Maryland Approval for Relocation Expenses and Allowances

Description

How to fill out Approval For Relocation Expenses And Allowances?

Locating the appropriate legal document template can be a challenge. Certainly, there are numerous templates available online, but how can you find the legal format you need? Utilize the US Legal Forms website. This service offers thousands of templates, including the Maryland Approval for Relocation Expenses and Allowances, which you can use for both business and personal purposes. All of the forms are vetted by experts and comply with federal and state standards.

If you are already registered, Log In to your account and click on the Download option to access the Maryland Approval for Relocation Expenses and Allowances. Use your account to browse through the legal forms you have previously purchased. Navigate to the My documents section of your account and obtain an additional copy of the documents you need.

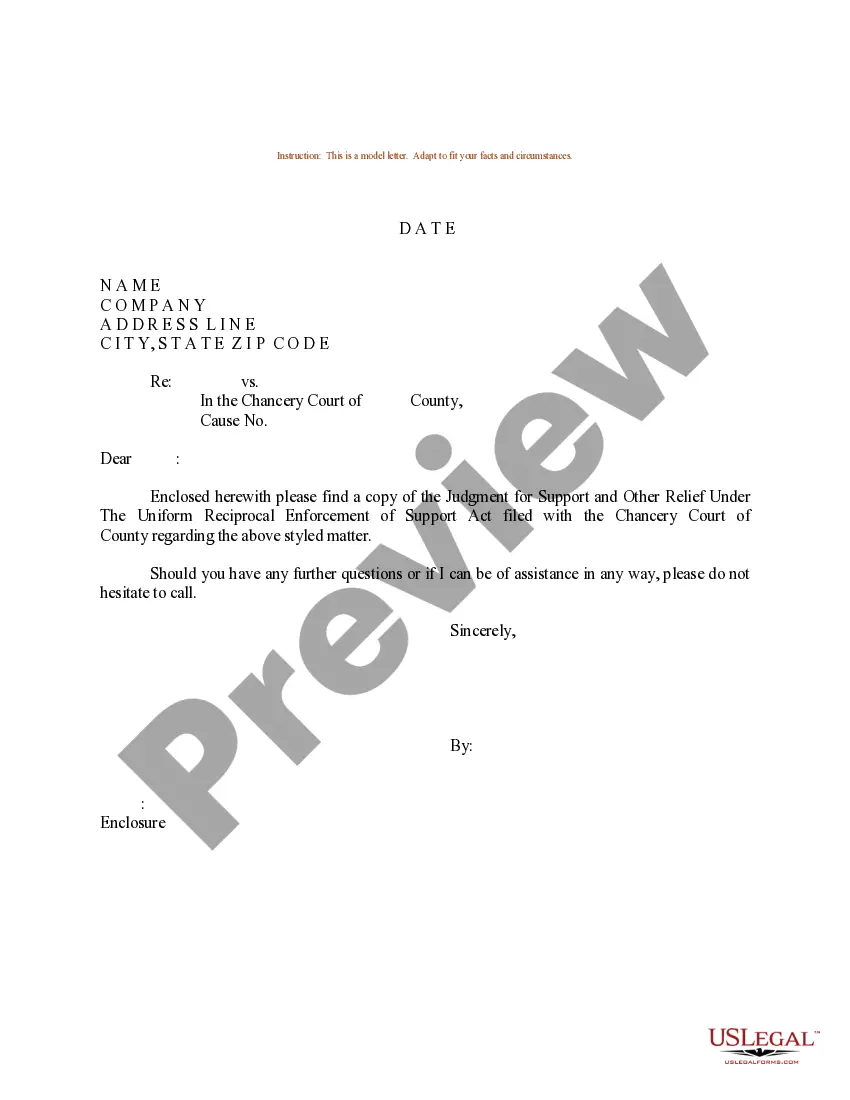

If you are a new user of US Legal Forms, here are some straightforward instructions that you can follow: First, ensure you have selected the appropriate form for your state/territory. You may review the document using the Preview feature and read the form description to verify it is suitable for you. If the form does not fulfill your requirements, use the Search field to locate the correct document. Once you are confident that the form is appropriate, click the Get now button to acquire the form. Choose the pricing plan you prefer and input the necessary information. Create your account and complete the payment using your PayPal account or credit card. Select the file format and download the legal document template to your device. Finally, complete, edit, print, and sign the acquired Maryland Approval for Relocation Expenses and Allowances.

US Legal Forms is the largest repository of legal forms where you can find various document templates. Utilize this service to obtain professionally crafted documents that meet state requirements.

- Ensure you have selected the appropriate form for your state/territory.

- You may review the document using the Preview feature.

- Read the form description to verify it is suitable for you.

- If the form does not fulfill your requirements, use the Search field to locate the correct document.

- Once you are confident that the form is appropriate, click the Get now button to acquire the form.

- Select the file format and download the legal document template to your device.

Form popularity

FAQ

You can generally deduct your expenses of moving yourself, your family, and your belongings. This includes the cost of: Professional moving company services. Do-it-yourself moving trucks or pods.

For most taxpayers, moving expenses are no longer deductible, meaning you can no longer claim this deduction on your federal return. This change is set to stay in place for tax years 2018-2025.

To qualify, reimbursements or payments must be for work-related moving expenses that would have been deductible by the employee if the employee had directly paid them before Jan. 1, 2018.

You can deduct the expenses of moving your household goods and personal effects, including expenses for hauling a trailer, packing, crating, in-transit storage, and insurance. You can't deduct expenses for moving furniture or other goods you bought on the way from your old home to your new home.

You can deduct certain expenses associated with moving your household goods and personal effects. Examples of these expenses include the cost of packing, crating, hauling a trailer, in-transit storage, and insurance.

The expenses must be incurred or the benefit given to the employee within one year following the end of the tax year in which the change to their employment occurred.

The short answer is yes. Relocation expenses for employees paid by an employer (aside from BVO/GBO homesale programs) are all considered taxable income to the employee by the IRS and state authorities (and by local governments that levy an income tax).

The short answer is yes. Relocation expenses for employees paid by an employer (aside from BVO/GBO homesale programs) are all considered taxable income to the employee by the IRS and state authorities (and by local governments that levy an income tax).

These include: The cost of packing, crating and transporting household goods of the employee and family. This includes cars and pets. The cost of connecting or disconnecting utilities.

Qualifying Relocation Expenses Payments and Beliefs CostsDisposal or intended disposal of old residence.Acquisition or intended acquisition of new residence.Transporting belongings.Travelling and subsistence.Domestic goods for the new residence.Bridging loans.