Maryland Agreement for Sales of Data Processing Equipment

Description

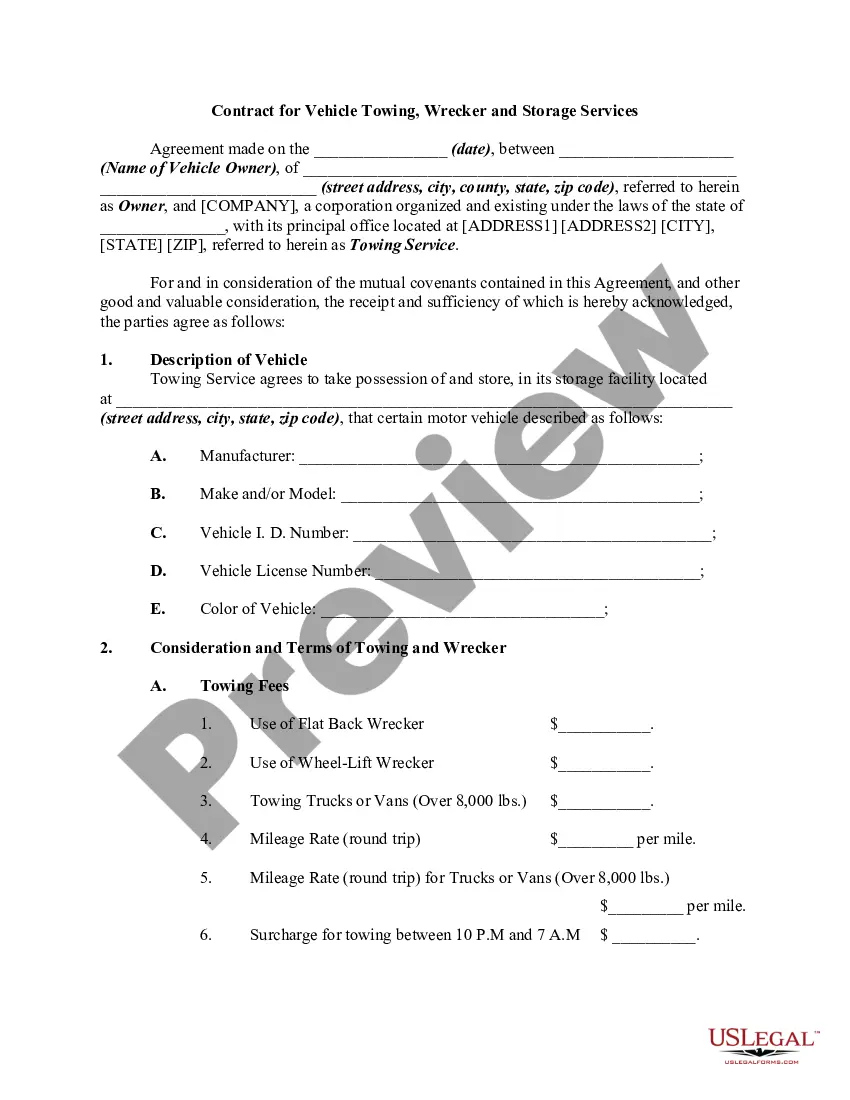

How to fill out Agreement For Sales Of Data Processing Equipment?

If you wish to finalize, obtain, or print legal document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Make use of the site’s easy and user-friendly search to find the documents you require.

Various templates for commercial and personal purposes are categorized by types and titles, or keywords.

Step 4. Once you have located the form you need, click on the Download now button. Choose the pricing plan you prefer and enter your details to create an account.

Step 5. Process the payment. You can use your Visa or Mastercard or PayPal account to complete the transaction. Step 6. Select the format of your legal document and download it to your device. Step 7. Fill out, modify and print or sign the Maryland Agreement for Sale of Data Processing Equipment. Every legal document template you purchase is yours forever. You have access to every document you downloaded in your account. Click the My documents section and choose a document to print or download again.

- Utilize US Legal Forms to acquire the Maryland Agreement for Sale of Data Processing Equipment with just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click on the Download button to obtain the Maryland Agreement for Sale of Data Processing Equipment.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are utilizing US Legal Forms for the first time, follow the instructions below.

- Step 1. Make sure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form’s content. Don’t forget to read the details.

- Step 3. If you are not satisfied with the document, use the Search box at the top of the screen to find other versions of the legal document template.

Form popularity

FAQ

In Maryland, the sales tax on electronics typically stands at six percent. This rate applies to most purchases, including data processing equipment covered under the Maryland Agreement for Sales of Data Processing Equipment. It is essential to consider this tax when budgeting for your equipment purchases. For detailed guidance and the latest updates, you can explore resources on the US Legal Forms platform.

Data centers in Maryland may qualify for sales tax exemptions depending on their specific use of equipment and the services they provide. Under the Maryland Agreement for Sales of Data Processing Equipment, certain operations within data centers can be exempt. Understanding the eligibility for such exemptions is essential for financial planning. Platforms like USLegalForms can help you navigate these complex tax issues.

The sales tax applicable in Maryland for data processing is currently set at 6%. This rate applies to any sales under the Maryland Agreement for Sales of Data Processing Equipment, which encompasses hardware and related services. Staying informed about tax rates ensures you budget correctly and follow state regulations. If you need assistance understanding these rules, USLegalForms can be a valuable resource.

In Maryland, software is generally not exempt from sales tax, which includes software related to the Maryland Agreement for Sales of Data Processing Equipment. However, certain software solutions offered as a service may qualify for exemptions. It's wise to analyze the specific features of your software to determine tax liabilities. Utilizing resources like USLegalForms can clarify exemptions and compliance requirements.

The Maryland Agreement for Sales of Data Processing Equipment requires certain businesses to file Maryland Form 1. Typically, any seller of tangible personal property, including those dealing in data processing equipment, must complete this form. It’s important to understand your obligations to ensure compliance. If you're unsure, consider using platforms like USLegalForms for guidance.

The sale of electronic data products such as software, data, digital books (eBooks), mobile applications and digital images is generally not taxable (though if you provide some sort of physical copy or physical storage medium then the sale is taxable.)

A contract to receive electronically delivered digital products, entered on December 1, 2020, is not subject to sales and use tax. The fact that the digital products are not scheduled to be delivered until April 1, 2021, and payment is not due under the contract until June 1, 2021, does not change this result.

Maryland's Office of the Comptroller issued guidance on digital products and streaming tax and announced that "software as a service" (SaaS) is taxable.

Some goods are exempt from sales tax under Maryland law. Examples include most non-prepared food items, prescription and over-the-counter medicines, and medical supplies.

As noted above, as of March 14, 2021, Maryland's sales and use tax applies to the sale of a digital product, regardless of whether the digital product is sold to the customer with rights of permanent use or less than permanent use (i.e., a rental) as well as sold as a subscription to access or stream the product.