New Jersey Management Agreement between Prudential Tax-Managed Growth Fund and Prudential Investments Fund Management, LLC

Description

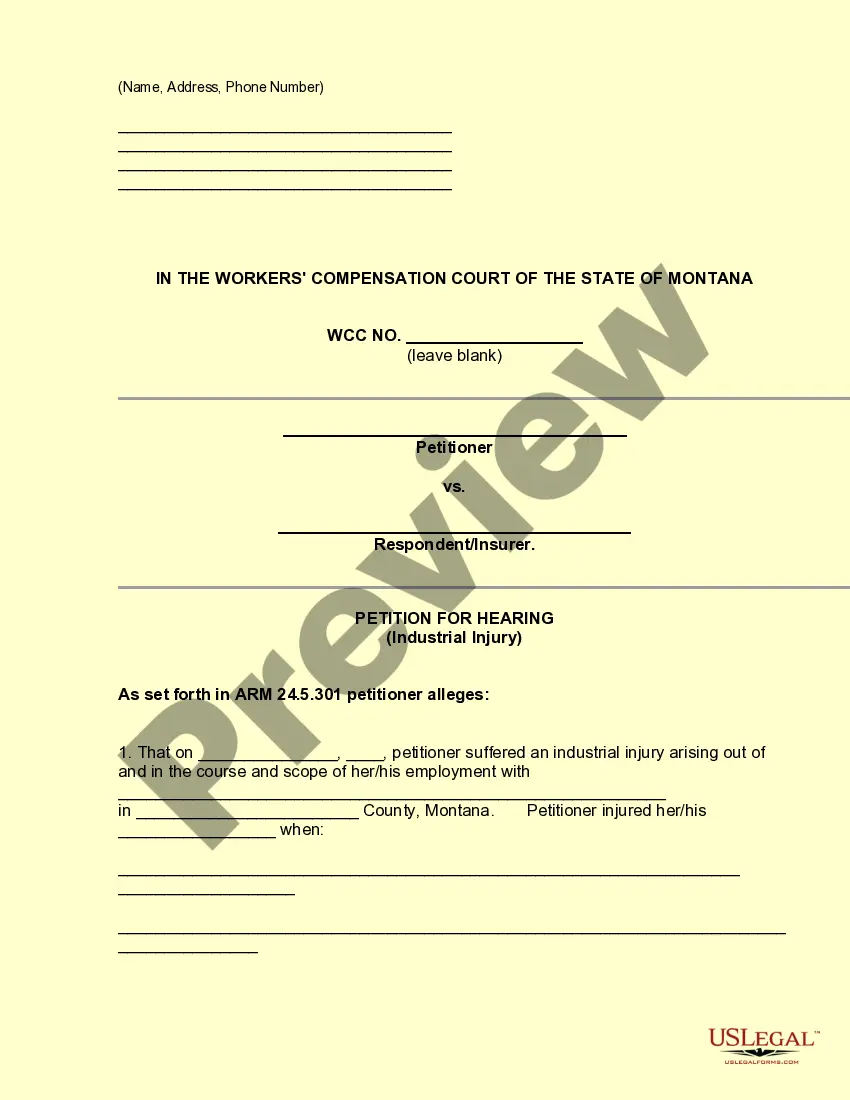

How to fill out Management Agreement Between Prudential Tax-Managed Growth Fund And Prudential Investments Fund Management, LLC?

Choosing the best lawful record web template might be a have difficulties. Naturally, there are a variety of templates accessible on the Internet, but how can you discover the lawful form you want? Take advantage of the US Legal Forms site. The assistance gives a large number of templates, like the New Jersey Management Agreement between Prudential Tax-Managed Growth Fund and Prudential Investments Fund Management, LLC, which can be used for enterprise and personal demands. All the forms are inspected by specialists and meet up with state and federal needs.

If you are already listed, log in for your account and then click the Acquire key to find the New Jersey Management Agreement between Prudential Tax-Managed Growth Fund and Prudential Investments Fund Management, LLC. Make use of your account to check with the lawful forms you might have ordered previously. Check out the My Forms tab of your own account and obtain another copy in the record you want.

If you are a whole new user of US Legal Forms, allow me to share easy instructions so that you can comply with:

- Very first, make sure you have chosen the appropriate form for your personal city/area. It is possible to look over the shape using the Review key and browse the shape explanation to make certain it will be the best for you.

- In case the form does not meet up with your preferences, use the Seach discipline to obtain the right form.

- Once you are sure that the shape is proper, click the Acquire now key to find the form.

- Pick the costs plan you want and enter the needed info. Make your account and pay for the transaction utilizing your PayPal account or charge card.

- Select the data file file format and download the lawful record web template for your device.

- Total, revise and printing and signal the attained New Jersey Management Agreement between Prudential Tax-Managed Growth Fund and Prudential Investments Fund Management, LLC.

US Legal Forms will be the largest local library of lawful forms where you can find a variety of record templates. Take advantage of the service to download appropriately-manufactured papers that comply with condition needs.

Form popularity

FAQ

Acquisition expands Empower's reach across retirement services market to more than 17 million individuals and $1.4 trillion in AUA. GREENWOOD VILLAGE, Colo. April 4, 2022?Empower today announced it has completed the previously announced acquisition of Prudential Financial, Inc.'s full-service retirement business.

Click ?View Details? for the Prudential plan for your Group Annuity benefit (there may be more than one account if you have multiple Prudential products). From the menu on the left-hand side, choose ?E-Documents.? ?Tax Forms? are the first section.

Based on former employees' testimony, investors alleged that Prudential already knew in February that there had recently been an unexpected number of deaths among holders of 700,000 policies the company purchased from another insurer.

To request a loan or withdrawal from your Prudential policy, or to perform a cash surrender of your policy, contact your Prudential professional, or call our Customer Service Center at 1-800-778-2255, Mon. -Fri., 8 a.m.-8 p.m. ET. Please have your policy numbers available when you call.

Net Loss in the current quarter included $2.491 billion of pre-tax net realized investment losses and related charges and adjustments, largely reflecting the impacts of rising interest rates, and also $107 million of pre-tax net impairment and credit-related losses, $251 million of pre-tax losses related to net change ...

Prudential has faced many legal challenges in how it pays out benefits to its customers, including numerous class action lawsuits based on payment of life insurance claims. Many of these claims have centered on Prudential's practice of using retained asset accounts to pay life insurance benefits.

Wells Fargo customers have filed a class-action lawsuit against Prudential Insurance Co., alleging the company worked with Wells Fargo to sign up low-income customers for life insurance policies without their permission or knowledge.

Fitch Ratings - Chicago - : Fitch Ratings has affirmed the 'AA-' Insurer Financial Strength ratings of Prudential Financial, Inc.'s (PFI) primary U.S. life insurance subsidiaries.