Maryland Stock Option Plan - Permits Optionees to Transfer Stock Options to Family Members or Other Persons for Estate Planning Purposes

Description

How to fill out Stock Option Plan - Permits Optionees To Transfer Stock Options To Family Members Or Other Persons For Estate Planning Purposes?

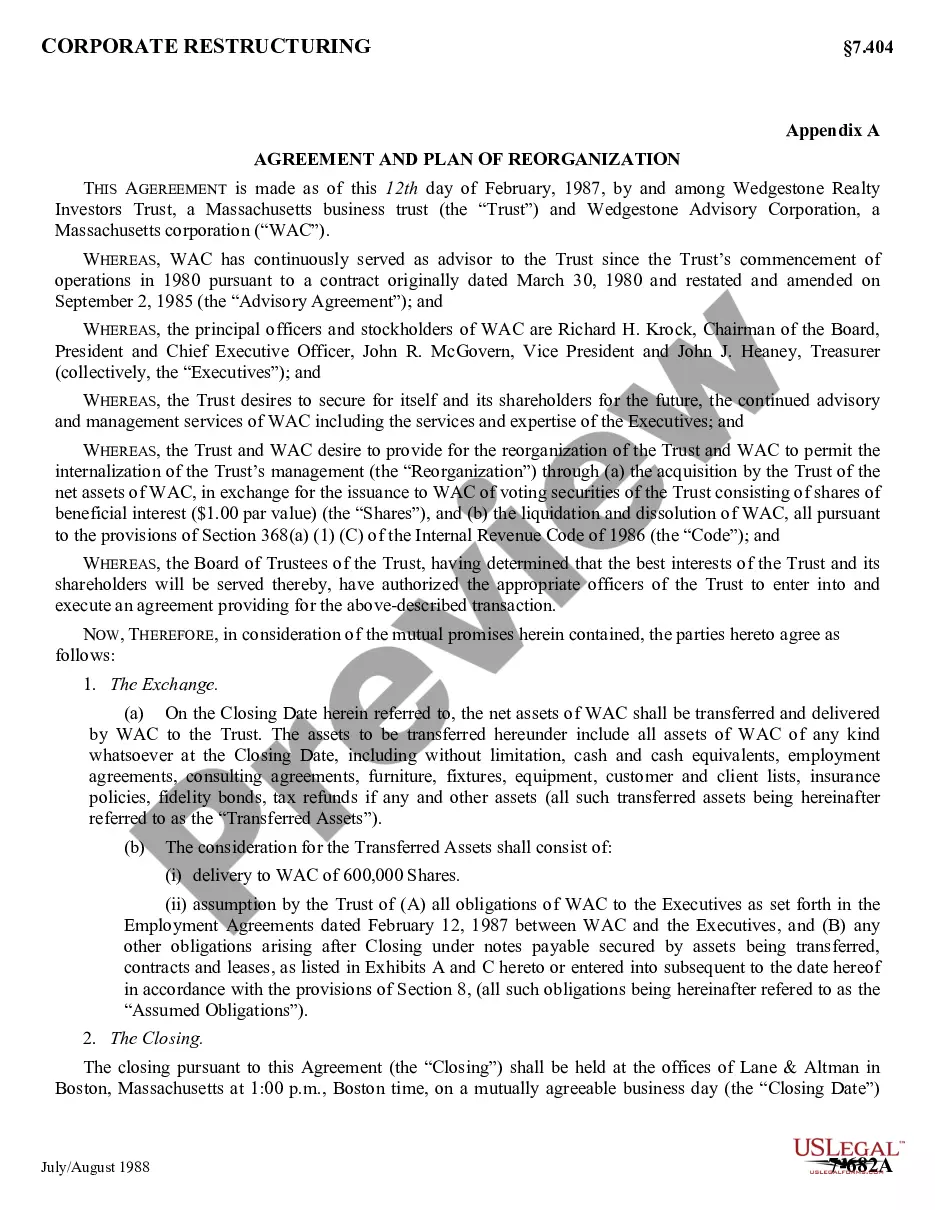

Discovering the right legitimate record template can be a have difficulties. Obviously, there are a lot of layouts accessible on the Internet, but how will you find the legitimate develop you will need? Make use of the US Legal Forms web site. The assistance provides a large number of layouts, including the Maryland Stock Option Plan - Permits Optionees to Transfer Stock Options to Family Members or Other Persons for Estate Planning Purposes, which you can use for enterprise and personal needs. All of the varieties are checked out by pros and satisfy federal and state needs.

In case you are already authorized, log in for your profile and click on the Obtain button to obtain the Maryland Stock Option Plan - Permits Optionees to Transfer Stock Options to Family Members or Other Persons for Estate Planning Purposes. Make use of your profile to check through the legitimate varieties you might have bought previously. Visit the My Forms tab of your own profile and acquire another copy of your record you will need.

In case you are a fresh end user of US Legal Forms, allow me to share easy recommendations that you should stick to:

- Initial, make sure you have chosen the correct develop for your personal metropolis/region. It is possible to check out the shape making use of the Preview button and study the shape outline to make sure it is the right one for you.

- In the event the develop fails to satisfy your preferences, use the Seach discipline to get the proper develop.

- Once you are sure that the shape is suitable, click the Acquire now button to obtain the develop.

- Choose the rates prepare you would like and enter the needed information and facts. Make your profile and buy an order making use of your PayPal profile or charge card.

- Opt for the submit format and obtain the legitimate record template for your device.

- Complete, modify and produce and indication the obtained Maryland Stock Option Plan - Permits Optionees to Transfer Stock Options to Family Members or Other Persons for Estate Planning Purposes.

US Legal Forms will be the biggest catalogue of legitimate varieties for which you can see numerous record layouts. Make use of the service to obtain expertly-made paperwork that stick to state needs.

Form popularity

FAQ

A transfer of employee stock options out of the employee's estate (i.e., to a family member or to a family trust) offers two main estate planning benefits: first, the employee is able to remove a potentially high growth asset from his or her estate; second, a lifetime transfer may also save estate taxes by removing ...

Unfortunately, not all stock options are transferable -- meaning you can not leave unexercised options to a loved one in your Estate Plan. In these cases, the stock options would expire at the time of your death. Even if your stock options are transferable, some companies limit who they can be transferred to.

Unfortunately, not all stock options are transferable -- meaning you can not leave unexercised options to a loved one in your Estate Plan. In these cases, the stock options would expire at the time of your death. Even if your stock options are transferable, some companies limit who they can be transferred to.

Equity compensation award types The awards themselves generally are not transferable and therefore cannot be given to charity. However, once these awards are vested and/or exercised?and the underlying stock is held for more than one year?they make tax-smart charitable gift options.

In most cases, the options do not lapse. After your death, your estate or beneficiary may exercise any vested options, ing to the option grant's terms and deadlines, along with any estate-planning documents (e.g. a will).

Vested restricted stock and exercised stock options are typically held in your brokerage account and covered by the beneficiary associated with this account. Your unvested awards or unexercised options are a different story.

Your brokerage firm may provide TOD or other beneficiary documents in order to designate a beneficiary for your brokerage account. Designating a beneficiary can be very helpful, but be aware that a TOD plan or other beneficiary document supersedes your will.

Non-Qualified Stock Option Plans do not get the same favorable tax treatment, but they are more flexible and often can be transferrable from an employee to a beneficiary or a Trust.