Maryland Approval of Ambase Corporation's Stock Incentive Plan

Description

How to fill out Approval Of Ambase Corporation's Stock Incentive Plan?

US Legal Forms - one of the biggest libraries of legitimate varieties in the States - gives a wide array of legitimate papers web templates you may download or printing. While using web site, you can get a large number of varieties for business and specific reasons, categorized by types, claims, or search phrases.You will find the most recent types of varieties just like the Maryland Approval of Ambase Corporation's Stock Incentive Plan in seconds.

If you currently have a monthly subscription, log in and download Maryland Approval of Ambase Corporation's Stock Incentive Plan in the US Legal Forms collection. The Download key will appear on every develop you view. You have accessibility to all formerly acquired varieties from the My Forms tab of the bank account.

If you would like use US Legal Forms the very first time, here are basic guidelines to help you began:

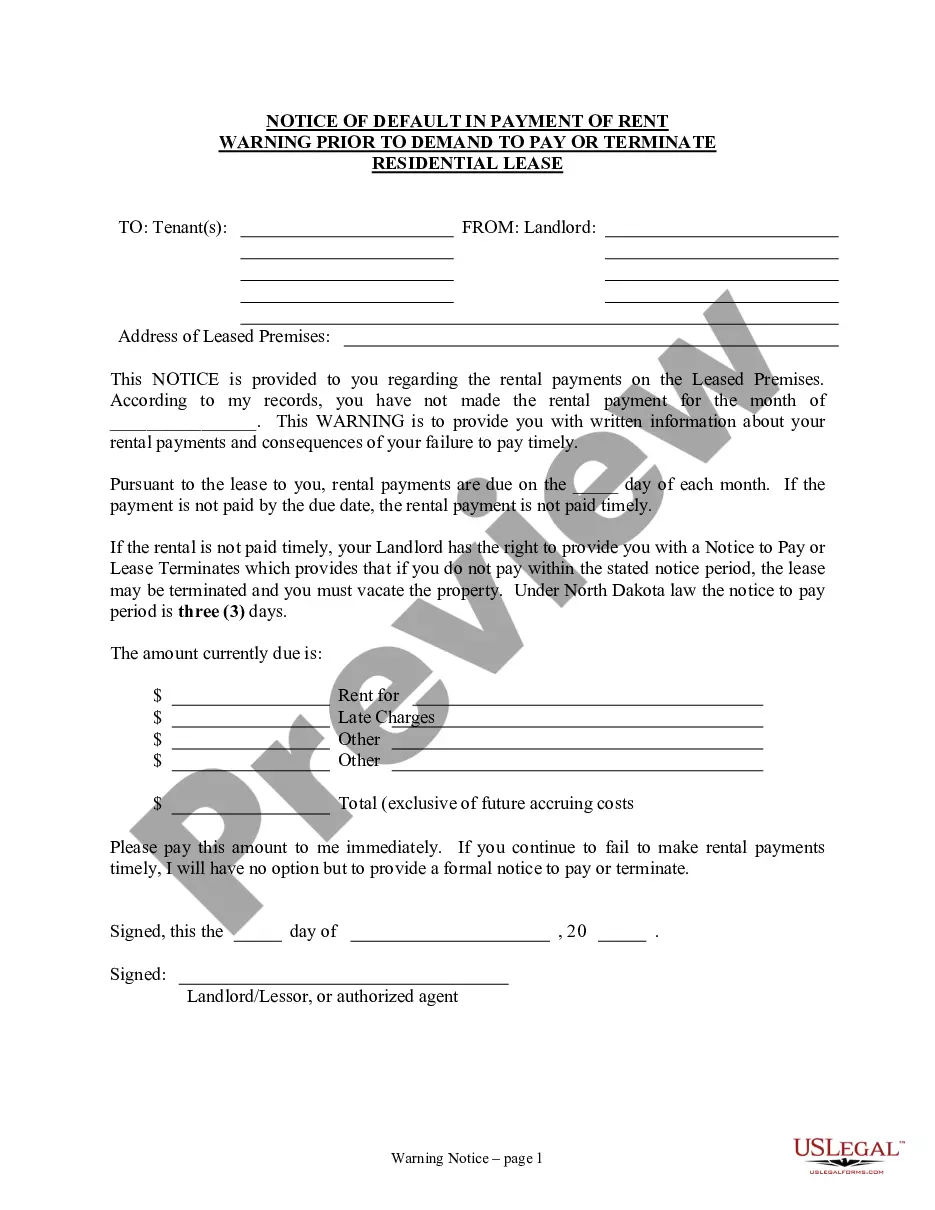

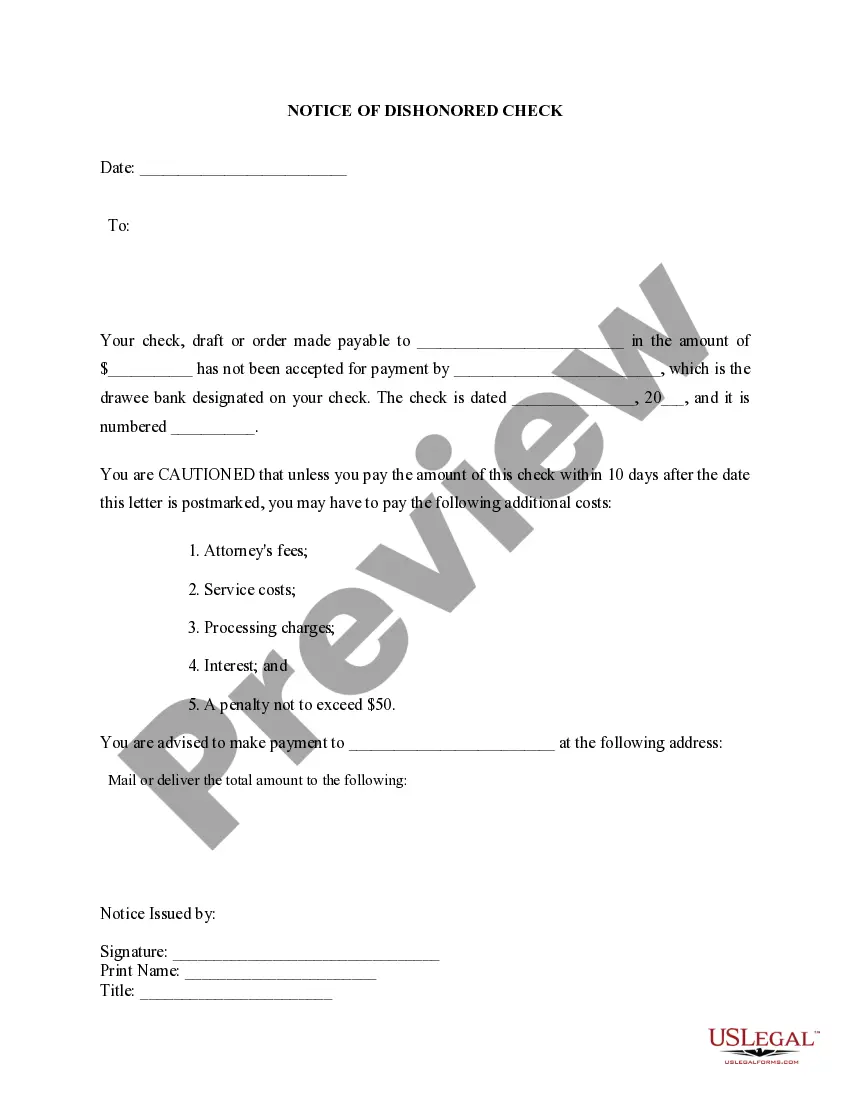

- Be sure you have picked out the best develop for your personal area/county. Select the Review key to check the form`s information. Look at the develop explanation to ensure that you have selected the proper develop.

- In case the develop doesn`t satisfy your demands, utilize the Search field towards the top of the display screen to find the one that does.

- Should you be pleased with the form, validate your choice by simply clicking the Buy now key. Then, pick the costs strategy you want and give your accreditations to sign up on an bank account.

- Procedure the transaction. Make use of your Visa or Mastercard or PayPal bank account to accomplish the transaction.

- Pick the format and download the form on your own device.

- Make adjustments. Fill up, edit and printing and indicator the acquired Maryland Approval of Ambase Corporation's Stock Incentive Plan.

Each design you put into your account lacks an expiry day and it is yours permanently. So, if you wish to download or printing yet another version, just go to the My Forms segment and click on in the develop you require.

Gain access to the Maryland Approval of Ambase Corporation's Stock Incentive Plan with US Legal Forms, probably the most comprehensive collection of legitimate papers web templates. Use a large number of specialist and state-distinct web templates that meet up with your small business or specific requires and demands.

Form popularity

FAQ

They provide employees the right, but not the obligation, to purchase shares of their employer's stock at a certain price for a certain period of time. Options are usually granted at the current market price of the stock and last for up to 10 years.

An incentive stock option (ISO) is a corporate benefit that gives an employee the right to buy shares of company stock at a discounted price with the added benefit of possible tax breaks on the profit.

Options are a common equity incentive plan example. A stock option is the right to buy a company's stock at a predefined price. That price is usually equal to the fair market value of the stock at the time that the option is granted.

term incentive plan (LTIP) incentivizes employees to take actions that will maximize shareholder value and promote longterm growth for the organization. In a standard LTIP, the employee, who is normally a senior executive, is required to meet a number of criteria to receive the incentive.

Taxes and Incentive Stock Options Your employer isn't required to withhold income tax when you exercise an Incentive Stock Option since there is no tax due (under the regular tax system) until you sell the stock.