Maryland Proposal to decrease authorized common and preferred stock

Description

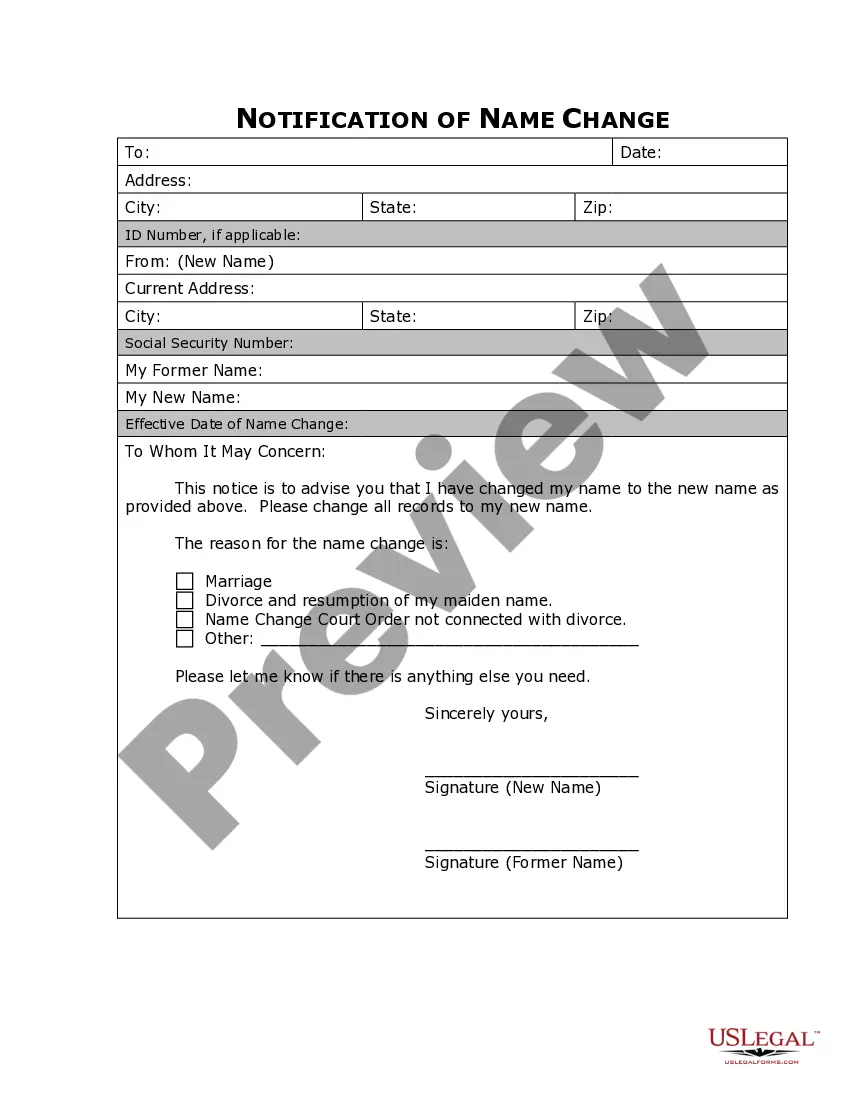

How to fill out Proposal To Decrease Authorized Common And Preferred Stock?

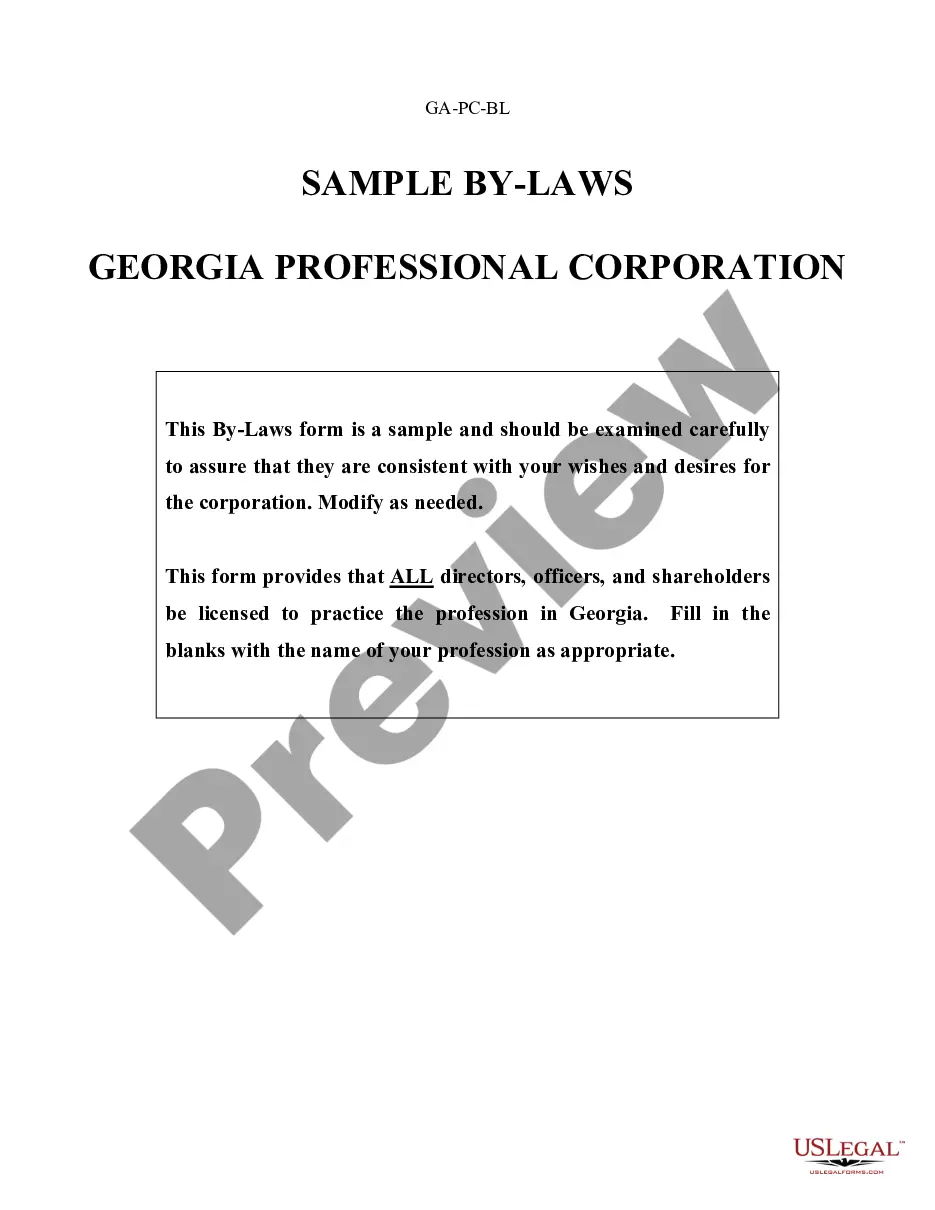

Choosing the right legal papers design can be quite a have a problem. Naturally, there are tons of themes available online, but how do you find the legal kind you will need? Use the US Legal Forms website. The support delivers 1000s of themes, including the Maryland Proposal to decrease authorized common and preferred stock, that you can use for enterprise and private requirements. All of the kinds are examined by pros and satisfy federal and state requirements.

In case you are currently authorized, log in in your profile and click the Down load option to find the Maryland Proposal to decrease authorized common and preferred stock. Use your profile to search through the legal kinds you have purchased formerly. Check out the My Forms tab of the profile and have yet another version from the papers you will need.

In case you are a new consumer of US Legal Forms, allow me to share easy instructions that you should comply with:

- Initial, make certain you have selected the proper kind to your city/county. You can check out the shape utilizing the Review option and look at the shape description to guarantee it will be the best for you.

- In the event the kind fails to satisfy your needs, utilize the Seach discipline to discover the right kind.

- Once you are positive that the shape is acceptable, click on the Buy now option to find the kind.

- Opt for the rates program you would like and enter the needed info. Build your profile and buy the order making use of your PayPal profile or bank card.

- Select the data file file format and acquire the legal papers design in your product.

- Comprehensive, edit and print out and signal the obtained Maryland Proposal to decrease authorized common and preferred stock.

US Legal Forms is definitely the largest catalogue of legal kinds in which you can discover various papers themes. Use the service to acquire expertly-produced documents that comply with status requirements.

Form popularity

FAQ

[7] For example, the Maryland Control Share Acquisition Act (MCSAA) provides that ?control shares? are those shares with more than one-tenth (but less than one third), one-third (but less than a majority), or a majority of the power to vote in the election of directors. Control Share Acquisition Statutes - SEC.gov sec.gov ? investment ? control-share-acquisi... sec.gov ? investment ? control-share-acquisi...

Any change in the Common Stock, Retained Earnings, or Cash Dividends accounts affects total stockholders' equity. Stockholders' equity increases due to additional stock investments or additional net income. It decreases due to a net loss or dividend payouts.

The stockholders' equity section of the balance sheet reports the worth of the stockholders. It has two subsections: Paid-in capital (from stockholder investments) and Retained earnings (profits generated by the corporation.)

In the case of common stockholders, the equity section changes year to year, regardless of whether new shares are bought or sold. This is because the retained earnings of the company belong to the common shareholders. They are considered the owners of the company. Why is it that the preferred stockholders' equity section of the ... study.com ? explanation ? why-is-it-th... study.com ? explanation ? why-is-it-th...

Any change in the Common Stock, Retained Earnings, or Dividends accounts affects total stockholders' equity, and those changes are shown on the statement of stockholder's equity. Stockholders' Equity can increase in two ways: Stock is issued and Common Stock increases, and/or.