Maryland Financial Services Agent Agreement - Self-Employed Independent Contractor

Description

How to fill out Financial Services Agent Agreement - Self-Employed Independent Contractor?

Are you currently in a situation where you frequently require documents for either business or personal purposes? There are numerous legitimate document templates accessible online, but finding ones you can rely on isn't simple.

US Legal Forms offers a vast array of form templates, such as the Maryland Financial Services Agent Agreement - Self-Employed Independent Contractor, designed to comply with state and federal regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the Maryland Financial Services Agent Agreement - Self-Employed Independent Contractor template.

Choose a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents menu. You can get another copy of the Maryland Financial Services Agent Agreement - Self-Employed Independent Contractor anytime, if needed. Just select the necessary form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legitimate forms, to save time and prevent errors. The service provides professionally crafted legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start making your life easier.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/area.

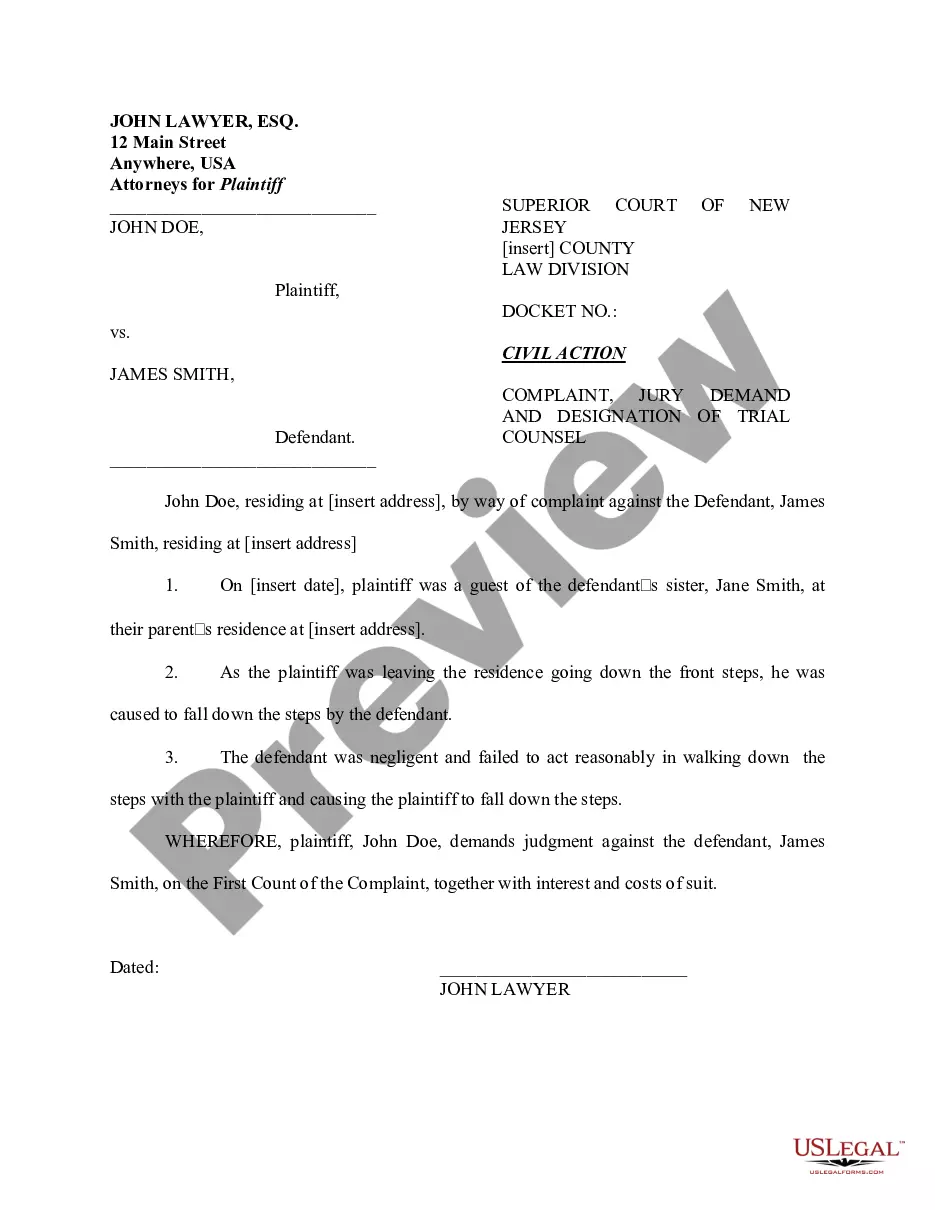

- Use the Review option to view the form.

- Check the details to ensure you have selected the right form.

- If the form isn’t what you’re looking for, use the Lookup field to find the form that suits your needs and requirements.

- Once you find the appropriate form, click Purchase now.

- Select the pricing plan you prefer, fill in the required information to create your account, and pay for your order using your PayPal or credit card.

Form popularity

FAQ

Yes, you can write your own service agreement as a self-employed individual. However, it's important to ensure that it includes all necessary elements, such as the scope of work, payment agreements, and legal protections. Using a service like US Legal Forms offers templates for the Maryland Financial Services Agent Agreement - Self-Employed Independent Contractor, helping you create a professional document that meets all legal requirements.

Yes, having a contract is essential when you are self-employed. It protects your interests and establishes clear expectations between you and your clients. A Maryland Financial Services Agent Agreement - Self-Employed Independent Contractor outlines the scope of services, payment terms, and other vital details, minimizing potential disputes.

To create an effective independent contractor agreement, begin by clearly outlining the roles and responsibilities of each party. Include the terms of payment, duration of the agreement, and any specific deliverables. Utilizing a platform like US Legal Forms can simplify this process, as it offers templates tailored for the Maryland Financial Services Agent Agreement - Self-Employed Independent Contractor, ensuring you cover all necessary legal aspects.

To fill out an independent contractor agreement, start with the essential information such as names and addresses of both parties. Include a detailed description of the services and payment terms under the Maryland Financial Services Agent Agreement - Self-Employed Independent Contractor. Don’t forget to mention the start date and duration of the contract. Using a reliable resource like uslegalforms can help you ensure you include all necessary components.

Yes, an independent contractor can serve as an agent for a company, provided that both parties agree to the terms. This is often formalized in a Maryland Financial Services Agent Agreement - Self-Employed Independent Contractor. This agreement will outline the responsibilities and rights of the contractor as an agent, ensuring clarity and legality. Consult uslegalforms to find templates that help you draft this agreement.

Filling out an independent contractor form requires you to input your personal information, including your legal name and contact details. Next, describe the services you will provide under the Maryland Financial Services Agent Agreement - Self-Employed Independent Contractor. Be sure to outline your payment terms and agreement duration. For added efficiency, uslegalforms offers a platform with easy-to-follow forms that can guide you through this process.

To write an independent contractor agreement, start by clearly defining the scope of work. Include important details like payment terms, deadlines, and deliverables. Additionally, ensure you clarify the relationship type by specifying that it's a Maryland Financial Services Agent Agreement - Self-Employed Independent Contractor. You might also consider using a template from uslegalforms, as it can simplify the process and ensure you cover all necessary elements.

Yes, a realtor can also function as an independent contractor. Many realtors operate under this model, allowing them to manage their own business while serving clients in the real estate market. The Maryland Financial Services Agent Agreement - Self-Employed Independent Contractor provides a framework that helps realtors navigate their responsibilities and opportunities as independent agents in the industry.

An agent typically represents others in transactions, especially in financial, real estate, and insurance domains. Any individual or professional who acts on behalf of another party to facilitate agreements can be classified as an agent. According to the Maryland Financial Services Agent Agreement - Self-Employed Independent Contractor, anyone meeting the necessary qualifications and who operates within the legal framework can hold this designation.

Yes, an independent contractor can also be an agent. In fact, many individuals in the financial sector choose this structure to maximize their earnings and enjoy the autonomy of being self-employed. The Maryland Financial Services Agent Agreement - Self-Employed Independent Contractor outlines how these roles can coexist, allowing independent contractors to represent clients while also providing their services directly.