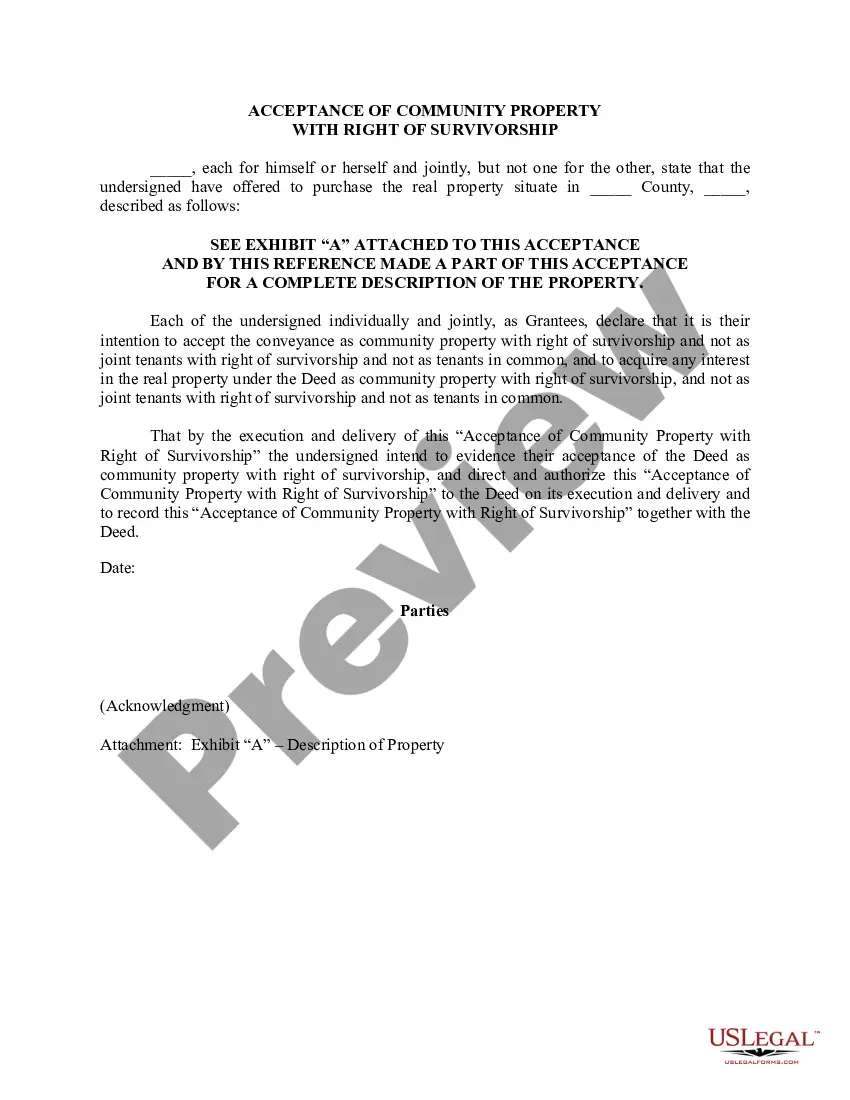

Maryland Deed (Including Acceptance of Community Property with Right of Survivorship)

Description

How to fill out Deed (Including Acceptance Of Community Property With Right Of Survivorship)?

Choosing the right authorized papers template can be a have difficulties. Obviously, there are tons of themes available on the Internet, but how would you discover the authorized form you need? Use the US Legal Forms site. The service gives a large number of themes, for example the Maryland Deed (Including Acceptance of Community Property with Right of Survivorship), which you can use for company and private demands. All the types are examined by specialists and meet state and federal specifications.

Should you be presently signed up, log in for your bank account and click the Acquire switch to have the Maryland Deed (Including Acceptance of Community Property with Right of Survivorship). Make use of your bank account to look from the authorized types you might have ordered formerly. Go to the My Forms tab of your bank account and acquire one more version in the papers you need.

Should you be a brand new end user of US Legal Forms, allow me to share easy recommendations that you can adhere to:

- Very first, make sure you have selected the right form for your personal metropolis/area. You may check out the shape utilizing the Review switch and study the shape information to make sure it is the best for you.

- If the form will not meet your preferences, use the Seach industry to obtain the right form.

- Once you are certain that the shape is acceptable, click on the Get now switch to have the form.

- Select the costs plan you would like and enter the necessary details. Build your bank account and pay for an order using your PayPal bank account or credit card.

- Pick the submit structure and down load the authorized papers template for your product.

- Full, modify and produce and indication the obtained Maryland Deed (Including Acceptance of Community Property with Right of Survivorship).

US Legal Forms may be the biggest catalogue of authorized types in which you will find different papers themes. Use the company to down load appropriately-produced paperwork that adhere to condition specifications.

Form popularity

FAQ

Joint tenancy has right of survivorship Joint tenants own equal shares of the property and each one has the right to possess the property. When a joint tenant dies, the other joint tenants automatically inherit the property.

Community property with the right of survivorship is an agreement where, after the death of a spouse, ownership of the property that is jointly owned by both spouses automatically passes to the other spouse. The property or asset therefore avoids probate completely.

In Community Property States In a community property state ? let's say California ? your ownership rights are automatic for a house acquired during your marriage. Your home is equally shared between you, fifty-fifty ? no matter how it's titled. You can change this only by giving up your rights in the home.

?Right of survivorship? means that a surviving co-owner can take ownership of the deceased co-owner's share of the property. ?Undivided interest? means that each owner has an equal right to use and enjoy the entire property. However, no individual has an exclusive right to any specific part of the property.

Maryland is considered an equitable distribution state. This means that the court is not required to divide property equally in a 50/50 split between spouses. Instead, it divides property in a manner that the court believes is fair.

Maryland law requires all deeds to include the names of the grantor (the seller) and grantee (the buyer), a description of the property, and the interest that you intend to convey. All deeds must be recorded with the Department of Land Records in the county where the property is located.

Sole Ownership in Maryland Maryland does not recognize community property or homestead, meaning that a spouse can buy, sell, or own property without the involvement of the other spouse.

If only the spouse survives, he/she is entitled to 1/2 of the decedent's augmented estate. Maryland has greatly expanded the types of assets to include when calculating the augmented estate. This broadening of the law is beneficial because the electing spouse may be entitled to receive more assets than before.