Maryland Technical Writer Agreement - Self-Employed Independent Contractor

Description

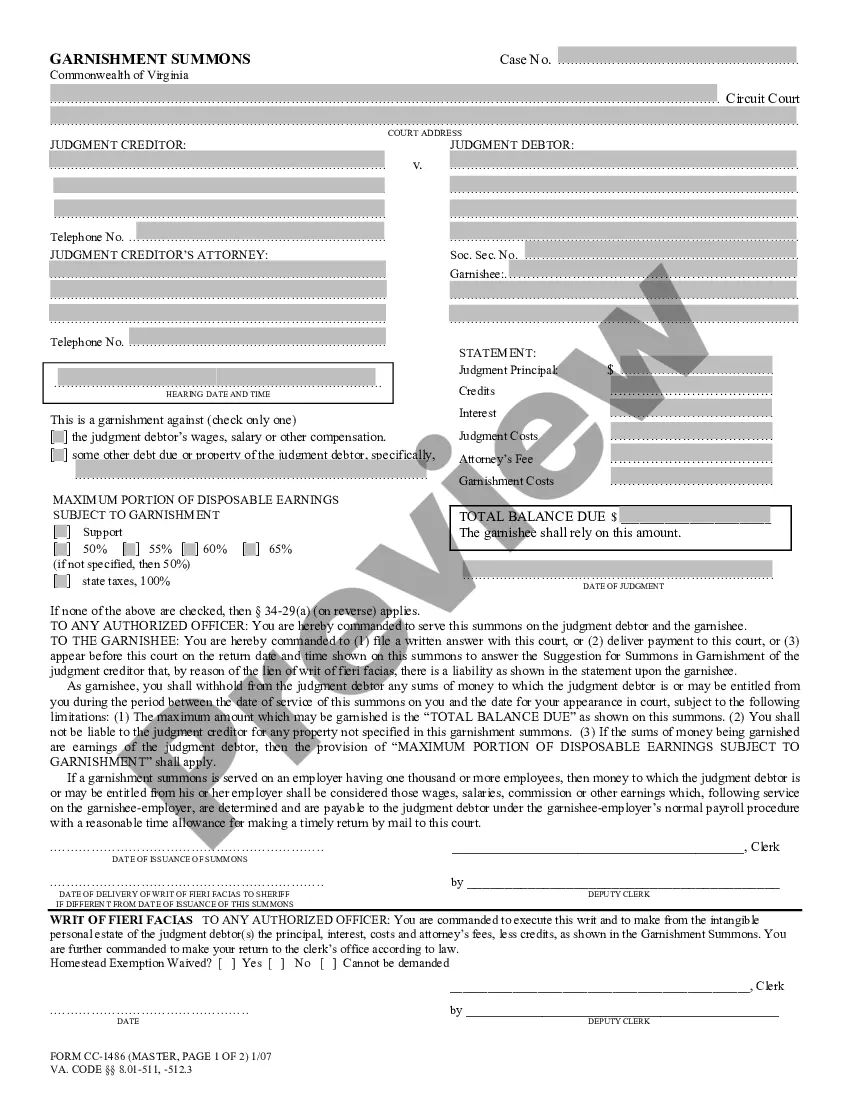

How to fill out Technical Writer Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a variety of legal form templates you can download or print.

By utilizing the website, you can acquire numerous forms for business and personal purposes, categorized by types, states, or keywords. You can find the latest versions of forms such as the Maryland Technical Writer Agreement - Self-Employed Independent Contractor in just moments.

If you have a subscription, Log In to access the Maryland Technical Writer Agreement - Self-Employed Independent Contractor in the US Legal Forms library. The Download button will appear on each form you view. You can access all previously downloaded forms under the My documents section of your account.

Next, choose the pricing plan that suits you and provide your information to register for the account.

Process the transaction. Use your Visa or Mastercard or PayPal account to complete the purchase. Select the format and download the form to your device. Edit. Fill out, modify, and print and sign the downloaded Maryland Technical Writer Agreement - Self-Employed Independent Contractor. Each template you added to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you desire.

- If you are using US Legal Forms for the first time, here are simple instructions to get started:

- Make sure you have selected the correct form for your city/county.

- Click the Preview button to review the form's content.

- Check the form details to confirm that you have chosen the right form.

- If the form does not meet your needs, use the Search box at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button.

Form popularity

FAQ

Yes, a freelance writer is typically classified as an independent contractor. This means they work on a contractual basis rather than as an employee, which provides them with flexibility and autonomy in their projects. For those in the writing field, having a Maryland Technical Writer Agreement - Self-Employed Independent Contractor is essential to outline the work and protect their rights while ensuring compliance with state laws.

In Maryland, having an operating agreement for your LLC is not legally required, but it is highly recommended. This document offers clarity on the management structure and the financial arrangements among members. By establishing an operating agreement, you protect your business and gain a clear framework for how your Maryland Technical Writer Agreement - Self-Employed Independent Contractor operates with respect to member roles and responsibilities.

Creating an independent contractor agreement involves several key steps. Start by clearly outlining the scope of work, payment terms, and deadlines. Next, specify the rights and responsibilities of both parties to avoid misunderstandings later. For a thorough and compliant document, consider using a Maryland Technical Writer Agreement - Self-Employed Independent Contractor template from USLegalForms, which provides a solid foundation tailored to your needs.

An independent contractor typically fills out several forms, including a Maryland Technical Writer Agreement - Self-Employed Independent Contractor. This agreement outlines the services to be provided and the terms of payment. Additionally, contractors may need to complete tax forms, such as a W-9, and submit invoices for payment. Using resources available on uslegalforms can help simplify your paperwork.

To fill out an independent contractor form effectively, start by including your personal details, such as name and address. Then, list the services you offer under the Maryland Technical Writer Agreement - Self-Employed Independent Contractor. Make sure to specify your payment information and any relevant tax identification numbers. Double-check all entries to ensure accuracy before submission.

Writing a Maryland Technical Writer Agreement - Self-Employed Independent Contractor involves several key components. Begin with a title, followed by the contact information for both the contractor and the client. Clearly outline the services provided, payment structures, confidentiality clauses, and termination provisions to protect both parties. Using templates from platforms like uslegalforms can streamline this process.

Filling out a Maryland Technical Writer Agreement - Self-Employed Independent Contractor requires careful attention to detail. Start by entering your name and the client's name at the top. Next, specify the scope of work, payment terms, and deadlines to ensure both parties have a clear understanding. Finally, review the document for accuracy before both parties sign.

Yes, independent contractors generally file as self-employed individuals. When you work under a Maryland Technical Writer Agreement - Self-Employed Independent Contractor, you operate your own business, so you report your earnings accordingly. This means you will need to fill out specific tax forms that reflect your self-employment status, such as a Schedule C along with your tax return. Using platforms like US Legal Forms can help you easily access the proper agreements and resources to manage your independent contractor status effectively.

While forming an LLC is not mandatory for freelance writers, it can provide several advantages, such as liability protection and clearer tax structures. By registering as an LLC when working under a Maryland Technical Writer Agreement - Self-Employed Independent Contractor, you can separate your personal assets from your business obligations. This separation often proves beneficial in managing risks and establishing credibility with clients. Always consult a legal advisor to determine what suits your specific situation best.

In Maryland, independent contractors typically do not need workers' compensation insurance unless they hire employees. However, carrying this coverage can be beneficial, as it protects you in the event of work-related injuries. When working under a Maryland Technical Writer Agreement - Self-Employed Independent Contractor, consider evaluating your risk and engaging with insurers to understand your options. It’s always wise to protect yourself and your business.