Maryland Song Collaboration License

Description

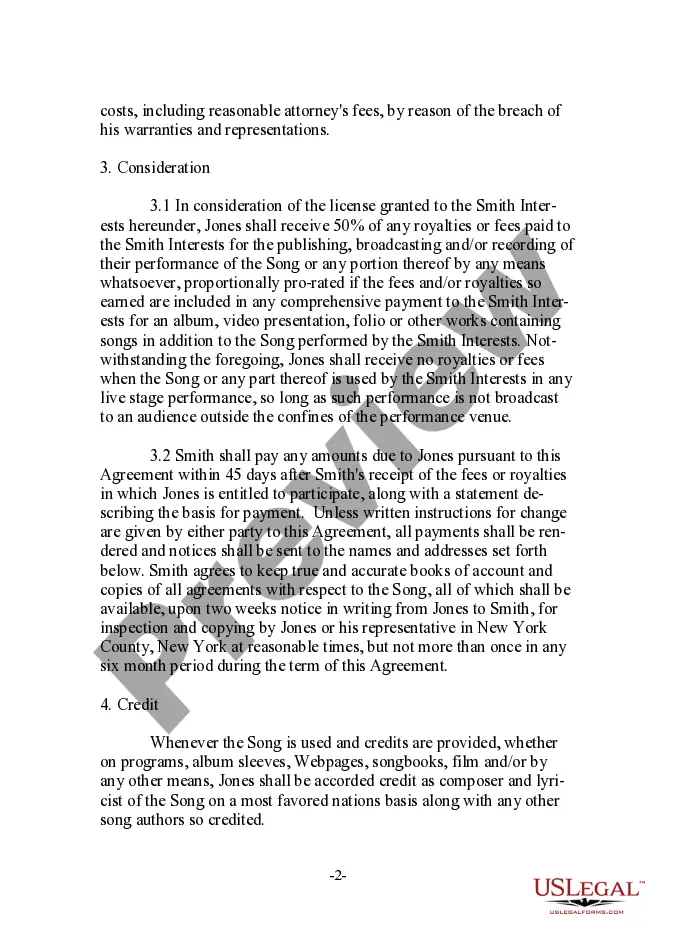

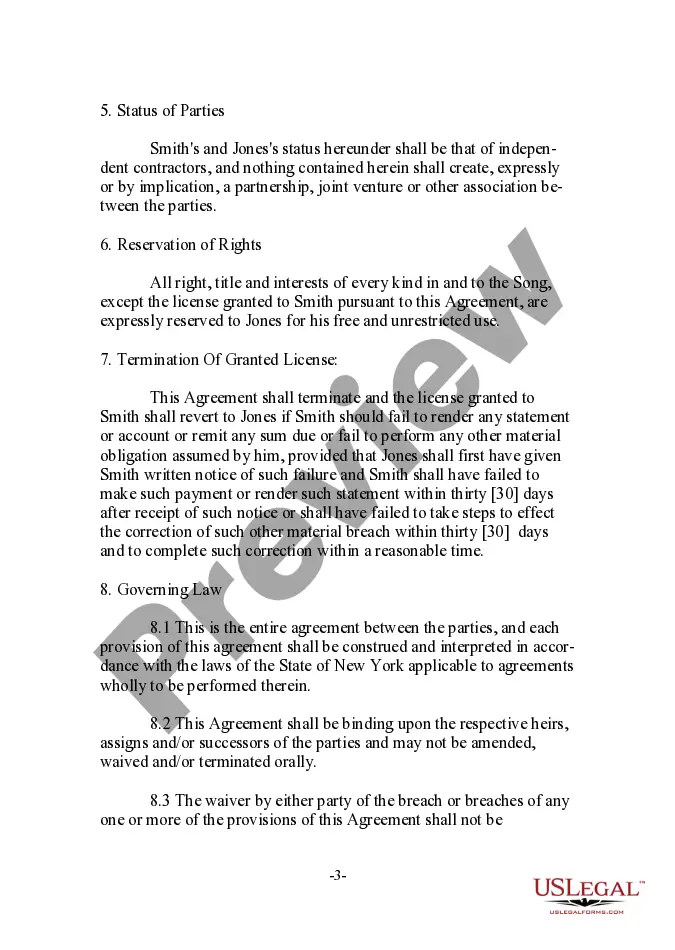

How to fill out Song Collaboration License?

Are you currently in the placement where you will need files for either enterprise or personal reasons just about every day time? There are a variety of authorized record templates available on the net, but finding versions you can rely is not simple. US Legal Forms delivers a huge number of kind templates, like the Maryland Song Collaboration License, that are published to meet state and federal specifications.

When you are currently knowledgeable about US Legal Forms internet site and also have an account, merely log in. Next, you can obtain the Maryland Song Collaboration License design.

Should you not come with an profile and wish to begin to use US Legal Forms, adopt these measures:

- Find the kind you want and make sure it is for your correct town/county.

- Make use of the Preview button to analyze the form.

- See the information to actually have selected the proper kind.

- If the kind is not what you`re looking for, take advantage of the Search discipline to obtain the kind that meets your requirements and specifications.

- If you obtain the correct kind, just click Get now.

- Pick the prices strategy you desire, submit the required information to generate your account, and purchase the order using your PayPal or charge card.

- Pick a handy paper structure and obtain your version.

Discover each of the record templates you may have purchased in the My Forms menu. You can get a more version of Maryland Song Collaboration License whenever, if required. Just click on the necessary kind to obtain or print the record design.

Use US Legal Forms, the most comprehensive variety of authorized types, in order to save efforts and avoid errors. The support delivers appropriately created authorized record templates which can be used for a range of reasons. Produce an account on US Legal Forms and initiate producing your lifestyle a little easier.

Form popularity

FAQ

Single taxpayers under 65 are not required to file a Maryland income tax return unless their Maryland gross income was $10,400 or more in 2017. Maryland gross income is federal gross income (but do not include Social Security or Railroad Retirement income) plus Maryland additions.

An Annual Report must be filed by all business entities formed, qualified or registered to do business in the State of Maryland, as of January 1st.

TaxByte: Maryland Will No Longer Tax Commercial Software or SaaS Effective July 1st, 2022.

The state of Maryland requires all corporations, nonprofits, LLCs, LPs, and LLPs to submit a Maryland Annual Report each year. In addition, your business may have to file a Personal Property Tax Return if your business owns, leases, or uses personal property located in the state or maintains a trader's license.

Responsibility for the assessment of all personal property throughout Maryland rests with the Department of Assessments and Taxation. Personal property generally includes furniture, fixtures, office and industrial equipment, machinery, tools, supplies, inventory and any other property not classified as real property.

Filing a Combined Registration Application (CRA) A combined Registration Application can assist with registering the following tax accounts: Sales and use tax license: If you will make sales in Maryland and collect sales tax, you will need a sales and use tax license.

All legal business entities formed, qualified, or registered to do business in Maryland MUST file an Annual Report: Legal business entities (Corporations, LLC, LP, LLP, etc.), whether they are foreign or domestic, must file a Form 1 Annual Report (fees apply)

BUSINESS PERSONAL PROPERTY RETURN An Annual Report must be filed by all business entities formed, qualified or registered to do business in the State of Maryland, as of January 1st.