Maryland Voting Trust and Divestiture Agreement

Description

How to fill out Voting Trust And Divestiture Agreement?

If you want to comprehensive, acquire, or printing legal file templates, use US Legal Forms, the greatest assortment of legal kinds, that can be found on-line. Utilize the site`s basic and practical research to find the papers you will need. Various templates for business and person purposes are categorized by categories and says, or keywords and phrases. Use US Legal Forms to find the Maryland Voting Trust and Divestiture Agreement in just a handful of mouse clicks.

Should you be previously a US Legal Forms consumer, log in to your bank account and click the Download switch to get the Maryland Voting Trust and Divestiture Agreement. You can also access kinds you formerly acquired from the My Forms tab of your own bank account.

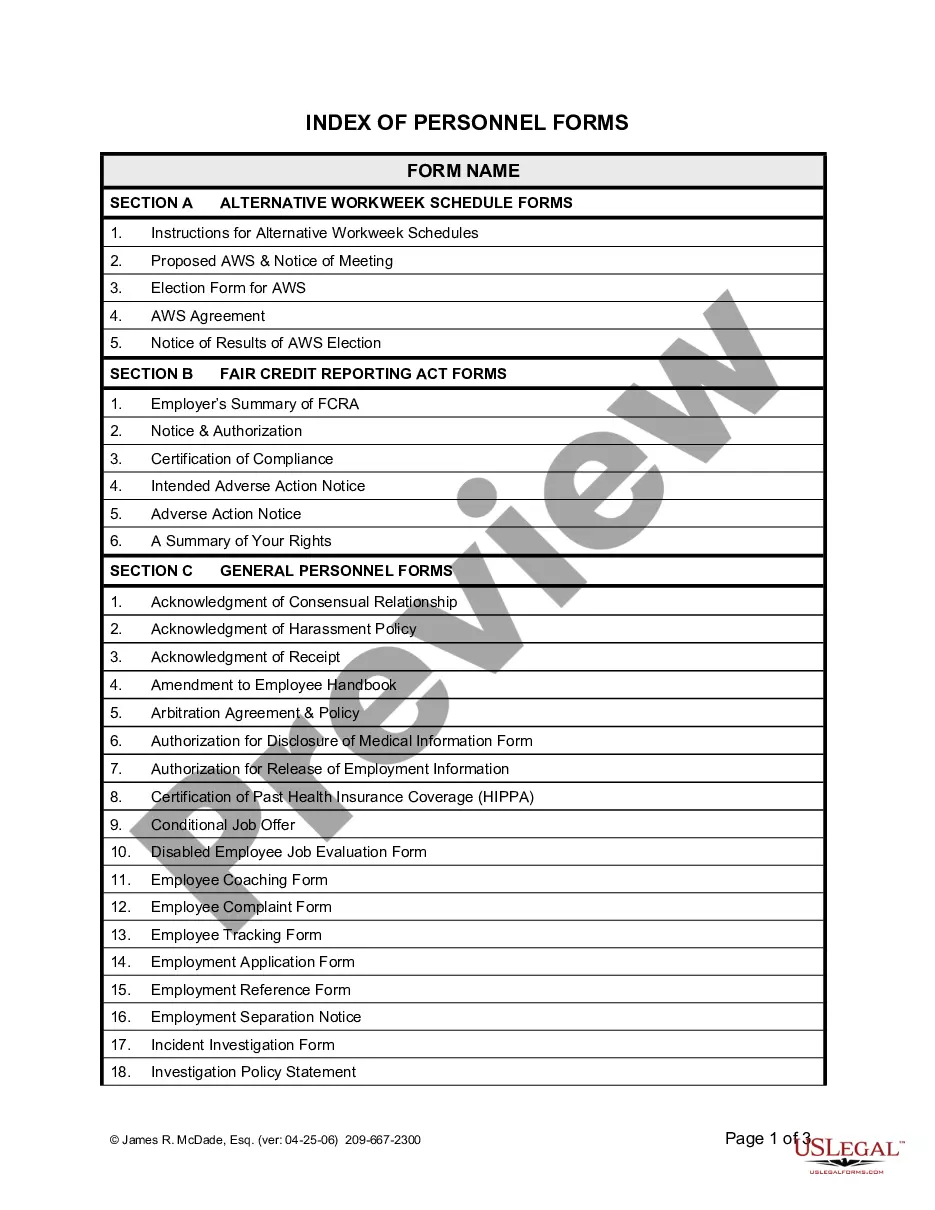

If you use US Legal Forms the very first time, follow the instructions under:

- Step 1. Be sure you have selected the form for your proper city/land.

- Step 2. Take advantage of the Preview choice to examine the form`s content. Never overlook to read through the information.

- Step 3. Should you be not satisfied together with the kind, take advantage of the Research field near the top of the display to get other models of your legal kind format.

- Step 4. Upon having located the form you will need, click the Buy now switch. Opt for the pricing prepare you like and include your accreditations to register for the bank account.

- Step 5. Approach the financial transaction. You can use your bank card or PayPal bank account to perform the financial transaction.

- Step 6. Pick the format of your legal kind and acquire it on your device.

- Step 7. Comprehensive, edit and printing or signal the Maryland Voting Trust and Divestiture Agreement.

Each legal file format you buy is yours permanently. You might have acces to each and every kind you acquired within your acccount. Click on the My Forms area and decide on a kind to printing or acquire once more.

Compete and acquire, and printing the Maryland Voting Trust and Divestiture Agreement with US Legal Forms. There are millions of professional and express-particular kinds you can utilize for your personal business or person needs.

Form popularity

FAQ

A voting trust is a contract between shareholders in which their shares and voting rights are temporarily transferred to a trustee. A voting agreement is a contract in which shareholders agree to vote a certain way on specific issues without giving up their shares or voting rights.

(1) The term ?security? means any note, stock, treasury stock, security future, security-based swap, bond, debenture, evidence of indebtedness, certificate of interest or participation in any profit-sharing agreement, collateral-trust certificate, preorganization certificate or subscription, transferable share, ...

While the proxy may be a temporary or one-time arrangement, often created for a specific vote, the voting trust is usually more permanent, intended to give a bloc of voters increased power as a group?or indeed, control of the company, which is not necessarily the case with proxy voting.

For a proxy vote, it is a temporary arrangement for a one-time issue; whereas, for a voting trust, it gives the trustees increased power to make decisions on behalf of all shareholders to control the company, which differs from proxy voting in terms of how much power is allocated.

A voting trust agreement transfers the voting rights of shareholders to a trustee, giving the trustee temporary control of the corporation. A fiduciary is a person or organization that acts on behalf of a person or persons and is legally bound to act solely in their best interests.

A voting trust can be revocable or irrevocable; typically they are irrevocable for a period of years, or for life of the key person, or until the company is sold. But any other arrangement that suits the objectives and is within the law can be made as well.

What is a Voting Trust? A voting trust is an arrangement where the voting rights of shareholders are transferred to a trustee for a specified period. The shareholders are then awarded trust certificates that provide evidence that they are beneficiaries of the trust.

A trust formed when individual shareholders transfer both the legal title and voting rights in their shares to a trustee. The trustee then controls a unified voting block - with a stronger voice on matters of corporate governance than the individual shareholders could have on their own.