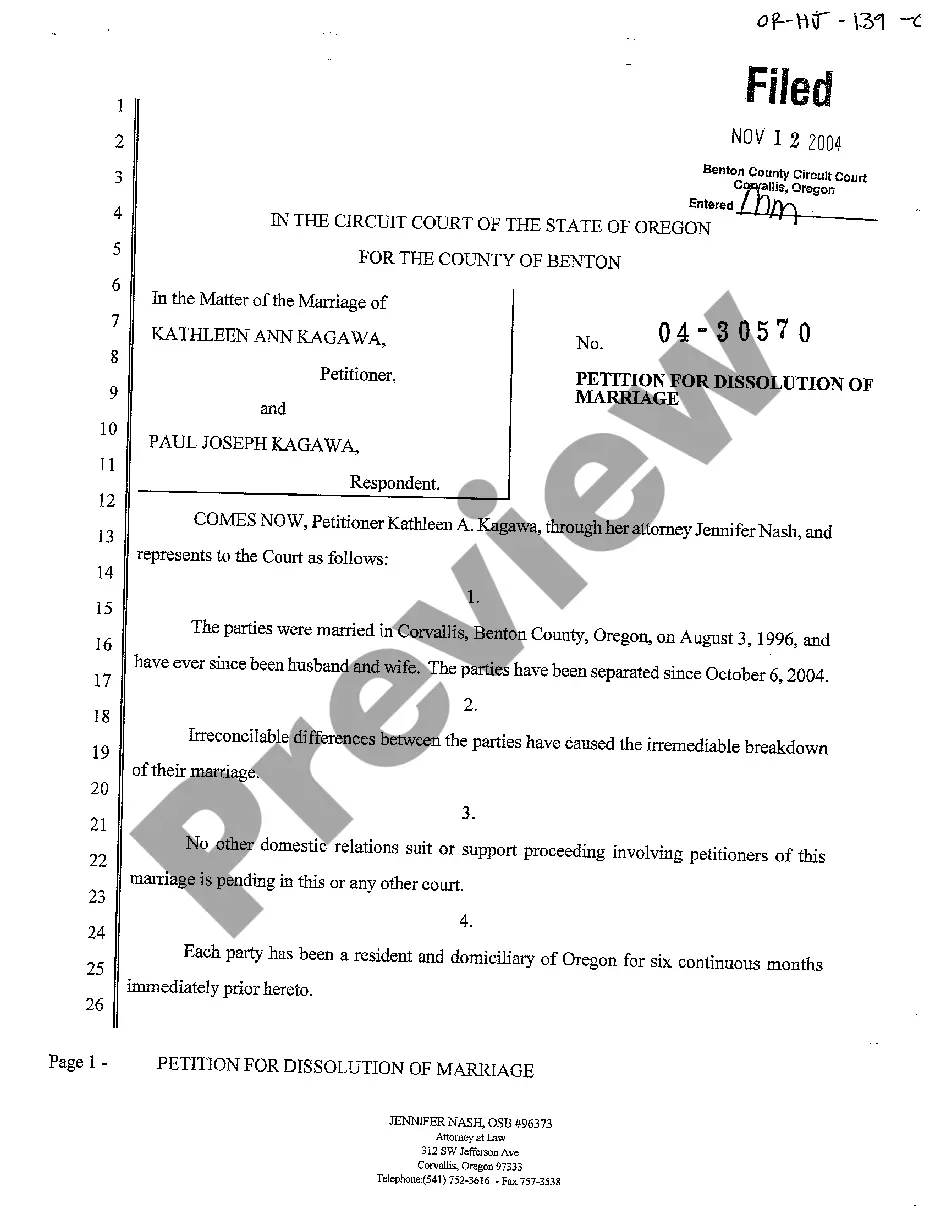

In the first instance, if your deed is not recorded, there is nothing in the public record to stop the seller from conveying the property to another person.The second situation could happen if your seller fails to pay his or her debts and the seller's creditors file liens or judgments against your property.

The only way to add or remove a name on a deed is to have a new deed recorded. Once a document is recorded, it cannot be altered. In order to protect your legal interests, we strongly suggest that you contact an attorney to have this done for you.

The buyer must record the contract for deed with the county recorder where the land is located within four months after the contract is signed. Contracts for deed must provide the legal name of the buyer and the buyer's address.

Retrieve your original deed. Get the appropriate deed form. Draft the deed. Sign the deed before a notary. Record the deed with the county recorder. Obtain the new original deed.

Generally, contract for deed sellers use IRS Form 6252 to report installment sales in the year in which they take place. You also use Form 6252 during each year you receive income from your contract for deed.

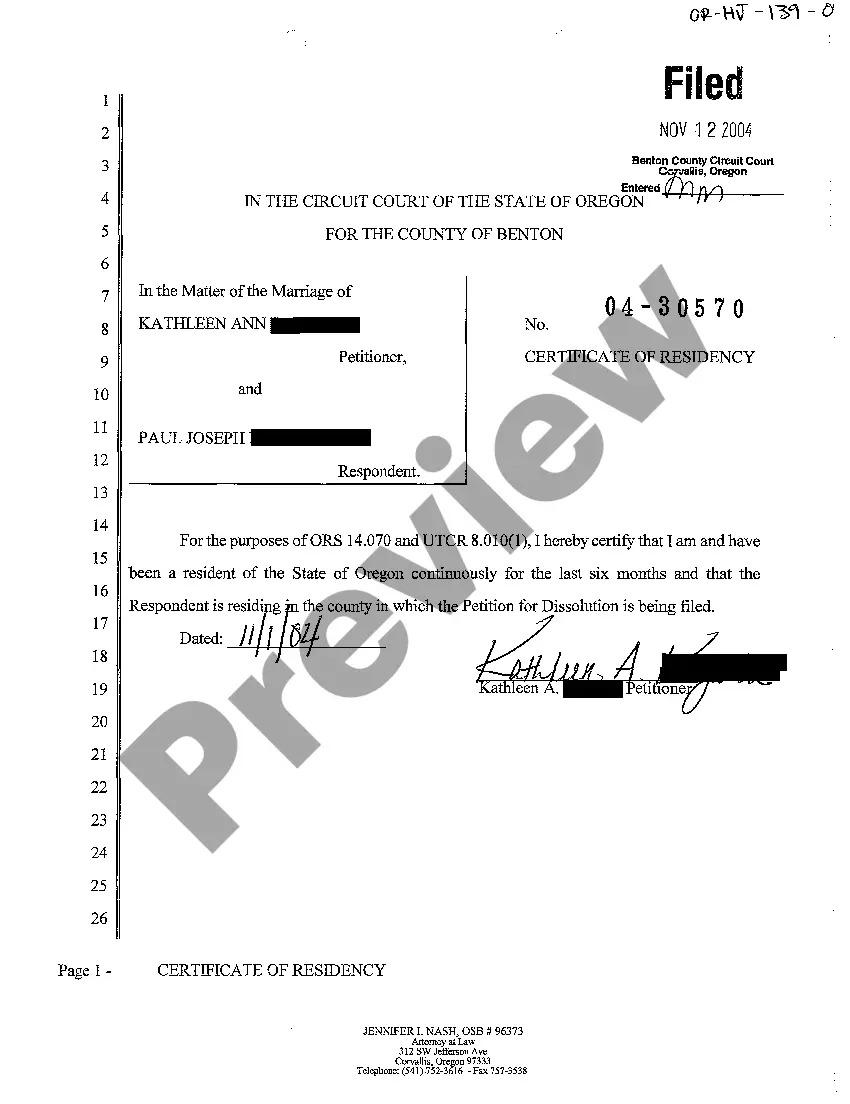

A properly recorded deed provides constructive notice of its contents, which means that all parties concerned are considered to have notice of the deed whether or not they actually saw it.

To be able to record the deed, it must be accompanied by a transfer tax form and payment of transfer tax. Transfer tax rate in Maine is $2.20 per $500 or fractional part of $500 of the value of the property being transferred. Further, transfer tax is imposed 50/50 on both the grantor and grantee.

The buyer should record the contract for deed with the county recorder where the land is located and does so normally within four months after the contract is signed, though the time may vary depending on state law.