Maryland Payroll Deduction Authorization Form for Optional Matters - Employee

Description

How to fill out Payroll Deduction Authorization Form For Optional Matters - Employee?

If you require extensive legal document templates, download or print them using US Legal Forms, the largest collection of legal forms available online.

Utilize the site’s straightforward and user-friendly search to find the necessary paperwork.

Different templates for business and personal purposes are organized by categories and claims, or keywords.

Step 4. Once you have located the form you need, click the Purchase now button. Choose your preferred pricing plan and provide your details to register for the account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Utilize US Legal Forms to obtain the Maryland Payroll Deduction Authorization Form for Optional Matters - Employee with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to get the Maryland Payroll Deduction Authorization Form for Optional Matters - Employee.

- You can also access forms you previously obtained from the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/region.

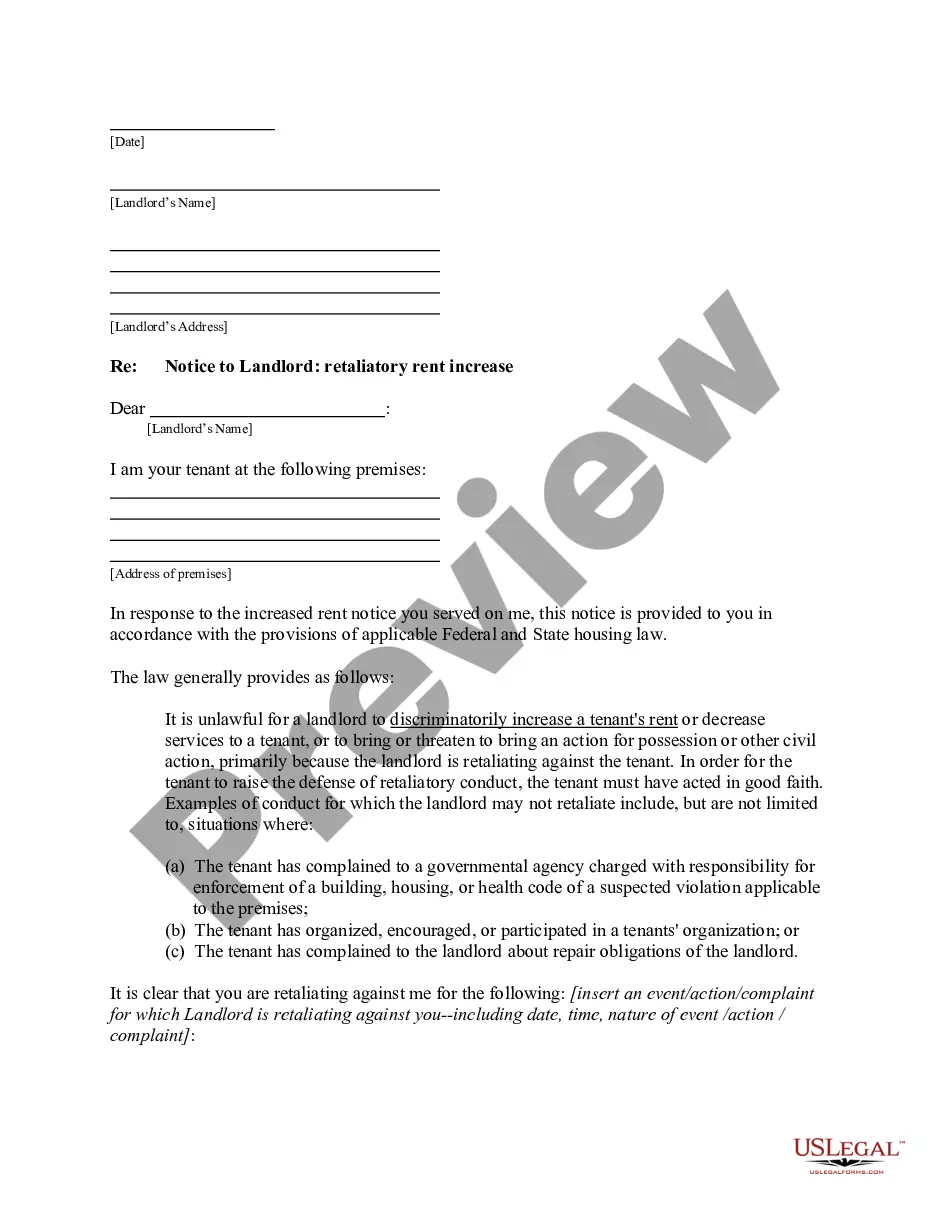

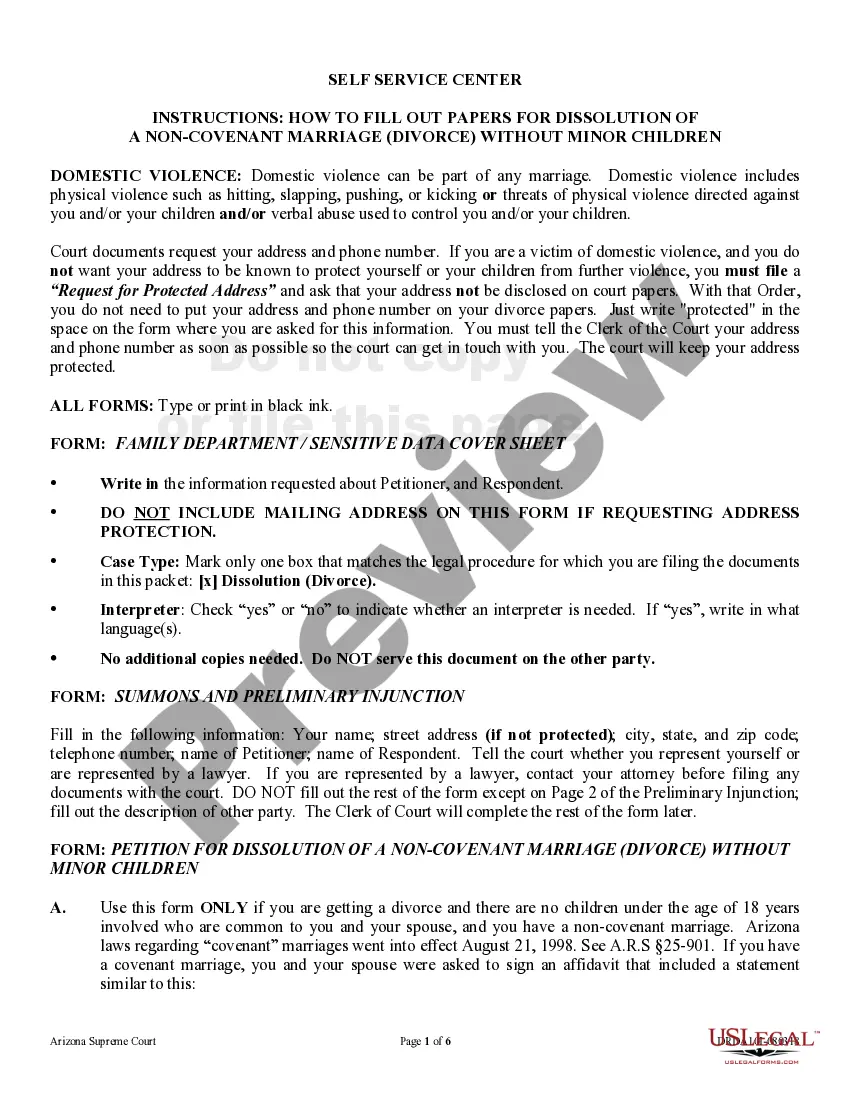

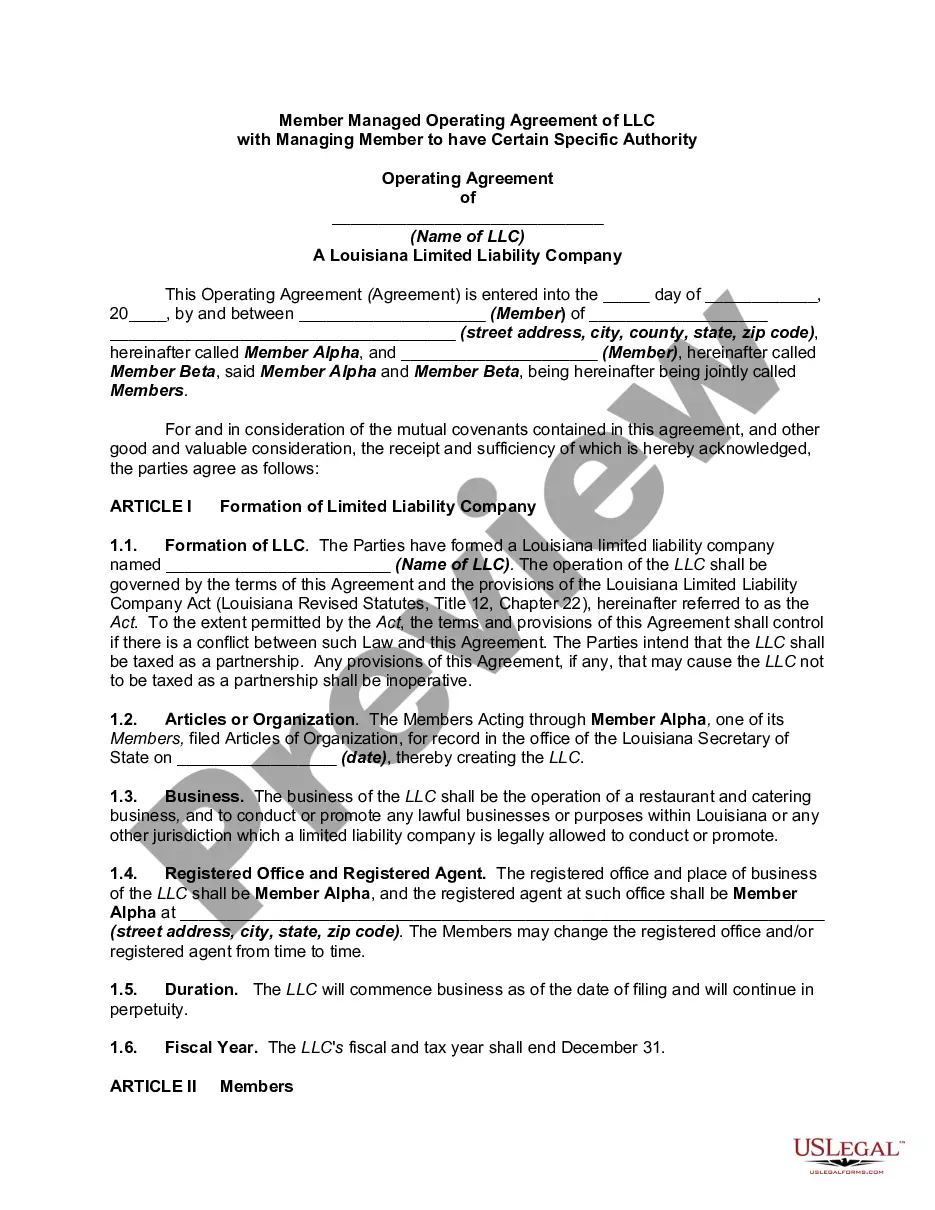

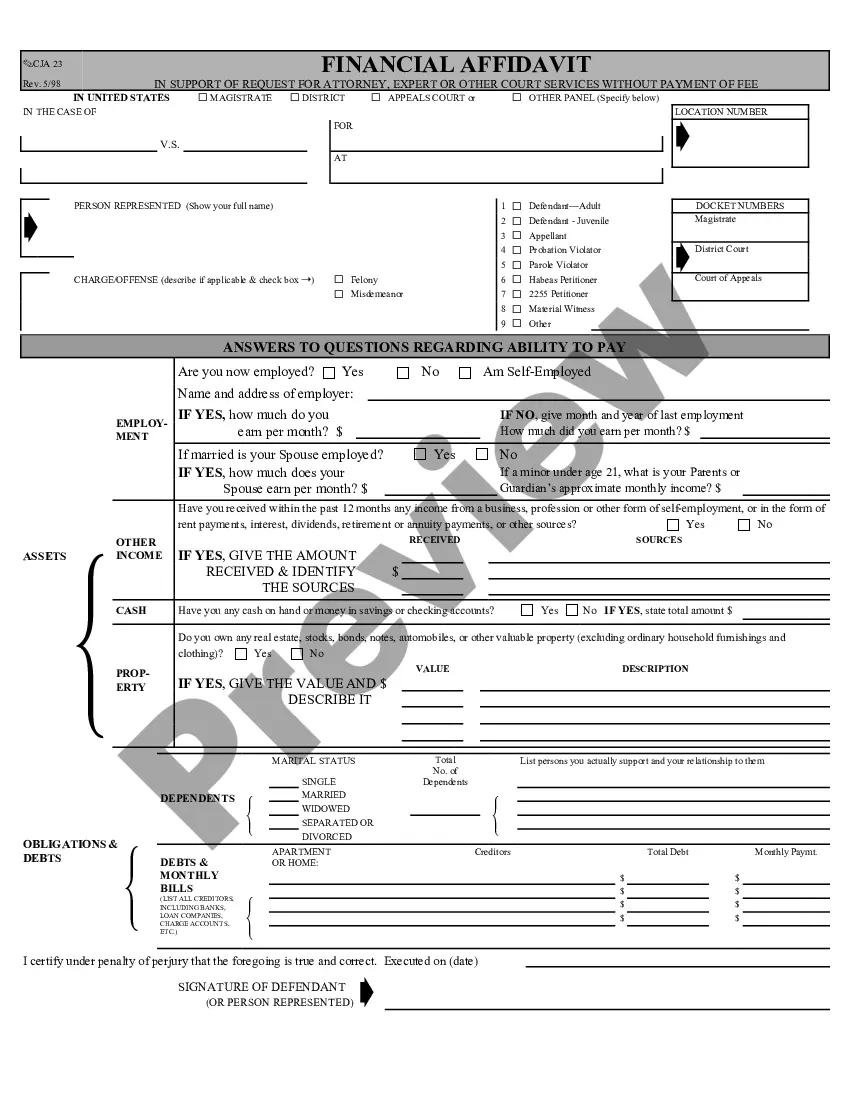

- Step 2. Use the Preview option to review the form’s details. Don't forget to read the information.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other versions in the legal form format.

Form popularity

FAQ

Payroll deduction is the process by which an employer withholds a portion of an employee's wages to cover various expenses such as taxes, insurance, or retirement contributions. The Maryland Payroll Deduction Authorization Form for Optional Matters - Employee is a specific tool that companies can use to facilitate this process for optional matters. Understanding payroll deductions can help employees better manage their finances and make informed decisions about their compensation. This system ultimately promotes trust and clarity in employer-employee relationships.

Payroll deduction authorization refers to the permission granted by an employee to their employer to withhold specific amounts from their wages. This process is often formalized through the Maryland Payroll Deduction Authorization Form for Optional Matters - Employee, which clearly outlines what the deductions will be used for. This form protects both parties by ensuring that deductions are agreed upon and documented. It is an essential step in managing employee finances and benefits.

A wage authorization form is a document that allows employers to deduct certain amounts from an employee's paycheck. This is particularly relevant when considering the Maryland Payroll Deduction Authorization Form for Optional Matters - Employee. This form helps ensure transparency and compliance, making it easier for both employers and employees to understand the deductions. Using this form can streamline the process and eliminate confusion regarding payroll deductions.

An example of an optional payroll deduction is a contribution to a 401(k) retirement plan or a premium for additional life insurance. These deductions are not required but can offer significant benefits. Completing the Maryland Payroll Deduction Authorization Form for Optional Matters - Employee allows you to specify these deductions and plan for your financial future effectively.

An authorized deduction is a deduction taken from your paycheck with your permission, usually for taxes or benefits you've agreed to. Unlike optional deductions, authorized deductions are often necessary for compliance with tax laws or company policies. You can list your authorized options using the Maryland Payroll Deduction Authorization Form for Optional Matters - Employee to keep everything organized.

Yes, you can opt out of payroll deductions, particularly those that are labeled as optional. However, the process may vary depending on your employer’s policies. For a seamless transition, use the Maryland Payroll Deduction Authorization Form for Optional Matters - Employee to ensure that your choices are documented and implemented accurately.

Typically, optional deductions on a paystub include contributions to retirement accounts, health savings accounts, or various insurance premiums. These deductions are not required and depend on your individual choices. You can manage these optional deductions through the Maryland Payroll Deduction Authorization Form for Optional Matters - Employee to ensure accuracy and compliance.

An optional deduction refers to a specific amount taken from your paycheck that you voluntarily choose. It is not mandated by law or necessary for your employment. In the context of your choices, the Maryland Payroll Deduction Authorization Form for Optional Matters - Employee allows you to authorize these types of deductions easily.

The form for payroll deduction permission is a document that employees fill out to provide consent for specific deductions from their paycheck. It confirms their agreement to the amounts and purposes of these deductions. For employees in Maryland, the Maryland Payroll Deduction Authorization Form for Optional Matters - Employee is the ideal choice for setting this permission clearly and effectively.

Form 2159 is specifically used to authorize payroll deductions for various purposes, including contributions to retirement plans. This form ensures that the correct amount is deducted based on the employee's preferences and selections. By utilizing the Maryland Payroll Deduction Authorization Form for Optional Matters - Employee, you can simplify the process of authorizing these deductions.