Maryland Software Specifications Agreement

Description

How to fill out Software Specifications Agreement?

If you want to finalize, retrieve, or create valid document templates, utilize US Legal Forms, the premier collection of valid forms available online.

Employ the site’s simple and convenient search to find the files you require. Numerous templates for business and personal purposes are categorized by types and jurisdictions, or keywords.

Use US Legal Forms to locate the Maryland Software Specifications Agreement with just a few clicks.

Step 5. Process the payment. You can use your Visa or MasterCard or PayPal account to complete the transaction.

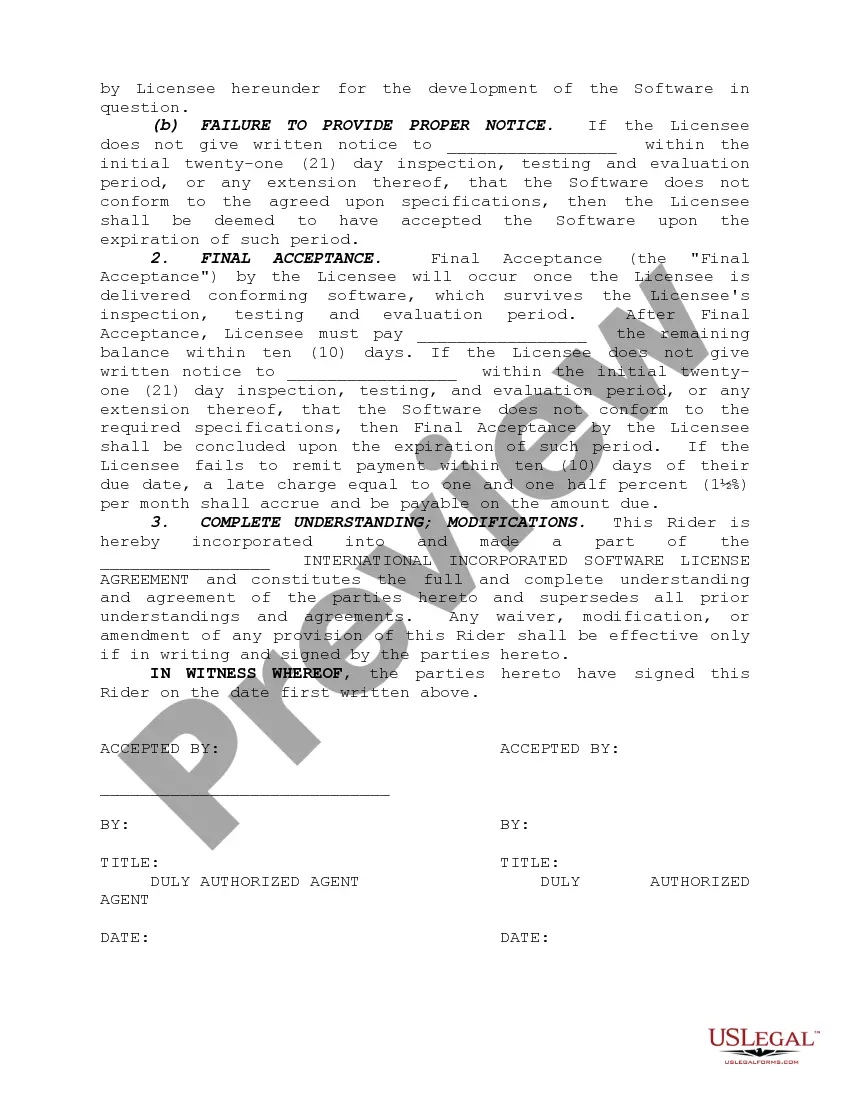

Step 6. Choose the format of your legal form and download it to your device. Step 7. Complete, edit, and print or sign the Maryland Software Specifications Agreement. Each legal document template you acquire is yours indefinitely. You will have access to every type you downloaded in your account. Visit the My documents section and select a form to print or download again. Finalize and download, and print the Maryland Software Specifications Agreement with US Legal Forms. There are numerous professional and state-specific forms you can use for your business or personal needs.

- When you are already a US Legal Forms customer, sign in to your account and click the Download button to obtain the Maryland Software Specifications Agreement.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct region/state.

- Step 2. Use the Review option to examine the form’s content. Don’t forget to read the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, select the Get now option. Choose the pricing plan you prefer and enter your details to register for an account.

Form popularity

FAQ

The Maryland Tech tax 2025 refers to upcoming legislation impacting technology-related goods and services. As strategies evolve, this tax may influence many aspects of software development and sales. Businesses should incorporate these changes in their Maryland Software Specifications Agreement, ensuring they remain compliant and prepared for the future.

A contract in software clearly outlines the expectations and responsibilities between software developers and clients. This document includes important details like deliverables, timelines, and payment terms. By using a Maryland Software Specifications Agreement, you can create a legally binding document that protects both parties and ensures project success.

The software tax in Maryland pertains to the sale of software and related services. Businesses involved in software development must be aware of this tax to avoid any unexpected costs. A well-structured Maryland Software Specifications Agreement can help clarify the responsibilities concerning taxes between parties involved.

The new technology tax in Maryland targets digital products and services. This tax aims to boost economic growth and foster innovation within the state. When considering a Maryland Software Specifications Agreement, you may want to factor in how this tax affects software development costs and compliance.

The new Maryland software services tax applies to various software services and products sold in Maryland. Understanding how the Maryland Software Specifications Agreement interacts with this tax is crucial for compliance. Businesses must assess how this tax impacts their agreements and operations. Consulting with experts or using resources from uslegalforms can help navigate these recent changes effectively.

In Maryland, a contract is legally binding when it includes an offer, acceptance, consideration, and mutual intent to create a legal obligation. The Maryland Software Specifications Agreement fulfills these criteria by outlining clear terms. Moreover, both parties should understand their rights and obligations, ensuring fairness in the agreement. Seeking guidance from professionals or platforms like uslegalforms can enhance the clarity and legality of your contract.

The five key elements of a legally binding contract include an offer, acceptance, consideration, capacity, and legality. Each party must have legal capacity to enter into the Maryland Software Specifications Agreement. Furthermore, the contract should be for a legal purpose and provide mutual consent. Recognizing these elements can protect both parties in any potential disputes.

For a contract to be legally binding, it must have an offer, acceptance, consideration, and a mutual agreement between the parties. Each party should clearly understand their responsibilities under the Maryland Software Specifications Agreement. Additionally, the terms of the contract should not violate any laws. This ensures that the agreement holds up in a court of law.