Maryland Carrier Services Contract - Self-Employed Independent Contractor

Description

How to fill out Carrier Services Contract - Self-Employed Independent Contractor?

Are you currently in a location where you need documents for both professional or personal purposes nearly every day.

There are many reliable document templates accessible online, but finding ones you can depend on is not simple.

US Legal Forms offers thousands of form templates, including the Maryland Carrier Services Contract - Self-Employed Independent Contractor, that are crafted to comply with federal and state regulations.

When you locate the correct form, click Get now.

Select the pricing plan you prefer, fill out the required information to create your account, and pay for the order using your PayPal or credit card. Choose a convenient file format and download your version. Find all of the document templates you have purchased in the My documents section. You can acquire an additional copy of the Maryland Carrier Services Contract - Self-Employed Independent Contractor at any time, if needed. Simply click the desired form to download or print the document template. Use US Legal Forms, one of the most extensive collections of legitimate forms, to save time and avoid mistakes. The service provides professionally crafted legal document templates that can be used for various purposes. Create your account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have your account, simply Log In.

- After that, you can download the Maryland Carrier Services Contract - Self-Employed Independent Contractor template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Obtain the form you require and ensure it is for the correct area/county.

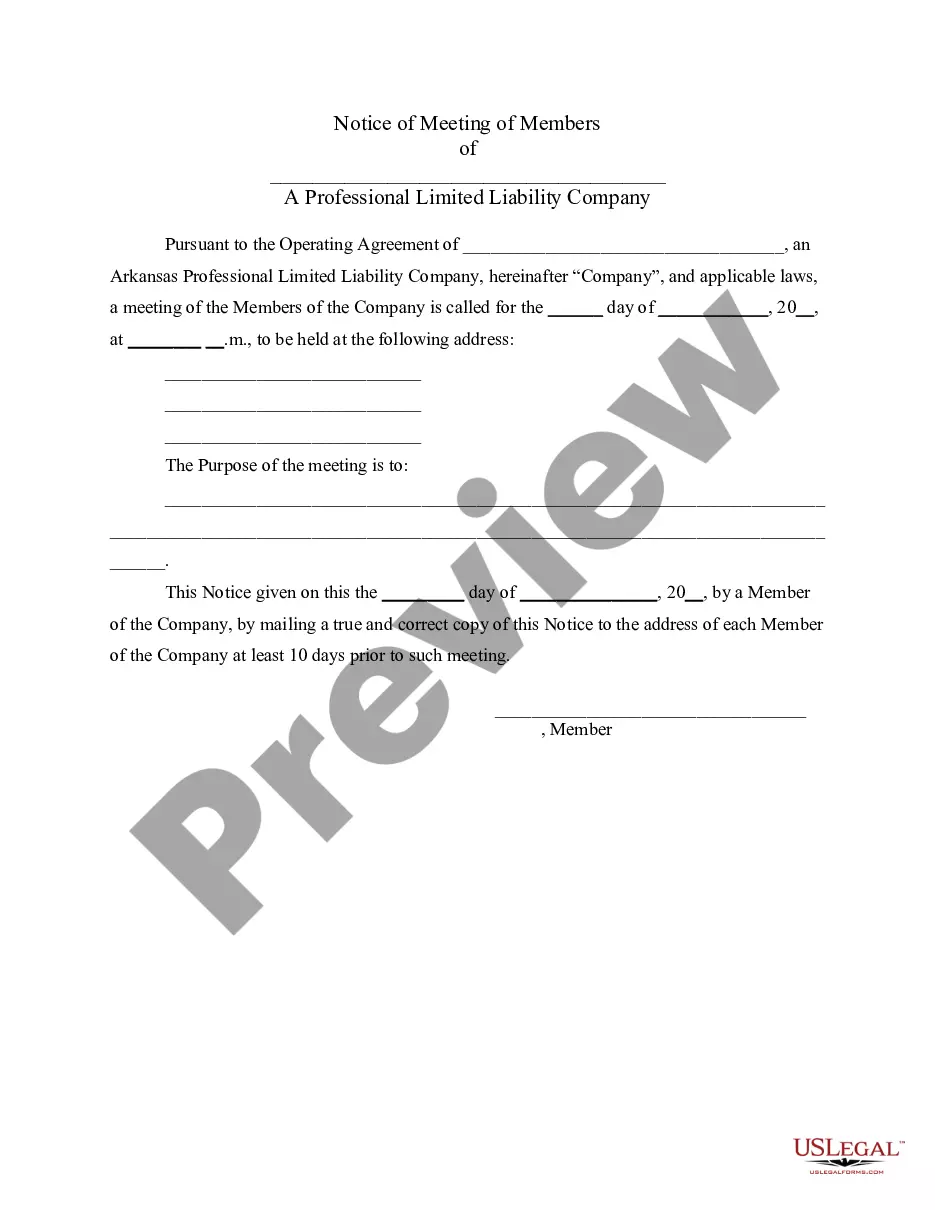

- Utilize the Preview option to examine the form.

- Read the description to confirm that you have chosen the correct form.

- If the form is not what you are looking for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

To fill out an independent contractor form for a Maryland Carrier Services Contract - Self-Employed Independent Contractor, start by entering your personal and business information. Make sure to include the nature of the services offered and other relevant details per your agreement. Completing forms correctly is crucial for compliance and smooth transactions, and resources like uslegalforms can simplify this process by providing ready-to-use forms and guidelines.

An independent contractor must typically fill out a W-9 form when working under a Maryland Carrier Services Contract - Self-Employed Independent Contractor. This form collects essential information such as the contractor's name and tax identification number. Ensure this form is completed accurately for tax reporting purposes. You can find the W-9 form easily online or through platforms like uslegalforms, which provide additional resources for contractors.

To write an independent contractor agreement for Maryland Carrier Services Contract - Self-Employed Independent Contractor, start by outlining the scope of services, payment details, and project timeline. Be clear about the obligations of both parties, and include any confidentiality or non-compete clauses if necessary. Consider using uslegalforms for accessible templates that guide you through each section, making the writing process straightforward.

Filling out an independent contractor agreement for a Maryland Carrier Services Contract - Self-Employed Independent Contractor involves specifying the contractor's role and listing the services to be performed. Include payment terms, deadlines, and termination conditions to clarify expectations. You can utilize online platforms like uslegalforms to access comprehensive templates. These resources make it easier and faster to complete your agreement correctly.

Yes, you can write your own service agreement for Maryland Carrier Services Contract - Self-Employed Independent Contractor. However, ensure that it covers key elements like services provided, payment terms, and confidentiality clauses. Using templates can help guide you in the right direction. Reviewing legal advice can also ensure your agreement meets all legal requirements.

To become a self-employed courier, start by identifying your target market and offering specific services to meet their needs. Develop an efficient logistics plan to streamline operations and delivery routes. Market your services online and offline to attract clients. A Maryland Carrier Services Contract - Self-Employed Independent Contractor can provide the legal framework you need to operate effectively and professionally.

Being an independent courier offers flexibility and the potential for good earnings. You can set your own schedule and choose which contracts to accept based on your preferences. While there may be challenges like fluctuating demand, many couriers find the independence rewarding. A well-structured Maryland Carrier Services Contract - Self-Employed Independent Contractor can further enhance your experience by establishing fair payment terms.

To attract clients for your courier business, focus on delivering exceptional service and building customer relationships. Utilize social media to share testimonials and promote your services to a wider audience. You can also consider partnerships with local businesses that may require regular delivery services. A Maryland Carrier Services Contract - Self-Employed Independent Contractor can help establish trust and clarity with potential clients.

Yes, having a contract is essential even if you are self-employed. A contract protects your interests and outlines the terms of your services, payment agreements, and responsibilities. For Maryland independent contractors, a clearly defined Maryland Carrier Services Contract - Self-Employed Independent Contractor ensures you and your clients are aligned and aware of each other’s obligations.

As an independent courier, start by showcasing your reliability and professionalism. Attend networking events specific to logistics and delivery services to meet potential clients. Consider using online job platforms tailored for freelance couriers. Utilizing a Maryland Carrier Services Contract - Self-Employed Independent Contractor can streamline your agreements and clarify expectations with clients.