Pennsylvania Agreement and Plan of Reorganization by Wedgestone Realty Investors Trust and Wedgestone Advisory Corp.

Description

How to fill out Agreement And Plan Of Reorganization By Wedgestone Realty Investors Trust And Wedgestone Advisory Corp.?

If you have to complete, obtain, or print authorized papers templates, use US Legal Forms, the biggest collection of authorized types, that can be found on the web. Use the site`s basic and practical lookup to discover the files you need. Various templates for business and individual functions are categorized by classes and claims, or keywords and phrases. Use US Legal Forms to discover the Pennsylvania Agreement and Plan of Reorganization by Wedgestone Realty Investors Trust and Wedgestone Advisory Corp. with a couple of click throughs.

If you are previously a US Legal Forms customer, log in for your account and click on the Obtain key to find the Pennsylvania Agreement and Plan of Reorganization by Wedgestone Realty Investors Trust and Wedgestone Advisory Corp.. You may also accessibility types you formerly acquired within the My Forms tab of your account.

If you use US Legal Forms for the first time, follow the instructions under:

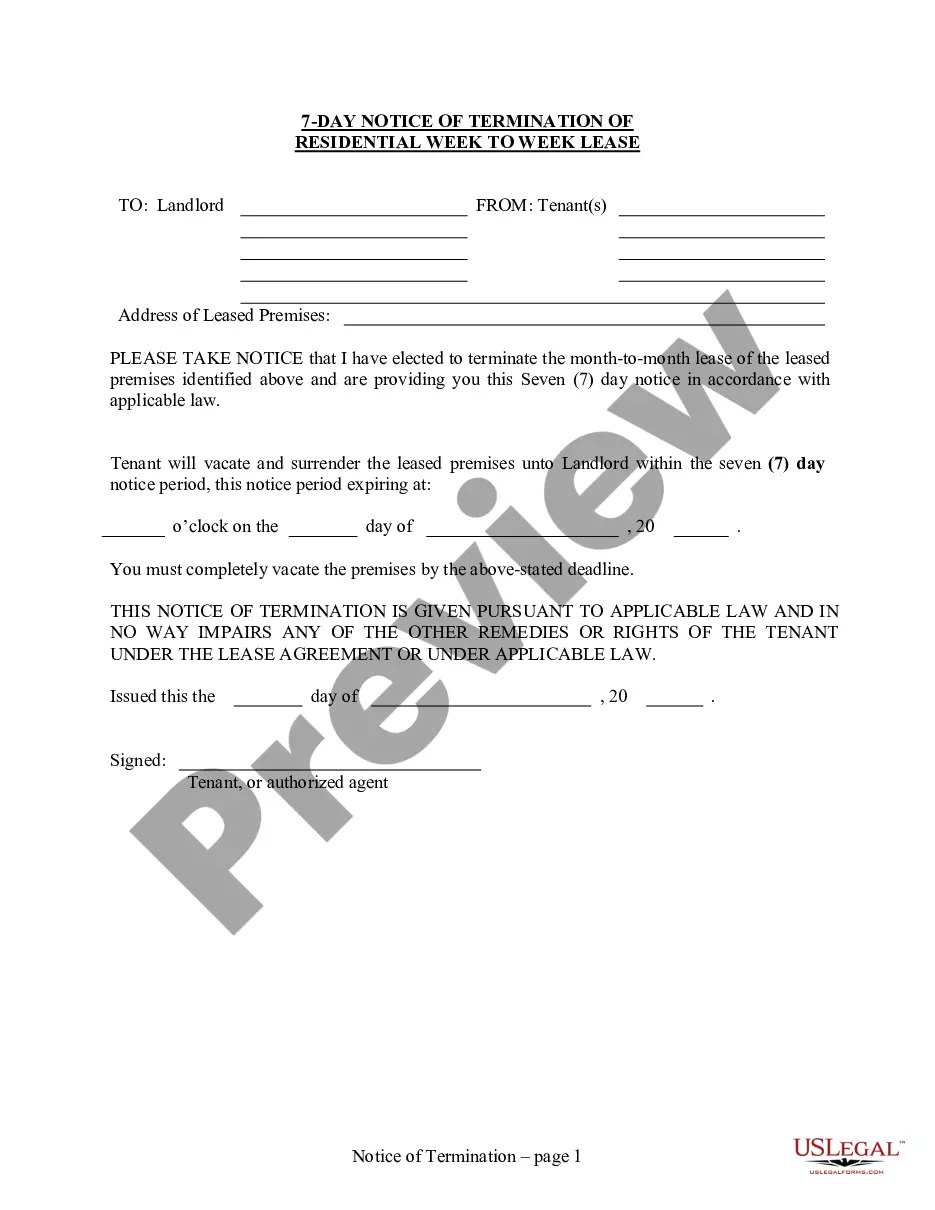

- Step 1. Ensure you have selected the shape for the correct city/land.

- Step 2. Make use of the Preview method to check out the form`s information. Never neglect to read through the outline.

- Step 3. If you are not satisfied with all the type, take advantage of the Look for industry towards the top of the screen to get other versions of your authorized type template.

- Step 4. Upon having found the shape you need, select the Purchase now key. Choose the costs program you choose and include your references to register to have an account.

- Step 5. Approach the financial transaction. You should use your charge card or PayPal account to perform the financial transaction.

- Step 6. Pick the format of your authorized type and obtain it on your own gadget.

- Step 7. Full, revise and print or signal the Pennsylvania Agreement and Plan of Reorganization by Wedgestone Realty Investors Trust and Wedgestone Advisory Corp..

Each and every authorized papers template you purchase is your own permanently. You might have acces to every type you acquired within your acccount. Select the My Forms section and choose a type to print or obtain once again.

Compete and obtain, and print the Pennsylvania Agreement and Plan of Reorganization by Wedgestone Realty Investors Trust and Wedgestone Advisory Corp. with US Legal Forms. There are millions of specialist and status-particular types you can utilize for the business or individual demands.

Form popularity

FAQ

The prospectus goes by several names, notably 'private placement memorandum', or 'offering memorandum', and of course just 'prospectus'. The REIT document details the terms of the offering such as the type of securities that the issuer is offering to investors for their funds.

Though they're different groupings, all REITs are structured as C-corporations for tax purposes that are allowed a special tax deduction for dividends paid from taxable income. For a REIT to receive a dividend paid deduction (DPD), they are required to make an election and adhere to certain rules and compliance.

How to Qualify as a REIT? To qualify as a REIT, a company must have the bulk of its assets and income connected to real estate investment and must distribute at least 90 percent of its taxable income to shareholders annually in the form of dividends.

Invest at least 75% of its total assets in real estate. Derive at least 75% of its gross income from rents from real property, interest on mortgages financing real property or from sales of real estate. Pay at least 90% of its taxable income in the form of shareholder dividends each year.

A commercial real estate prospectus is a formal document required and filed with the SEC when offering real estate investment for sale to the public. The prospectus provides details about the investment and educates investors on the benefits and risks.