Maryland Approval of Employee Stock Purchase Plan of Charming Shoppes, Inc.

Description

How to fill out Approval Of Employee Stock Purchase Plan Of Charming Shoppes, Inc.?

If you have to complete, obtain, or print authorized papers templates, use US Legal Forms, the largest variety of authorized types, that can be found online. Utilize the site`s simple and hassle-free search to find the papers you want. A variety of templates for business and individual functions are sorted by categories and says, or search phrases. Use US Legal Forms to find the Maryland Approval of Employee Stock Purchase Plan of Charming Shoppes, Inc. in a few click throughs.

Should you be already a US Legal Forms buyer, log in to your account and then click the Acquire button to find the Maryland Approval of Employee Stock Purchase Plan of Charming Shoppes, Inc.. You may also access types you earlier downloaded within the My Forms tab of your respective account.

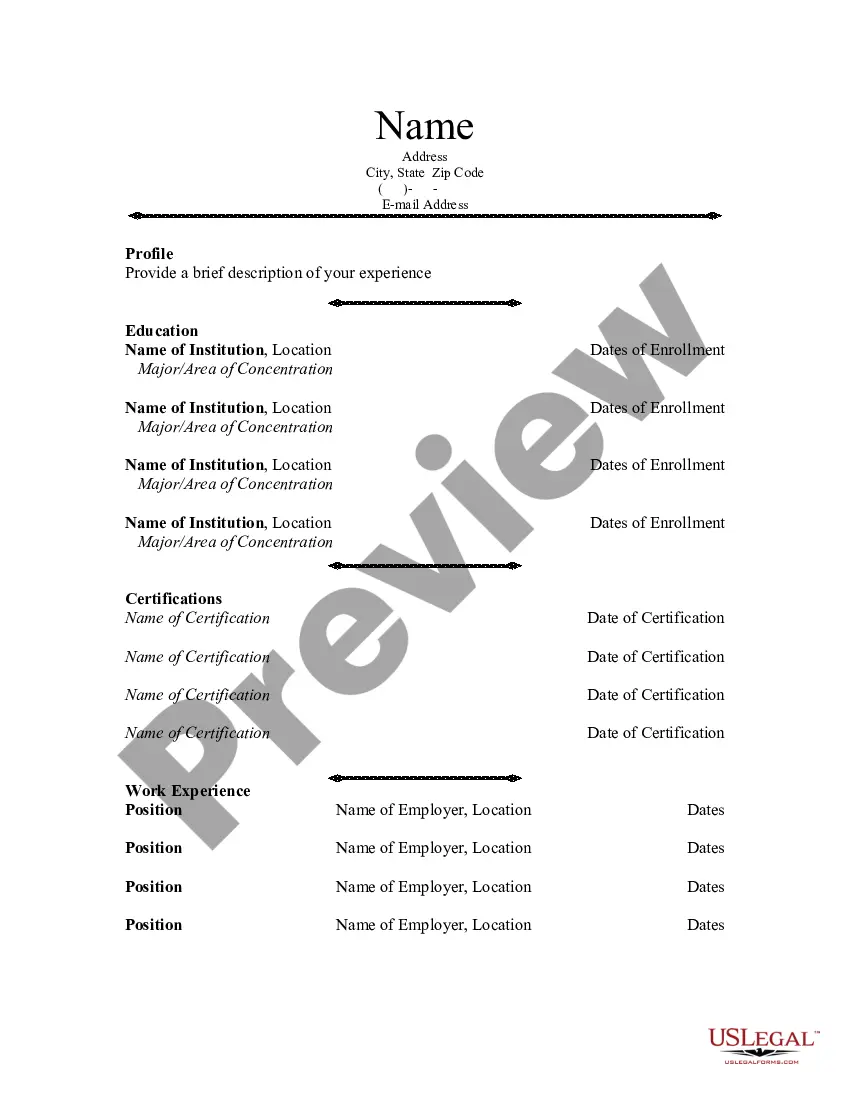

If you work with US Legal Forms the first time, refer to the instructions listed below:

- Step 1. Be sure you have chosen the form to the proper metropolis/country.

- Step 2. Utilize the Review option to examine the form`s content. Don`t overlook to see the information.

- Step 3. Should you be unsatisfied using the kind, make use of the Search discipline towards the top of the monitor to discover other variations of your authorized kind format.

- Step 4. After you have identified the form you want, click on the Buy now button. Choose the rates prepare you prefer and include your accreditations to register for an account.

- Step 5. Approach the purchase. You should use your credit card or PayPal account to accomplish the purchase.

- Step 6. Find the formatting of your authorized kind and obtain it on the device.

- Step 7. Comprehensive, revise and print or indicator the Maryland Approval of Employee Stock Purchase Plan of Charming Shoppes, Inc..

Each and every authorized papers format you buy is your own forever. You might have acces to each kind you downloaded in your acccount. Go through the My Forms section and pick a kind to print or obtain once again.

Compete and obtain, and print the Maryland Approval of Employee Stock Purchase Plan of Charming Shoppes, Inc. with US Legal Forms. There are thousands of professional and express-specific types you can use to your business or individual needs.

Form popularity

FAQ

An employee stock purchase plan (or ESPP) can be a very valuable benefit. In general, if your employer offers an ESPP, we think you should participate at the level you can comfortably afford and then sell the shares as soon as you can.

With qualified Section 423 employee stock purchase plans, you are not taxed at the time the shares are purchased, only when you sell. Depending on whether the shares were held for the required holding period, a portion of your gain may be taxed as capital gains or as ordinary income.

An ESPP is a program in which employees can purchase company stock at a discounted price. Income or loss from the sale of shares you purchased through an ESPP is generally taxed as a capital gain or loss, though there are holding period requirements.

The IRS limits purchases under a Section 423 plan to $25,000 worth of stock value (based on the grant date fair market value) for each calendar year in which the offering period is effective.

Limited Liquidity: In some cases, ESPPs may have restrictions on when employees can sell their shares, making it difficult to access the funds in an emergency or for other purposes. This lack of liquidity can be a drawback, especially for employees who may need to sell their shares quickly.

An employee stock purchase plan (ESPP) is a company-run program in which participating employees can purchase company stock directly, at a discounted price. Employees contribute to the plan through payroll deductions which build up between the offering date and the purchase date.

The most notable difference between an ESOP vs ESPP is in how the employee receives the stock and when they can sell the stock. ESOPs provide the stock or shares at no cost to employees. ESPPs require participants to contribute funds to purchase shares of stock, though at a discounted rate.

The ESOP vs 401K Plan With a 401(k), the employer's contributions are tax-deferred, meaning that the money is taken out of each paycheck before taxes, and those wages are not taxed until withdrawal. Whereas with an ESOP, employees also do not pay taxes on the shares in their account until distribution.