A debt collector may not use obscene or profane language or language likely to abuse the hearer or reader. This includes abusive language includes religious slurs, profanity, obscenity, calling the consumer a liar or a deadbeat, and the use of racial or sexual epithets.

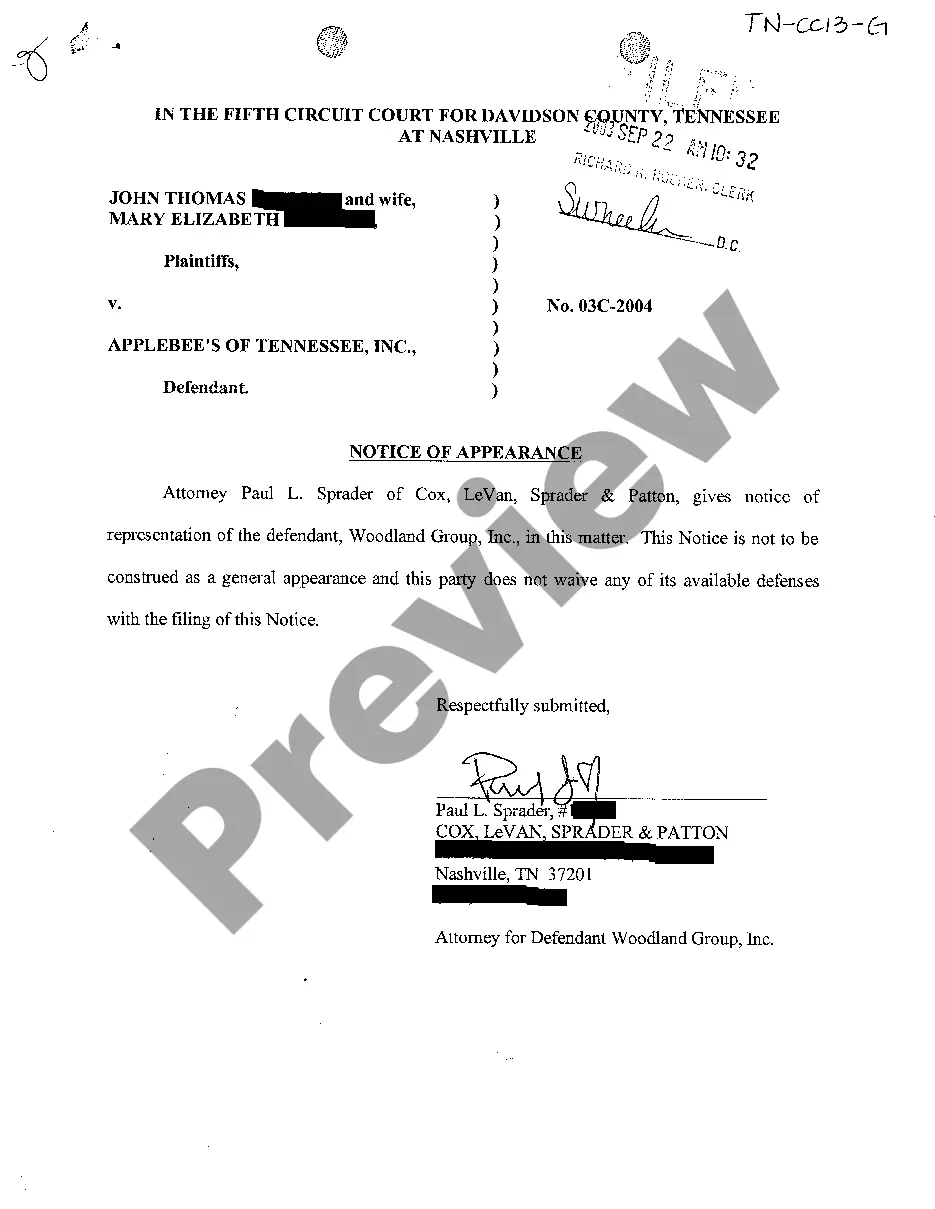

Maryland Notice to Debt Collector - Use of Abusive Language

Description

How to fill out Notice To Debt Collector - Use Of Abusive Language?

Locating the appropriate legal document layout can be challenging.

Certainly, there are numerous online templates available, but how do you locate the legal format you require.

Visit the US Legal Forms website. This service offers thousands of templates, including the Maryland Notice to Debt Collector - Use of Abusive Language, which you can utilize for both business and personal needs. All forms are reviewed by professionals and comply with federal and state regulations.

Once you are confident the form is accurate, click the Purchase now button to obtain the document. Choose the pricing plan you desire and input the required information. Create your account and finalize your order using either your PayPal account or credit card. Select the file format and download the legal document design to your device. Complete, edit, print, and sign the acquired Maryland Notice to Debt Collector - Use of Abusive Language. US Legal Forms is the largest repository of legal documents where you can find various document templates. Utilize the service to download professionally crafted files that adhere to state regulations.

- If you are already registered, Log In to your account and click the Obtain button to download the Maryland Notice to Debt Collector - Use of Abusive Language.

- Use your account to search for the legal forms you have purchased previously.

- Visit the My documents tab in your account to download another copy of the document you need.

- If you are a new user of US Legal Forms, follow these simple steps.

- First, ensure you have selected the correct form for your area/county. You can review the document using the Review button and check the form description to verify it is suitable for you.

- If the document does not meet your requirements, use the Search field to find the appropriate form.

Form popularity

FAQ

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take.

Yes. The federal Fair Debt Collection Practices Act specifically gives you the right to sue a debt collector for harassment. If a debt collector is found to have engaged in harassing behavior, you are entitled to up to $1,000 in damages, along with court costs and attorney fees.

7 Ways To Defend a Debt Collection LawsuitRespond to the Lawsuit or Debt Claim.Challenge the Company's Legal Right to Sue.Push Back on Burden of Proof.Point to the Statute of Limitations.Hire Your Own Attorney.File a Countersuit if the Creditor Overstepped Regulations.File a Petition of Bankruptcy.

9 Ways to Outsmart Debt CollectorsDon't Get Emotional.Make Sure the Debt Is Really Yours.Ask for Proof.Resist the Scare Tactics.Be Wary of Fees.Negotiate.Call In Backup.Know the Time Limits.More items...?

The FTC enforces the Fair Debt Collection Practices Act (FDCPA), which makes it illegal for debt collectors to use abusive, unfair, or deceptive practices when they collect debts.

If you believe a debt collector is harassing you, you can submit a complaint with the CFPB online or by calling (855) 411-CFPB (2372). You can also contact your state's attorney general .

How to Stop Debt Collector HarassmentWrite a Letter Requesting To Cease Communications.Document All Contact and Harassment.File a Complaint With the FTC.File a Complaint With Your State's Agency.Consider Suing the Debt Collection Agency for Harassment.

3 Things You Should NEVER Say To A Debt CollectorAdditional Phone Numbers (other than what they already have)Email Addresses.Mailing Address (unless you intend on coming to a payment agreement)Employer or Past Employers.Family Information (ex.Bank Account Information.Credit Card Number.Social Security Number.

Federal law doesn't give a specific limit on the number of calls a debt collector can place to you. A debt collector may not call you repeatedly or continuously intending to annoy, abuse, or harass you or others who share the number.