Maryland Amendments to certificate of incorporation

Description

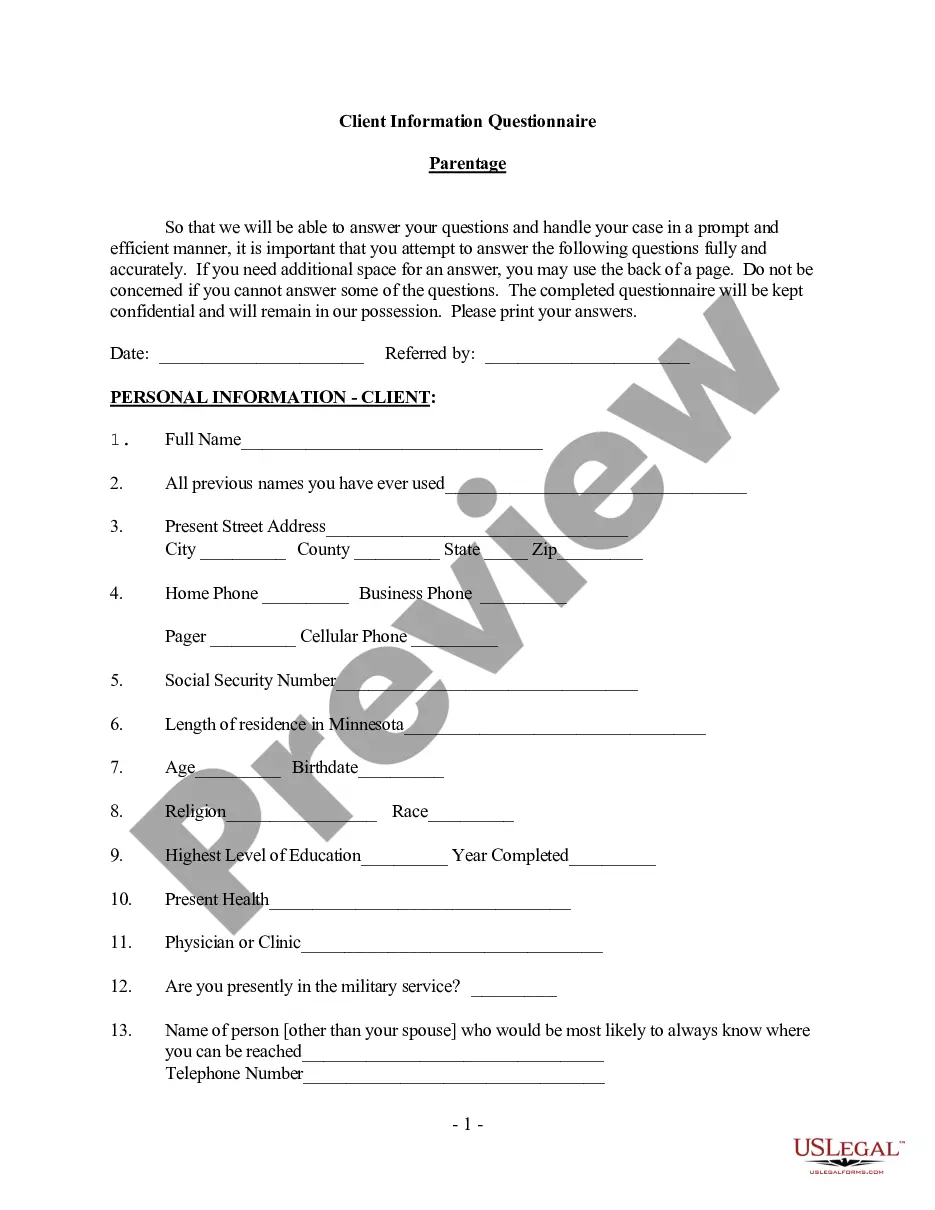

How to fill out Amendments To Certificate Of Incorporation?

If you wish to complete, acquire, or print lawful file templates, use US Legal Forms, the largest selection of lawful kinds, which can be found online. Take advantage of the site`s simple and easy handy research to discover the files you require. Numerous templates for business and personal functions are sorted by types and states, or keywords. Use US Legal Forms to discover the Maryland Amendments to certificate of incorporation in just a number of clicks.

Should you be currently a US Legal Forms customer, log in in your account and click on the Obtain switch to get the Maryland Amendments to certificate of incorporation. You may also accessibility kinds you previously delivered electronically within the My Forms tab of your respective account.

Should you use US Legal Forms the first time, refer to the instructions below:

- Step 1. Be sure you have chosen the shape for the correct area/region.

- Step 2. Take advantage of the Preview solution to look over the form`s information. Do not forget about to read through the outline.

- Step 3. Should you be not happy using the kind, use the Lookup area towards the top of the display to find other versions of the lawful kind format.

- Step 4. Once you have identified the shape you require, click on the Purchase now switch. Select the pricing program you favor and include your credentials to register for an account.

- Step 5. Procedure the deal. You can use your credit card or PayPal account to complete the deal.

- Step 6. Choose the formatting of the lawful kind and acquire it in your device.

- Step 7. Full, revise and print or indication the Maryland Amendments to certificate of incorporation.

Each lawful file format you purchase is your own property for a long time. You might have acces to each and every kind you delivered electronically in your acccount. Select the My Forms segment and select a kind to print or acquire once again.

Contend and acquire, and print the Maryland Amendments to certificate of incorporation with US Legal Forms. There are thousands of professional and status-certain kinds you can use for the business or personal requirements.

Form popularity

FAQ

An LLC name change in Maryland costs $100. This is the filing fee for the Articles of Amendment, the official form used to change your Maryland LLC name. If you file your name change online (for next-day approval time), it costs $150 for the expedited filing.

How to Amend Articles of Incorporation Review the bylaws of the corporation. ... A board of directors meeting must be scheduled. ... Write the proposed changes. ... Confirm that the board meeting has enough members attending to have a quorum so the amendment can be voted on. Propose the amendment during the board meeting.

File Articles of Organization ? Conversion (Form LLC-1A (PDF)) online at bizfileOnline.sos.ca.gov, by mail, or in person. The filing fee is $150 if a California Corp is involved; and $70 for all others.

Do you need a new EIN when converting LLC to C Corp? It depends on the type and method of conversion used. If a new corporation was formed due to a statutory merger, the corporation would need to apply for a new EIN.

Maryland LLCs that want to file amendments have to file a completed Articles of Amendment form with the State Department of Assessments and Taxation. You can do this by mail, fax, or in person. You can use the fillable form or draft your own. However, the state only accepts typed documents.

It is possible to change a limited liability company (LLC) to a corporation, and it's a simple process in many states. But if you only want to become a corporation for its tax advantages, you can also remain an LLC and elect to be to be taxed as an S-Corporation.

File form to apply for S corp status The IRS requires that you complete and file your Form 2553: Within 75 days of the formation of your LLC or C corporation, or no more than 75 days after the beginning of the tax year in which the election is to take effect.

Maryland law has no provisions for entity conversion from LLC to corporation or from corporation to LLC. The only solution would be to dissolve the original company and form a new one.