This is a rider to the software/services master agreement order form. It provides that a related entity of the customer may use the software purchased from the vendor.

Maryland Related Entity

Description

How to fill out Related Entity?

Discovering the right authorized file web template can be quite a struggle. Naturally, there are a variety of web templates available online, but how can you find the authorized form you will need? Utilize the US Legal Forms website. The services provides 1000s of web templates, like the Maryland Related Entity, which you can use for organization and personal demands. All of the types are checked out by experts and fulfill federal and state demands.

If you are already listed, log in for your bank account and click the Download button to have the Maryland Related Entity. Make use of bank account to check throughout the authorized types you have purchased previously. Go to the My Forms tab of your bank account and acquire an additional backup from the file you will need.

If you are a whole new consumer of US Legal Forms, listed here are straightforward recommendations that you should comply with:

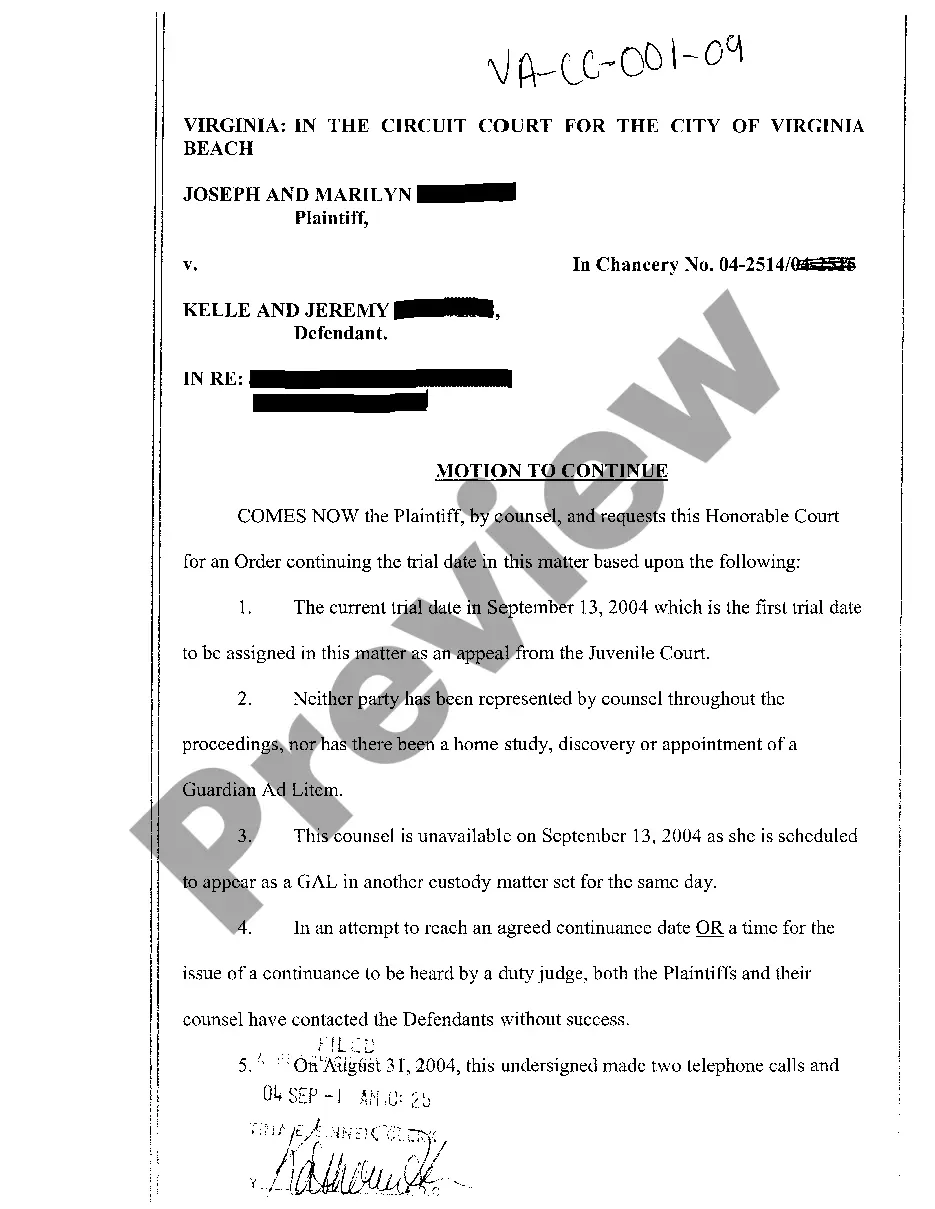

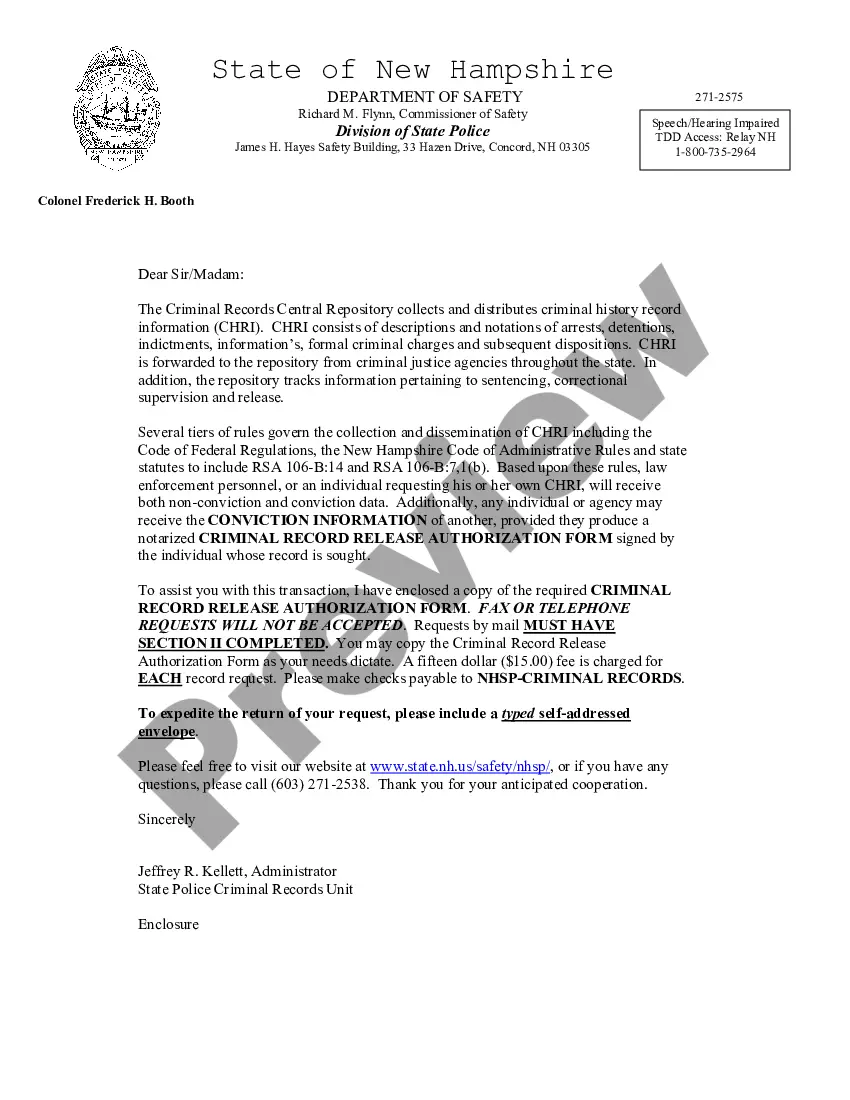

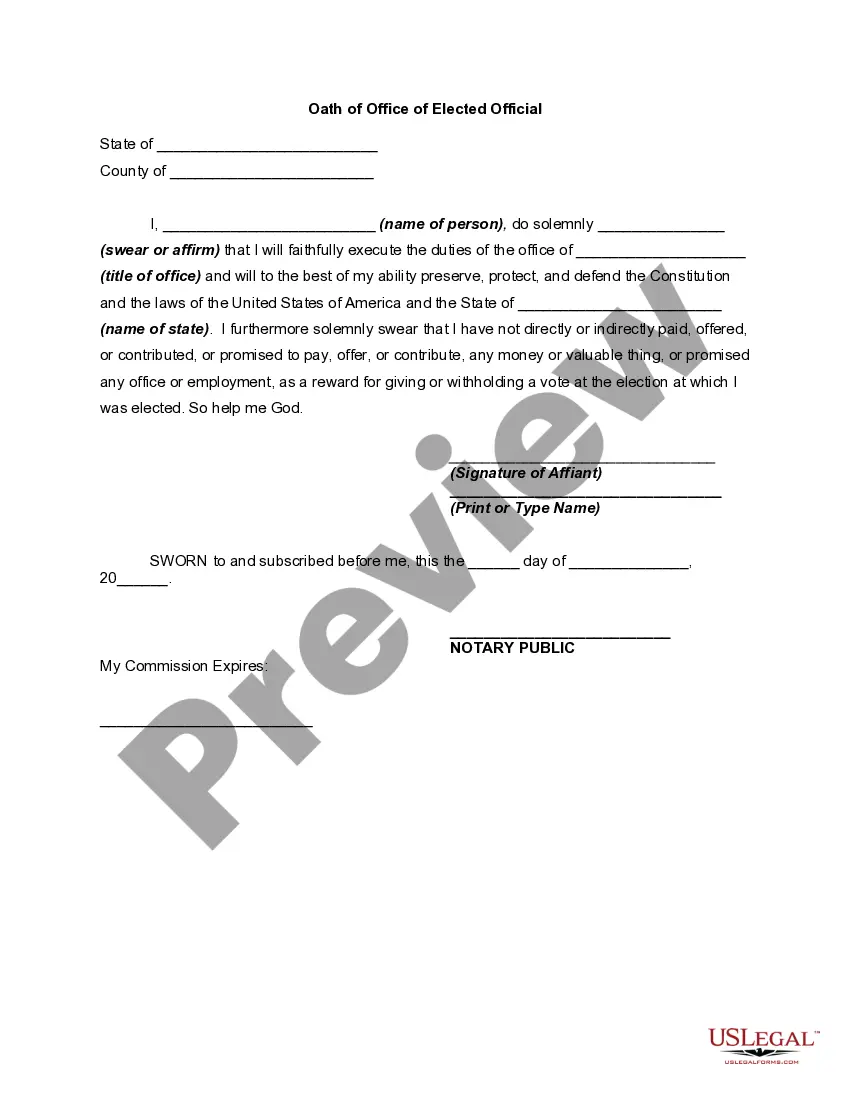

- First, make certain you have selected the right form for the area/state. It is possible to look through the form making use of the Preview button and look at the form explanation to make sure it will be the best for you.

- When the form is not going to fulfill your expectations, utilize the Seach area to discover the appropriate form.

- When you are sure that the form is suitable, click on the Acquire now button to have the form.

- Opt for the prices plan you want and type in the required information. Create your bank account and purchase the order with your PayPal bank account or Visa or Mastercard.

- Choose the file file format and acquire the authorized file web template for your system.

- Complete, revise and printing and sign the acquired Maryland Related Entity.

US Legal Forms will be the largest local library of authorized types in which you can see various file web templates. Utilize the company to acquire skillfully-created papers that comply with express demands.

Form popularity

FAQ

Limited Liability Companies (defined under Title 4A-101 of the Corporations and Associations Article of the Maryland Code Annotated) classified as partnerships, as defined in § 761 of the Internal Revenue Code, and not taxed as a corporation or disregarded as an entity.

A Maryland LLC is a business entity type that allows for pass through taxation like a sole proprietorship or partnership, but with the limited liability protection of a corporation.

Closed corporations are companies with a small number of shareholders that are privately held by managers, owners, and even families. These companies are not publicly traded and the general public cannot readily invest in them.

This business structure is sometimes referred to as a "closely held corporation." Close corporations are permitted to have one individual acting as all required officers and may also elect to have no board of directors. Close corporations are subject to restrictions on the number and identity of shareholders.

Maryland recognizes the federal S corporation election and does not require a state-level S corporation election.

The difference lies primarily in the way that ownership, by way of shares, is distributed. In a close corporation, shares of the corporation are generally held by only a small number of people and are not available for sale or purchase in the public markets.

A CC is similar to a private company. It is a legal entity with its own legal personality and perpetual succession and must register as a taxpayer in its own right. A CC has no share capital and therefore no shareholders. The owners of a CC are the members of the CC.

With fewer shareholders and a relaxed corporate structure, a close corporation provides each shareholder with more control over shares. For example, if one owner wants to leave the company, the other shareholders can better control those shares. More freedom.