Maryland Participation Agreement between Variable Insurance Products Fund, III, Lincoln Life and Annuity Company of New York

Description

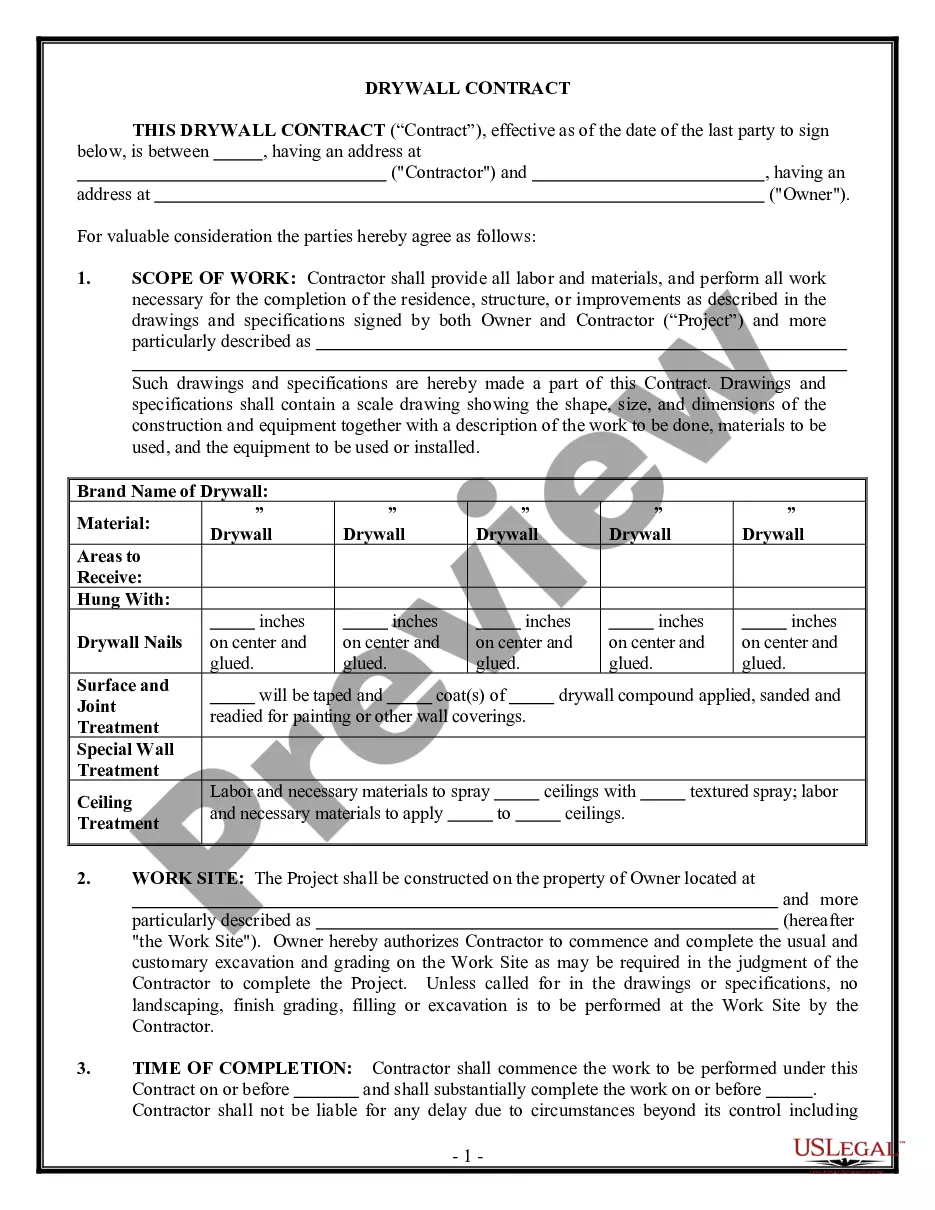

How to fill out Participation Agreement Between Variable Insurance Products Fund, III, Lincoln Life And Annuity Company Of New York?

Have you been inside a place where you need to have documents for sometimes business or personal functions almost every working day? There are a variety of lawful papers templates available on the Internet, but finding ones you can trust is not simple. US Legal Forms delivers thousands of develop templates, much like the Maryland Participation Agreement between Variable Insurance Products Fund, III, Lincoln Life and Annuity Company of New York, which are created to fulfill state and federal specifications.

When you are previously knowledgeable about US Legal Forms site and have a free account, merely log in. Next, you can down load the Maryland Participation Agreement between Variable Insurance Products Fund, III, Lincoln Life and Annuity Company of New York web template.

If you do not have an bank account and want to begin to use US Legal Forms, adopt these measures:

- Discover the develop you require and make sure it is for the proper area/area.

- Take advantage of the Preview switch to analyze the shape.

- Read the explanation to ensure that you have selected the proper develop.

- In the event the develop is not what you are searching for, utilize the Research discipline to find the develop that fits your needs and specifications.

- If you obtain the proper develop, just click Purchase now.

- Choose the prices prepare you would like, complete the required information and facts to produce your money, and buy the transaction with your PayPal or bank card.

- Select a practical data file structure and down load your backup.

Discover every one of the papers templates you possess bought in the My Forms food selection. You can get a more backup of Maryland Participation Agreement between Variable Insurance Products Fund, III, Lincoln Life and Annuity Company of New York whenever, if required. Just select the needed develop to down load or print the papers web template.

Use US Legal Forms, probably the most substantial assortment of lawful kinds, in order to save time and prevent mistakes. The services delivers expertly produced lawful papers templates that can be used for a variety of functions. Produce a free account on US Legal Forms and initiate creating your daily life easier.

Form popularity

FAQ

While variable annuities have greater potential for earnings, since their interest rate rises and falls with their underlying investments, they can lose money. They are also riddled with fees, which can cut into profits. Fixed annuities typically earn at a lower, stable rate. Variable Annuity: Definition, How It Works, and vs. Fixed Annuity Investopedia ? ... ? Annuities Investopedia ? ... ? Annuities

Lincoln Level Advantage® indexed-linked variable annuity is a long-term investment product designed for retirement purposes. There are no explicit fees associated with the indexed-linked account options available. Lincoln Level Advantage lincolnfinancial.com ? variableannuities ? le... lincolnfinancial.com ? variableannuities ? le...

Third, variable annuities let you receive periodic income payments for a specified period or the rest of your life (or the life of your spouse). This process of turning your investment into a stream of periodic income payments is known as annuitization. Variable Annuities | Investor.gov Investor.gov ? insurance-products ? varia... Investor.gov ? insurance-products ? varia...

A variable annuity is a contract between you and an insurance company, under which the insurer agrees to make periodic pay- ments to you, beginning either immediately or at some future date. You purchase a variable annuity contract by making either a single purchase payment or a series of purchase payments. Variable Annuities: What You Should Know - SEC.gov sec.gov ? investor ? pubs ? sec-guide-to-var... sec.gov ? investor ? pubs ? sec-guide-to-var...

For example, a 65-year-old man who invests $50,000 in an immediate annuity could receive about $247 per month for life. A 70-year-old man who invests $50,000 could receive $286 per month, in part because his life expectancy is shorter. And second, that you might get even more if interest rates rise by then. 5 Things You Should Know About Annuities - AARP aarp.org ? retirement-savings ? info-2020 aarp.org ? retirement-savings ? info-2020

Variable Annuity Disadvantages There are two big disadvantages to variable annuities that you should take into account when comparing annuity plans?the possibility of market loss and high management fees and account charges. You may also have IRS penalties and tax implications to consider. Pros and Cons of a Variable Annuity: What You Should Know canvasannuity.com ? blog ? variable-annuities-pr... canvasannuity.com ? blog ? variable-annuities-pr...