Maryland Freelance Writer Agreement - Self-Employed Independent Contractor

Description

How to fill out Freelance Writer Agreement - Self-Employed Independent Contractor?

Are you presently inside a placement where you require papers for either company or specific uses just about every day time? There are plenty of legitimate file layouts available on the Internet, but discovering types you can trust is not simple. US Legal Forms gives a huge number of form layouts, such as the Maryland Freelance Writer Agreement - Self-Employed Independent Contractor, which are published to fulfill federal and state requirements.

If you are presently knowledgeable about US Legal Forms site and get a free account, just log in. Next, you are able to download the Maryland Freelance Writer Agreement - Self-Employed Independent Contractor design.

Unless you come with an accounts and wish to start using US Legal Forms, adopt these measures:

- Obtain the form you will need and ensure it is to the proper metropolis/county.

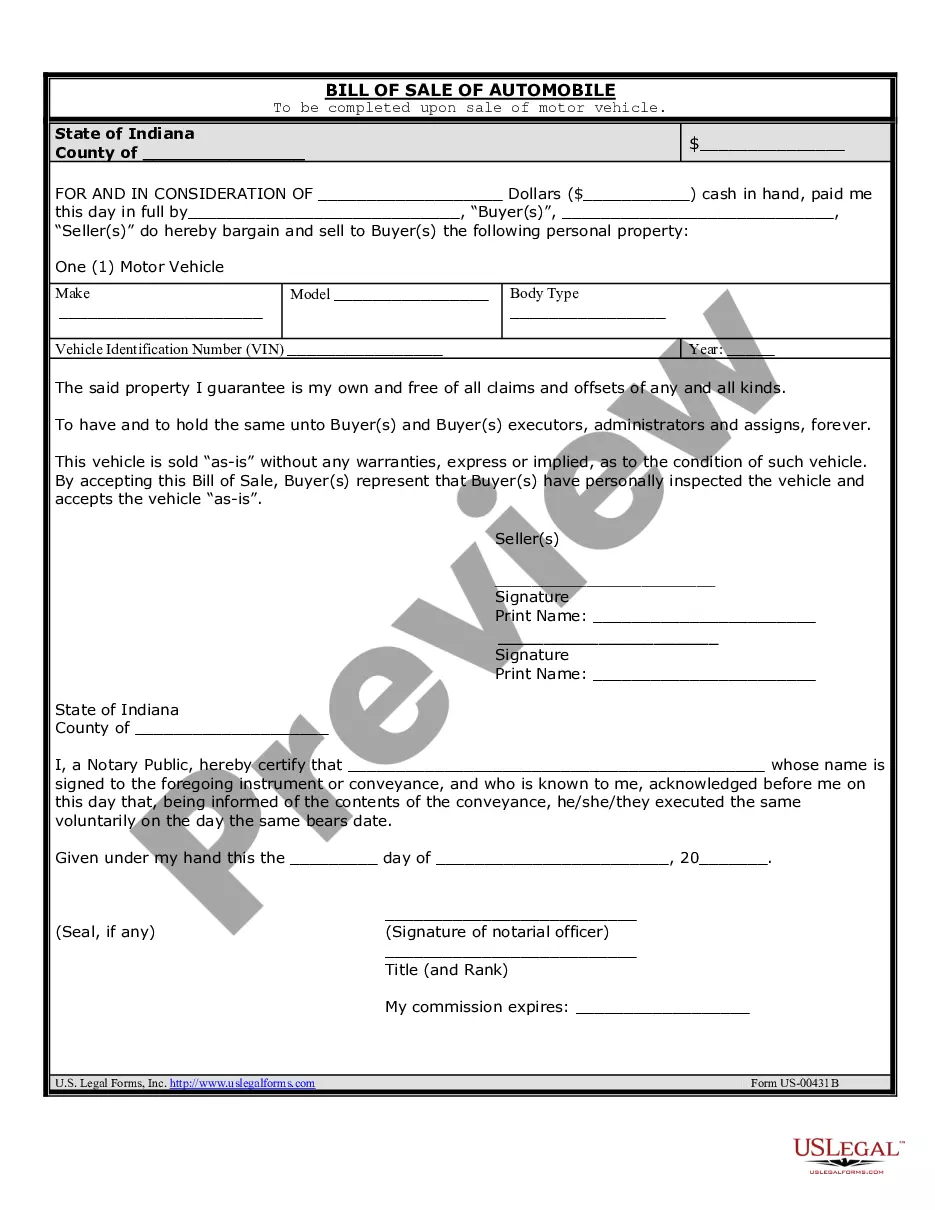

- Use the Review key to examine the form.

- See the description to ensure that you have chosen the correct form.

- In the event the form is not what you are looking for, utilize the Search area to discover the form that meets your requirements and requirements.

- When you get the proper form, just click Buy now.

- Select the prices program you need, fill in the necessary information to create your bank account, and pay for your order with your PayPal or credit card.

- Pick a handy document formatting and download your backup.

Find every one of the file layouts you possess bought in the My Forms food selection. You can obtain a additional backup of Maryland Freelance Writer Agreement - Self-Employed Independent Contractor whenever, if necessary. Just click on the needed form to download or printing the file design.

Use US Legal Forms, probably the most extensive assortment of legitimate kinds, in order to save some time and avoid mistakes. The services gives skillfully produced legitimate file layouts that you can use for a variety of uses. Make a free account on US Legal Forms and begin generating your lifestyle a little easier.

Form popularity

FAQ

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

A freelancer is similar to an independent contractor, but they tend to work on a project-to-project basis and have multiple employers at the same time. Independent contractors will be on long-term contracts, where freelancers are usually hired on short-term contracts.

Freelance Writer Requirements:Bachelor's degree in creative writing, journalism, communication studies, or an adjacent field.Prior writing experience, preferably as a freelancer.Portfolio of completed works.Own personal or laptop computer.Familiarity with mainstream word processing software.More items...

Freelancers are independent contractors who should receive 1099 from the company using their services and are subject to paying their own taxes, including self-employment tax.

What is a Writing Contract? Writers and their clients use Writing Contracts as a means of documenting the details of work that will be delivered. Signed by the writer and the client, this essential document can help define each party's expectations.

That's why contracts are still super important for the self-employed. It's invaluable to have a formal, written agreement with your clients. But for a lot of freelancers, especially writers who may work on multiple smaller-scale projects simultaneously, the hassle of a full contract may simply be too much.

The Internal Revenue Service considers freelancers to be self-employed, so if you earn income as a freelancer you must file your taxes as a business owner.

Many freelance journalists, musicians, translators and other workers in California can operate as independent contractors under a new law signed by Gov. Gavin Newsom on Sept. 4.

As a freelancer, you also have to manage invoicing and following up on payments. When you work as an independent contractor, you work on an hourly or project-based rate that may vary from client to client or job to job. If you work independently, you have control over setting and negotiating your rates.

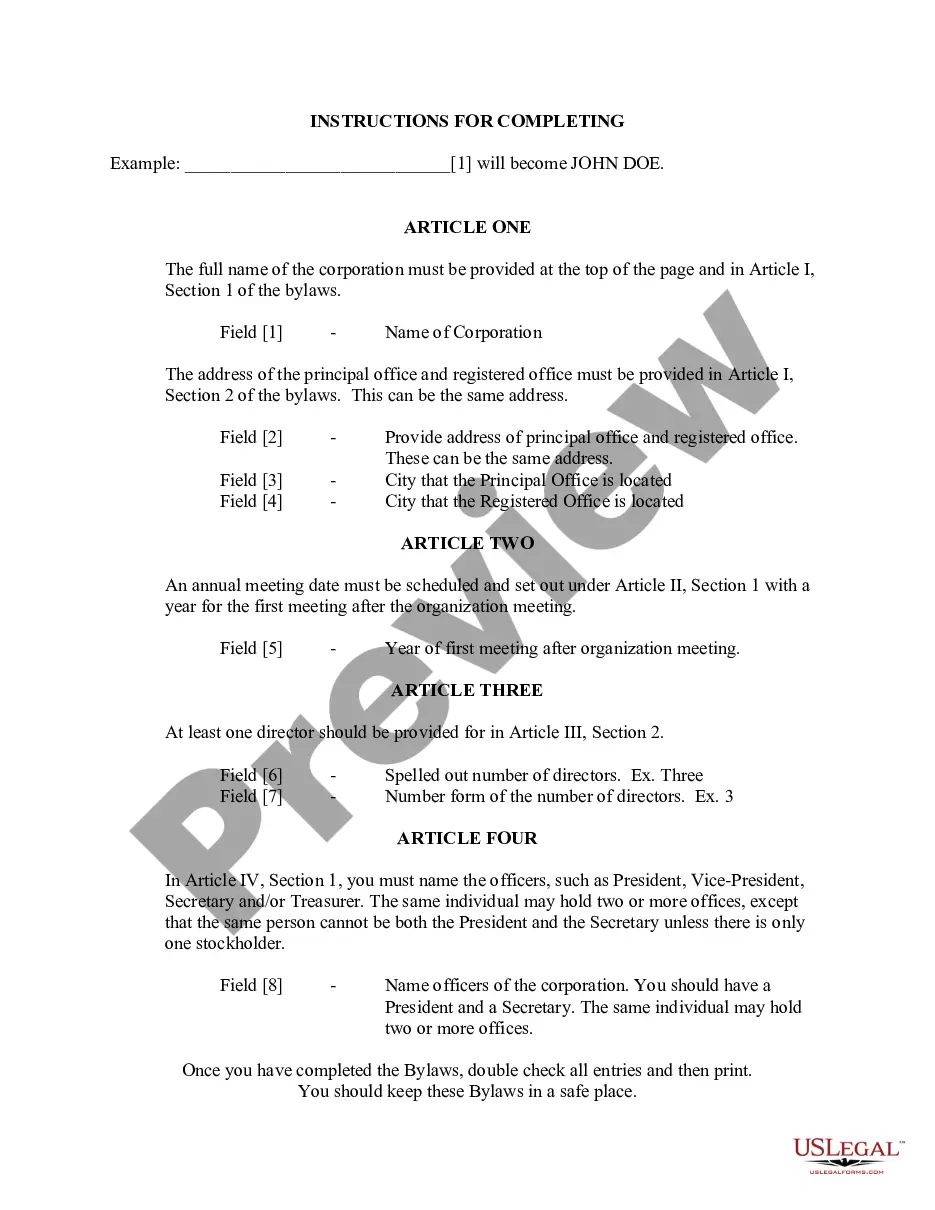

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.