Maryland Comprehensive Special Tax Notice Regarding Plan Payments

Description

How to fill out Comprehensive Special Tax Notice Regarding Plan Payments?

Finding the right lawful papers design could be a struggle. Of course, there are a lot of layouts available on the net, but how would you obtain the lawful kind you require? Utilize the US Legal Forms web site. The services gives thousands of layouts, such as the Maryland Comprehensive Special Tax Notice Regarding Plan Payments, that you can use for company and personal needs. All the kinds are checked out by specialists and meet federal and state demands.

Should you be currently authorized, log in for your bank account and click on the Obtain option to find the Maryland Comprehensive Special Tax Notice Regarding Plan Payments. Utilize your bank account to appear with the lawful kinds you might have ordered in the past. Go to the My Forms tab of your respective bank account and get an additional backup of your papers you require.

Should you be a new end user of US Legal Forms, allow me to share straightforward guidelines so that you can comply with:

- First, be sure you have selected the proper kind for your personal city/area. You can check out the shape while using Review option and browse the shape description to make sure it will be the right one for you.

- In the event the kind is not going to meet your needs, use the Seach industry to discover the right kind.

- When you are certain the shape is acceptable, click on the Acquire now option to find the kind.

- Pick the rates program you desire and type in the required info. Build your bank account and pay for the transaction using your PayPal bank account or Visa or Mastercard.

- Choose the data file formatting and obtain the lawful papers design for your device.

- Full, modify and produce and indication the received Maryland Comprehensive Special Tax Notice Regarding Plan Payments.

US Legal Forms is the greatest library of lawful kinds in which you can find numerous papers layouts. Utilize the company to obtain skillfully-manufactured documents that comply with express demands.

Form popularity

FAQ

IRS Publication 575 is a document published by the Internal Revenue Service (IRS) that provides information on how to treat distributions from pensions and annuities, and how to report income from these distributions on a tax return. It also outlines how to roll distributions into another retirement plan.

Under the special rule, the net unrealized appreciation on the stock included in the earnings in the payment will not be taxed when distributed to you from the Plan and will be taxed at capital gain rates when you sell the stock.

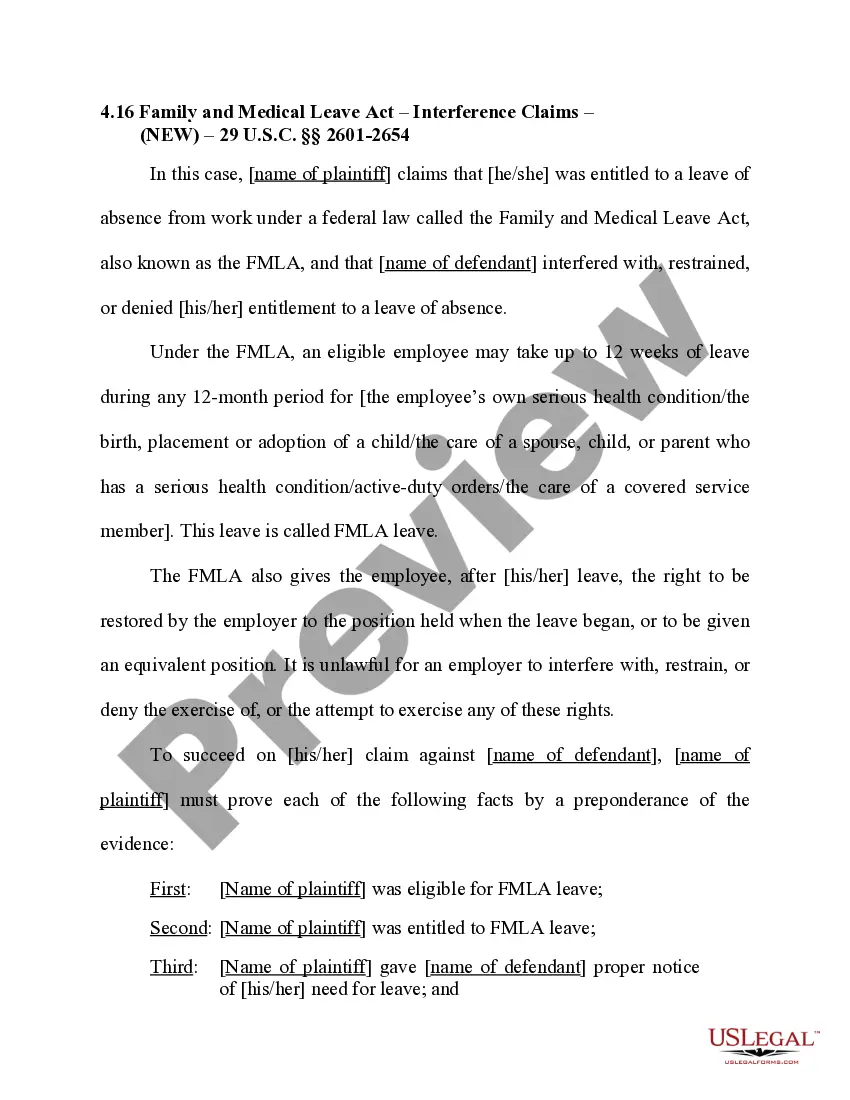

This notice is intended to help you decide whether to do such a rollover. This notice describes the rollover rules that apply to payments from the Plan that are not from a designated Roth account (a type of account with special tax rules in some employer plans).

This notice is intended to help you decide whether to do such a rollover. This notice describes the rollover rules that apply to payments from the Plan that are not from a designated Roth account (a type of account with special tax rules in some employer plans).

The notice is a document provided to each participant, beneficiary and alternate payee under the plan stating that the employer did not make a required funding contribution. Notice must be given before the 60th day following the due date of the quarterly or other required contribution.

You are receiving this notice because all or a portion of a payment you are receiving from the Plan is eligible to be rolled over to either an IRA or an employer plan; or if your payment is from a Designated Roth Account to a Roth IRA or Designated Roth Account in an employer plan.

Your rollover is reported as a distribution, even when it is rolled over into another eligible retirement account. Report your gross distribution on line 15a of IRS Form 1040. This amount is shown in Box 1 of the 1099-R. Report any taxable portion of your gross distribution.

The 402(f) notice provides important information about rolling over an eligible rollover distribution (i.e., generally, any lump sum payment or series of installment payments over a period of less than 10 years) to another eligible retirement plan, or individual retirement account (IRA).