Maryland Specialty Services Contact - Self-Employed

Description

How to fill out Specialty Services Contact - Self-Employed?

Are you currently in a situation where you require documents for either business or personal reasons daily.

There are many legitimate document templates available online, but finding ones you can rely on is not easy.

US Legal Forms offers a wide range of form templates, including the Maryland Specialty Services Contact - Self-Employed, that are designed to meet federal and state requirements.

Once you find the right form, click Acquire now.

Choose the pricing plan you want, fill out the required information to create your account, and pay for the order using your PayPal or credit card. Select a convenient file format and download your copy. Access all the document templates you have purchased in the My documents menu. You can obtain another copy of the Maryland Specialty Services Contact - Self-Employed at any time if needed. Simply click the desired form to download or print the document template. Use US Legal Forms, the largest collection of legitimate forms, to save time and avoid mistakes. The service provides properly crafted legal document templates that you can use for various purposes. Create your account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms site and have an account, simply Log In.

- After that, you can download the Maryland Specialty Services Contact - Self-Employed template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct area/county.

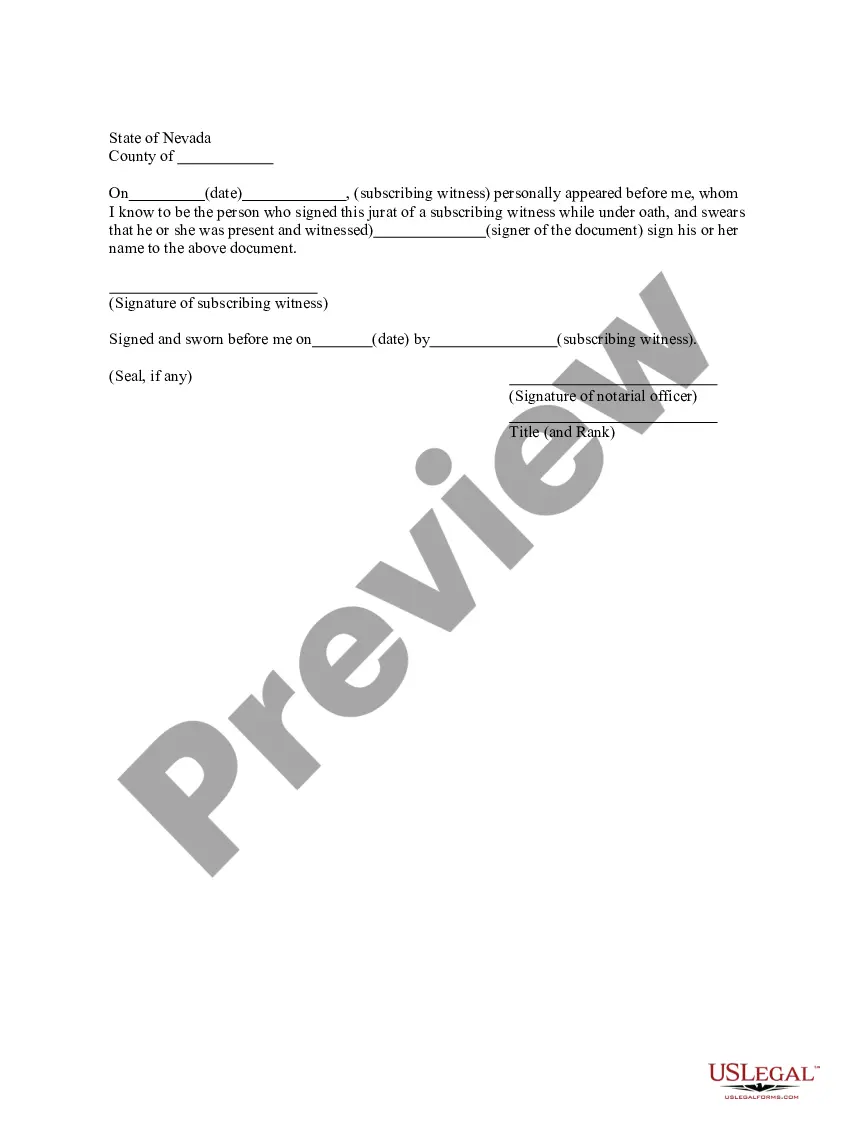

- Use the Preview button to review the form.

- Check the details to confirm you have selected the correct form.

- If the form is not what you're looking for, utilize the Search area to find the form that suits your needs and requirements.

Form popularity

FAQ

Several types of businesses may not require a license in Maryland, including certain home-based businesses and freelance work, depending on their nature. However, it's essential to verify specific local zoning rules or state regulations that may apply to your situation. Consulting with a Maryland Specialty Services Contact - Self-Employed can clarify these nuances and provide tailored guidance.

In Maryland, most businesses operating in the state must obtain a business license. This requirement applies to sole proprietors, partnerships, and corporations based on the nature of their business activities. Having the appropriate licenses ensures compliance with state regulations and grants you a level of credibility. If you're unsure about your licensing needs, a Maryland Specialty Services Contact - Self-Employed can help you navigate the requirements.

An affidavit of self-employment income in Maryland is a document that verifies your income as a self-employed individual. It is often required for applications related to loans, housing assistance, or government benefits. You must include accurate details regarding your earnings to ensure the validity of the affidavit. For assistance with this process, consider connecting with a Maryland Specialty Services Contact - Self-Employed.

You can contact Maryland Social Services by visiting their official website or calling their customer service line. They offer a variety of resources and assistance programs for residents. Ensuring you reach out to the right department will help you access the services you need. For self-employed inquiries, a Maryland Specialty Services Contact - Self-Employed can guide you further.

To set up as a sole proprietor in Maryland, you need to choose a business name and file a trade name application with the state. Additionally, register for any necessary permits or licenses specific to your business type. This process provides you with legal recognition, ensuring that you can operate effectively. For further assistance, you can reach out for a Maryland Specialty Services Contact - Self-Employed.

As a self-employed individual in Maryland, you typically do not need to register as a sole proprietor if you operate your business under your legal name. However, if you choose to use a business name different from your own, you must register that name with the appropriate local authorities. Additionally, registering allows you to establish a legal identity for your business, which can enhance credibility. For more tailored guidance, the Maryland Specialty Services Contact - Self-Employed feature on USLegalForms can provide essential resources.

MD Form 1 is required to be filed by individuals, including self-employed persons, who need to report their Maryland income. This form is essential for tax purposes and helps you maintain compliance with state regulations. For assistance with filing and to make sure you meet all requirements, it's beneficial to consult a Maryland Specialty Services Contact - Self-Employed.

Yes, Maryland requires LLCs to file an annual report to maintain good standing. Filing this report keeps your business information updated and ensures compliance with state laws. If you have questions about the filing process, a Maryland Specialty Services Contact - Self-Employed can offer useful assistance.

Yes, Maryland offers a self-employment assistance program to help individuals transition to self-employment. This program provides training, technical assistance, and support that can be crucial for your success. Engaging with a Maryland Specialty Services Contact - Self-Employed can help you navigate this program effectively.

Several states across the U.S. offer self-employment assistance programs, including New Jersey, Florida, and Mississippi. These programs are designed to support those moving from unemployment to self-employment. For more information on how Maryland aligns with these efforts, you may consult with a Maryland Specialty Services Contact - Self-Employed.