Maryland Choreographer Services Contract - Self-Employed

Description

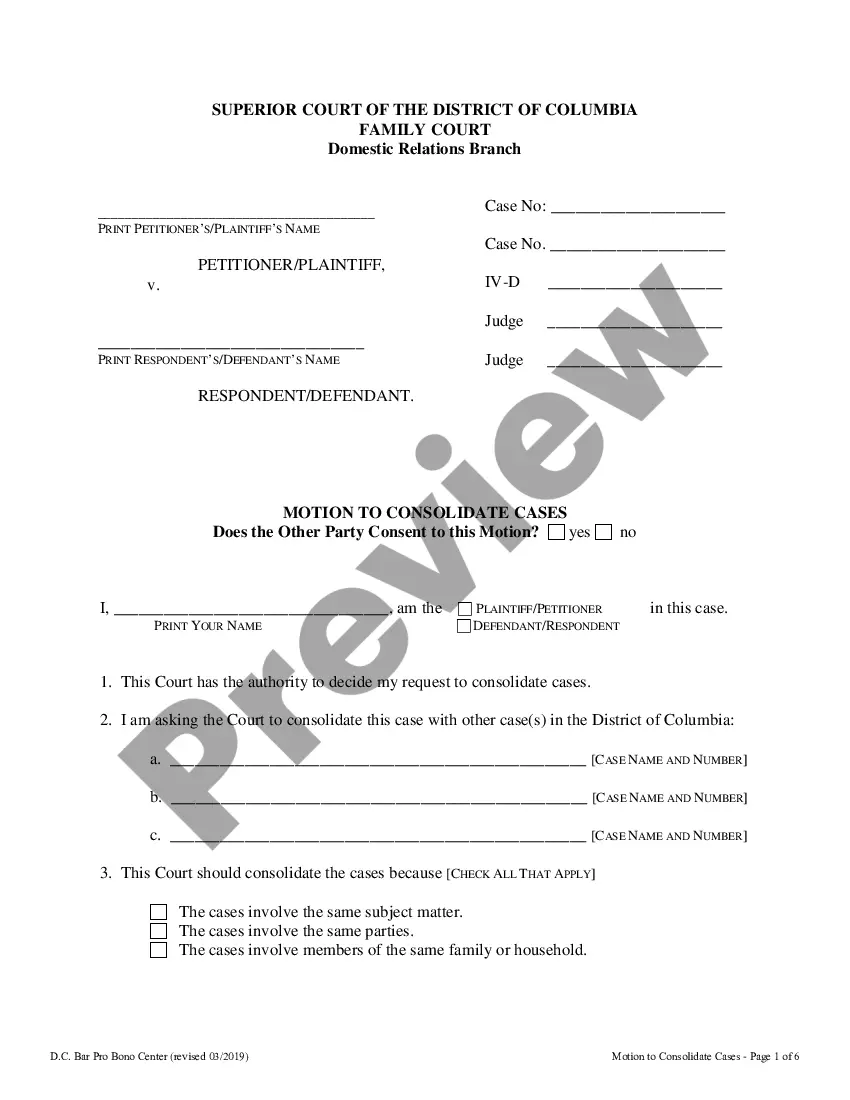

How to fill out Choreographer Services Contract - Self-Employed?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a variety of legal document templates that you can download or print. By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the Maryland Choreographer Services Contract - Self-Employed in just a few minutes.

If you already have a subscription, Log In and download the Maryland Choreographer Services Contract - Self-Employed from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously acquired forms in the My documents section of your account.

If you are using US Legal Forms for the first time, here are simple instructions to help you get started: Make sure you have selected the appropriate form for your area/region. Click the Preview button to review the form's details. Check the form description to ensure you have chosen the correct form. If the form does not meet your needs, use the Search field at the top of the screen to find one that does. When you are satisfied with the form, confirm your selection by clicking the Purchase now button. Then, choose the payment plan you desire and provide your information to register for an account.

Utilize a vast array of professional and state-specific templates that fulfill your business or personal requirements and demands.

- Process the transaction. Use your credit card or PayPal account to complete the transaction.

- Select the format and download the form onto your device.

- Make adjustments. Fill out, modify, print, and sign the downloaded Maryland Choreographer Services Contract - Self-Employed.

- Every template you added to your account does not have an expiration date and is yours indefinitely.

- So, if you want to download or print another copy, just go to the My documents section and click on the form you need.

- Access the Maryland Choreographer Services Contract - Self-Employed with US Legal Forms, one of the most extensive collections of legal document templates.

Form popularity

FAQ

The legal requirements for independent contractors in Maryland vary but generally include maintaining accurate records and filing taxes correctly. When using a Maryland Choreographer Services Contract - Self-Employed, it's crucial that you distinguish between your personal and business expenses. It's also wise to ensure compliance with any state-specific regulations. Utilizing platforms like uslegalforms can help you access templates and resources to meet these requirements.

Yes, an independent contractor is indeed considered self-employed. When you sign a Maryland Choreographer Services Contract - Self-Employed, you assume the responsibilities and benefits that come with self-employment. You are essentially running your own business, which gives you freedom but also places an obligation on you to manage your own records and taxes. Knowing this helps in structuring your contracts appropriately.

Yes, contract work is a form of self-employment. Individuals who provide services under a Maryland Choreographer Services Contract - Self-Employed qualify as self-employed because they manage their own business operations. This means you set your own hours, decide your rates, and handle your own taxes. Being clear about this status can influence how you approach clients and contracts.

While both terms can describe similar roles, 'self-employed' is a broader term that encompasses various working arrangements. Independent contractor typically refers to a specific type of self-employed individual who works under a contract. When drafting a Maryland Choreographer Services Contract - Self-Employed, you may choose the term that best fits your situation. Understanding the nuances can aid in presenting yourself professionally.

Yes, you can and should have a contract if you're self-employed. A Maryland Choreographer Services Contract - Self-Employed provides legal backing for your agreements with clients and outlines payment terms, delivery expectations, and more. This document prevents misunderstandings and helps establish a professional relationship. Always ensure your contract is comprehensive and clear.

In Maryland, independent contractors generally do not need workers' compensation; however, it depends on the nature of the work. If you have employees or if your contract stipulates it, you may need coverage. It's wise to review your Maryland Choreographer Services Contract - Self-Employed for any clauses related to insurance requirements. Always consult a legal professional if you're unsure.

The rules for self-employed individuals, including those entering a Maryland Choreographer Services Contract - Self-Employed, can vary by state. New regulations often focus on tax responsibilities, benefits eligibility, and worker protections. It's important to stay informed about any changes that could impact your business. Legal resources can help you navigate these new requirements effectively.

Yes, a self-employed person can absolutely have a contract. In fact, a Maryland Choreographer Services Contract - Self-Employed is essential for defining the terms of your work. This contract helps protect both you and your clients by clarifying responsibilities and expectations. Having a solid contract ensures that all parties involved understand their rights and obligations.

The average salary of a choreographer can vary widely based on experience, location, and the specific field of dance. In general, self-employed choreographers in Maryland may earn between $30,000 to $70,000 annually, depending on the scope of their contracts. To get a clearer picture of earnings, consider utilizing a Maryland Choreographer Services Contract - Self-Employed to establish fair compensation.

A dance contract is a formal agreement outlining the terms and conditions between a choreographer and their clients, such as studios or performers. It details the responsibilities, payment terms, and any specific requirements for the dance project. Using a Maryland Choreographer Services Contract - Self-Employed can ensure both parties understand their obligations and protect their rights.